If you’re looking for a mortgage, you might want to look at HSBC.

There are many mortgage providers in Canada, so comparing options is always a good idea, but I like what HSBC offers.

Read on to find out what I think about HSBC Canada mortgages, including the pros and cons and whether it’s worth it.

Key Takeaways

- HSBC Canada offers a range of mortgages, including variable and fixed-rate open and closed mortgages.

- It has a reputation for good rates, but always check and compare the current rates at other lenders too.

- HSBC mortgage rates compare well with other mortgage providers like Tangerine, BMO Mortgage and Neo Mortgage.

HSBC Canada Mortgage Overview

HSBC Canada is one of the biggest banks in the country, and it has a wide range of mortgage products.

It offers a Traditional Mortgage, which is available in both fixed and variable rates as well as open and closed. This may include the option of flexible early payment.

You might be interested in the HSBC Equity Power Mortgage, which allows you to access up to 80% of your home’s value.

You can also use the HSBC Home Equity Line of Credit (HELOC) and get access to cash when you want it, only paying interest on what you use.

Several HSBC Canada mortgage calculators are available, so you can work out how much you can borrow, your mortgage payments, and more.

As one of the world’s largest banks, HSBC has millions of customers in Canada and worldwide.

It also offers its New to Canada Mortgage, targeted at new immigrants.

HSBC Canada Mortgage Rates

Mortgage rates change constantly, so I won’t list them here. But you can find details of all the current rates on their website for the following mortgages:

- Fixed Rate Open Mortgage – Terms of six months and one year.

- Fixed Rate Closed Mortgage – Many term options available from six months to 10 years.

- Variable Rate Open Mortgage – Just one term of three years, and the rate is the highest on the list.

- Variable Rate Closed Mortgage – The five-year term is the only option.

Pros and Cons of an HSBC Mortgage

Pros

- Transparent mortgage rates.

- Good reputation for competitive mortgage rates.

- Large and reputable bank with a global presence.

- A good option for newcomers to Canada.

- Special offers are sometimes available for banking customers.

- Easy application process.

- Quick mortgage pre-approval option.

Cons

- Not a great option for people with low credit scores.

- Prepayment penalties can be high.

How to Apply for HSBC Canada Mortgage

I’ve found applying for an HSBC Canada mortgage to be similar to other mortgages from major banks.

You must be the age of majority in your province or territory and be a Canadian resident.

When you apply, you must provide your personal details and gross annual income. You must also consent to HSBC checking your credit report.

You can get pre-approved too, which doesn’t take long. This is a great way to determine how much you can afford.

Depending on your situation, you may need to provide proof of employment, tax returns, your Social Insurance Number, credit history, and more.

HSBC Interest Rates Promotion

Special rates are often available for HSBC mortgages, but these change constantly.

Go to the rates page for the latest promotions and see the Special Offers section for the latest promotional rates.

Why Are HSBC Mortgage Rates So Low?

HSBC Canada has something of a reputation for low rates, but this isn’t always the case.

It made headlines in 2020 with a low rate of 0.99%, but interest rates have risen considerably since then. The Prime Rate is much higher at the time of writing.

But while I find mortgage rates are competitive at HSBC, they are not always lower than other banks. Depending on when you search for rates, you may find that they are higher. It also depends on the type of mortgage you want and the term.

So always compare mortgages, and don’t assume you will get the best rate at HSBC.

How to Choose the Right Mortgage Term

Choosing a mortgage term is one of the most important things you must decide when applying for a mortgage, whether at HSBC Canada or another provider.

The main thing I would consider is that a longer term will mean smaller monthly payments but paying back more overall in interest payments.

Also, check the interest rates for different terms. HSBC has several terms for fixed-rate closed mortgages, from six months to 10 years.

You may want a shorter term if you think interest rates will decrease in the coming years. This would allow you to renew your mortgage at a lower rate. However, if you think rates will increase, it may be better to lock in a rate now.

Think very carefully about your options. No one knows what will happen with rates, so consider all the factors.

HSBC Mortgage Alternatives

Featured Mortgage Offer

Neo Mortgage

On Neo Financial’s website

- Compare mortgage rates across several lenders

- Access to competitive rates and online applications.

- Available Canada-wide

- Accepts a wide range of credit scores

HSBC Canada is not the only mortgage lender in the country, and there are many more to choose from. Here are some of the other options I recommend looking at.

Neo Mortgage

Neo offers digital mortgages with dedicated support. You can get a new mortgage here or refinance or renew your mortgage.

You can do everything from home and even sign all the legal documents online. There are no hidden fees, and you can apply with as little as 5% down.

Rather than provide its own mortgages, it checks the market to find the best rates. Check out our review of Neo Mortgage here.

Nesto Mortgage

Nesto is another digital bank offering low rates and a simple, fast process for mortgage application.

It’s a reputable bank, and it scans the market for the best rates. You can also get expert advice, and it offers mortgage renewal and refinancing.

Here’s a guide for Nesto mortgages.

BMO Mortgage

BMO offers a full suite of products and a 130-day mortgage rate guarantee, which is longer than most banks. It also has accelerated payment options.

You can get fixed and variable mortgages here, along with a line of credit, mortgage renewals, and mortgage refinancing.

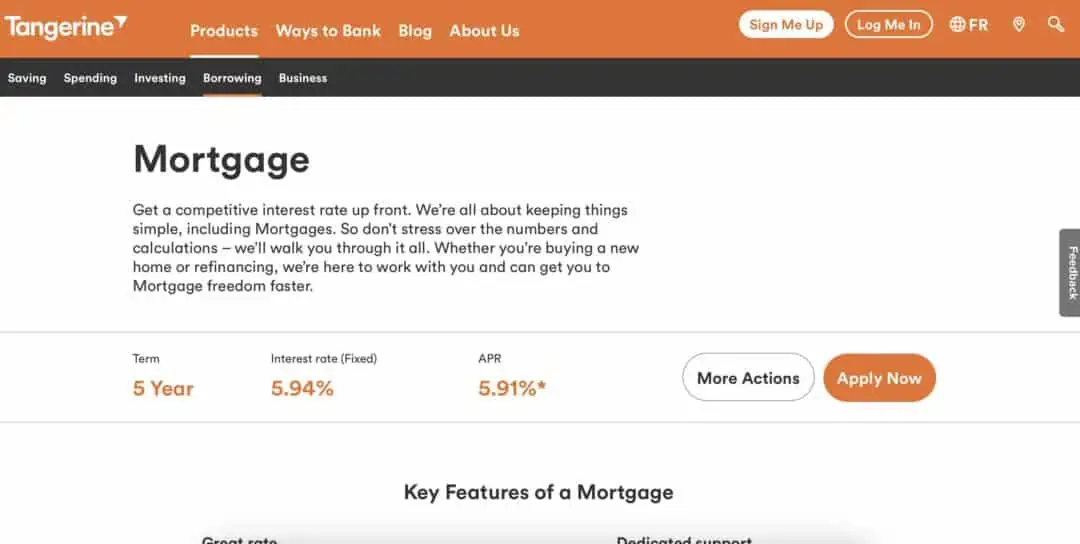

Tangerine Mortgage

This digital bank offers competitive rates and a simple and fast process for getting a mortgage to buy a home. You can also access mortgage refinancing.

Tangerine offers a guaranteed rate for 120 days, and it also provides the option of flexible prepayments.

Related: Tangerine mortgage rates review.

RBC Mortgage

RBC is one of the largest banks in Canada, and its mortgage offerings are similar to those of other big banks.

It also offers the option of arranging your mortgage remotely, and you can quickly get an estimate of how much you can afford by getting prequalified.

You will find fixed and variable mortgages, and you can also access home equity.

Is Getting an HSBC Mortgage Worth It?

Getting a mortgage from HSBC could be a good decision for you. I’m impressed by the number of mortgages they provide, as well as their rates, and I like the fact that they are transparent about their rates.

HSBC is a large and trusted financial institution. You can get help from a mortgage advisor, and the option to quickly get pre-approved can help when you are searching for a property to buy.

While I think HSBC is a good option, always compare different mortgage providers, including those I’ve included in this guide.

FAQs

Getting a mortgage from HSBC is fairly straightforward for most people. You will need to have a good credit score, but other than that, you will need to provide the standard information, including details about your income.

HSBC is one of the biggest banks in the world, and it is a popular choice of bank in Canada. It is also a popular option for anyone looking for a mortgage.

HSBC announced in 2022 that it has agreed to sell its business in Canada to RBC. This decision was made following a review of the business, and selling it made strategic sense. However, the sale is not expected to be completed until 2024.

While some expect mortgage rates to go down, no one can say exactly what will happen with mortgage rates in Canada in 2023 or beyond.