Whether you are a kid or a student opening your first bank account or you have been banking for decades, a chequing account is generally a starting point for managing your money.

While online-only banking and the digital banks that enable them have made chequing account transactions a lot cheaper, some of the best chequing accounts in Canada are offered by the big banks.

Chequing accounts come in various ‘shapes and sizes.’

Two characteristics that cut across the board are that they simplify financial transactions and your ability to deposit and withdraw cash wherever you want.

This article covers the best chequing accounts in Canada for 2024, how chequing accounts work, no-fee chequing account options, the pros and cons of chequing accounts, how to save on chequing account fees, and whether they are safe.

Best Chequing Accounts in Canada

This list of the best chequing accounts in Canada includes premium accounts with monthly fees and no-fee bank accounts that punch above their weight.

1. Simplii Financial No-Fee Chequing Account

Simplii Financial was founded in 2017 and is the digital banking arm of CIBC. It offers the best no-fee chequing account in Canada.

The Simplii No-Fee Chequing Account has no monthly fees or minimum balance and includes:

- $400 bonus when you qualify

- Free unlimited debit purchases and bill payments

- Free unlimited Interac e-Transfers

- Access to 3,400+ CIBC ATMs

- 0.05% to 0.10% interest on your account balance.

- Mobile cheque deposits

- Access to global money transfer.

If you are looking to replace your day-to-day banking with an online bank, Simplii works well as it provides an extensive suite of products: investments, credit cards, mortgages, personal loans, and more.

Fees: No monthly account fee. Service fees may apply to stop payments, non-CIBC ATM transactions, inactivity, FX conversions, overdraft, and NSF fees.

Promotion: Get a $400 bonus when you open a new chequing account and set up a direct deposit of at least $100 for 3 consecutive months.

Cons: Simplii Financial does not have a physical bank branch.

2. EQ Bank Personal Account

EQ Bank offers the best hybrid bank account in Canada (which combines savings and chequing account features). This online bank was founded in 2016 and is the digital banking arm of Equitable Bank.

EQ Bank’s Personal Account pays a high interest rate on your balance (up to 125x more than other banks) while also offering:

- No monthly bank account fees

- Unlimited free Interac e-Transfers

- Unlimited free bill payments and electronic fund transfers

- Mobile cheque deposits

- CDIC insurance

- Access to international money transfers

- A Mastercard that offers free ATM withdrawals and 0.5% cash back on all purchases

There are no minimum balance requirements to enjoy these benefits, which is great.

For your other banking needs, EQ Bank has TFSA and RSP savings accounts, GIC investment, U.S. Dollar account, and access to competitive mortgage rates.

Fees: No monthly banking fees ($0).

Promotion: The saving rate is non-promotional.

Cons: It does not offer access to paper cheques.

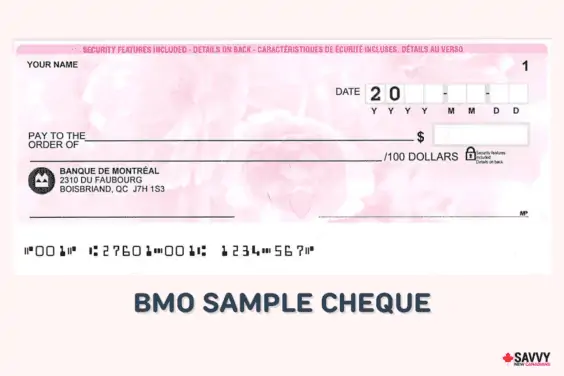

3. BMO Performance Chequing Account

This premium chequing account offers several perks at a $16.95 monthly fee. It is BMO’s most popular chequing account, and the monthly fee is waived if you maintain a $4,000 minimum balance.

The BMO Performance Plan includes:

- $350 bonus when you meet the eligibility requirements

- Unlimited debit transactions and Interac e-Transfers

- Up to $40 waived on eligible BMO credit cards

- Identity theft protection, valued at over $150 per year

- Access to BMO Family Bundle that gives your loved ones no-fee daily banking (plus extra $100 bonus if eligible)

- Access to a high-interest savings account

- One free non-BMO ATM withdrawal each month in Canada

BMO often has new bank account promotions on its chequing accounts. For example, for a limited time, you can earn up to a $450 welcome bonus when you open a BMO Performance Chequing Account as follows:

- Get a $350 bonus when you complete two of the following for at least 2 consecutive months: set up a recurring direct deposit, make two eligible online bill payments of at least $50 to different billers, or set up two eligible pre-authorized debits of at least $50

- Get a $100 bonus when you invite a family member as part of a BMO Family Bundle

Fees: Costs $16.95 per month. This fee is waived if you maintain a daily minimum balance of $4,000. Other service charges may apply.

