Finding the best mortgage rate as a first-time home buyer in Canada can be challenging.

From learning all about mortgage terms (such as variable and fixed rates) to comparing rates between lenders and getting pre-approved, it can be a lot to take in at once.

This is where, Homewise, a digital mortgage service, comes into play. The company has simplified the mortgage process by giving home buyers a platform to access 30+ lenders and receive free, unbiased assistance from in-house mortgage experts and advisors.

Not only that, but Homewise also negotiates the best rates on your behalf, and with everything done online, you don’t need to leave the comfort of your home.

This Homewise review covers what it offers, its benefits and downsides, and whether it is legit.

What is Homewise?

Homewise is a modern online mortgage platform designed to make the mortgage approval process fast and efficient for first-time home buyers and even those who are familiar with how the process works.

The company was founded in 2018 by Jesse Abrams and Carlos Medeiros. Since then, the company has grown and has been used by Canadians to obtain mortgages worth over $2.65 billion.

Homewise offers direct and brokered mortgage services in all Canadian provinces except Quebec, where they co-broker.

Competitors of Homewise in Canada include online mortgage rate aggregators like Ratehub and Intellimortgage.

How to Find the Best Mortgage Rates with Homewise

It used to be challenging to compare multiple mortgage rates across lenders and do so within a reasonable period of time. This is why many home buyers defaulted to their regular bank and simply accepted whatever mortgage rate they were quoted.

The advent of online mortgage sites such as Homewise has changed all that, and you can now compare your best options from the comfort of your home.

Even better, you don’t need to call around or visit multiple locations. Simply jump online, complete a short application form (which takes 5 minutes or less), upload documents, and choose your pick from a list of the best options that meet your needs.

Homewise works with 30+ lenders, including banks, credit unions, and private lenders.

The financial institutions they are partnered with include:

- Equitable Bank

- TD Canada Trust

- Scotiabank

- Desjardins

- DUCA

- First National

- Home Trust

- MCAP

- ICICI Bank

- Canadian Western Bank

- WealthOne Bank of Canada

- Alterna Savings, and several others

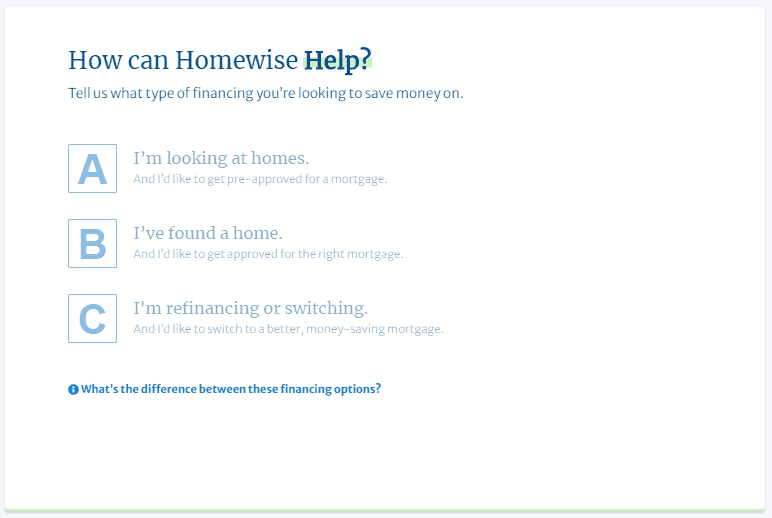

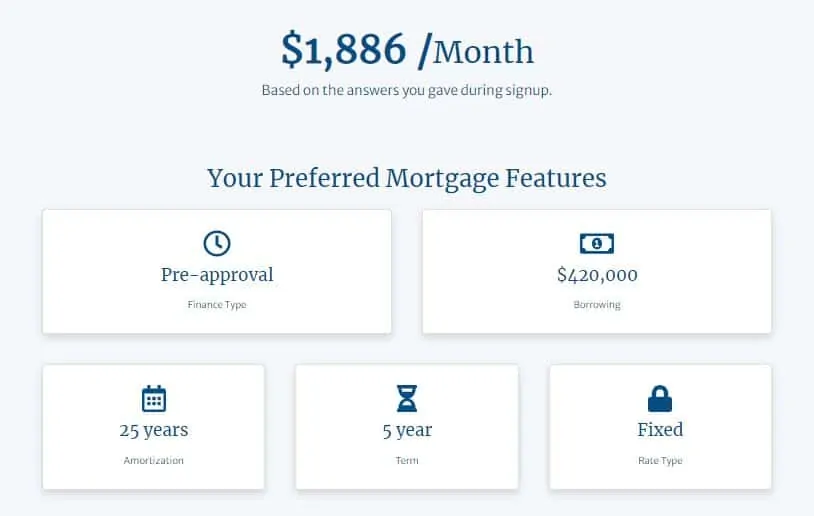

Using the Homewise platform, you can obtain a mortgage (preapproved and approved loans), Home Equity Loan (HELOC), and a mortgage switch/refinancing.

How Homewise Works

To get started, visit Homewise and complete the application form.

