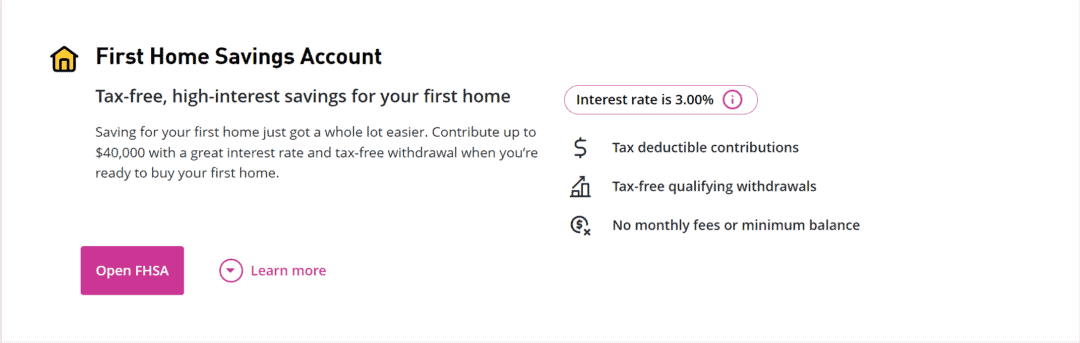

EQ Bank became the latest bank to offer the First Home Savings Account (FHSA), a tax-free plan you can use to save for your first home.

With the EQ Bank FHSA, you earn competitive interest rates on savings and GICs, and there are no fees.

Other financial institutions offering FHSAs in Canada include Wealthsimple, Questrade, RBC, and Fidelity.

How To Open an EQ Bank FHSA

EQ Bank’s FHSA Savings Account is all digital, meaning you can fully open the account online from home.

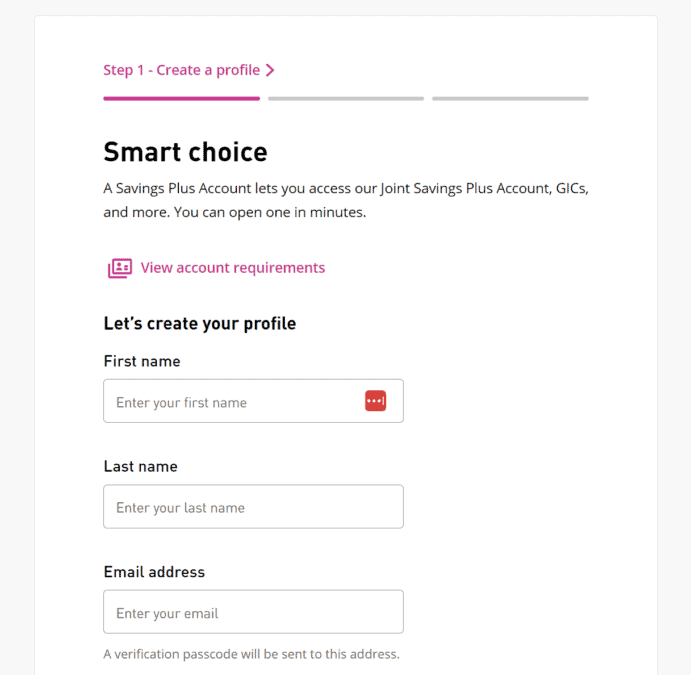

Step 1: To get started, visit EQ Bank here (unavailable in Quebec). Enter your name and email address to create your banking profile.

A passcode will be sent to your email. Enter this code on the next page. Provide your phone number and verify it by entering the passcode received.