Cons: If you don’t meet the minimum balance requirement, this account could cost you $203.40 annually.

4. Scotiabank Ultimate Chequing Package

Scotiabank is a top-5 bank in Canada by market capitalization. Its Ultimate Package account is one of the best premium chequing accounts in Canada.

The Ultimate Package comes loaded with perks, including:

- Unlimited transactions

- No overdraft protection fee

- $350 welcome bonus when you meet the eligibility requirements

- Improved rates on Scotiabank’s HISA account and select GICs.

- 10 free equity trades at Scotia iTrade in the first year

- Personalized cheques and drafts

- Safety deposits box

- Earn rewards points on everyday spending

- Save the annual fee on eligible Scotia credit cards (up to $139/year)

Scotiabank has all the account types you can think of for everyday financial needs, including mortgages, loans, credit cards, investments, and insurance.

Fees: The Ultimate Package chequing account has a $30.95 monthly fee. This fee is waived if you maintain a minimum daily closing balance of $5,000.

Cons: If you don’t meet the minimum balance requirement, this account will cost you $371.40 per year. Alternatively, you could opt for the Scotiabank Preferred Package, which has a $16.95 monthly fee.

5. TD All-Inclusive Banking Plan

TD’s All-Inclusive Banking Plan is a premium chequing account option if you don’t mind paying monthly fees. It includes;

- Unlimited transactions

- Annual fee waivers on eligible TD credit cards

- Personalized cheques, money orders, and certified cheques

- Small safety deposit box

Fees: TD’s All-Inclusive Banking Plan has a $29.95 monthly fee. This fee is waived if you keep a minimum daily balance of $5,000. Other service fees may apply.

Cons: This premium chequing will set you back $359.40 annually unless you are willing to keep $5,000 sitting idle in your account.

Here’s a review of TD Chequing accounts.

6. RBC Day to Day Banking Account

RBC is the largest bank in Canada. Its Day to Day Banking Account is one of the best no-fee bank accounts by a big bank if you qualify for a rebate.

This account includes:

- 12 free debits per month (including Interac e-Transfers)

- Free paper statements

- Access to rewards points (3 cents/litre on gas at Petro-Canada)

- Access to thousands of free RBC ATMs

Fees: RBC Day to Day Banking costs $4 per month. This fee is waived if you use multiple RBC products (e.g. credit card and investment). Seniors also get a full rebate.

Other service fees may apply, including bank drafts, personalized cheques, non-RBC ATM transactions, etc.

Cons: 12 transactions may not be adequate monthly, and each debit above this limit costs $1.25.

Learn about RBC savings accounts.

7. PC Money Account

The PC Money Account is offered by PC Financial.

It is a bank account that’s tied to a Mastercard debit/prepaid card, and you earn PC Optimum points with every purchase.

This is what you get with a PC Money Accounts:

- 10 PC Optimum points per $1 spent

- Access to your paycheque up to 2 days early

- Free Interac e-Transfers

- Unlimited debits and bill payments

- Extra points when you pay bills of $50+

You can pair this account with several no-fee cash back credit cards, including the PC Financial World Elite Mastercard.

Fees: No monthly account fee. Other fees may apply, including overdraft protection, ATM, inactivity, NSF, and card replacement fees.

Cons: PC Financial ATMs are mostly located inside Loblaw stores. Depending on where you live, you may not have one close by.

Learn more in this PC Money Account review.

8. Tangerine No-Fee Chequing Account

Tangerine Bank is one of the most popular online banks in Canada. It is a subsidiary of Scotiabank and was formerly known as ING DIRECT Canada.

The Tangerine No-Fee Daily Chequing Account offers:

- Unlimited free debit transactions and bill payments

- Unlimited free Interac e-Transfers

- Easy access to 3,500+ Scotiabank ATMs across Canada

- Interest on your account balance (up to 0.10%)

- Mobile cheque deposits

When combined with the no-fee Tangerine Money Back Credit Card, you earn up to 2% cash back on everyday purchases.

In addition to its chequing account and credit cards, Tangerine also provides investments, mortgage loans, and lines of credit.

Fees: No monthly account fee. Service charges apply to non-Scotiabank ATM transactions, non-sufficient funds, drafts, and stop payments.

