If you enjoy flying, the RBC Avion Visa Infinite is worth considering as your next credit card.

With this card, you can earn Avion points on all your spending, which you can quickly and easily redeem for flights and other types of travel, including cruises.

But is the RBC Avion Visa Infinite right for you?

In this RBC Avion Visa Infinite Credit Card review, we look at its main features, pros and cons, and alternative credit cards to help you make your decision.

RBC Avion Visa Infinite Credit Card – Summary

RBC Avion Visa Infinite Card

Competitive RBC rewards credit card

Annual fee: $120

Rewards: Earn 1 Avion point for every dollar you spend, plus 25% more points on travel-related purchases.

Interest rates: 20.99% on purchases and 22.99% on cash advances.

Minimum income requirement: A minimum annual personal income of $60,000 or household income of $100,000.

Recommended credit score:

Good or better

On RBC’s website

Benefits of the RBC Avion Visa Infinite Credit Card

There are several RBC Avion Visa Infinite benefits you can enjoy when you use this card:

- You will earn 1 Avion point for every $1 spent on any category of spending. However, you can earn even more by getting an extra 25% on travel-related purchases.

- You can use your Avion points for any airline and flight without restrictions. This includes travel in peak seasons. As long as there is an open seat, you can fly on it, and there are no seat restrictions or blackouts.

- You can book flights for as few as 15,000 Avion points, and redeeming your points is easy at the Avion Rewards website.

- You also get access to the Avion Collection, an exclusive catalogue where you can find experiences and get access to dining, entertainment and activities.

- RBC Offers include personalized offers for several brands, so you can check them out before shopping to make savings or earn bonus points.

- You can also redeem points for things besides flights. Use your Avion points to spend on Apple products, tech products at Best Buy, RBC Financial Vouchers, gift cards and more.

- You can easily convert your Avion points to several loyalty programs, including Hudson’s Bay Rewards and WestJet dollars.

- RBC Avion Visa Infinite insurance coverage includes insurance for mobile devices.

- You can also benefit from travel insurance coverage, including emergency medical, trip cancellation and trip interruption coverage.

- Protection is included for eligible purchases you make on the card.

- Get access to Visa Infinite, which includes events, hotel and dining benefits.

- You can include several optional extras as add-ons, including RBC Road Assist, identity theft and credit protection, and BalanceProtector Max Insurance.

Downsides of the RBC Avion Visa Infinite Credit Card

- The annual fee for this credit card is $120, which is fairly high.

- Additional cards cost $50 each, while many other credit cards provide additional cards for free.

- The minimum personal income requirement of $60,000 or household income of $100,000 is quite high and may impact whether you are eligible to apply for the credit card.

How to Apply for the RBC Avion Visa Infinite Credit Card

Applying for the RBC Avion Visa Infinite Credit Card is a simple process.

First, check that you meet the requirements, including the minimum personal or household income requirements of $60,000 or $100,000. You also need to be the age of majority in your province or territory and be a Canadian resident.

While not specifically stated, you should also have a good credit score of 660 or more to apply for this credit card.

When you are sure you meet the requirements, you can start the application process online by clicking on the ‘Apply Now’ button.

You will be asked if you are already an RBC client. You can then review the information about the card to make sure you are happy with it. This includes interest rates, the grace period, the minimum payment, foreign currency conversion charges, and more.

You can then go through the process and provide all the information required. RBC claims you will get a response in under 60 seconds.

How to Redeem RBC Avion Points

Redeeming RBC Avion Points is straightforward, and there are several ways to go about it.

First, if you want to redeem points for flights, go to the Air Travel Redemption Schedule. Here, you can find out how many points you need to redeem to travel.

You will see that for ‘Quick Getaways,’ you need 15,000 points, and for the ‘Visit Europe’ option, you need 65,000 points.

You can also redeem your points for other types of travel, including hotels, car rentals, and cruises, instead of flights. The basic conversion is 100 points for $1 CAD in any of these cases.

When redeeming your points, go to the Avion Rewards website or the Avion Rewards app. Choose from the travel options and use your points on travel purchases, or use your points in the shop for gift cards, merchandise, etc.

You can also use this website to transfer your points if you want to convert them to points or miles from another loyalty program.

