Ampli is one of Canada’s cash back and rewards apps for smart shoppers.

Similar to other popular cash back apps like Checkout 51, Rakuten, or Drop, Ampli provides opportunities to return money to your wallet when you make purchases online or in the store.

Read this Ampli review to learn about how the app works, how to get a $10 bonus, and why I consider it to be a worthwhile rewards program.

What is Ampli?

Ampli is a recently introduced cash back program available to all Canadians and backed by RBC Ventures.

The Ampli app makes it easy to take advantage of everyday cash back offers from some of Canada’s top brands and retailers.

Some of the featured brands on the platform include WestJet, The Home Depot, Budget, Hudson’s Bay, The Keg, Rexall, ToysRus, Hello Fresh, Petro Canada, Freshii, Golf Town, Ownr, Baskin Robbins, DAVIDsTEA, Boston Pizza, and several others.

It is available on the App Store and Google Play Store.

As of this update, app users have received over $2 million in cash back rewards and prizes.

How To Earn Cash Back With Ampli

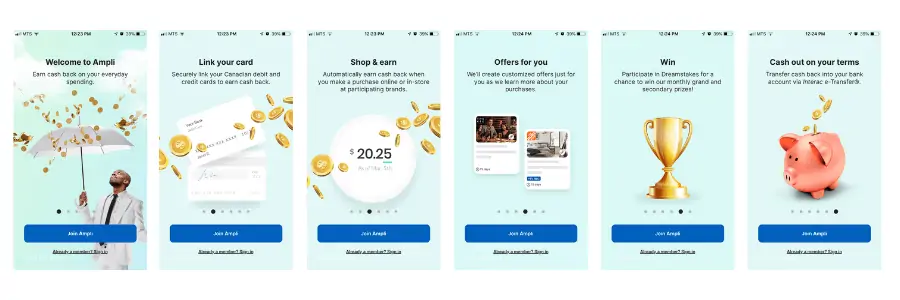

- Download the app on your phone and link your debit and/or credit cards from any of 130 different Canadian financial institutions.

- During the signup process, you will be asked to enter your postal code so the app can easily find offers available in your area, but that’s optional.

- Cash back is credited to your account when you make a purchase using a linked card at participating brands.

- When your cash back balance reaches $15 or more, you can cash out using Interac e-Transfer. There are no fees to cash out the cash back that you’ve earned.

Some of the offers recently available to me in Manitoba are:

- Foodora: 6% cash back

- Petro Canada: 1%

- Rexall: 1% cash back

- Mary Brown’s: Up to 5% cash back

- Golf Town: $15 cash back

- WestJet: 1% cash back

- Mr. Lube: Up to 5% cash back

In addition to earning cash back when you shop, Ampli also offers users monthly opportunities to earn entries to its Dreamstakes contest.

For example, at the time of this writing, you could enter for a chance to win one of ten $1,000 cash prizes or win 1 of 3 Nespresso coffee machines.

To earn contest entries, you should link an account to the app and participate in some of the various in-app challenges that may include taking surveys, shopping at specific retailers, and more.

Ampli users have already won more than $1 million in cash prizes and cash back!

Ampli Extra Cash Back Offers

Ampli offers its members many ways to amplify their cash back.

Members earn cash back on top of the rewards associated with the credit card and other loyalty programs they already use.

Users who spend at participating Ampli brands with their RBC credit or debit cards can receive an additional 1% cash back as part of certain offers.

There is a blue symbol to denote amplified offers and bonus cash back opportunities on the app.

Ampli Referral Code

*expired offer** When you sign up for an Ampli account, connect your card, and use the promo code AMP10, you receive a $10 welcome bonus.

You can also refer friends using your referral code, and you both get $5 after they link their first bank account.

Why Use Ampli?

Why should you consider Ampli if you are already using one of the other existing cash back apps to save when you shop?

- Earning cash back is easy: Ampli does not require you to scan and upload your purchase receipts. Cash back is awarded when you shop with your linked card. You can easily link accounts from over 130 Canadian financial institutions.

- Double up on cash back earnings: Easily combine more than one cash back app and save more money. For example, you can shop with your Ampli-linked card to earn cash back and still get paid when you submit your eligible receipts to Checkout 51 or shop online with Rakuten.

- Earn real cash back and not points: Many loyalty and rewards programs give you points you can redeem for gift cards. Ampli offers its members actual cash and you can transfer earned cash directly to your bank account using Interac e-Transfer for free once you’ve earned at least $15.

Is Ampli Safe and Legit?

Ampli is backed by Canada’s largest bank, RBC, a financial institution that has been around since 1864. Its operating name is RBC Ampli Inc.

As per its website, it uses 256-bit encryption technology to keep your data safe, and your transactional data is anonymized.

The Ampli app is well-rated on the Google Play Store and App Store and has a 4.1/5 and 4.5/5 rating, respectively.

Ampli vs. Rakuten

Rakuten (formerly eBates) automatically tracks your online purchases and credits your balance with cash back earned through offers and discounts.

It is much more popular than Ampli and has partnerships with more than 750 retailers in Canada and 3,000 in the U.S.

To earn with Rakuten, sign up for a free account and visit your dashboard before visiting your favourite retailer’s online store. You can also use Rakuten’s browser extension and it alerts you when cash back offers are available.

New Rakuten users get a $30 bonus after they complete their first online purchase of $30 or more via the site. Your earnings are paid out quarterly through PayPal or cheque.

Rakuten

$30 sign-up bonus when you spend at least $30

Earn up to 40% cashback

Features 3,000 stores and retailers

Redeem earnings by PayPal & check

Ampli vs. Drop

Ampli and Drop offer automatic cash back when you shop at participating retailers. While the Drop app does not offer Dreamstakes (giveaways), you get opportunities to earn extra rewards when you:

- Answer paid surveys

- Play arcade games

- Watch video ads

- Participate in special offers

Both apps pay you to refer friends, and you earn $5 for each referral that signs up using your referral link or code.

You can redeem your Drop points for several popular gift cards.

Final Thoughts

The Ampli app is my latest cash back app for earning money; my review is positive.

As the company grows, we will see many more merchants and increased opportunities for users to save money on their everyday shopping.

Related Posts

Hi Enoch, read your review my wife has been with ampli for a bit she has entered the sweepstakes they informed her she is one of the winners of 5000, is this site legit? They told her they will be in touch but weare scepticle not dure what to think please reply to my email XYZXYZXYZ thank you very much

@Rick: Yes, the app is definitely legit, however, your wife should be contacting them directly about any wins or other information. Be careful so you don’t fall victim to other unsavoury individuals on the internet. I have deleted your email address so it’s not public.

You can reach them at: [email protected]

Do you realize they track you? Are you really comfortable giving an app your debit card # and password to your online banking? Do you fully realize what you authorize when you accept terms and conditions?They also do a soft credit check.

https://ampli.ca/terms-and-conditions/

My privacy is worth much more then a few $$$.

So i guess you don’t use a smart phone? any social media? or interest browsers?

Thanks for this straightforward review.