Augusta Precious Metals is a reputable company that provides services related to gold and silver Individual Retirement Accounts (IRAs) in the United States.

With a focus on supporting individuals in their retirement planning, Augusta Precious Metals aims to simplify the complex world of commodities and help clients understand the importance of diversifying their investment portfolios through precious metals.

In today’s uncertain economic landscape, many individuals seek alternative assets to safeguard their retirement savings and protect against potential economic downturns.

Precious metals have long been recognized as a reliable hedge against inflation and a means to diversify investments, reducing vulnerability to market fluctuations.

Founded in 2012 and based in Beverly Hills, California, Augusta Precious Metals stands out among gold IRA companies for its commitment to education, customer service, and transparency.

The company offers a range of products, including gold and silver coins, bullion, and IRA-eligible metals, providing clients with options to suit their financial goals and preferences.

Augusta Gold IRA

Augusta Precious Metals offers a comprehensive Gold IRA program that allows US individuals invest in gold as part of their retirement strategy.

A Gold IRA, also known as a precious metals IRA, is a self-directed Individual Retirement Account (SDIRA) that holds physical gold or other precious metals as the primary investment.

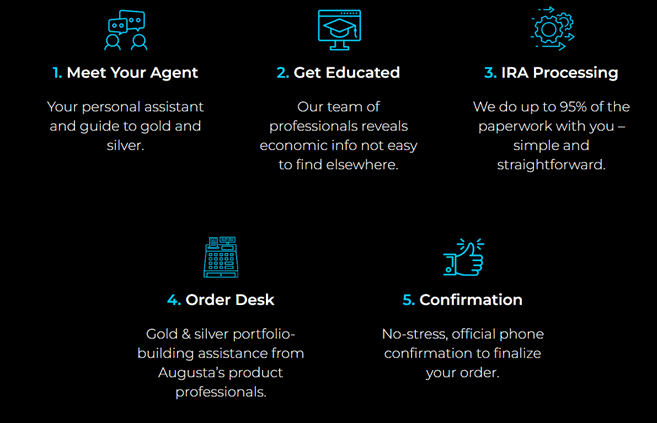

How Augusta Gold IRA Works: Setting up a Gold IRA with Augusta Precious Metals is a straightforward process. Here’s a step-by-step overview:

- Contact Augusta Precious Metals: Begin by contacting Augusta Precious Metals through their official website or by contacting their team directly. A representative will guide you through the process and provide assistance along the way.

- Educational Materials and Guidance: Once you’ve established contact, Augusta Precious Metals will provide you with educational materials, including videos, guides, and market insights. These resources help you understand the benefits of investing in gold and make informed decisions.

- IRA Processing: Augusta Precious Metals will assist you in both – setting up your Gold IRA, and rolling over your existing IRA from an eligible retirement account – by handling the necessary paperwork and documentation. The company’s IRA processing department will guide you through the process, making it a hassle-free experience.

- Building Your Gold Portfolio: After your Gold IRA is set up, you can start building your portfolio. Augusta Precious Metals offers a range of gold products for investment, including gold coins and bullion. Their knowledgeable professionals will provide guidance on selecting the right products based on your financial goals.

- Finalize Your Order: Once you have chosen the gold products you want to purchase, Augusta Precious Metals will finalize your order. A representative will contact you to confirm the order details, and the company will then process the transaction.

What You Can Invest in with Augusta Gold IRA: Augusta Precious Metals offers various gold investment options for your Gold IRA. Here are some examples:

- Common Gold Bullion: This category includes popular gold coins and bars, such as the Gold American Buffalo, Gold American Eagle, Gold Canadian Polar Bear, and Gold Bar.

- Premium Gold: Augusta Precious Metals also provides premium gold coins, which may have additional numismatic value. Examples of premium gold coins include the 2014 Canadian Gold Arctic Fox, $20 Saint Gaudens, $10 Indian, and $20 Liberty.

- IRA-Eligible Coins: These coins meet the criteria for inclusion in a self-directed IRA. Some examples of IRA-eligible gold coins are American Eagle Proofs, Canadian Maple Leaf, Australian Striped Marlin, and American Silver Eagle.

The selection of gold products may vary, so it is recommended to contact Augusta Precious Metals directly for up-to-date information on available options.