RBC Avion Visa Infinite Alternatives

There are several alternatives you might prefer to the RBC Avion Visa Infinite. Here are a few to consider:

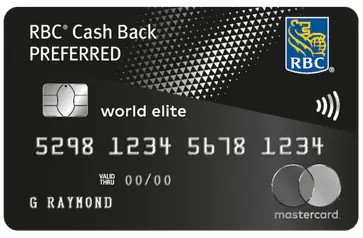

RBC Cash Back Preferred World Elite Mastercard

RBC travel credit card

Annual fee: $99

Rewards: 1.5% unlimited cash back

Interest rates: 19.99% for purchases and 22.99% for cash advances (21.99% in Quebec)

Minimum income requirement: $80,000 personal income or $150,000 household income.

Recommended credit score:

Good or better

On RBC’s website

Tangerine World Mastercard

Excellent no-fee cash back card with travel perks

Annual fee: $0

Rewards: Earn up to 2% unlimited cash back in 2-3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an additional 10% cash back valued at $100 in the first 2 months.

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Minimum income requirement: $12,000

Recommended credit score:

Fair to Good

On Tangerine’s website

WestJet RBC World Elite Mastercard

Premium credit card for earning WestJet dollars

Annual fee: $119

Rewards: Earn up to 2% back in WestJet dollars on eligible travel purchases.

Welcome offer: Get up to 300 bonus WestJet dollars in the first 3 months.

Interest rates: 20.99% on purchases and 22.99% on cash advances.

Minimum income requirement: $80,000 for personal income and $150,000 for household income.

Recommended credit score:

Good or better

On WestJet RBC’s website

RBC ION+ Visa

Entry-level RBC credit card

Annual fee: $48

Welcome offer: Get 3,500 bonus Avion points following approval, and earn 3,500 bonus points when you spend $500 in the first 3 months.

Rewards: Earn 3x Avion points per $1 spent on groceries, rides, gas, streaming, subscriptions, digital gaming, and EV charging; 1 Avion point for every $1 spent on all other purchases.

Interest rates: 19.99% on purchases and 22.99% on cash advances.

Minimum income requirement: None

Recommended credit score:

Good or better

On RBC’s website

Is the RBC Avion Visa Infinite Card Worth It?

The RBC Avion Visa Infinite Card is an excellent choice if you want to earn Avion points by using your credit card.

You can earn 1 Avion point for every $1 you spend. Depending on how much you spend, you can quickly earn enough points to put towards a flight, cruise or another form of travel.

And with the addition of other benefits like travel insurance coverage, the RBC Avion Visa Infinite Card is a good choice for frequent travellers.

RBC Avion Visa Infinite Card vs Alternatives

| Credit Card | Annual Fee | APR | Rewards | Minimum Income |

| RBC Avion Visa Infinite | $120 | 19.99% for purchases and 22.99% for cash advances | 1 Avion point for every $1 spent | $60,000 personal income, $100,000 household income |

| RBC Cash Back Preferred World Elite Mastercard | $99 | 19.99% for purchases and 22.99% for cash advances | 1.5% unlimited cash back | $80,000 personal income, $150,000 household income |

| Tangerine World Mastercard | $0 | 19.95% for purchases and cash advances | Earn 0.5% – 2% cash back | $60,000 personal income, $100,000 household income |

| WestJet RBC World Elite Mastercard | $119 | 19.99% for purchases and 22.99% for cash advances | Get 1.5% – 2% WestJet dollars on purchases | $80,000 personal income, $150,000 household income |

| RBC ION+ Visa | $48 | 19.99% for purchases and 22.99% for cash advances | 1-3 Avion points for every $1 spent | N/A |

FAQs

Avion points don’t expire as long as your account remains open. If your account is closed, the points will be forfeited after 12 months.

The main benefit is that you can earn Avion points. You earn 1 point for every $1 spent, and you can redeem points for flights, travel and more.

It depends on your circumstances. If you want to earn Avion points, the RBC Avion Visa Infinite is a good choice. However, if you would prefer to earn cash back on your purchases, the RBC Cash Back Preferred World Elite Mastercard might be a better option.

Related: Best RBC no-fee credit cards.