Wealthsimple is Canada’s most popular robo-advisor, with more than $15 billion in assets under management.

Wealthsimple’s promotional offer gives new clients a $25 cash bonus (no longer a $75 bonus) when they open and fund their robo-advisor investment account with at least $500.

When you share your Wealthsimple referral or promo code with friends, you also get to invest up to $10,000 free for 1 year.

This is in addition to all the other benefits and perks you enjoy when you utilize its online investment management service.

There is also a $25 bonus offer for self-directed Wealthsimple Trade accounts (see more below).

For an in-depth look into the services, products, fees, and financial planning offered by the company, read our detailed Wealthsimple guide.

Wealthsimple Referral Program and Sign-Up Bonuses

When you sign up for a new Wealthsimple Invest account using our referral link, you receive a $25 cash bonus.

If you transfer your existing investment account to Wealthsimple, they also waive the transfer fees of up to $150 when your assets exceed $5,000. This makes for a total of $175 in sign-up bonuses/benefits.

As a client, you can share your custom referral link with friends and family. When they sign up, you get $10,000 managed for free for 12 months for each person that funds their account.

Your referrals also get free management of up to $10,000 for one year.

Other Wealthsimple Rewards

1) Download the mobile app and get an additional $100 managed for free for 12 months.

2) Turn on auto-deposits and deposit $50 or more monthly to get an extra $1,000 managed for free.

3) Transfer an investment account of at least $5,000 from another institution to Wealthsimple and get $10,000 managed for free for 12 months.

4) Get an extra $100 managed for free when you activate two-step verification for your account.

5) Open a self-directed Wealthsimple Trade account and get a $25 bonus when you deposit $200 or more in your new account.

Wealthsimple Trade

Trade stocks and ETFs for free

Great trading platform for beginners

$25 cash bonus when you deposit $200+

Transfer fees waived up to $150

6) Open a Wealthsimple Crypto account and get a $25 bonus when you fund your new account with $200.

Wealthsimple Crypto

Trade several cryptocurrencies

Excellent trading platform

1.5% to 2% trading fee

Get a $25 bonus when you deposit $200+

Wealthsimple Overview

Wealthsimple is the largest digital registered portfolio manager (robo-advisor) in Canada based on the number of clients and assets under management. Its headquarters is in Toronto, and the company also has offices in New York and London.

Wealthsimple provides everyday investors with access to diversified portfolios that are modelled after Nobel Prize-winning strategies. In addition, you enjoy:

- Very low investment management fees (as low as 0.4% compared to almost 2% when you invest in equity mutual funds).

- Portfolios are customized to suit your investment objectives, return expectations, and risk tolerance.

- Automatic rebalancing.

- Dividend re-investing.

- Free expert financial advice.

- Low-cost ETF portfolios and more.

Even better, you can sit back and not worry about your portfolio because they take care of all that stuff!

Wealthsimple Accounts and Products

You can invest in a variety of accounts with Wealthsimple. They offer:

- Registered accounts like TFSA, RRSP, RESP, RRIF, and LIRA

- Personal non-registered investment accounts

- Joint accounts

- Business investment accounts

As a client, you also have access to their various innovative products and services, including:

1. Stock Trading: Wealthsimple Trade is a commission-free stock trading app that enables you to buy and sell thousands of stocks and ETFs for free.

2. High-Interest Savings Account: The Wealthsimple Save Account pays a 1.50% interest rate that is one of the best in Canada and easily beats what the big banks are offering.

3. Socially Responsible Investing: Access to investment portfolios that align with your values. For example, you can invest in ETFs that are environment-friendly or those that feature only companies with positive human rights and corruption records.

4. Roundup Investing: This feature of Wealthsimple invest makes it easy for you to automatically invest your spare change.

5. Halal Investing: Investors who adhere to the Islamic faith can invest in a smart portfolio that complies with Islamic Law.

6. Tax Returns: They recently purchased SimpleTax, a “pay what you can” online tax return software.

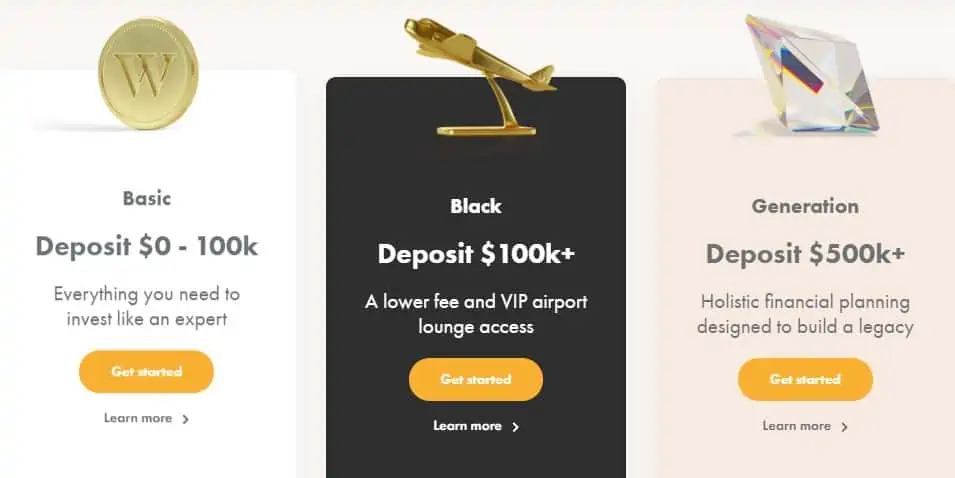

Wealthsimple Fees

One of the reasons why robo-advisors have increased in popularity is the lower fees they charge for managing your money.

