The RBC Cash Back Preferred World Elite Mastercard is a popular credit card that you can use to earn cash back on all purchases. It also comes with several other benefits besides earning cash back.

In this guide, we’ll look at everything you need to know about the RBC Cash Back Preferred World Elite Mastercard, including the key features and pros and cons.

We’ll also compare it with similar cards to help you decide whether it is the right credit card for you.

RBC Cash Back Preferred World Elite Mastercard Overview

RBC Cash Back Preferred World Elite Mastercard

RBC travel credit card

Annual fee: $99

Rewards: 1.5% unlimited cash back

Interest rates: 19.99% for purchases and 22.99% for cash advances (21.99% in Quebec)

Minimum income requirement: $80,000 personal income or $150,000 household income.

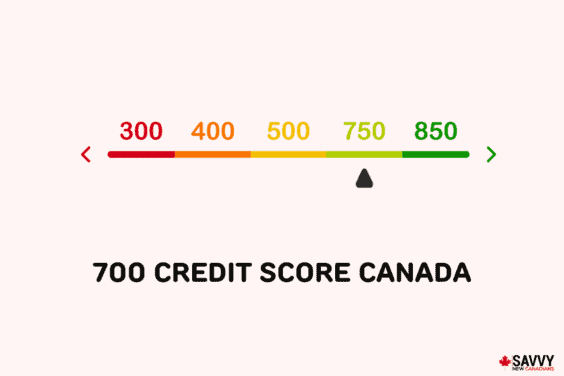

Recommended credit score:

Good or better

On RBC’s website

Benefits of the RBC Cash Back Preferred World Elite Mastercard

- With this card, you can earn unlimited cash back at a rate of 1.5% on all your spending. Rewards accumulate automatically, making tracking your rewards even easier.

- Supplementary cards are free.

- Get a complimentary Boingo Wi-Fi account and connect to over 1 million hotspots worldwide.

- Make savings on your Petro-Canada purchases. Link your card and save 3 cents per litre. You also earn 20% more Petro-Points when you use Petro-Canada.

- Shop at Rexall and earn extra Be Well points. Earn 50 points for every $1 spent, with 25,000 Be Well points equaling $10.

- Save on DoorDash delivery fees by getting $0 fees for 12 months for orders of $15 or more. Plus, add your card to your DoorDash account and get a free 12-month subscription worth $120.

- Use Credit Card Lock to temporarily lock your card if you misplace it. Just go to the app to activate the lock.

- Enjoy Mastercard subscription services and on-demand apps with exclusive offers and benefits.

- Enjoy Mastercard Travel Rewards and get cash back offers at international restaurants and retailers.

- With Mastercard Airport Experiences, provided by DragonPass, you can access over 1,300 airport lounges and enjoy airport spa and dining offers.

- RBC Offers provides personalized offers where you can enjoy cash savings and bonus points.

- Car rental collision/loss damage insurance is included with the card.

- Purchase security and extended warranty insurance are included.

- You can add several optional extras, including travel insurance, RBC Road Assist, BalanceProtector Max Insurance, and ID Theft and Credit Protection.

Downsides of the RBC Cash Back Preferred World Elite Mastercard

- The $99 annual fee is quite high, if not as high as some premium cards.

- The minimum personal income requirement of $80,000 is quite high and could affect whether you can apply for the card.

- While unlimited cash back of 1.5% is good, there are no options to earn more for purchases in specific categories, which some other credit cards provide.

How to Apply for the RBC Cash Back Preferred World Elite Mastercard

First, find out whether you are eligible for this credit card. Although it is not specifically stated, you will need a good credit score. If you have a fair or poor score, you may want to find a secured credit card instead.

Make sure you meet the minimum income requirements of $80,000 personal income or $150,000 household income. You must also be the age of majority in your province or territory and a Canadian resident.

You can apply directly via the website using the ‘Apply Now’ button if you meet the requirements.

Simply provide all the required information, and RBC claims you will get a response in under 60 seconds.

