Purpose investments launched the world’s first Bitcoin ETF in February 2021.

Similar to purchasing popular commodity ETFs on the Toronto Stock Exchange (TSX) to gain exposure to the underlying commodity, e.g. Gold, the Purpose Bitcoin ETF provides exposure to actual Bitcoin.

Packaging cryptocurrency in an Exchange-Traded Fund makes it easier for retail investors to hold digital currency without worrying about losing their private keys or getting hacked.

It also means you don’t need to open an account at a cryptocurrency exchange since the ETFs are available through your existing brokerage account.

Since the Purpose Bitcoin ETF (BTCC) was launched, many other crypto ETFs (both bitcoin and Ethereum) have been listed on the TSX.

This BTCC review summarizes its asset allocation, fees, returns, pros and cons, how it compares to EBIT, and how to purchase it in Canada.

Purpose Investments Cryptocurrency Portfolios

Purpose Investments was established in 2012. It offers several investment products utilizing alternative strategies and asset classes.

Two of its most popular funds are:

- Purpose Bitcoin ETF (BTCC), and

- Purpose Ether ETF (ETHH)

Related: Best Bitcoin App.

What is BTCC?

BTCC provides investors with an easy way to invest in Bitcoin by purchasing a publicly traded ETF.

The fund carries a “high” risk rating and is unsuitable for all investors. This is because the price of the underlying bitcoin asset is volatile, with significant intraday increases or decreases in price.

BTCC is traded on the TSX under three different tickers: BTCC, BTCC.B, and BTCC.U.

BTCC is purchased with Canadian dollars and is hedged against USD exposure.

BTCC.B is also purchased using Canadian dollars; however, it does not hedge against USD fluctuations.

BTCC.U is denominated in US dollars.

Some of the key fund facts for BTCC as of July 12, 2022, are:

- Inception date: February 18, 2021

- Assets under management (AUM): $591.3 million

- Management fee: 1.00%

- Management Expense Ratio: 1.49%

- Eligible accounts: Registered and non-registered accounts

- Number of BTC: 23494.116891

BTCC is eligible for registered accounts like the TFSA and RRSP and supports DRIP and PACC.

BTCC ETF Holdings

BTCC is 100% invested in “physically settled” Bitcoin. This means the ETF holds no other assets outside of bitcoin (cryptocurrency).

If your investment portfolio is 100% made up of BTCC, you are 100% invested in bitcoin, and your portfolio could experience significant declines if the asset falls in price (i.e. your portfolio is undiversified).

This is unlike all-in-one stock/bond portfolios like VGRO, which holds more than 28,000 individual stocks and bonds.

BTCC’s bitcoin holdings are held in cold storage, keeping them safe and away from potential hacking attempts.

Related: How To Buy Bitcoin.

BTCC Returns and Fees

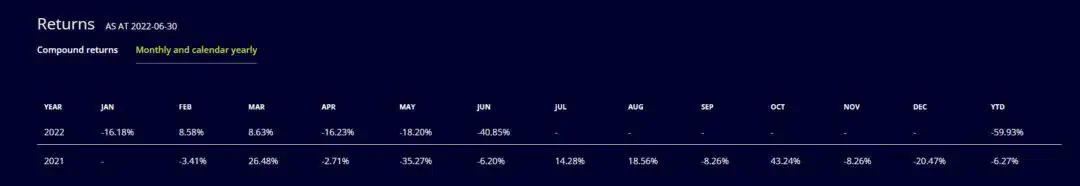

Bitcoin has not performed well in 2022. You can see its monthly and annual returns so far in the image below.

The management fee for BTCC is 1.00%, and its Management Expense Ratio (MER) has been capped at 1.50%.

Compared to other low-fee ETFs, BTCC investors pay a hefty fee similar to equity mutual funds.

Pros and Cons of BTCC

I purchased some BTCC when it was initially launched, as it was easy to buy through my Questrade account.

Pros

- Easy to purchase and gain exposure to bitcoin, even if you are a newbie to cryptocurrency.

- Sold on regulated brokerage platforms with access to the Canadian Investor Protection Fund (CIPF) protection if the brokerage becomes insolvent.

