Credit Karma makes it easy for Canadians to obtain their credit score and credit report online and to monitor their credit free of charge.

Credit scores have been available for free over the Southern border for a while. However, until recently, you were required to pay $20 or more to obtain your credit score in Canada.

These days, online financial services companies such as Borrowell, Credit Karma, and Mogo offer Canadians access to a free credit score that is regularly updated.

Read on to learn how to use Credit Karma for your TransUnion credit score and report, and how it compares to Borrowell.

Credit Karma Overview

Credit Karma was founded in 2006 in the United States.

In 2016, it expanded its operations to Canada and is available to residents of Alberta, Ontario, Manitoba, British Columbia, New Brunswick, PEI, Saskatchewan, Nova Scotia, and Newfoundland and Labrador.

Credit Karma offers users free credit scores, reports, and credit monitoring. In the U.S., it also provides free tax filing services.

Since Credit Karma offers these services for free, it begs the question: “how does it make money?”

The company makes money by providing credit card recommendations to you based on your credit profile. If you apply for one of these credit card offers, the bank issuing the card pays it a referral fee at no additional cost to you.

How To Get Your Credit Score and Report From Credit Karma

Signing up for the free credit score and credit monitoring service is easy.

- Visit CreditKarma.ca

- Enter your basic details and choose if you want to receive email updates of activity on your credit profile (i.e. for credit monitoring). You can also opt-in for promotional emails if you want.

- Verify your identity.

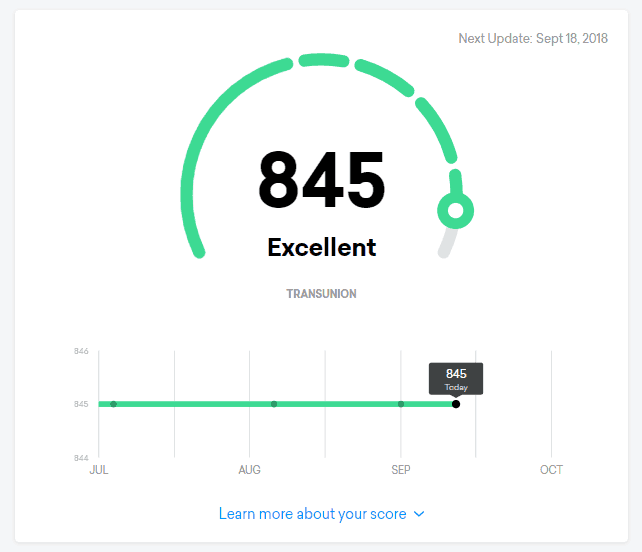

- You now have access to your TransUnion credit score free of charge. This score is updated weekly.

Checking your credit score online through a service like the one Credit Karma provides is referred to as a “soft inquiry,” and does not lower your credit score (has no impact).

Is Credit Karma Safe and Legit?

Yes, Credit Karma is safe and legit. I have never had to enter my credit card information or Social Insurance Number. I get the occasional email with credit card offers, but I never bite, which has not been an issue. Free access to my credit score and report has been “free” so far.

With regards to the security measures in place to protect your private information, Credit Karma says they use “128-bit or higher encryption to protect the transmission of your data to our site” and “do not share your personal information with unaffiliated third parties for their own marketing purposes.” The company also uses firewalls and other technologies to protect your account.

That being said, the internet is what it is. If you remember, Equifax (a major credit bureau) was hacked a while back, so there is no iron-clad guarantee when you are online, in my opinion.

Is Credit Karma Accurate in Canada?

The credit score and report you see on Credit Karma are from TransUnion, which is the second main credit bureau in Canada.

Because Equifax and TransUnion use different algorithms to calculate your score, it may be different. Also, the TransUnion score you get on Credit Karma may differ from the one shown to lenders.

Credit Karma vs. Borrowell

Credit Karma and Borrowell are my go-to’s for free credit score monitoring.

Borrowell was the first company to offer free credit score checks in Canada. It was founded in 2014 and has been used by over 2 million Canadians.

Borrowell scores are based on Equifax’s proprietary model and may differ from your TransUnion score.

I get my Equifax credit score and report through Borrowell, and my TransUnion credit score and report using Credit Karma. Since both are updated regularly, I do not need to subscribe to a credit monitoring service.

Both Credit Karma and Borrowell send occasional product recommendations for credit cards to your email if you opt in while registering. However, you do not need to apply for a credit card to use their free service.

Borrowell is available in all provinces, including Quebec. Credit Karma is unavailable in Quebec, Nunavut, the Yukon, and Northwest Territories.

| Credit Karma | Borrowell | |

| Monthly fee | None | None |

| Credit bureau | TransUnion | Equifax |

| Mobile app | Yes (iOS and Android) | Yes (iOS and Android) |

| Customer support | ||

| Security | 128-bit or higher encryption | 256-bit encryption |

| Other features | Comparison platform for credit cards, loans and mortgages | Comparison platform for credit cards, loans, and other banking products; bill tracker, rent advantage and credit builder products |

What is Considered a Good Credit Score in Canada?

