As parents, one of the most important investments you will make is in your child’s future education. In 2023, the average tuition for undergraduate students in Canada is just shy of $7,000 per year. This figure jumps higher for graduate students in specialized degree programs like law or dentistry.

With the cost of tuition rising alongside everything else these days, it’s important to have a plan for your children. An RESP or Registered Education Savings Plan is the easiest way to do this. Not only is an RESP non-taxable until the investments are sold, but the Canadian government will also match a portion of your deposits with grants.

If you are looking to set up an RESP plan for your children then this article is for you. We will discuss Embark’s new RESP Plan and why it stands out from other education investment strategies.

Embark RESP Plan

The Embark Student Plan uses an investment strategy that is flexible and grows alongside your children. At a young age, it focuses on investing in high-growth assets. As your children grow older, the fund will shift to a more conservative strategy to protect capital.

This RESP Plan can cover the educational costs of all of your children. Unlike some products from other institutions offering specialized RESPs, the Embark Student Plan is not a Group RESP.

Group RESPs tend to have higher fees and even penalties if you do not continue to contribute to the fund. You also have less control over the amounts you can withdraw at any given time, as it is decided entirely by the institution.

Embark Student Plan: How it Works

The Embark Student Plan is an RESP that is designed to support and financially assist your children through their post-secondary education journey.

To qualify for the Embark Student Plan, the beneficiary needs to be a Canadian citizen or resident with a valid Social Insurance Number (SIN).

This RESP has the same contribution limits as any other RESP in Canada. The government will also match your contributions by 20% under the Canada Education Savings Grant (CESG) to a maximum of $500 each year and $7,200 in a lifetime. There is no annual contribution limit for an RESP, but there is a lifetime contribution limit of $50,000. Contributing a minimum of $2,500 per year to the RESP qualifies you for the maximum CESG amount every year, though you’ll still receive a portion of these grants if you contribute less.

The Embark Student Plan can be used to automatically take advantage of many government grants. Here is a list of the grants that you can apply for in an Embark RESP:

| Government Grant Name | What it Provides |

| Canada Education Savings Grant (CESG) | 20% of the first $2,500 you contribute each year; Lifetime maximum of $7,200; Annual maximum of $500; Can carryover unclaimed CESG from 2007 for a maximum of $500/year |

| Additional Canada Education Savings Grant (ACESG) | An extra 10% or 20% for the first $500 you contribute each year (depending on your income); Annual maximum of $100; Part of the CESG lifetime maximum of $7,200 |

| Canada Learning Bond (CLB) | First payment of $500; Subsequent payments of $100/year up to when your child turns 15; Lifetime maximum of $2,000; Income dependant |

| British Columbia Training and Education Savings Grant (BCTESG) | A one-time grant of $1,200 between age 6 and 9; Applies only to B.C. residents |

| Quebec Education Savings Incentive (QESI) | 10% of the first $2,500 you contribute each year; Unused QESI accumulated rights of $250/year can be claimed back to 2008; Applies only to Quebec residents |

| Additional Quebec Education Savings Incentive (AQESI) | An additional $50/year depending on your income and annual contribution; Part of the QESI lifetime limit |

In terms of what the Embark Student Plan invests in, it varies by the age of your child. In the beginning, the fund employs an asset mix of 10% fixed income and 90% equities that are held in a variety of ETFs. By the time the beneficiary is ready to graduate, that mix will have shifted to 90% fixed income and 10% equities.

The fund managers have the right to invest in any equities regardless of market capitalization and can include common stock, preferred stock, rights and warrants, and securities that are convertible to common stock.

This is what Embark calls a glide path strategy. It is based on an 18-year time horizon. The strategy takes the age of your child into account when the Embark Student Plan is started. How is a glide path beneficial? It allows for maximum growth at the start of the journey and works to protect capital and gains as your child approaches the age of graduation.