- Can hold in registered investment accounts and keep gains tax-free.

- The fund holds bitcoin assets in cold storage, removing the need to purchase your own hardware wallet.

- Good liquidity makes it easy to sell your holdings when you want to.

Cons

- Volatile, risky asset and not for risk-averse investors.

- Bitcoin in cold storage is still not 100% secured.

- High management fees.

- BTCC alone is not diversified and should be held as part of a wider portfolio.

BTCC vs. Bitcoin

BTCC is a way for investors to access the Canadian dollar price of bitcoin.

As of this writing, you cannot redeem your ETF holdings for actual bitcoin. You can only buy and sell BTCC using fiat currency (CAD).

If you are paying with U.S. dollars, you can purchase BTCC.U.

BTCC vs. EBIT

Evolve’s Bitcoin ETF (EBIT.) is available on the TSX in two series:

- EBIT: Purchased with CAD and unhedged.

- EBIT.U: Purchased with US dollars.

Similar to BTCC, you can hold EBIT in registered (TFSA or RRSP) and non-registered investment accounts.

EBIT is 100% invested in physical Bitcoin and was launched on February 19, 2021.

Its AUM, as of July 12, 2022, was $62.2 million, and it has a 0.75% management fee, plus applicable sales taxes.

BTCC vs. BTCX

CI Global Assets Management’s bitcoin ETF is called CI Galaxy Bitcoin ETF (BTCX).

This fund is available in two series with the following ticker:

- BTCX.B: Priced in Canadian dollars and unhedged.

- BTCX.U: Priced in US dollars.

Similar to BTCC and EBIT, you can hold BTCX in registered accounts such as TFSA, RRSP, RRIF, RESP, and non-registered accounts.

BTCX has a 0.40% management fee, and its MER is capped at 0.95%.

It is 100% invested in bitcoin and, as of July 12, 2022, had $221.09 million in assets under management.

Related: Best Bitcoin ETFs in Canada.

How To Buy BTCC in Canada

You can easily purchase BTCC using a regulated brokerage platform like Wealthsimple Trade or Questrade.

Questrade: This independent brokerage platform allows investors to trade a variety of investment products, including stocks, bonds, ETFs, options, FX, GICs, and mutual funds.

When you open an account and deposit at least $1,000, you get $50 in free credits. Read my detailed Questrade review for more insights.

Wealthsimple Trade: This platform allows users to buy and sell stocks and ETFs listed on Canadian exchanges without paying commissions.

When you open a new account and deposit at least $150, you get a $25 bonus. Learn more in this Wealthsimple Trade review.

How about purchasing ‘physical’ bitcoin in Canada?

If you prefer to hold bitcoin directly (i.e. not as an ETF), the following cryptocurrency exchanges offer direct crypto trading:

- CoinSmart (read review)

- NDAX (read review)

- Bitbuy (read review)

Bitcoin ETF FAQs

The BTCC ETF is available for trading on all major online brokerage platforms in Canada, including Questrade, Wealthsimple Trade, TD Direct Investing, RBC Direct Investing, Qtrade, and more.

Questrade does not offer direct cryptocurrency trading. However, you can purchase a variety of crypto ETFs on the platform, including BTCC, BTCX, and even Ether ETFs like EBIT.

Bitcoin ETFs are just as volatile as the underlying cryptocurrency asset. If you prefer to take limited risks with your investment portfolio, a Bitcoin ETF is not suitable for you.

Do you have cryptocurrency ETFs in your portfolio? Let us know what your experience has been so far in the comments.

Enoch,

I love your write-ups on various financial topics!

Do you know which of the BTC and ETH ETFs have the best liquidity (lowest bid-ask spreads) and smallest tracking errors?

Thanks,

Herman

@Herman: I haven’t looked at them that closely…and certainly not recently. The liquidity is dependent on several factors including how investors interact with the ETFs and does not necessarily give a true picture of how the funds will perform over time. I am looking forward to comparing their returns when they pass the 1-year mark. I think this data will tell us a lot more about how they purchase the underlying assets and the impact of their fees.