1. Choose the type of mortgage you are looking for.

2. Indicate your home purchase timeline. This will factor into your mortgage pre-approval as it typically holds the rate for 90-120 days. It also informs the lender when you would like to close.

3. Provide details about the home you want to buy – location, price, how much you have for a down payment, type of property.

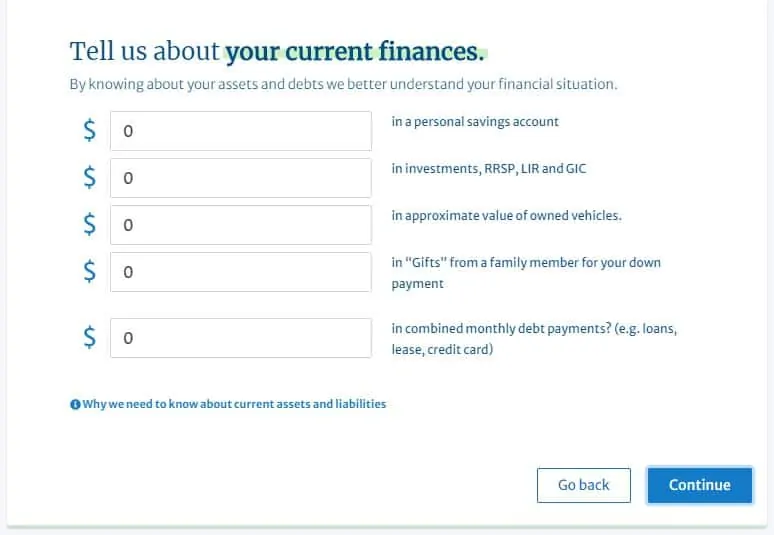

4. Provide your personal details, current residence, employment, and current financial position.

You can always access support and reach out to the expert assigned to you (via email and phone) throughout the mortgage approval process.

After submitting all required documentation, your mortgage approval or pre-approval occurs within 48-72 hours.

Documents required by lenders include:

- Photo ID

- Letter of employment

- Pay stubs

- Bank statement

- T4, Notice Assessment or Tax Return

Before funds are released, you will also be required to provide the agreement of purchase and sale, MLS listing, proof of down payment, proof of insurance, etc.

Why Should You Use Homewise?

Here are some of the benefits of using the Homewise platform for your mortgage needs:

Get the Best Mortgage Rate: With over 30 lenders on the platform, you get access to some of the best mortgage rates available at any point in time. This also saves you the time it would take you to approach all these lenders individually on your own.

Save Money Now and Later: A low mortgage rate can save you money now and over several years. Even a few basis points shaved off your approved mortgage rate can translate into thousands of dollars over a five-year term. As per its website, Homewise aims to save members up to $20,000 on average.

Save Time and Effort: The online application process takes about 5 minutes or so to complete. Homewise negotiates with lenders on your behalf so you won’t need to endure high-pressure sales tactics and calls from lenders.

Free Mortgage Service: You don’t pay to use Homewise. It is a free service. Homewise is compensated directly by lenders when your mortgage closes. Since it is an online company with lower costs, Homewise is able to take a lower commission and get you a better deal – compared to a bank or traditional broker.

Great Customer Service: You get a dedicated Homewise support person you can reach by email, chat or phone to discuss your options and ask questions when required. This way they can also offer you unbiased advice on the best rates, regardless of who is offering them.

Free Mortgage Education: You can use the site to learn about the home buying process and also access free resources including mortgage calculators and an information-packed blog.

Downsides

Homewise does not offer its service in Quebec at this time.

Also, you can’t view what rates are being offered by the lenders it is affiliated with until you complete and submit an application.

Homewise vs. Alternatives

Similar to shopping around for the best savings rates or a free chequing account, a digital mortgage comparison service like Homewise can save you a lot of money.

Other mortgage broker platforms that help to broaden your options include Ratehub, RateSpy, and Canwise Financial.

Is Homewise Legit?

Homewise is a reputable company that has been operating since 2018. Its head office is located at 609 Marlee Avenue, North York, in Ontario.

It is licensed as a mortgage broker in Ontario, British Columbia, Manitoba, and Alberta. The company can also broker mortgages in Saskatchewan, Newfoundland and Labrador, Nova Scotia, and New Brunswick.

Homewise uses SSL technology and bank-level encryption to protect any information you submit on its website.

You can check out the company’s privacy policy for details about how your information is used.

Final Thoughts

A home is one of the biggest investments the average Canadian holds during their lifetime.

While homeownership costs continue to rise, you can save some money by finding the best mortgage matching your needs.

Get your mortgage with Homewise.

Related:

- Best Life Insurance Rates in Canada

- Best Pet Insurance in Canada

- PolicyMe Review

- Best Mortgage Rates in Canada

- Emma Life Insurance Review

- How To Create a Will Online

Homewise Mortgage Review

Overall

Summary

Homewise can help you find the best mortgage rates in Canada for free. This Homewise review covers its online mortgage application, benefits, downsides, and whether it is safe.