A credit score is a 3-digit number between 300 and 900 that reflects how “good” or “bad” you are with debt. The credit score you obtain from the two major credit bureaus in Canada (Equifax and TransUnion) may be slightly different; however, they can generally be ranked as:

800 – 900: Excellent

720 – 799: Very Good

650 – 719: Good

600 – 649: Fair

300 – 599: Poor

Based on the numbers above, a “good” credit score is technically any score over 650. The higher your credit score, the better your chances of getting a competitive interest rate when you want to borrow money.

To arrive at your score, credit bureaus consider the following:

- Your loan repayment history

- Total debt

- Length of your credit history

- New credit inquiries on your account

- Your credit mix

Credit Karma provides a credit score that is obtained from TransUnion. If you also want to see your Equifax credit score, you can obtain it for free through Borrowell.

You can also obtain your credit score directly from the credit bureaus, but this service comes at a cost.

Learn about how your Canadian credit score is calculated.

What’s in a Credit Report?

Your credit report shows details of how you have used debt over time. In addition to your credit score, a lender also looks at what is on your credit report. Some of what credit bureaus record on your credit report include:

- Personal information

- List of your credit accounts

- Public records and collections

- Credit report inquiries

- Consumer statements

In Canada, credit bureaus are obligated to provide you with one free copy of your credit report annually if you request it.

Companies like Credit Karma and Borrowell provide free monthly or weekly credit report updates when you sign up with them.

Credit Karma FAQs

Some other popular questions people ask about Credit Karma and their answers are below:

Credit score inquiries that occur from checking your own score are known as soft inquiries and do not impact your credit score one way or another.

No, your credit card information is not required on Credit Karma, and there is no fee for accessing your free credit score.

Providing your social insurance number (SIN) is optional on Credit Karma and is not required. You can access your free credit score even if you do not disclose it during the sign-up process.

Credit Karma does not offer phone support; however, you can submit your questions through their website support page, and they will respond to you via email.

How does your Credit Karma credit score compare with the Equifax one you get from Borrowell?

Related:

- 4 Ways To Get Your Credit Score in Canada

- Borrowell Review: Free Credit Score in Canada

- TransUnion vs. Equifax Credit Scores

- 10 Ways To Improve Your Credit Score

Credit Karma Canada Review

-

Fees

-

Ease of Use

-

Security

-

Mobile app access

-

Customer support

Overall

Summary

Credit Karma provides free credit score and report checks from TransUnion. This Credit Karma review covers how it works and whether it is legit.

Pros

- Access to a free credit score check

- Access to a free credit report check

- Provides financial education around credit management

- Has a mobile app

Cons

- Will send you marketing emails

- Does not include your Equifax score, which may be different

- There’s no phone support

- Not available in Quebec

Credit karma is good to help you get back on track but take it with a grain of salt with your score tho. So pretty much if you have a 720 score you really have a 680 or 700. It gives you an idea.

@Keith: It’s best to obtain from both credit bureaus so you can compare. There is often a difference between the scores though:

https://www.savvynewcanadians.com/transunion-vs-equifax-credit-scores-why-the-difference/

Been improving my credit but major difference -credit karma score 631, but then when i check borrwell, it says more score is 477!!! what the heck???

@Veej: If you feel there’s an error in your score, you can contact Equifax and TransUnion directly. That being said, it is usual for there to be a difference between the scores from the different credit bureaus…although yours is a major difference.

Also note that it may take a while for the different credit bureaus to process new information from lenders/banks.

Got my report and score from one of the bureaus online. Signed up for one of the free ones using that same bureau next day. Information matched up perfectly and timing of reporting from creditors was the same. BUT the score from the free service was 25 points lower!

Also had a client show me his score of 640 from a free service. When I put the info to the banks it came back that his score was below 500 and his credit was a mess with non-pays and collections. Not impressed.

My Equifax/Borrowell credit score is 0. My TransUnion credit score (obtained from TransUnion themselves for a fee) is 772. But my CreditKarma credit core which is supposed to be the same as the TransUnion credit score, is 590. Maybe it’s just me, but that doesn’t seem very reliable to me, and now I can’t get housing because more and more landlords are doing a credit check, even though rent is not credit because it is paid in advance.

I keep receiving “your new score reports are ready”, however, the login page does not come. How do we fix this????

In canada we’re supposed to be able to get a annual report/score for free. The customer disclosure that transunion provides doesn’t have that information. I’ve called and accessed chat, in the site due to a major drop in my score a year ago. No one will help me find out what happened or who is responsible. As I didn’t have anything in my name that would effect my score. How can I file a dispute if I don’t have all the info needed?

@Mindy: We are supposed to be able to get a credit report. I believe the obligation to provide a free access to credit scores only applies in Quebec currently.