Wealthsimple Trade now offers fractional shares, allowing investors to buy less than a full share of their favourite stocks.

With as little as $1, you can now get a slice of great companies in Canada and the United States, like Shopify, RBC, Amazon, Tesla, Microsoft, and Apple.

This feature makes it a lot easier for everyday retail investors to hold diversified stock portfolios and benefit from the growth of exceptional companies.

Not only that, but they can do so for free using Wealthsimple’s commission-free trading platform.

Read on to learn about how to trade fractional shares in Canada.

What is Wealthsimple Trade?

Wealthsimple Trade is Canada’s only trading platform to offer the ability to buy and sell thousands of stocks and ETFs for free.

You can hold your investments in a personal non-registered investment account or use a TFSA or RRSP.

As a member of the Canadian Investor Protection Fund (CIPF) via Canadian ShareOwner Investments Inc., your account is protected against insolvency by up to $1 million.

In recent times, Wealthsimple has been busy rolling out new features on its Trade app including:

- Support for fractional shares

- Wealthsimple Plus subscription with access to real-time market data, USD accounts, and instant deposits up to $5,000

Fractional shares refer to the purchase and ownership of part of one share of a company’s stock, instead of buying the whole share.

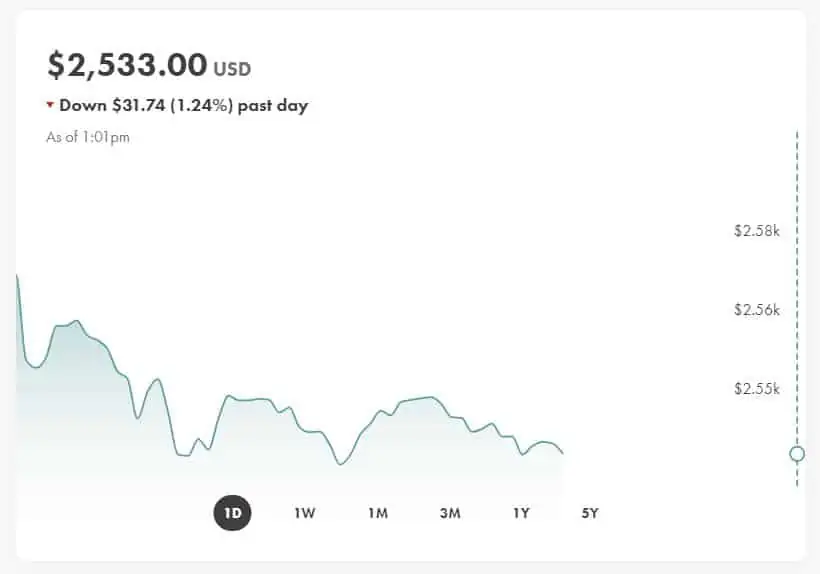

For example, one share of Google (Alphabet Inc – GOOGL) sold for $2,533 USD when I initially wrote this article.

Traditionally, if you were to buy the stock, you’d need at least $2,533 USD to become a shareholder.

However, with fractional share trading, you can own a little piece or “fraction” of one share of a stock starting at $1.

Fractional shareholders enjoy the same shareholder benefits as everyone else and receive dividends based on the proportion of shares they own. You can also sell your shares.

In addition to deliberately buying a fractional share through a trading platform, you can also get fractional shares through stock splits and dividend reinvestment plans (DRIPs).

Wealthsimple Trade is the only trading platform in Canada that supports fractional shares of Canadian and U.S. companies.

Previously, you could buy fractional shares through Canadian ShareOwner Investments Inc.; however, that company is now a wholly-owned subsidiary of Wealthsimple.

Here are the steps to buying fractional stocks on Wealthsimple Trade:

1. Create an account for free (this link includes a bonus). It takes a few minutes to onboard, and you can deposit up to $1,000 instantly (or $5,000 with Wealthsimple Trade Plus).

2. You can place a trade using the mobile app or desktop interface (web). Search for the stock you are interested in. I will use Shopify (SHOP) as an example (was selling at $1,810.97).

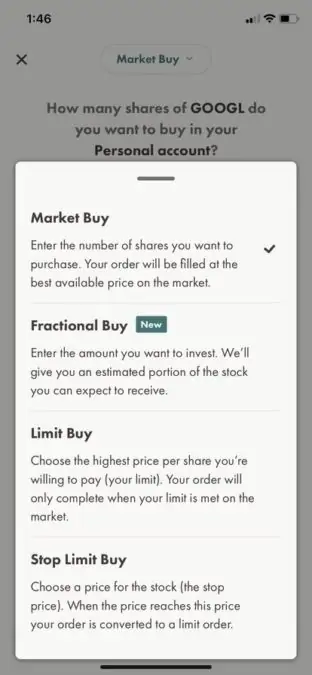

3. Choose your preferred order type, either a market buy, fractional buy, limit buy, or stop-limit buy. In this case, we want to place a “fractional buy.”

If this is your first fractional buy, you will see a prompt explaining what it means.