Cons: This is an online-only account with limited access to in-person assistance.

Related:

9. Alterna Bank No Fee eChequing Account

Alterna’s no-fee chequing account is one of the best in Canada, as it is a convenient account that pays 0.05% interest on all balances, no matter how high or low.

Alterna’s eChequing account features:

- No monthly fee or minimum balance

- Free daily transactions and Interac e-Transfers

- Optional overdraft protection for $2.50/month

- Access over 3,300 fee-free ATMs in the EXCHANGE Network

Fees: $2.50/month for optional overdraft protection

Cons: There aren’t many physical bank branches, so it may be out of the way from where you live. If you opt for overdraft protection, you’ll pay the $2.50 fee even in months you don’t need it.

10. BMO Premium Chequing Account

This premium chequing account offers a bunch of VIP perks at a $30 monthly fee.

The BMO Premium Plan includes:

- Unlimited debit transactions and Interac e-Transfers

- Unlimited non-BMO ATM withdrawals worldwide (BMO fees are waived)

- Free overdraft protection (not including interest)

- Up to $150 waived on eligible TD credit cards

- Personalized cheques, money orders, and drafts

- Identity theft protection

- Discount on safety deposit box

- Preferential U.S. exchange rates for transfers between CAD and USD accounts

Fees: Costs $30 per month. This fee is waived if you maintain a daily minimum balance of $6,000. Other service charges may apply.

Cons: Unless you are willing to keep $6,000 sitting in a non-interest-bearing account, it will cost $360 per year.

Compare BMO chequing account options.

11. motusbank Chequing Account

motusbank has a $0 monthly fee chequing account that includes unlimited free Interac e-Transfers.

It also offers:

- Unlimited debits, bill payments, and withdrawals

- Mobile cheque deposits

- Interest on your balance (0.15%)

motusbank is a subsidiary of Meridian Credit Union, and members get access to thousands of free ATMs.

Fees: No monthly account fee; other transaction and service charges may apply.

Cons: motusbank has no physical branches. Also, it does not offer credit cards and investment products are limited to GICs.

Learn more about it in this motusbank review.

Bonus: Neo Financial

Neo Money is a free hybrid account that supports day-to-day debit transactions, high interest savings rates, and cash back.

A regular Neo Money account includes a free prepaid Mastercard and a budgeting app.

It also offers:

- Unlimited bill payments, POS transactions, and Interac e-Transfers.

- Average of 5% cash back on debit purchases (online and in-store) at thousands of stores

- Interest on your account balance

Neo Financial customers can also access optional paid services, including Neo Premium, credit monitoring, and more.

Fees: A regular Neo Money account has no monthly fees.

Promotions: Get a $20 bonus when you sign up here and deposit $50 or more in your account.

Cons: It does not support mobile cheque deposits. Learn more in this detailed Neo Money review.

Credit Union Chequing Accounts

Many of the best chequing account options can also be found with your local credit union.

Credit union members may be able to access no-fee chequing accounts or spending accounts with low fees and unlimited transactions.

Also, you get to share in the profits at the end of the year.

That said, read the fine print carefully, as I have also come across credit union chequing accounts with transactional fees that significantly exceed what some big banks charge.

Compare the Best Chequing Accounts in Canada

| Chequing Account | Monthly fee | Minimum balance to waive fee | Free debit transactions | Free Interac e-Transfers | Extra features |

| Simplii Financial No-Fee Chequing Account | $0 | N/A | Unlimited | Unlimited | Up to 0.10% interest on balance, free cheques |

| BMO Performance Chequing Account | $16.95 | $4,000 | Unlimited | Unlimited | Up to $40 rebate on credit cards annually |

| Scotiabank Ultimate Chequing Package | $30.95 | $5,000 | Unlimited | Unlimited | Unlimited no-fee international money transfers, no-fee overdraft protection |

| EQ Bank Savings Plus Account | $0 | N/A | Unlimited | Unlimited | 2.50% interest on balance |

| TD All-Inclusive Banking Plan | $29.95 | $5,000 | Unlimited | Unlimited | Credit card fee waived, get a small deposit box, free cheques |

| RBC Day to Day Banking Account | $4 | N/A | 12 | 999 | Earn Avion points, save on gas at Petro-Canada |

| BMO Premium Chequing Account | $30 | $6,000 | Unlimited | Unlimited | Credit card fee waived, unlimited no-fee global money transfers |

| PC Money Account | $0 | N/A | Unlimited | Unlimited | Earn PC Optimum points, access your paycheque early |