Custodian and Storage: As with any self-directed IRA, a custodian is required to hold and manage the assets within the account. Augusta Precious Metals partners with multiple custodians, including Equity Trust, a reputable and trusted custodian in the industry, to ensure the safekeeping of your gold holdings.

Regarding storage, although Augusta Precious Metals recommends Delaware Depository, a secure storage facility located in Delaware, there are other locations too where you can store your gold, including Nampa, Idaho, Shiner, Texas, Dallas, Texas, Los Angeles, California, Bridgewater, Massachusetts, Salt Lake City, Utah, South Fargo, North Dakota, Springfield Gardens, New York, New Castle, Delaware, Wilmington, Delaware, and Las Vegas, Nevada.

Your gold will be stored in a segregated account, separating your assets from others’ holdings. This arrangement provides additional security for your precious metals.

It’s important to note that although Augusta Precious Metals doesn’t charge any other fee other than the wholesale to retail spread, they make by selling you precious metals, you pay an annual custodian and storage fees to your custodian and depository company, respectively. These fees cover the maintenance and security of your Gold IRA assets.

Augusta Silver IRA

Augusta Precious Metals also offers a Silver IRA program, allowing individuals to include silver as part of their retirement savings. Similar to a Gold IRA, a Silver IRA is a self-directed Individual Retirement Account that holds physical silver or other precious metals.

How Augusta Silver IRA Works: Setting up a Silver IRA with Augusta Precious Metals follows a similar process to the Gold IRA. Here’s an overview:

- Contact Augusta Precious Metals: Begin by contacting Augusta Precious Metals and expressing your interest in a Silver IRA. Their knowledgeable team will guide you through the process and address any questions or concerns you may have.

- Educational Materials and Guidance: Augusta Precious Metals provides educational resources to help you understand the benefits of investing in silver and its potential role in your retirement strategy. These materials will equip you with the knowledge necessary to make informed decisions.

- IRA Processing: Augusta Precious Metals will assist you in setting up your Silver IRA and rolling over your existing IRA from an eligible retirement account by handling the required paperwork and documentation. Their experienced IRA processing department will streamline the process, ensuring a seamless experience for you.

- Building Your Silver Portfolio: Once your Silver IRA is established, you can start building your silver portfolio. Augusta Precious Metals offers a range of silver products for investment, including silver coins and bullion. Their team will provide guidance on selecting the right products based on your investment objectives.

- Finalize Your Order: After choosing the silver products for your portfolio, Augusta Precious Metals will finalize your order. A representative will confirm the order details with you before processing the transaction.

What You Can Invest in with Augusta Silver IRA: Augusta Precious Metals offers a variety of silver investment options for your Silver IRA. Some examples include:

- Silver Bullion Coins: This category includes popular silver coins like the American Silver Eagle, Canadian Silver Maple Leaf, Austrian Silver Philharmonic, and Australian Silver Kookaburra.

- IRA-Eligible Silver Coins: These coins meet the requirements for inclusion in a self-directed IRA. Examples of IRA-eligible silver coins include the American Silver Eagle, Canadian Silver Maple Leaf, and Mexican Silver Libertad.

- Silver Bars: Augusta Precious Metals also offers silver bars from reputable mints, such as the 1 oz and 10 oz silver bars.

Please note that the availability of specific silver products may vary, and it is recommended to contact Augusta Precious Metals directly for the most up-to-date information on available options.

Similar to the Gold IRA, Augusta Precious Metals partners with multiple custodians offering SDIRA, including Equity Trust. You can store your silver holdings securely in a segregated account at any of the storage facilities we have mentioned in the Gold IRA section, but Augusta Precious Metals strongly recommends the Delaware Depository for its enhanced security and protection.

It’s important to remember that annual custodian and storage fees will apply to your Silver IRA, separate from the product prices you pay Augusta Precious Metals, to cover your silver assets’ ongoing maintenance and security.

Pros and Cons of Augusta Precious Metals

Pros of Augusta Precious Metals:

- Focus on Education: Augusta Precious Metals is dedicated to providing educational resources and information to its clients. This focus on education helps investors make informed decisions and understand the intricacies of investing in precious metals.

- Lifetime Support: Augusta Precious Metals offers lifetime support to its clients. This means that investors can rely on ongoing assistance and guidance throughout their investment journey, ensuring a long-term relationship with the company.

- Transparent Fee Structure: Augusta Precious Metals maintains a transparent fee structure. They do not charge any additional fees apart from the wholesale/retail spread on precious metals during the buying process. The only fees investors need to pay are the annual custodian fee of $100 to the custodian company and the annual storage fee of $100 to the depository company. This transparency helps investors understand the costs associated with their investment.

- Easy Setup Process: Augusta Precious Metals provides an easy setup process for their gold and silver IRA accounts. This streamlined process simplifies account creation and funding, making it convenient for investors to establish their retirement accounts.

- Positive Customer Reviews: Augusta Precious Metals has garnered positive customer reviews, indicating a high level of customer satisfaction. These reviews suggest that clients have had a positive experience with the company’s services, including their educational resources, support, and overall investment process.

- Buyback Option: Augusta Precious Metals offers a buyback program, allowing investors to sell their precious metals back to the company at the prevailing market price. This buyback option provides liquidity and flexibility for investors who may need to liquidate their holdings in the future.

Cons of Augusta Precious Metals:

- Minimum Investment Requirement: Augusta Precious Metals has a minimum investment requirement of $50,000. This may be a barrier for investors who do not have a significant amount of capital to allocate to precious metals or those who prefer to start with smaller investments.

- No Pricing on Website: Augusta Precious Metals does not display pricing information for its products on its website. This lack of pricing transparency can make it challenging for potential investors to evaluate and compare prices without directly contacting the company.

- No Online Orders: Augusta Precious Metals does not facilitate online orders for its products. Investors are required to contact the company directly to place orders, which may be less convenient for individuals who prefer to conduct transactions online.

Related: Pros and Cons of Gold IRAs.

Augusta Precious Metals Fees and Pricing

Augusta Precious Metals offers transparent and competitive fees for clients interested in investing in precious metals. With a minimum purchase requirement of $50,000, an initial setup fee of $50, an annual custodian fee of $100, and an annual storage fee of $100 (non-segregated), clients can confidently plan their investments.

The total IRA fees are $250 for the first year and $200 thereafter, ensuring a fair and straightforward pricing structure. Note that Augusta Precious Metals, as a service provider, charges ZERO fees for up to 10 years. There are no shipping costs or additional fees involved, providing clients with a clear understanding of their investment expenses.

How To Invest in Augusta Gold and Silver IRAs

Investing in Augusta Gold and Silver IRAs is a straightforward process that enables you to diversify your retirement portfolio with precious metals. Here’s a step-by-step guide on how to get started:

- Research and Determine Your Investment Goals: Begin by researching the benefits and potential risks of investing in gold and silver. Consider your long-term investment objectives, risk tolerance, and the role you want precious metals to play in your retirement portfolio.

- Meet the Minimum Purchase Requirement: Augusta Precious Metals requires a minimum purchase of $50,000 to establish a Gold and Silver IRA. Ensure that you meet this requirement to open your account.

- Contact Augusta Precious Metals: Contact Augusta Precious Metals to initiate the investment process. Our experienced team will guide you through the necessary paperwork and answer any questions you may have.

- Set Up Your Self-Directed IRA: Augusta Precious Metals will assist you in setting up a self-directed IRA, which allows you to have control over your investment decisions. This process involves filling out the required forms and selecting a custodian to safeguard your precious metals.

- Choose Your Precious Metals: Work with Augusta’s knowledgeable representatives to select the gold and silver products that align with your investment goals. Augusta offers a wide range of IRS-approved coins and bars, ensuring you have diverse options to choose from.

- Fund Your Account: Transfer funds from your existing retirement account or make a cash contribution to fund your Augusta Gold and Silver IRA. Our team will provide you with the necessary instructions and assist you throughout the funding process.

- Confirm Purchase and Secure Storage: Once your account is funded, Augusta Precious Metals will execute your purchase and arrange for the secure storage of your precious metals with a trusted storage facility. Rest assured that your assets will be protected in a controlled and insured environment.

- Monitor and Manage Your Investment: Stay informed about market trends and regularly review your portfolio. Augusta Precious Metals provides resources and expertise to help you make informed decisions regarding your precious metals investments.

Is Augusta Precious Metals Legit?