How to Open an Account

Opening an Embark Student Plan account is simple and can be completed online in about ten minutes. The person who opens the plan is called a subscriber and must enter into a contract with Embark. Spouses, common-law partners and family members can sign up to be joint subscribers.

To qualify to be an Embark Student Plan subscriber, you must be at least 18 years of age and must sign up for either an Individual Plan or Family Plan. The difference between the two is that a Family Plan can hold education savings for more than one beneficiary.

As the subscriber, you must provide both your own and your beneficiary’s SIN. The beneficiary must be a resident of Canada, and for a family plan, they must be your child, grandchild or sibling by blood or adoption and cannot be older than the age of 21.

If you’d like some assistance with setting up an Embark Student Plan, you can book an appointment with an Embark Education Savings Specialist. This can be done via telephone or a video call and can be scheduled directly from the Embark website.

Benefits of the Embark RESP

Here are some of the best benefits of using Embark to start your child’s RESP in 2023.

User-Friendly Online Service

The Embark Student Plan is completely online and available through its website. This allows you to have the flexibility to customize your plan 24/7 from anywhere. Embark provides interactive and visual analytics, account insights, and cutting-edge security to protect your personal information.

Tailored Portfolios

Embark automatically invests your portfolio based on where your child is along the glide path. No matter when you start your plan, Embark will suggest balanced portfolios that focus on growth and later capital preservation depending on your child’s age and how much time they have before starting post-secondary school.

No Minimums and Easy Contributions

One great thing about the Embark Student Plan is that there are no minimum requirements. This includes no minimums for the account balance, initial investment, and subsequent contributions.

You can contribute as much as you can when you can. And, speaking of contributions, Embark makes it easy by allowing you to set up automatic contribution plans and create your own contribution schedule.

Easy-to-Understand Analytics and Tuition Calculator

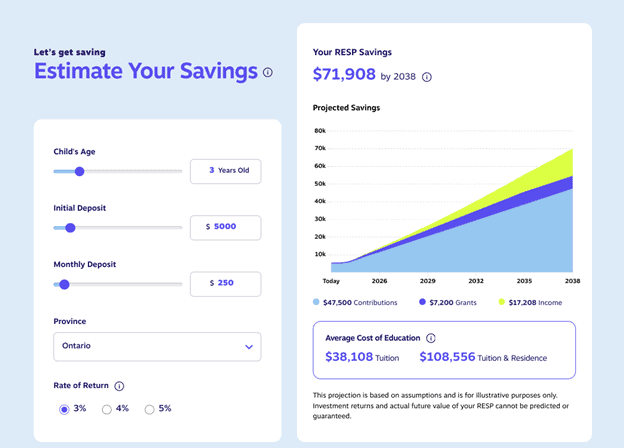

Embark provides cutting-edge analytics and insights to help plan your contributions for the future. You can easily see and understand how your account is doing, given current market conditions. Embark also includes a tuition calculator so you can see exactly how your glide path and investment strategy will pan out.

Costs of Embark Student Plan

The Embark Student Plan does come with some management fees, which is standard for any investment management service.

The management fee for the Embark Student Plan is 1.65% for both individual and family plans. This equates to about $16.50 in annual fees for every $1,000 you have invested. While it isn’t the cheapest management fee around, it is competitive with many other managed funds, especially when considering the portfolio is automatically rebalanced as the child grows older based on their needs.

Is Embark Safe?

This is a common question as Embark is not CIPF or CIRO registered and is owned by a not-for-profit foundation. Some people are more skeptical of investing their money with an institution that is not a major bank or credit union in Canada.

Embark does use CIPF and CIRO registered institutions as the custodian, investment manager, and trust to manage its funds and accounts. The custodian, which holds the assets of the Plan Trust is RBC Investor Services Trust. The portfolio manager for the accounts is BMO Asset Management Inc., and the Trustee is the Bank of Nova Scotia Trust Company. Finally, the auditor for the Embark Student Plan is KPMG.