| Tangerine No-Fee Chequing Account | $0 | N/A | Unlimited | Unlimited | Up to 0.10% interest on your balance, combine with the credit card to earn up to 2% cash back |

| motusbank Chequing Account | $0 | N/A | Unlimited | Unlimited | Earn 0.15% interest on your balance, Price Drop feature, first 25 cheques free |

| Neo Money | $0 | N/A | Unlimited | Unlimited | Earn 2.25% interest on your balance, earn up to 5% cash back on purchases |

| Alterna Bank No Fee eChequing Account | $0 | N/A | Unlimited | Unlimited | 0.05% interest on all balances, low cost for overdraft protection |

What is a Chequing Account?

A chequing account is a bank account you use to conduct day-to-day transactions that include paying bills, making purchases, transferring funds, depositing cheques, withdrawing cash at an ATM, and receiving your payroll direct deposit.

Chequing accounts are also referred to as transactional or demand accounts. In the U.S., it is spelled as ‘checking’ account.

Chequing accounts are very liquid, and because you can as easily fund or defund the account, banks rarely pay you interest on monies held in the account.

How Chequing Accounts Work

You can open a chequing account at a bank, credit union, and other financial institutions. Most of them come with a monthly account fee; however, the fee may be waived if you keep a minimum balance.

A chequing account provides you with a debit card you can use to withdraw or deposit money at an Automated Banking Machine (ABM) in-branch at a teller and to pay for purchases at a point of sale.

They also offer chequing privileges, so you can write cheques as a means of payment.

You can ask your employer to deposit your paycheque in your account and set up pre-authorized payments or transfers to other bank accounts.

Some online banks do pay interest on your chequing account balance; however, most traditional banks do not. In Canada, the Canada Deposit Insurance Corporation (CDIC) protects deposits in chequing accounts up to $100,000.

Types of Chequing Accounts in Canada

There are different types of chequing accounts tailored to meet various needs. Here are some of the most common types of chequing accounts you will encounter in Canada.

Youth Chequing Accounts

This account is for children under 18 years of age and has no monthly fee.

It usually offers free transactions, has no minimum balance, and may pay a small interest. A parent or guardian maintains control of the account while the child is under a specified age.

Related: Best Kid’s Bank Accounts in Canada.

Student Chequing Accounts

This account is for students and also offers free or low-fee transactions and Interac e-Transfers, no minimum balance, and no monthly fee.

To open a student account, you must show proof of enrollment in post-secondary or tertiary education.

Seniors Chequing Accounts

A seniors chequing account offers a discount to customers who are 60 years and older.

This discount may be available on existing accounts at the bank or, in some cases, is specifically customized for only seniors.

Newcomer Chequing Accounts

The big 5 banks offer chequing accounts for newcomers that waive the monthly fees for up to 1 year.

These accounts may come with additional perks, including a free safety deposit box, access to a premium savings account, and free international money transfers.

After the promotional one-year period expires, a monthly fee applies to the account.

No Fee Chequing Accounts

No-fee chequing accounts with unlimited free transactions are offered by online banks, including Tangerine, Simplii Financial, Neo Financial and motusbank.

These accounts come with unlimited debits, bill payments, and Interac e-Transfers.

Their main downside is that you do not have access to in-person support at a physical branch.

Hybrid Chequing Accounts

The newest introduction to chequing accounts in Canada is the hybrid account that combines savings and chequing account capabilities.

While these accounts do not offer all the features of a traditional chequing account, they do go a long way to make savings accounts more flexible.

For example, the EQ Bank Personal Account comes with unlimited free transactions, no monthly fees, free unlimited Interac e-Transfers, and mobile cheques. You do not get a debit card.

Business Chequing Accounts

This account is designed for businesses – corporations, sole proprietorships, partnerships, non-profit organizations, and more.

A business chequing account is used to manage the day-to-day transactions and cash flow needs of a business enterprise.

These accounts come with varying monthly fees depending on the number and types of transactions allowed.

Basic Chequing Accounts

A basic chequing account is an entry-level chequing account offered by a bank. This is the bank account with its lowest monthly fee.

The number of transactions offered by this plan is limited, and fees apply when you exceed the limit.

Premium Chequing Accounts

A premium chequing account is the most expensive chequing account offered by a traditional bank or credit union.

It offers an unlimited number of debits, ATM transactions, free access to premium credit cards, free cheques, drafts, safety deposit boxes, and other VIP perks.

Chequing Account vs. Savings Account

A chequing account is used to conduct daily transactions, pay bills, transfer funds, make withdrawals, write cheques, receive deposits, and more.

It is basically a place to manage your cash flows without worrying about the restrictions imposed by a savings account. This flexibility attracts a monthly fee.

Chequing accounts also offer overdraft protection which means you can spend more money than you have in your account and avoid the dreaded Non-Sufficient Funds (NSF) fee. The overdraft fee is charged monthly. Overdraft protection is optional.

A savings account is where you can safely keep money and earn interest over time.

Savings accounts are generally free; however, you get dinged on transaction fees if you start using your savings account to conduct everyday transactions. In some cases, your bank limits how many transactions you can conduct using your savings account.

There are different types of savings accounts. A high-interest savings account offers a higher interest rate than a regular savings account. If you are eligible for a tax-free savings account, you can save and earn interest income tax-free.

Savings and chequing accounts can work together to help you reach your financial goals. For example, you can set up automatic transfers from your chequing account to your savings account after your paycheque is deposited.

Pros and Cons of Chequing Accounts

The benefits of a chequing account include:

- Easy access to your money when you need it using your debit card, ATM, and cheque

- Access to online banking and easy cheque deposits, fund transfers, and bill payments

- Safety through deposit insurance by the CDIC up to a limit

- Some chequing accounts offer budgeting tools and free credit scores

The downsides of a chequing account are:

- Monthly account fees

- No interest is paid on your balance

- Minimum account balances to waive the monthly account fee can be high

How To Save on Chequing Account Fees in Canada

Canadians spend more than $200 on average annually on chequing account fees. You can avoid or minimize your bank fees using these strategies:

1. Choose the right chequing account: If you only need to conduct a few transactions every month and have basic banking needs, there’s no need to pay $30 or more for an unlimited premium chequing account.

2. Maintain a minimum balance: Monthly chequing account fees may be waived when you keep a minimum daily closing balance in your account, e.g. at least $3,000. Remember that if your balance drops below the minimum threshold for just one day, you will need to pay the monthly fee.

3. Bundle services: Banks waive a portion of the monthly fee when you have several services with them, such as a combination of chequing, credit cards, mortgages, and investment accounts.

4. Choose an online bank: Virtual banks offer no-fee banking accounts since they can save on overhead costs by not needing to maintain physical branches. With unlimited free transactions, you can save a fortune over time. You can also check out the credit unions in your area.

5. Avoid overdraft and other convenience fees: Ensure you have enough money in your account before writing a cheque or setting up pre-authorized debits; use free ATMs owned by your bank, and sign up for electronic statements. Use overdraft protection if necessary, and by all means, avoid the $40 to $45 per count NSF fee.

6. Negotiate a fee break from your bank: Perhaps they could make an exception and not charge you a monthly fee, or there may be another account that best suits your needs. Find out how far your bank will go to keep your business.

Are Chequing Accounts Safe?

Most chequing accounts in Canada are offered by CDIC-member institutions, and they are considered safe. CDIC protects your deposits in chequing accounts up to $100,000 per member institution.

The organization also guarantees your savings accounts and Guaranteed Investment Certificates (GICs) with a term of 5 years or less.

Credit union chequing accounts are guaranteed by the relevant provincial deposit guarantee corporation, and funds may be protected up to 100%, i.e. without limit and including interest earned.

Chequing Account Fees in Canada

Depending on the account package you sign up for, the following transactions may incur additional fees in addition to the monthly chequing account fee.

- ATM withdrawals

- Debit card purchases

- Interac e-Transfers

- Cheques and pre-authorized debits

- Money transfers (email and wire)

- Overdraft protection

- NSF fees

- Bank drafts

- Assisted transactions

- Cross-border debits

- Paper statements

- Replacement bank cards

- Stop payments

- Safety deposit boxes

- Account closing and transfer fees

How To Choose a Chequing Account

Before applying to open a chequing account, carefully examine the features you need.

Do you need a no-fee chequing basic account with limited transactions? Are you a newcomer looking for a fee break while settling down in Canada?

How often will you need to conduct a transaction in-branch or in person? What’s their customer service like? 24/7?

Does the bank offer access to free ATMs in your area? Are they offering a new bank account promotion that’s worth checking out? What are the fees?

Shop around and compare accounts to find the best value for your money. You can open a bank account online or in-branch by appointment.

Typically, you will need to provide a government-issued ID, contact details, and your social insurance number to open your new chequing account.