Insurance is essential for all small business owners, startups, self-employed contractors and professionals.

With the right insurance policy, you and your business can be covered against liabilities such as the risk of a third-party lawsuit, damages to your place of business and inventory resulting from a fire or flood, legal expenses, and more.

If you are a Canadian small business owner or independent professional looking for an affordable business insurance policy, look at Zensurance, an online commercial insurance brokerage serving many industries.

This Zensurance review covers everything you need to know about the company, how to apply for business insurance, and the benefits of choosing Zensurance as your broker.

What Is Zensurance?

Zensurance is an online commercial insurance brokerage serving Canadian small businesses, entrepreneurs, and self-employed professionals and contractors.

Commercial insurance protects businesses against losses due to unforeseen events during daily business operations, like third-party injuries or property damage.

Zensurance has multiple types of business insurance to cover almost any liability for virtually any industry. With over 50 partnerships with leading Canadian insurance providers, any business owner or independent professional can visit their website, fill out an application, and receive a free quote.

What Types of Business Insurance Can You Get Through Zensurance?

There is a broad range of insurance coverage you can get through Zensurance.

The brokerage can help almost any type of business or professional in any industry get a customized, comprehensive policy. Some of the most common types of business insurance coverage include:

- Builders’ risk insurance

- Business interruption insurance

- Commercial auto insurance

- Commercial crime insurance

- Commercial general liability insurance

- Commercial property insurance (also known as business contents insurance)

- Cyber liability insurance

- Directors’ and officers’ insurance

- Equipment breakdown insurance

- Legal expense insurance

- Medical malpractice insurance

- Product liability insurance

- Professional liability insurance (also known as errors and omissions insurance)

- Tools and equipment insurance

What coverages you need to form a complete, comprehensive policy, the coverage limits you need, and what deductibles to select can be confusing. That’s where Zensurance’s licensed brokers can help.

They can partner with you to provide you with the trusted advice you need to choose the adequate amount of coverage and make sure you are not underinsured or buying more than what you need.

Your Zensurance broker will then tailor the policy to suit your specific needs.

How to Apply for Business Insurance With Zensurance

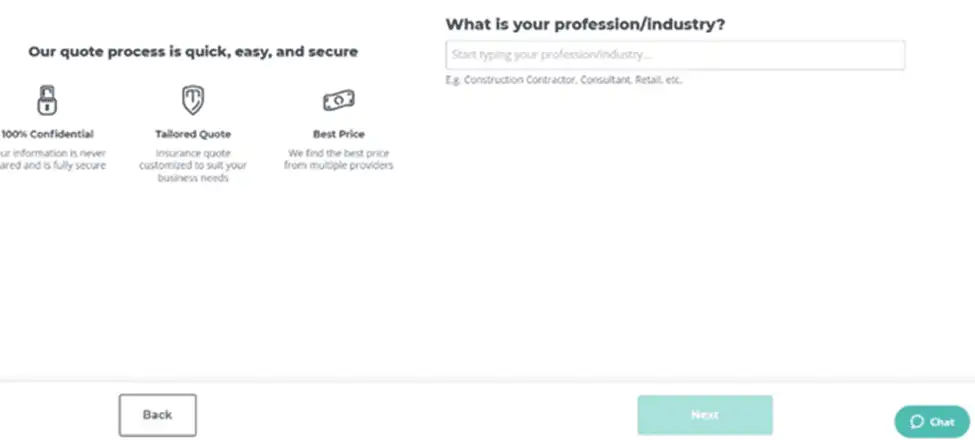

To apply for business insurance coverage through Zensurance, go to their website and click on the “get a quote” button, which is located on every page across the company’s site.

You’ll then be taken to the start of the online application process, which involves answering several questions about your profession or small business. The first question you are asked is what your profession or industry is.

