Holding an all-stock portfolio you have picked on your own and ensuring it is adequately diversified is a tall task that requires more than just a cursory understanding of the financial markets.

Instead of worrying about one of your stock picks losing steam and crashing, you could opt for a portfolio made up of thousands of stocks by buying Exchange-Traded Funds (ETFs), and rebalancing your holdings a few times every year.

Even better, the recent availability of all-in-one ETFs means you can now hold a single fund without worrying about rebalancing or under-diversification.

The iShares Core Equity ETF Portfolio (XEQT) is one such fund and it is 100% invested in stocks.

This asset allocation ETF works for beginner and experienced investors alike and can be used in both registered and non-registered accounts.

Read this XEQT review to learn about its holdings, pros and cons, fees, how to purchase XEQT in Canada, and how it compares to Vanguard’s all-equity ETF, VEQT.

What is XEQT?

XEQT seeks to provide long-term capital growth by investing primarily in one or more exchange-traded funds managed by Black Rock Canada or an affiliate that provides exposure to equity securities.

It aims to hold 100% of stocks; however, it may have small amounts of cash or cash equivalents at any time. As of March 2023, it comprised 99.79% equities and 0.21% cash and/or derivatives.

XEQT was launched in August 2019 and is traded on the Toronto Stock Exchange under the ticker symbol “XEQT.”

Some of its key features, as of March 2023, are:

- Net assets: $1.57 billion

- Management fee: 0.18%

- Management Expense Ratio (MER): 0.20%

- Number of holdings (funds): 4

- Underlying holdings: 9,321

- Distribution yield: 2.60%

- Price/Earnings: 14.89 (March 7, 2023)

- Eligible accounts: registered and non-registered

- Eligible for DRIP: Yes

Other asset allocation ETFs offered by iShares are:

- iShares Core Equity ETF Portfolio (XEQT)

- iShares Core Conservative Balanced ETF Portfolio (XCNS)

- iShares Core Income Balanced ETF Portfolio (XINC)

- iShares Core Growth ETF Portfolio (XGRO)

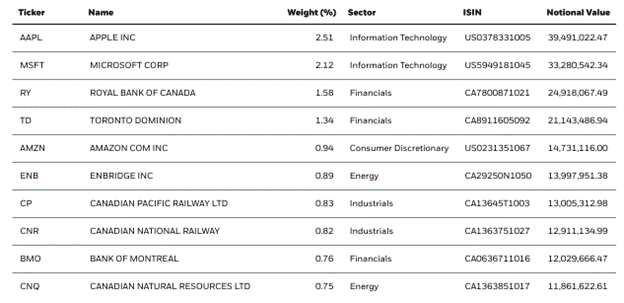

XEQT Holdings

This fund is rated by iShares to have “low to medium” risk characteristics. That said, you would be expected to be comfortable with significant swings in the value of your portfolio as it is made up of roughly 100% stocks.

The underlying funds making up XEQT as of March 7, 2023, are:

| XEQT ETF Holdings | Allocation |

| iShares Core S&P Total U.S. Stocks (ITOT) | 44.87% |

| iShares MSCI EAFE IMI Index (XEF) | 25.18% |

| iShares S&P/TSX Capped Composite (XIC) | 24.83% |

| iShares Core MSCI Emerging Markets (IEMG) | 4.91% |

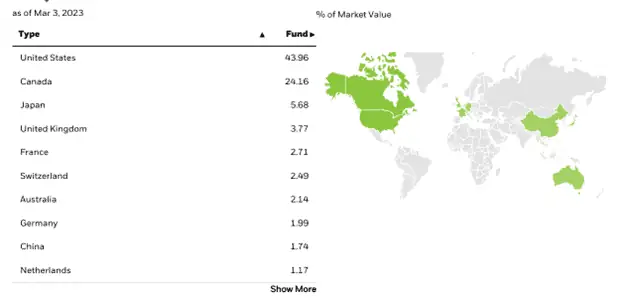

Of the 9,000+ individual stocks making up XEQT, 43.96% of the market value relates to equities issued in the United States and 24.16% in Canada.

It is diversified across North America, Europe, Emerging Markets, and the Pacific.

Also, some of the top equity holdings are financials and Information Technology, including Apple, Microsoft, Amazon, RBC, TD, and the Canadian National Railway.

Related: Investment Accounts for Beginners.

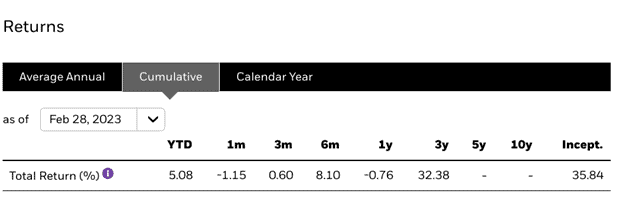

XEQT Returns

This is a relatively new fund that has been traded for just over three years.