When evaluating the legitimacy of Augusta Precious Metals, the available information clearly demonstrates its credibility and customer satisfaction. Let’s consider the following factors:

Better Business Bureau (BBB) Rating and Customer Reviews: Augusta Precious Metals holds an A+ rating with the BBB, indicating their commitment to resolving customer issues. With 121 customer reviews and an average rating of 4.92 out of 5, Augusta Precious Metals has not received any complaints, highlighting its exceptional service in the financial sector.

Consumer Affairs and Other Platforms: Consumer Affairs, a reputable customer reviews and news platform, features 133 positive Augusta gold IRA reviews, with an average rating of 4.9 out of 5. Moreover, Augusta Precious Metals has received over 354 reviews on Google, averaging 4.9 out of 5 stars, and on Facebook, they have amassed more than 128 Augusta gold IRA reviews with an average rating of 4.8 out of 5.

Money magazine & Investopedia: Augusta Precious Metals has been recognized for its excellence in the industry. The company has received prestigious awards, including the 2022 and 2023 Money magazine’s “Best Overall Gold IRA Company” accolade, highlighting its commitment to providing top-quality services and products to its clients.

In addition, Investopedia has recognized Augusta Precious Metals as the “Most Transparent” gold IRA company, emphasizing the company’s dedication to transparency and fostering trust with its customers.

Trustlink Ratings: Augusta Precious Metals also garners positive reviews on Trustlink, a trusted platform for customer reviews. With over 285 reviews and an average rating of 4.9 out of 5, Augusta Precious Metals has established a strong reputation for customer satisfaction.

Overall, Augusta Precious Metals has consistently received excellent reviews and ratings across multiple platforms. With its high customer satisfaction, Augusta Precious Metals demonstrates its legitimacy and reliability as a trusted provider of gold IRA services for retirement accounts.

Conclusion

Augusta Precious Metals is a trusted company that focuses on gold and silver Individual Retirement Accounts (IRAs), catering to individuals who want to secure their retirement savings and diversify their investment portfolios.

With a commitment to transparency, education, and excellent customer service, Augusta Precious Metals simplifies the process of investing in precious metals for retirement planning. By offering a range of gold and silver products, including coins and bullion, they provide options that align with the client’s financial goals and preferences.

It’s important to note that this review is provided for informational purposes only and should not be considered financial advice. Individuals should seek professional guidance before making any investment decisions.

FAQs

Augusta Precious Metals sells various types of gold and silver, including popular coins like the Gold American Buffalo and the American Silver Eagle, as well as gold and silver bars. They offer a wide range of IRA-approved precious metals to cater to different investment preferences.

Augusta Precious Metals prioritizes the safety and security of its clients’ investments. They partner with trusted custodians and recommend secure storage facilities to ensure the protection of precious metals. However, as with any investment, there are inherent risks, and individuals should conduct thorough research and seek professional advice before making investment decisions.

Gold-backed IRAs can be a good idea for individuals looking to diversify their investment portfolios and hedge against inflation. Gold has historically been a reliable store of value and a hedge against economic uncertainties. However, the suitability of a gold-backed IRA depends on individual financial goals, risk tolerance, and other factors, so it’s essential to consult with a financial advisor to determine if it aligns with your specific circumstances.

IRA-approved gold refers to gold coins or bars that meet the criteria set by the Internal Revenue Service (IRS) for inclusion in a self-directed IRA. These coins and bars must meet specific purity and authenticity standards. Augusta Precious Metals offers a range of IRA-approved gold products that can be held in a self-directed IRA.

Augusta Precious Metals is a privately-owned company, and the ownership details are not publicly disclosed. However, it was founded in 2012 and has since established a strong reputation in the precious metals industry.

While Augusta Precious Metals is a reputable company, there are a few cons to consider when buying precious metals. These include the potential for price volatility, liquidity challenges compared to traditional investments, and the need for secure storage. Additionally, investing in precious metals may not be suitable for everyone, depending on individual financial circumstances and investment goals.

How many years has Augusta Precious Metals been in business?

Augusta Precious Metals has been in business since 2012, accumulating over a decade of experience in the precious metals industry. Their longevity in the market indicates their ability to provide reliable services and maintain customer satisfaction over the years.

Related: