Albertans pay one of the lowest income tax rates in Canada.

Even with the pause in the indexation of tax brackets for some time, the “Alberta Tax Advantage” still means that residents of the province pay the lowest federal and provincial marginal tax rates in the country.

Like other provinces, Alberta has a progressive tax system, and you pay more taxes as your income increases.

Alberta’s tax rate for personal income ranges from 10% to 15%, and the combined federal and provincial tax rate is between 24% and 48%.

Related: Ontario Tax Brackets and Rates.

Alberta Tax Brackets 2022-2023

The income tax brackets and rates that apply to taxable income in Alberta for the 2022 and 2023 tax years are:

| AB Tax Bracket 2022 | Tax Rate 2022 | AB Tax Bracket 2023 | Tax Rate 2023 |

|---|---|---|---|

| Up to $131,220 | 10% | Up to $142,292 | 10% |

| $131,221 to $157,464 | 12% | $142,293 to $170,751 | 12% |

| $157,465 to $209,952 | 13% | $170,752 to $227,668 | 13% |

| $209,953 to $314,928 | 14% | $227,669 to $341,502 | 14% |

| $314,929 and over | 15% | $341,503 and over | 15% |

To break down the numbers, for 2022, you pay:

- 10% on the first $131,220 of taxable income, plus

- 12% on the next $26,244 (i.e. on the portion of taxable income over $131,220 up to $157,464), plus

- 13% on the next $52,488 (i.e. on the portion of taxable income over $157,464 up to $209,952), plus

- 14% on the next $104,976 (i.e. on the portion of taxable income over $209,952 up to $314,928), plus

- 15% on amounts exceeding $314,928

Along with provincial taxes, you must also pay federal taxes on your income. For 2021, the applicable federal tax brackets and rates are:

| Taxable Income | Tax Rate |

|---|---|

| Up to $50,197 | 15% |

| Over $50,197 up to $100,392 | 20.50% |

| Over $100,392 up to $155,625 | 26% |

| Over $155,625 up to $221,708 | 29% |

| $221,708 and over | 33% |

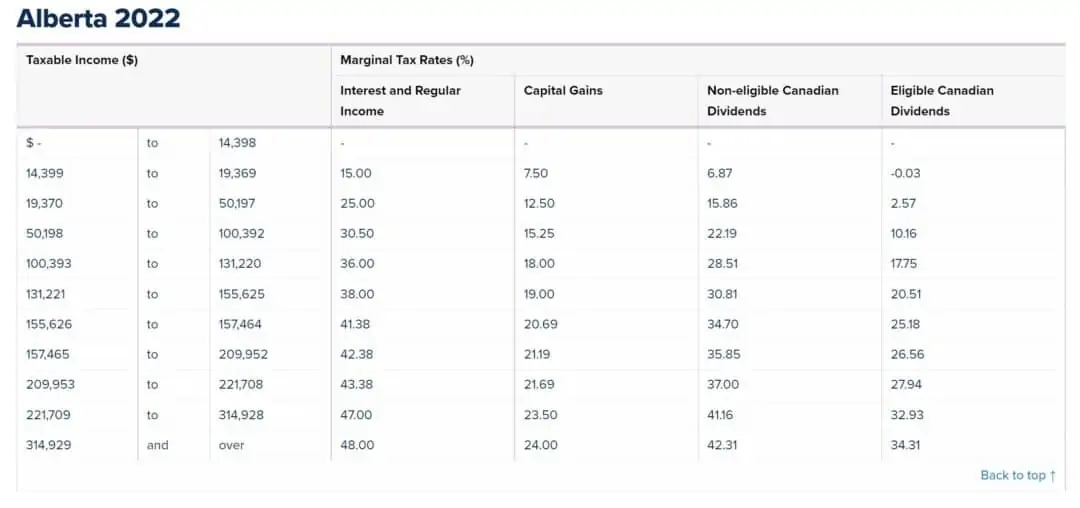

Alberta Marginal Tax Rates (Federal and Provincial)

Marginal tax rates reflect how much you pay in taxes on an additional dollar of income.

Using the tool here, the combined federal and provincial marginal tax rates for Alberta residents in 2022 are as follows:

The numbers above consider Alberta’s basic personal amount, which is $19,369 for this year. It also includes the federal basic personal amount of up to a maximum of $14,398.

You can use your marginal tax rate to determine how much you save in taxes when you make a tax deduction, e.g. after you make an RRSP contribution.

For example, if your taxable income is $100,000 and your RRSP contribution in 2022 is $10,000, you can expect a tax refund of $3,600 based on a marginal tax rate of 36%.

Alberta Tax Credit and Deductions

You can lower your taxes payable using applicable refundable and non-refundable tax credits available federally and provincially.

Popular non-refundable credits include the basic personal amount for eligible dependents, age amount, charitable donations, medical expenses, caregiver amount, public transit passes, and first-time homebuyer credit.

A non-refundable tax credit can reduce your taxes to zero; however, you won’t get a refund if your credits exceed taxes owed.

Popular refundable tax credit includes the working income tax credit and Goods and Services Tax credit. Alberta also has the investor tax credit (AITC), and Alberta stock savings plan tax credit.

Refundable tax credits lower your taxes, and if you don’t owe taxes, you get a refund.

Tax deductions lower your taxable income. Regular deductions applicable to Albertans include CPP contributions, employment insurance, RRSP contributions, and loan interest.

How To File Your Tax Return in Alberta

The deadline for individuals to file their taxes each year is April 30. Self-employed folks get an extension until June 15.

If you have a modest income, CRA offers free tax clinics where volunteers complete your tax return for free. Alternatively, you can file your tax return using the following:

- Free tax software such as TurboTax or WealthsimpleTax.

- A paper tax return you can download from the CRA website.

- A paid tax preparation service such as HR Block.

Here’s an article with more details about free tax return software in Canada.

Good article but its claim that Alberta has “the lowest federal and provincial marginal tax rates in the country” is not entirely accurate. I cannot speak for other provinces but British Columbia, which has brackets that levy 5.06% against income up to $41,725 and 7.7% against the next $41,726 (i.e. up to a total of $83,451) is certainly lower for 5-figure incomes.

Certainly, higher income earners who would pay 16.8% for income between $157,748 and $220,000 and 20.5% for income above $220,000, would pay less tax if they moved to Alberta.

However, I’m not a high income earner and we’re in the process of moving from Alberta to BC this year. By my calculations – I’ve built a spreadsheet that I use for annual tax planning – I project that I’ll pay about $1300 less income tax in BC than I would if I remained in Alberta. If I play with the taxable income amount, my spreadsheet says that I would begin to pay more income tax in BC if I earned ~$150,000 and up, although the exact figure would depend on the composition of that income.

Of course, if you expand the scope to all taxes – such as PST and other taxes in BC – the situation changes and Alberta once again has an “overall” tax advantage.

@Michael: Thanks for your comment. I believe Alberta still maintains its position for having one of the lowest combined tax rates in Canada and North America. That said, I agree that the Alberta Tax Advantage has eroded a bit in recent years and this is more pronounced at some tax brackets. The subject is interesting to me as I’m also looking at potentially bailing from Manitoba for similar reasons.

This article digs into it a bit further: https://www.fraserinstitute.org/sites/default/files/end-of-the-alberta-tax-advantage.pdf

Cheers!