XEQT’s return for this year to date, as of March 7, 2023, is 5.08%. Since its inception, it has generated 35.84% in returns cumulatively.

Note that past performance does not guarantee future returns.

XEQT Fees

XEQT has a 0.18% management fee and an expense ratio of 0.20% per year that includes the management fees, fund fees, and GST/HST paid by the funds. The MER is equivalent to $2.00 for every $1,000 you invest.

If you are a self-directed investor, these low fees mean that you could be saving money compared to a:

Mutual Fund: Average of 1.98% for equity funds, or

Robo-Advisor: ~0.70% for Wealthsimple Invest.

That said, purchasing XEQT on a traditional trading platform would cost you up to $9.99 per trade.

If you make small purchases regularly, your trading fees could wipe out all your savings from using a low-cost ETF.

You can cut your trading fees by using a no-commission broker such as Questrade or Wealthsimple Trade.

If you’d like to compare other popular brokerage platforms in Canada or see what they offer, check out my reviews below:

- Questrade Online Brokerage

- RBC Direct Investing Review

- BMO InvestorLine Review

- Scotia iTrade Review

- CIBC Investor’s Edge Review

Pros and Cons of XEQT

XEQT is an all-equity portfolio which means you are taking on above-average investment risks if it makes up your entire portfolio.

Taking on this level of risk in exchange for a commensurate level of returns over time may be reasonable if you are willing to dig in for the long term.

You should expect your portfolio to respond more (up or down) to stock market swings. As with any other investment, you can lose money.

A similar all-in-one equity fund is offered by Vanguard and trades under the ticker symbol “VEQT”.

Since XEQT does not require rebalancing, it saves you the time and trading fees that would be required if your portfolio was made up of several individual stocks or ETFs.

XEQT vs. VEQT

VEQT refers to the Vanguard All-Equity ETF Portfolio, which also “seeks to provide long-term security by investing primarily in equity securities.”

VEQT was launched on January 29, 2019, and was made up of the following underlying ETFs as of March 2023:

| VEQT ETF Holdings | Allocation |

| Vanguard U.S. Total Market Index ETF | 42.11% |

| Vanguard FTSE Canada All Cap Index ETF | 30.40% |

| Vanguard FTSE Developed All Cap ex North America Index ETF | 19.97% |

| Vanguard FTSE Emerging Markets All Cap Index ETF | 7.52% |

VEQT has a 0.22% management fee (compared to 0.18% for XEQT) and an MER of 0.24% (compared to 0.20% for XEQT).

How To Purchase XEQT in Canada

If you are looking for long-term capital growth and are okay with significant market swings, XEQT may work for you. You can purchase the fund using a brokerage platform or registered dealer in Canada.

Questrade offers free ETF purchases; however, a $4.95 to $9.95 fee applies per trade when you sell the funds. You can open a Questrade account and get $50 in free trades when you fund your account with at least $1,000.

Questrade

Trade stocks, ETFs, options, FX, bonds, CFDs, mutual funds, etc.

Get $50 trade credit with $1,000 funding

Low and competitive trading fees

No quarterly inactivity fees

Access to advanced tools and trading data

Top platform for advanced traders

Transfer fees waived

For no-commission XEQT trading, try Wealthsimple Trade. You receive a $25 cash bonus after funding your account with at least $150 within 30 days of registering your account.

Wealthsimple Trade

Trade stocks, ETFs, and options

Excellent trading platform for beginners

Deposit $150+ to get a $25 cash bonus

Transfer fees waived up to $150

XEQT ETF Review FAQ

If you have a long investment timeframe and can tolerate higher volatility in the stock markets, XEQT may be a good addition to your investment portfolio.

XEQT is 100% stocks and includes popular blue-chip stocks like Amazon, Alphabet, TD, RBC, Scotiabank, Enbridge, etc.

Related: FEQT Review

XEQT Review

-

Ease of use

-

Availability

-

Fees

Overall

Summary

The iShares Core Equity ETF Portfolio (XEQT) offers long-term capital growth by investing in stocks. This XEQT review covers its fees, pros, cons, and how it compares to VEQT.

Pros

- Low-cost management fee compared to mutual funds

- Automatically rebalanced

- Easy to buy and sell using a brokerage account

- Can trade for free on Wealthsimple Trade

Cons

- Could be slightly cheaper to buy the individual ETFs making up the portfolio

- May have to sell your entire holding if your risk tolerance or investment objective changes

- Expect volatility with 100% stock holdings

Thank you for the article and review, much appreciated.

Your story is inspiring, keep on sharing.

@Mike: Glad to hear it was useful and thanks for your feedback.

Thanks again for a superb, easy to read article aimed at new investors!

FYA, you listed the same ETF in “other assets” as the article…

“Other asset allocation ETFs offered by iShares are: iShares Core Equity ETF Portfolio (XEQT)”