Your business may need to pay GST or HST to the CRA in quarterly instalments throughout the year or face penalties and interest at tax time.

If your business earns revenue exceeding $30,000 in the last calendar year, you no longer qualify as a “small supplier” and must register to collect and remit GST/HST on eligible sales in Canada. This $30,000 threshold may be met in a single quarter or over multiple quarters within your business year.

With GST/HST registration comes the need to file a GST/HST return at the end of your fiscal year.

If the net GST/HST collected by your business exceeds $3,000 in the previous year and you file your returns annually, CRA expects you to remit GST/HST in four quarterly instalments and not wait until the end of the year.

GST/HST Instalments Due Dates

GST/HST installment payment for each quarter is due within one month after the end of each fiscal quarter.

If your business has a December 31 year-end, you must make instalment payments by:

| Fiscal Quarters | Instalment Due Dates |

| January 1 – March 31 | April 30 |

| April 1 – June 30 | July 31 |

| July 1 – September 30 | October 31 |

| October 1 – December 31 | January 31 |

If your net GST/HST in the last fiscal year did not meet the $3,000 threshold, you have a payment deadline date of April 30 in the following year to pay any GST/HST balance outstanding, and your GST/HST return must be filed by June 15.

If you are required to pay GST/HST in instalments and you have a balance owing at the end of the fiscal year because your net GST/HST increased, the balance owed must be paid 3 months after your fiscal year end.

For example, if you have a December 31 year end, your GST/HST return must be filed by March 31st (and balance owing paid to avoid penalties).

Related: GST Payments Dates for Individuals.

How To Calculate GST/HST Instalment Payments

1. Divide the total GST you paid in the previous year into four parts and pay each “one-quarter” on or before the quarterly due dates mentioned earlier.

For example, if your net GST/HST in 2022 was $6,000, then $1,500 is due by April 30, July 31, October 31, 2023, and January 31, 2024.

If at the end of the year, it is determined you have overpaid GST/HST, CRA will issue you a refund. If the total instalments are lower than what you owe, you can pay the balance to the CRA and not incur penalties if you pay it on time.

2. Estimate what your GST/HST balance will be for the current year and pay it in instalments. This formula works if you believe that your GST/HST balance will be lower for the year and you don’t want to give the CRA an interest-free loan.

If you end up owing taxes, instalment interest will be charged, as it means your estimates were off, and your instalment payment should have been more.

How To Make GST/HST Payments

To start, you should register a CRA My Business Account to access your tax documents online.

This online service is available 24/7, and you can use it for GST/HST returns, payroll, corporation income tax filing, excise duties, and more.

For GST/HST purposes, the CRA MyBusiness Account also offers a nifty instalment tax calculator.

You can make GST/HST instalment payments via:

1. The CRA’s My Payment electronic service.

2. CRA’s My Business Account by setting up pre-authorized payments.

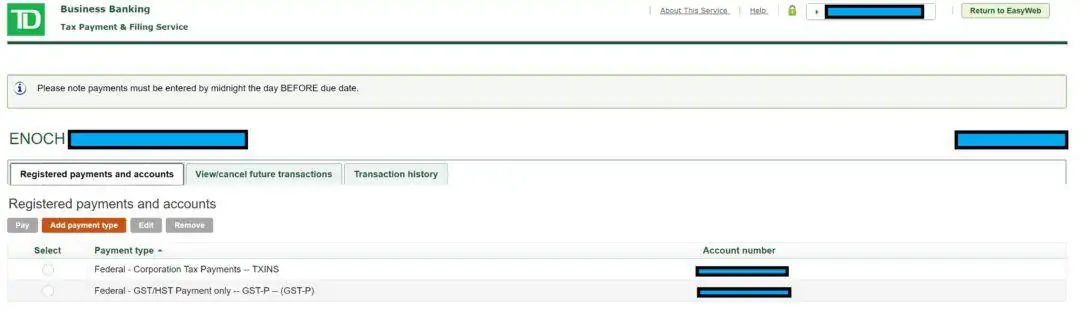

3. Your financial institution. For example, I can pay directly from my TD Business Account.

4. By Mail: Complete Form RC160, Remittance Voucher, and mail it with your cheque. You can order a personalized remittance voucher through My Business Account.

Related: How To Open a CRA My Business Account.

Instalment Interest and Penalties

If you are supposed to make GST/HST instalments and forget to do so, CRA adds interest to your balance starting on the day after the instalment was done until the earlier of:

- The day the overdue instalment amount and any accrued interest is paid

- The day your net tax for the year is due

The interest charged is based on CRA’s prescribed rate and is currently 5%.

Interest is also charged if you base your quarterly payments on your GST/HST for the current year (not the previous year), and there’s a shortfall at the end of the fiscal year.

Of note is the fact that this interest expense is not tax-deductible, so you won’t be getting a break by writing it off.

If you overpay GST/HST, CRA pays interest on your refund at a 1% rate (the timelines for earning interest on your refund are not as attractive).

In some situations (e.g. severe hardship), you may be able to apply for a waiver of interest and penalties.

Related: Legit Work From Home Jobs.

Final Thoughts

The CRA did not inform me when I needed to start making quarterly instalments for GST/HST. I learned about it the hard way after paying interest on the late payments. So you need to monitor your business finances and the $3,000 threshold.

Note that if your first fiscal year is shorter than 12 months, you may need to do some calculations to determine whether you are due for GST/HST instalments.

For example, if you collected $1,000 in GST and were in business for only 100 days in your first calendar year (2022), below is what the calculation looks like:

($1,000/100 days) x 365 days = $3,650 net GST/HST.

In this case, you must make quarterly instalments in 2023.

For inquiries about your business tax account, you can reach the CRA at 1-800-959-5525.

Easily Find Tax Write-Offs For Your Small Business

Benji makes it ridiculously easy to find tax write-offs, with self-employed Canadians finding $8,672.19 in tax write-offs per year, on average.

Sign up in minutes and start tracking your business expenses for free—no credit card required. If you need more horsepower, you can easily upgrade to a paid plan.

Benji is currently available for iPhone users operating as sole proprietors in the US and Canada.

Sign up with our exclusive link to save up to $174 when you upgrade to a paid plan.

Frequently Asked Questions

If you collected and remitted $3,000 or more in GST/HST in the previous fiscal year, you are required to make quarterly instalments in order to avoid interest fees or penalties.

When your business revenue is $30,000 or more, the CRA requires you to start collecting and remitting GST/HST.

You pay interest on the outstanding balance starting from when the payment was due. The current prescribed interest rate charged by the CRA is 5%.

They are due by April 30, July 31, October 31, and January 31.

Related:

- When Are Corporate Instalment Taxes Due?

- Best Business Credit Cards

- Best Business Savings Accounts

- How To Register a Business in Ontario

- Home Business Tax Deductions

Have questions? Leave them in the comments.