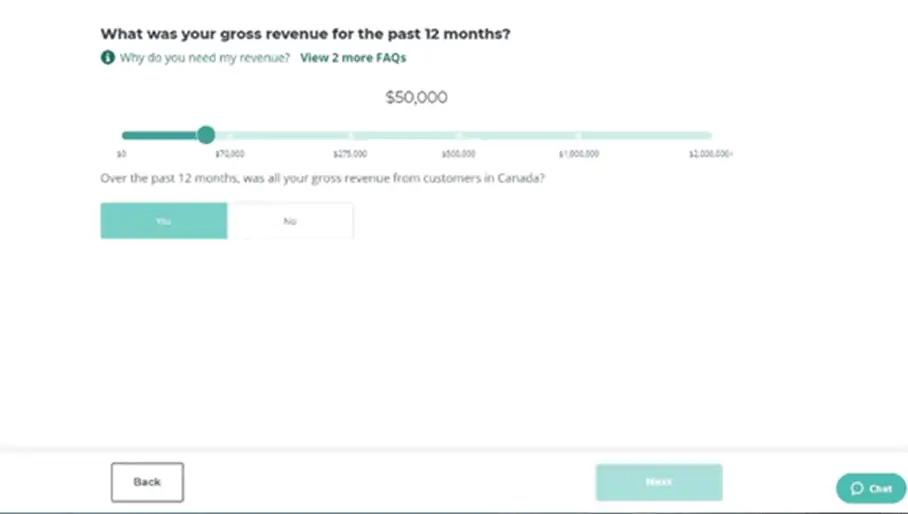

Next, you are asked what your gross revenue was in the past 12 months (if yours is a new business, you can leave this figure at $0).

The online application will then ask you how much you expect to earn in the next 12 months. Once you answer that question, you are asked to detail what products or services you provide. Additional questions about your business follow, including:

- What percentage of your sales are online, if any?

- If you sell products or provide services through a third-party marketplace such as Amazon.

- How many years your business has been operating, and what are your years of experience running this company or a similar company.

- Where your business is located.

Once you’ve answered all the questions, you are asked to provide your email address (Zensurance will email you the lowest quote it can find for the type of policy you need).

The system then produces an overview of the selected coverages, suggests others you may want to include, and asks you to confirm the information you provided.

Throughout the entire application process, there’s a “live chat” button in the bottom right corner that will connect you to a licensed broker if you need help completing the application.

After receiving your quote, you can contact a Zensurance broker directly by phone, email, or live chat if you have additional questions.

What Are the Benefits of Purchasing Business Insurance From Zensurance?

Zensurance is an online insurance brokerage, not an insurance company. That means its licensed insurance brokers work for you.

Zensurance’s brokers are trained and licensed by self-regulating industry bodies in each province across Canada. For instance, in Ontario, its brokers are licensed by the Registered Insurance Brokers of Ontario.

Although brokers sell insurance, they don’t work for one insurance company as an insurance agent does.

So when you fill out an online application for a business insurance policy with Zensurance, its brokers do the shopping for you through its partner network of more than 50 insurance companies to find the coverage you need at the lowest price on the market, often at up to 35% less than its competitors.

Plus, you can fill out an online application at any time of day or night and get a free, no-obligation quote for your insurance needs.

By working closely with you to understand your needs and potential risks, Zensurance brokers will customize your policy to ensure you are adequately protected and never underinsured or overinsured.

On the other hand, an insurance company is a corporation that provides insurance policies to its customers. Insurers may offer insurance policies directly if someone contacts them by phone or online and indirectly through insurance brokers like Zensurance. An insurance company determines how much your insurance will cost you annually (referred to as a premium).

In addition to issuing policies, the insurance company collects a premium from you to provide coverage. Therefore, if you need to file a claim (for example, if a fire damages your business’s workplace), the insurance company pays out that claim and provides you with financial support.

However, there is always a possibility that your insurance company may reject a claim you file. If that happens, your Zensurance broker will go to bat for you by talking to the insurance company to encourage them to reconsider your claim.

Zensurance brokers understand that insurance jargon may not be easy to understand. They explain in plain English what coverages you need and the details of your policy and its limits, and how to lower your annual insurance bill by taking steps to mitigate the risks you face.

Is Zensurance Legit?

Zensurance is a legitimate, licensed business insurance brokerage based in Toronto.

Furthermore, as Zensurance is a small business itself – the company was founded in 2016 – they understand the challenges small business owners face.

The brokerage has served over 100,000 Canadian small businesses and entrepreneurs and is highly rated by its customers, with a 4.8 out of 5 stars rating on Google Reviews.

Conclusion

Zensurance has transformed the business insurance landscape for small business owners, home-based businesses, and self-employed contractors and professionals by making the insurance buying process straightforward and transparent.

If you are a small business owner, entrepreneur, or self-employed contractor in Canada, you may want to consider checking out Zensurance for your business insurance needs.

This article is a sponsored post by Zensurance.

Related: