If you want to add balance and stability to your portfolio, look no further than the iShares Core S&P 500 Index ETF (XUS) from Blackrock.

Canadian investors can get exposure to the benchmark S&P 500 index by purchasing this ETF using Canadian dollars. The XUS ETF trades on the Toronto Stock Exchange, removing any potential foreign exchange fees.

Why choose an ETF? Exchange-Traded Funds provide instant diversification to your portfolio. In the case of XUS, investors get to own a basket of 500 of the largest publicly-traded American companies in just one asset.

ETFs also offer lower fees than traditional mutual funds, which can result in significant cost savings over the course of years or even decades.

Canadian investors can buy XUS and hundreds of other ETFs on trading platforms like Wealthsimple, Questrade, and Qtrade.

This XUS ETF review covers how it works, its holdings, returns, fees, pros, cons, and a comparison to other ETFs like VFV, XSP, and XUU.

What is XUS?

XUS is an ETF that tracks the S&P 500 index in a rather unique way, as you will see once we get to the XUS Holdings section.

The fund was established by iShares Canada in April of 2013 and is intended to allow Canadian investors to gain exposure to US companies without having to pay for equities in US dollars.

Canadian investors will be happy to hear that XUS is an ETF that is eligible for both registered and non-registered accounts.

If you are looking to add exposure to the US markets without having to buy individual stocks, then XUS is a viable solution for your needs.

Key facts for XUS as of January 2023 include:

- Inception date: April 10, 2013

- Number of underlying holdings: 503

- Price/Earnings Ratio: 19.01x

- Price/Book Ratio: 4.01x

- Management fee: 0.08%

- MER: 0.10%

- Assets under management: $4.6 billion

- 12-month trailing yield: 1.36%

- Distribution yield: 1.67%

- Distribution frequency: Semi-annually

- Eligible accounts: RRSP, TFSA, RRIF, TFSA, DPSP, RDSP

- Currency: CAD

XUS ETF Holdings

XUS is unique from other index fund ETFs, mainly because it is not an all-stock fund and actually includes another ETF as its main holding.

XUS mainly comprises the iShares Core S&P 500 ETF (IVV), which accounts for 99.94% of its ETF holdings. The IVV ETF trades on the NYSEARCA exchange in the US.

The largest holdings in IVV are familiar names. They are the largest weighted allocations in the S&P 500 index. These companies include Apple, Microsoft, Amazon, Alphabet, Tesla, Berkshire Hathaway, and NVIDIA.

As you can see, IVV accounts for a majority of the allocation in XUS. Why does Blackrock iShares do this? It allows Canadian investors to buy the IVV ETF without paying for it in US dollars.

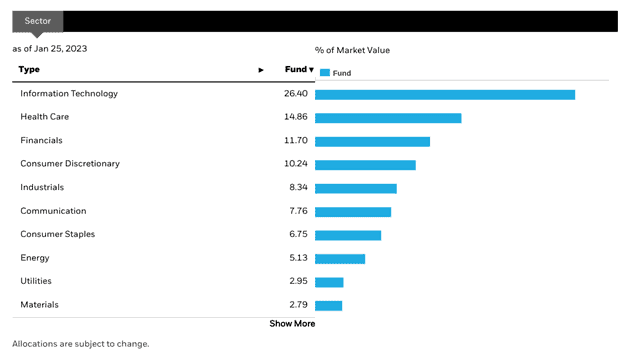

Here is the sector breakdown for XUS:

XUS Returns and Performance

Tracking XUS is relatively simple, as the ETF is meant to mirror the performance of the S&P 500 index. It has, however, lagged behind the annual average returns of IVV.

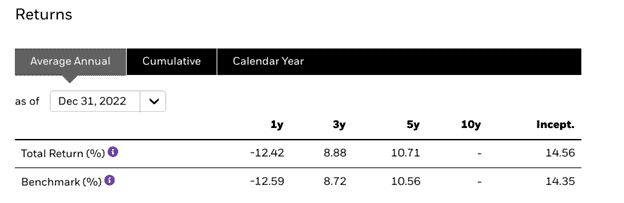

Here is a breakdown of the annual average returns over the past one, three, and five years, as well as since the inception of XUS.

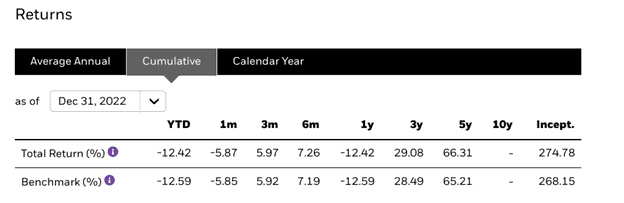

Here is a breakdown of the cumulative returns since inception for XUS.

As you can see, XUS has been a steady performer over the years, with a 274% total return since its inception in 2013. Of course, we always need to mention that historical returns do not indicate future performance.

XUS Fees

As of January 2023, Blackrock Canada reduced the management fees for some of its ETFs, and XUS is included. The management fee is now 0.08% compared to the 0.09% it was previously.

XUS also charges a 0.10% MER. Both the XUS MER and XUS management fees are well in line with industry standards.

It’s not the lowest MER you’ll see for an ETF, but it is considerably lower than the average mutual fund you can invest in through Canadian financial institutions. The average mutual fund usually charges about 1.98%.

The beautiful thing about ETFs is that low fees are all you really need to worry about, aside from the trading fees you may be charged by certain brokerages.

It’s never a bad thing to be able to get exposure to the largest American companies without having to pay foreign exchange fees.

Buying the XUS ETF allows you to buy every company in the S&P 500 rather than trying to pick and choose which ones will outperform.

Since XUS is eligible for registered and non-registered accounts, you can buy this ETF and hold it in your TFSA without paying capital gains tax.

Some investors will not like that distributions are paid out on a semi-annual basis rather than quarterly or even monthly, like other ETFs.

The XUS management fee and XUS MER are on the high end for ETFs, likely because you are getting passed on the fees for owning IVV as well.

XUS vs XSP

XUS and XSP are very similar ETFs. Both are from the iShares line of Blackrock ETFs, and both track the benchmark S&P 500 index.

The one main difference is that XSP is a hedged ETF against the Canadian dollar. XSP holds small amounts of both US and Canadian dollars.

If either currency were to fluctuate, having the other as a hedge can help keep your portfolio stabilized and eliminate the foreign exchange rate.

XSP is 100% invested in IVV but includes the currency as hedges. The management fee is 0.08%, and the MER is 0.10% to match XUS. XSP distributions are also paid out on a semi-annual basis.

XUS vs. VFV

VFV is the Vanguard Canada ETF that tracks the S&P 500 index. Unlike XUS, VFV is an exact mirror of the S&P 500 index and is an all-stock ETF.

VFV trades on the Toronto Stock Exchange in Canadian dollars, eliminating the foreign exchange fees Canadian investors would otherwise have to pay.

The management fee is the same as XUS at 0.08%, and the MER is 0.09%, which makes the VFV slightly cheaper to own than the XUS ETF.

VFV pays its distributions out quarterly compared to a semi-annual basis like XUS. Learn more about it in this review.

XUS vs XUU

While XUS tracks the S&P 500 index, XUU tracks the entire US Stock Market. It is the iShares S&P US Total Markets Index.

XUU consists of four other iShares ETFs, including a 48.60% weighted holding of IVV. XUU also holds the iShares Core S&P Total US Stock (ITOT) ETF, the iShares Core S&P Mid-Cap (IJH) ETF, and the iShares Core S&P Small-Cap (IJR) ETF.

XUU is also a hedged ETF, as the fund holds both Canadian and US dollars as well.

The management fee is at 0.07%, and MER is 0.08%, and the distributions for XUU are paid out every quarter.

Learn more in this XUU ETF review.

Buying the XUS ETF is simple on any Canadian brokerage, particularly Questrade and Wealthsimple. Here’s why:

Wealthsimple Trade

Wealthsimple Trade is a newer platform than Questrade and is popular amongst the younger generation of investors.

Wealthsimple offers commission-free buying and selling for Canadian ETFs like XUS.

Wealthsimple also has a desktop and mobile app and an intuitive interface that makes it easy to start a position in the XUS ETF.

Our readers get a welcome bonus when they open an account and deposit and trade at least $200. Get more details in this review.

Questrade

Questrade has long been a favourite amongst Canadian investors and has been helping them for more than 20 years since it was established in 1999.

Buying Canadian ETFs, like XUS, is free on Questrade. Selling the asset comes with at least a $4.95 charge.

Questrade has both a desktop and mobile app, and buying XUS is as simple as searching for the ticker symbol, selecting the number of units, and hitting the buy option.

To start, open an account here and use SAVVY50 to get $50 in free trades after you fund your account with at least $1,000.

Learn more about the platform in the Questrade review.

Is XUS a Good Buy?

Yes, Canadian investors who are looking to get exposure to the US stock market should consider giving the XUS ETF a look.

XUS provides the diversity of investing in the S&P 500 by owning the IVV ETF and investing in it with Canadian dollars.

If you want exposure to the S&P 500 index with minimal management fees and additional positions in the fund’s largest stocks, then XUS is a worthy addition to your portfolio.

XUS ETF Review FAQs

Yes, XUS can be a good investment. Protecting your portfolio with ETFs during times of volatility is a smart strategy, and you will be hard-pressed to find an index that exhibits consistent gains like the S&P 500.

No, XUS is not hedged. The fund does not hold any currencies, so you might be subject to foreign exchange fluctuations. If you want a hedged ETF, I suggest checking out XSP, which is also from iShares.

Yes. XUS pays its distributions semi-annually compared to a more standard quarterly basis. The distribution yield for XUS is 1.67%.

Related:

iShares Core S&P 500 Index ETF Review

Overall

Summary

iShares Core S&P 500 Index ETF comprises 500 large cap US companies. This XUS ETF review covers its holdings, returns, fees, how to buy it in Canada, and how it compares to XUU, XSP, and VFV.