At Wealthsimple, the fees are:

- $0 to $100,000 portfolio balance: 0.50% fee per year.

- $100,000 or more: 0.40% fee per year.

Using a calculator on the site, on a $100,000 portfolio, you could easily save $36,268 in fees over 20 years compared to an average mutual fund.

Is Wealthsimple Legit and Safe?

Wealthsimple Inc. is a registered portfolio manager in all of Canada, and they offer investment products via ShareOwner, a member of the Investment Industry Regulatory Organization of Canada (IIROC).

Clients of Wealthsimple are protected by the Canadian Investor Protection Fund (CIPF) up to $1 million if the firm becomes insolvent.

The company is backed by several well-regarded financial institutions, including Allianz X and Power Financial.

Wealthsimple Promotion FAQs

These are answers to some of the more common Wealthsimple FAQs:

When you sign up for a Wealthsimple investment account, you could qualify for a $50 welcome bonus. That said, the current best offer is for a $25 bonus after funding your account with at least $500. If you prefer a self-directed trading account using Wealthsimple Trade, you get a $25 bonus after depositing at least $200.

New clients get a $25 bonus after investing at least $500, plus a transfer fee rebate of up to $150. The total benefit available is valued at $175.

New clients who sign up using this referral link will get a $25 cash bonus after they fund their account with at least $500. Depending on your account balance, a 0.40% to 0.50% management fee applies annually.

Yes, as with any other investment (including mutual funds), there’s always a risk that you can lose your money.

The $300 Wealthsimple offer is no longer available.

Wealthsimple’s investment products are provided through Canadian ShareOwner Investments Inc., a member of IIROC. Client accounts are protected by CIPF up to $1 million if the firm becomes bankrupt.

We have written a detailed article comparing robo-advisor fees in Canada.

They charge a standard management fee of 0.4-0.5% per year, depending on your portfolio size.

If you are a self-directed investor who wants to buy and sell individual stocks, you can do so using Wealthsimple Trade, a no-commission stock trading platform.

Yes, you can transfer your existing investment accounts elsewhere to Wealthsimple. They reimburse any transfer fees incurred on accounts exceeding $5,000 in value. Read more about Wealthsimple TFSA accounts.

This refers to their referral program. You can invest up to $10,000 for free for every friend who signs up using your referral link. Your friend also gets to invest up to $10,000 free for 12 months.

Wealthsimple was founded in 2014 by Michael Katchen. Since then, the company has grown significantly and is backed by Power Financial Corporation.

Withdrawals take up to 5 business days to be completed.

Wealthsimple $25 Cash Bonus Offer (Up to $175 Back)

-

Ease of use

-

Trading fees

-

Accounts offered

-

Investment products

-

Security

Overall

Summary

Use this Wealthsimple promotional offer and get a $25 cash bonus when you sign up through our referral link, plus $150 in transfer fee rebates (up to $175 back). Refer friends and get $10,000 managed free for one year per referral.

Pros

- Invest on auto-pilot

- Low management fees

- User-friendly app

- Professionally managed portfolios

- Access to other financial products

- Welcome bonus

Cons

- Not the cheapest robo-advisor

Hi, if I sign up through your $75 referral link and deposit $500, will I also get the no fee for 1 year up to $10,000?

@Q: No, just the $75 cash bonus. Your portfolio will generate the regular 0.5% annual fee (for balances less than $100K). On a $500 account, this translates to $2.5 for the year. On a $10,000 account balance, it is $50.

So, it’s only if I refer someone that I get the fee waived for less than $10k investment and he also gets it waived?

Hi, is your $75 link still working? I clicked on it, try to create an account by entering my email and a pwd. But after pressing the “Get Started” button, nothing happens. I tried it a few times.

@S: Sorry to hear you ran into some problems. I will check with Wealthsimple to see what’s going on.

Hi, have you heard from Wealthsimple? I also have the same problem. When I emailed them, they replied saying they couldn’t help because my email is not in their system. Well, my email is not in their system because I can’t sign up using the referral link! (BTW, it seems to be a problem with other referral links because I tried the ones from Moneysense, and Maplemoney and it’s the same problem.)

@Q: No, I haven’t heard back as replies are delayed over the holidays. I will update this thread once I clarify what’s going on. Cheers.

Hi, it’s working again. Thanks

@Q: You are welcome. THanks for pointing out the error you experienced earlier!

Hi Enoch!

Silly question – but for the WealthSimple Trade promotion, does the criteria of “trade at least $300” mean I need to buy a total of at least $300 in any combination of stocks/ETFs, or does it mean something else?

i.e.: If I fund the account with $400 then buy 3 shares of RBC (currently valued ~$375), then that satisfies that sign-up criteria for the $150 bonus, right?

@Richard: Sorry about the delay here. Unfortunately, the $150 offer has been paused. The current best offer is a $25 bonus. As for your analogy above, yes, you are correct.