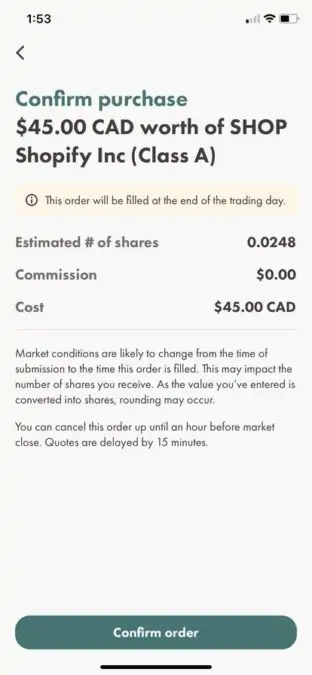

4. Enter the amount you want to buy. In this example, I only want to buy $45 CAD worth of Shopify.

5. Confirm your order. You can see how many shares of Shopify you are buying. In this case, I am buying 0.0248 shares of the SHOP stock (Shopify) or approximately 1/40th of one stock.

You can also sell a fractional share by entering the number of shares you want to sell. Fractional Share orders are fulfilled once a day.

There are hundreds of stocks available for fractional trading on Wealthsimple Trade. A few from the list include:

| Canadian Stocks | Canadian Stocks | U.S. Stocks | U.S. Stocks |

| Shopify (SHOP) | Intact Financial Corp (IFC) | Apple (AAPL) | Abbott Laboratories (ABT) |

| Royal Bank of Canada (RY) | National Bank Of Canada (NA) | Amazon (AMZN) | American Express Co. (AXP) |

| Toronto Dominion Bank (TD) | SNC – Lavalin Group Inc. | Google (GOOGL) | AstraZeneca plc (AZN) |

| Canadian National Railway Co. (CNR) | Suncor Energy, Inc. (SU) | Microsoft (MSFT) | Baidu Inc (BIDU) |

| Canada Goose Holdings Inc (GOOS) | Sun Life Financial, Inc. (SLF) | Netflix (NFLX) | Boeing Co. (BA) |

| Canadian Imperial Bank Of Commerce (CM) | TC Energy Corporation (TRP) | Tesla (TSLA) | Caterpillar Inc. (CAT) |

| Canadian Pacific Railway Ltd. (CP) | Thomson-Reuters Corp (TRI) | Airbnb (ABNB) | Chevron Corp. (CVX) |

| Dollarama Inc (DOL) | Wheaton Precious Metals Corp (WPM) | Coinbase (COIN) | Citigroup Inc (C) |

| Fortis Inc. (FTS) | Nuvei Corporation (NVEI) | Nvidia (NVDA) | Equifax, Inc. (EFX) |

| iA Financial Corp (IAG) | Kirkland Lake Gold Ltd (KL) | Facebook (FB) | General Electric Co. (GE) |

Thousands of other stocks (and ETFs) are also supported for regular trading; however, they are not yet listed for fractional shares.

Start Trading with a Cash Bonus

When you open a new Wealthsimple Trade account using our exclusive link, you get a welcome bonus.

Wealthsimple Trade

Trade stocks and ETFs for free

Great trading platform for beginners

$25 cash bonus when you deposit $200+

Transfer fees waived up to $150

The Wealthsimple Trade brokerage platform currently offers fractional shares for several stocks in Canada and the U.S. You can buy half a share or other fractions of your choice starting at $1.

Questrade does not currently offer fractional shares. If you want to trade fractional shares in Canada, the only option right now is Wealthsimple Trade.

Fractional shares make it easy for investors to hold shares in the stock of big and expensive companies. It can also help them to diversify their stock portfolio.

on your list of eligible stocks for fractional share purchases you list a never before heard of Canadian bank! At least I haven’t heard of it before. Have you ever heard of the Toronto Dominican Bank? I thought not.

I am interested in signing up with your platform but I have heard that you do not offer trading of all N American stocks/etfs. Do you have any information in regards to this?

thx, Gary

@Gary: Thanks for pointing out the type – it has been updated. Wealthsimple Trade does not list all North American stocks. Below is a copy from their website:

Wealthsimple Trade currently supports stocks and ETFs trading on the following exchanges:

Toronto Stock Exchange (TSX)

TSX Venture Exchange (TSXV)

New York Stock Exchange (NYSE)

NASDAQ

NEO

Canadian Securities Exchange (CSE)

BATS Exchange – limited securities available

If the security you’re looking for is listed on another exchange or is traded over-the-counter (OTC) you will not be able to purchase it on the Trade platform. If the security is listed on both a US exchange and a Canadian exchange, we will only support the security listed on the Canadian exchange.

https://help.wealthsimple.com/hc/en-ca/articles/360056580834

Good article with useful insights.

Wealthsimple deserves kudos for being first brokerage to launch fractional shares. This is a great option for investing in Canadian stocks that are pricey (3 digit prices or more). However, using this to buy US stocks would have downsides because you need to pay currency exchange fees of 1.5% for buying and at some point if you sell you get charged for the sale transaction. So that would make it less viable or not viable for US stocks.

Interactive Broker does fractional shares as well and at low fee.

@Mike: Is this available to Canadians? The last time I checked, I think it was only offered through their U.S. platform?

I so appreciate your work. You provide valuable information without jargon. Keep it up! And Thank you again!

@Dianne: Thanks for your feedback. Glad to hear you found the content useful.