Refresh Financial is an alternative lending financial institution that helps its customers build or rebuild their credit.

If you have ever applied for a loan or credit card with a bad credit score, you know it can be nearly impossible to get approved. Lenders either shun you or offer credit at very high rates.

If this is your story, a service like Refresh Financial may help get your finances back on track.

This Refresh Financial review covers its product offerings, how secured credit cards and credit builder loans work, and why you should watch out for fees.

Refresh Financial Overview

Refresh Financial was launched in 2013 and offers customized credit-building solutions to individuals with poor or bad credit or even no credit.

Its headquarters is based in Kelowna, British Columbia, and its services are available to residents of all provinces in Canada except Saskatchewan and New Brunswick.

Its two main products are:

- Refresh Credit Builder Loan

- Refresh Financial Secured Card

Customers can also sign up for a “Black Tier” service that is advertised as the “ultimate credit building experience.”

Refresh Financial was acquired by Borrowell, one of Canada’s largest financial technology companies, in 2021.

Refresh Credit Builder Loan

A Refresh Credit Builder Loan is unlike a traditional bad credit personal loan.

Instead of giving you funds upfront, this credit-building loan requires you to make payments into a loan amount that you can access in the future.

Your regular payments are reported to the credit bureaus, resulting in an improvement in your credit score over time.

How the Refresh Credit Builder Loan Works

After opening a Credit Builder Loan account, you need to set up pre-authorized payments to deposit funds on a bi-weekly or monthly basis.

The payment amount depends on how much you intend to borrow and ranges between $1,250 and $25,000.

Your payment history is reported to TransUnion and Equifax, and it shows up on your credit report.

The funds you have deposited can be accessed at any time and takes 10-15 business days to be deposited in your bank account.

Some of the key rates and conditions of a Refresh Builder Loan include:

- Loan amounts: $1,250, $2,500, $5,000, $10,000, and $25,000

- Loan interest: 19.99% APR

- Loan term: 36-60 months (open-ended)

- Credit score: No credit check

Refresh Financial Secured Card

**This card is no longer offered. You can try the Neo Secured Card instead**

A secured credit card requires that you provide collateral or a security deposit equivalent to your credit limit. The money you deposit beforehand protects the lender if you are unable to make payments in the future.

Secured credit cards are excellent for establishing or rebuilding your credit. When you close your account, and it is in good standing, your deposit is refunded.

Refresh Financial’s secured card is one of the best in Canada if you have a bad credit score and have faced challenges with qualifying for a traditional credit card.

How it works

No credit check is carried out when you apply for a Refresh Secured Card. Most people are approved, which is why the card is marketed as a “Guaranteed Approval” credit card.

You provide a security deposit that is equal to your credit limit, and this ranges between $200 and $10,000.

The card has a $12.95 annual fee plus a $3 monthly maintenance fee.

Your card payments are reported to credit bureaus, similar to a regular credit card, and this raises your credit score if you are using the card responsibly.

Refresh Financial Black Tier Service

Canadians can access their free credit scores in Canada using services like Borrowell (Equifax credit score), Mogo (Equifax credit score), and Refresh Financial (TransUnion credit score).

You can take your credit-building strategy a step further by signing up for Refresh Financial’s “Black Tier” service.

This product provides real-time access to your TransUnion credit report and score, and you receive alerts when your credit score changes.

Subscribers also get access to a credit simulator, educational videos via Refresh Academy, and a rewards program that offers discounts at 600+ retailers across Canada.

Black Tier costs $16.95 per month.

Pros and Cons of Refresh Financial

Individuals who have a bad credit rating can easily qualify for a Refresh credit builder loan or secured credit card. Neither product requires a credit check, and the secured card offers guaranteed approval.

Refresh Financial reports your transactions to the two main credit bureaus in Canada.

If you make your payments on time for these products, it can help improve your credit. If you miss payments, your credit score may be negatively affected, even though your security deposit is intact.

The Refresh Financial Secured Card is issued by Digital Commerce Bank under license by Visa. As a Visa Card, it is accepted at millions of locations.

This company provides a free snapshot of your credit score. If you want additional help with credit building, including access to a Goal Manager, you can sign up for Black Tier.

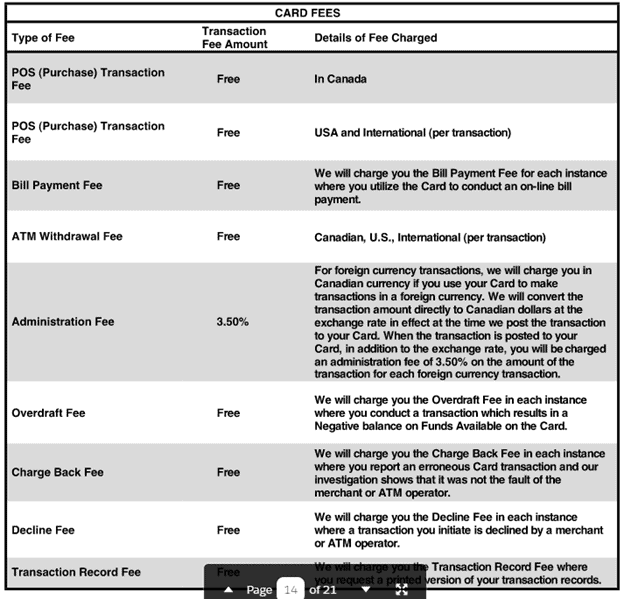

Customers of Refresh Financial should be aware of fees that may become applicable depending on how they use the credit products:

Fees

- Fund withdrawals from loan account: $20 (excluding Quebec)

- NSF fee: $25

- Annual card fee: $12.95

- Monthly maintenance card fee: $3

- Foreign currency transactions using Card: 3.50%

- Card over-limit fee: $5

Secured Credit Card Alternatives

If you have a poor or bad credit score, you can easily apply for a secured credit card and use it to improve your credit score.

- Neo Secured Mastercard (no annual or monthly fees, and you earn rewards when you shop; guaranteed approval).

Neo Secured Credit

Rewards: Earn an average of 5% real cash back on purchases.

Welcome offer: Up to 15% cashback on your first-time purchases, plus a $25 welcome bonus.

Interest rates: 19.99% – 29.99% for purchases; 22.99% – 31.99% for cash advances.

Annual fee: $0

Credit limit: Starts at $50.

Credit score required: Poor or bad credit score.

Is Refresh Financial Legit?

It is owned by a reputable company, Borrowell. Borrowell has been used by more than 1.9 million Canadians to access free credit scores and other financial products since its inception in 2016.

While not accredited by the Better Business Bureau (BBB), Refresh Financial holds an A- rating on the platform.

Its parent company, Borrowell, is accredited by the BBB and holds an A+ rating on the platform.

Refresh Financial FAQs

You can apply for their credit builder loan and secured credit card regardless of what your credit score is. Individuals who have no credit history can also qualify.

The company offers a free TransUnion credit report and score. Checking your score through this means does not affect it because it qualifies as a soft inquiry.

You can contact the company by email at [email protected] or call 1-800-746-4840.

A credit builder loan is a type of installment loan that involves the borrower making fixed payments towards a loan and getting access to the loan after it has been paid in full. This type of loan is designed to help borrowers improve their credit scores.

Related:

Kept a perfect account with this company and they actually damaged my credit by posting false derogatory info on my credit file.

Not impressed.

It also takes them 3-4 months to even start reporting.

They just nickle and dime you, taking everything that they can…they certainly have no interest in helping you build your credit.

If you want a solid, no fee secured card that starts reporting immediately….try the Hometrust secured card….very happy with it.