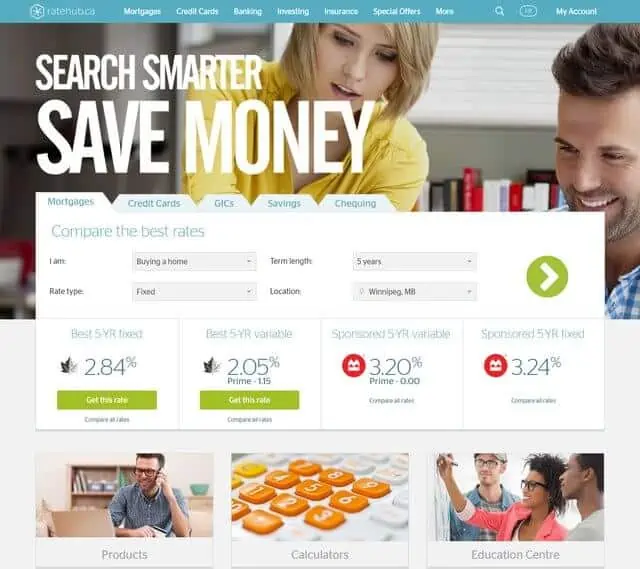

Ratehub is an online portal that allows visitors to compare several financial products online including mortgage rates, credit cards, high-interest savings accounts, insurance products, and so on.

Significant savings can be found by using online comparison websites to narrow down your options when looking for competitive rates, and without leaving your home.

Websites offering similar services to Ratehub have grown in popularity in recent times as Canadians realize that they can source financial products like mortgages through a mortgage broker rather than having to negotiate with their own bank.

For some of the best and lowest mortgage rates available in Canada, you should also check out IntelliMortgage.

About Ratehub

Ratehub.ca (or Ratehub.com) was founded in 2010 by Alyssa Richard and its office is located at 70 Richmond Street East, 4th Floor, Toronto, Ontario.

When the platform was first launched, the focus was on the online comparison of mortgage rates – a first for Canadians.

On its website, you can compare mortgage rates across the board including fixed, variable, HELOC, and cashback mortgage rates. Over 140 different rates are available from mortgage brokers and Canadian banks.

Essentially, Ratehub provides what you can call a one-stop-shop for mortgage rates comparison!

Ratehub also provides comparisons for other financial products including:

- Credit Cards: Best credit cards, reward, balance transfer, low-interest, no-fee, secured, student, and business credit cards.

- Bank Accounts: High-interest savings accounts, TFSA, Youth, and Senior accounts.

- Investing: GIC’s with different terms and rates, including for registered accounts.

- Insurance: Life insurance (whole, term, no-medical, mortgage, and guaranteed), Home Insurance, and Auto Insurance.

- In 2018, Ratehub purchased the popular personal finance website, MoneySense, from Rogers.

If you’re wondering how much this service will cost you, the answer is – nothing – It’s free to you! Ratehub gets paid a marketing fee by the financial institution or bank which eventually gets your business via their website.

Why Ratehub?

There are good reasons why Ratehub sees 800,000 Canadians visit their website every month.

- Rates are updated daily – and tailored to your location.

- Multiple mortgage rates across the market – over 140 rates to choose from (sourced from mortgage brokers and banks).

- View summary of prepayment options, rate hold period, preapproval options, other terms and conditions, all in one place.

- Compare rates across financial institutions for bank accounts, GICs, insurance, and more.

- Financial education – access valuable real estate, homeownership, credit management, and other personal financial information.

- Access sophisticated calculators for calculating mortgage payments, affordability, land transfer tax, mortgage insurance, refinancing; debt consolidation, and credit card rewards.

- Take advantage of special offers that are always available.

Potential Savings Comparing Mortgage Rates

Say you are in the market for a new home and you decide to do the savvy thing by comparing mortgage rates on Ratehub. On July 31, 2017, you find the following posted rates for a 5-year fixed mortgage ($400,000) in Winnipeg:

- CanWise Financial: 2.69%

- First National: 2.99%

- Laurentian: 3.04%

- PC Financial: 4.44%

- CIBC: 4.79%

Let’s assume you decide to go with the 2.69% rate offered by CanWise Financial. Compared to the 4.44% rate offered by PC Financial (and possibly fairly similar terms), your savings from the lower rate are as follows:

- Monthly savings on mortgage payments: $1,830 for CanWise Financial vs. $2,201 for PC Financial, for monthly savings of $371.

- 5-year savings: For the term of the mortgage i.e. 5 years, you can expect a total of $33,236 in interest savings ($49,634 vs. $82,870)!

Remember, the less you pay in interest, the more you pay down your principal debt, and the sooner you pay off your mortgage. While the example above is somewhat simplified, it clearly shows that getting a more competitive and lower mortgage rate will save you thousands of dollars in the long run.

Note: Always read the fine print for more details. Posted rates may have different terms such as pre-payment terms (lump-sum and regular), preapproval options, lock-in periods, etc.

If you are in the market for a mortgage, you can search for the best mortgage rates in Canada here or use the widget below.

Free Credit Score and Other Resources

The ability to compare financial products is not the only free resource you get on Ratehub.ca. You can also access your credit score.

The process takes less than 3 minutes to complete online and has no negative impact on your credit score (considered a soft inquiry). The credit score provided by Ratehub is the Equifax Risk Score and is based on Equifax’s proprietary model – also known as ERS 2.0.

Based on your credit score, Ratehub may make financial product recommendations they deem to be useful to you. Of course, you’re not obligated to consider any of these offers.

In addition to free credit scores, they do have a very extensive blog where you can obtain relevant information and access several useful calculators.

Competition

While Ratehub is the leading online financial products comparison site in Canada, there are several other companies that offer fairly similar services including IntelliMortgage, RateSpy, Lowest Rates, and Homewise.

The beauty of online comparison websites is that you don’t have to leave your home to get competitive quotes and there is no commitment. If you are not satisfied with the rate being offered, you can simply try another provider. No hassles!

Related: Complete Home Purchase Guide For Canadians

Ratehub Canada Review

-

Credibility

-

Competitive Rates

-

Ease of Use

-

Tools and Resources

-

Customer Service

Overall

Summary

Ratehub was the first major online mortgage rates comparison portal in Canada. In addition to comparing rates across a variety of lenders, you also have access to several useful home-ownership related calculators and other information.

Hi John,

Thanks for stopping by and engaging.

I think that all of the online mortgage comparison sites out there are great – they offer lots of choices. I f I was in the market shopping for a mortgage today, I would definitely try out a couple of them and go with the one that offers me the best rates for my particular preferences.

@Steve: Yes, when compared to the posted rates on offer by big banks, you could easily shave of a few tens of thousands of dollars over the life of your mortgage.

Like to know the GIC returns as offered by various financial instutions.

@Jay: Here is a link to some of the best GICs available in Canada:

https://www.savvynewcanadians.com/top-gic-rates-in-canada/