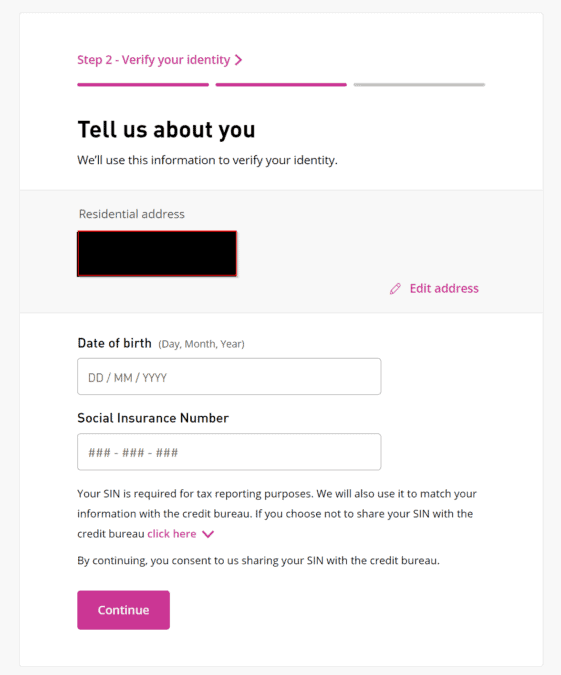

Step 2: Fill out the form to verify your identity by entering your home address, date of birth, and social insurance number.

Fund your FHSA by connecting an existing chequing or savings account at another bank.

If you are a current EQ Bank client, the process is straightforward. Click on the “Open FHSA” button from your dashboard and follow the prompts.

You can contribute up to $8,000 annually to your FHSA and up to a lifetime total of $40,000.

These contributions are tax-deductible, similar to RRSP contributions, and investment growth is tax-free (similar to the TFSA).

To be eligible for the FHSA, you must be a first-time homebuyer between 18 and 71 years of age.

EQ Bank FHSA Investments

EQ Bank currently offers two types of FHSAs:

- EQ Bank FHSA Savings Account

- EQ Bank FHSA GIC

The FHSA Savings Account offers a 3.00% interest rate, while the FHSA GIC pays up to 5.45%, depending on the term you choose (ranging from 3 months to 10 years).

Both accounts are eligible for CDIC deposit insurance, up to $100,000 per insured category, per depositor.

EQ Bank FHSA Fees

EQ Bank’s digital FHSA has no monthly account fees, similar to its other savings and GIC products.

If you overcontribute to your FHSA, the CRA will levy a monthly penalty tax of 1% on the excess contributions.

To avoid the overcontribution penalty, keep track of your contribution limit, especially if you have multiple FHSAs at different banks.

Benefits of the EQ Bank FHSA

The benefits of an EQ Bank FHSA include:

- High interest rates on FHSA Savings and GICs.

- No monthly account fees.

- Fully digital application process.

- Tax-deductible contributions and tax-free earnings and withdrawals.

- FHSA to RRSP transfers are possible.

Downsides of the EQ Bank FHSA

- It is not available in Quebec.

- EQ Bank FHSA is limited to savings and GICs. It does not offer access to stocks, mutual funds, or bonds.

EQ Bank FHSA vs. RSP vs. TFSA

Here’s how EQ Bank’s FHSA, RSP, and TFSA accounts compare:

| FHSA | RSP | TFSA | |

| Contribution limit | $8,000 per year and $40,000 lifetime | 18% earned income in the previous year up to a limit ($30,780 in 2023) | $6,500 in 2023 ($88,000 total since inception in 2009) |

| Over-contribution penalty | 1% monthly penalty on excess contributions | 1% monthly penalty on excess contributions over $ 2,000-lifetime buffer | 1% monthly on excess contributions |

| Withdrawals | Tax-free for home purchase | Pay taxes on withdrawals | Tax-free |

| Account expiration | After 15 years | Convert at age 71 | Does not expire |

| Tax-free gains | Yes | Tax-deferred | Yes |

| Contributions tax deductible | Yes | Yes | No |

| Investments | Savings deposits and GICs | Savings deposits and GICs | Savings deposits and GICs |

EQ Bank FHSA Savings Account

Top FHSA savings account

Earn 3% tax-free high interest on savings for your home

Contribute up to $8,000 annually and $40,000 lifetime

No monthly account fees

Also offers FHSA GICs (up to 5.35%)

FAQs

Yes, EQ Bank now offers FHSA Savings and GIC accounts.

You can contribute up to $8,000 annually and $40,000 lifetime. Unused contribution room can be carried forward to future years.

If you are saving for a home, the FHSA offers more advantages than the TFSA. You can deduct contributions from your taxable income while also earning tax-free investment income.

If you withdraw the funds for other purposes, withholding taxes may apply. Also, a second home does not qualify for the plan.

Yes, parents can gift money to a child to contribute to their FHSA. The child can then claim a tax deduction for the amount.