RBC Cash Back Preferred World Elite Mastercard Alternatives

Here are a few alternatives to the RBC Cash Back Preferred World Elite Mastercard that you might want to consider:

WestJet RBC World Elite Mastercard

Premium credit card for earning WestJet dollars

Annual fee: $119

Rewards: Earn up to 2% back in WestJet dollars on eligible travel purchases.

Welcome offer: Get up to 300 bonus WestJet dollars in the first 3 months.

Interest rates: 20.99% on purchases and 22.99% on cash advances.

Minimum income requirement: $80,000 for personal income and $150,000 for household income.

Recommended credit score:

Good or better

On WestJet RBC’s website

RBC Avion Visa Infinite Card

Competitive RBC rewards credit card

Annual fee: $120

Rewards: Earn 1 Avion point for every dollar you spend, plus 25% more points on travel-related purchases.

Interest rates: 20.99% on purchases and 22.99% on cash advances.

Minimum income requirement: A minimum annual personal income of $60,000 or household income of $100,000.

Recommended credit score:

Good or better

On RBC’s website

RBC Cash Back Mastercard

Entry-level RBC cash back card

Annual fee: $0

Rewards: Earn up to 2% cash back on high-spend categories.

Interest rates: 19.99% on purchases and 22.99% on cash advances.

Minimum income requirement: $0

Recommended credit score:

Good

On RBC’s website

RBC ION+ Visa

Entry-level RBC credit card

Annual fee: $48

Welcome offer: Get 3,500 bonus Avion points following approval, and earn 3,500 bonus points when you spend $500 in the first 3 months.

Rewards: Earn 3x Avion points per $1 spent on groceries, rides, gas, streaming, subscriptions, digital gaming, and EV charging; 1 Avion point for every $1 spent on all other purchases.

Interest rates: 19.99% on purchases and 22.99% on cash advances.

Minimum income requirement: None

Recommended credit score:

Good or better

On RBC’s website

Is the RBC Cash Back Preferred World Elite Mastercard Worth It?

The RBC Cash Back Preferred World Elite Mastercard is a great choice if you’re looking for a premium cash back card.

While you have to pay a reasonably high annual fee and there is a high minimum income requirement, it packs in enough benefits to make it worthwhile.

The 1.5% unlimited cash back is great, although it would be nice to have the opportunity to earn higher amounts on specific spending categories.

The extra savings and offers at Petro-Canada, Rexall, DoorDash and more are also useful.

RBC Cash Back Preferred World Elite Mastercard vs Alternatives

| Credit Card | Annual Fee | APR | Rewards | Minimum Income |

| RBC Cash Back Preferred World Elite Mastercard | $99 | 19.99% for purchases and 22.99% for cash advances | 1.5% unlimited cash back | $80,000 personal income, $150,000 household income |

| WestJet RBC World Elite Mastercard | $119 | 19.99% for purchases and 22.99% for cash advances | Get 1.5% – 2% WestJet dollars on purchases | $80,000 personal income, $150,000 household income |

| RBC Avion Visa Infinite | $120 | 19.99% for purchases and 22.99% for cash advances | 1 Avion point for every $1 spent | $60,000 personal income, $100,000 household income |

| RBC Cash Back Mastercard | $0 | 19.99% for purchases and 22.99% for cash advances | Unlimited 2% cash back on groceries, 1% on everything else | N/A |

| RBC ION+ Visa | $48 | 19.99% for purchases and 22.99% for cash advances | 1-3 Avion points for every $1 spent | N/A |

FAQs

You will earn 1.5% unlimited cash back on all your purchases made using the RBC Cash Back Preferred World Elite Mastercard.

The primary benefit is the 1.5% cash back you can earn on all purchases. However, it also comes with several other benefits, including complimentary Boingo Wi-Fi, fuel savings at Petro-Canada, delivery fee savings at DoorDash and more.

The APR for purchases is 19.99%, and the APR for cash advances is 22.99% or 21.99% for residents of Quebec.

They are both good credit cards, and it depends on your personal preferences. The RBC Cash Back Preferred World Elite Mastercard comes with 1.5% cash back on all purchases, while with the RBC Cash Back Mastercard, you can earn 2% cash back on groceries without paying an annual fee.

Related: Ways to increase your credit score.