Exchange-Traded Funds (ETFs) such as the Vanguard S&P 500 Index ETF (VFV) make it easier for investors to diversify their portfolio holdings while saving on fees.

Compared to traditional mutual funds and their expensive management expense ratios (MER), an ETF can cost as low as 0.05% per year. This means the fees are $5.00 for every $10,000.00 you have invested in the fund.

Over the long term, the fee savings can result in higher returns as you keep more of your gains.

Stocks and ETFs like VFV are also easier to purchase these days using a discount brokerage platform. For example, you can use Wealthsimple Trade and Questrade to buy VFV for free (no trading commissions).

This VFV review covers its holdings, performance, pros and cons, how to purchase it in Canada, and how it compares to VOO.

What is VFV?

VFV, aka Vanguard S&P 500 Index ETF, is a US-equity ETF from Vanguard Canada.

It is designed to track the performance of the S&P 500 Index by investing in large-capitalization U.S. stocks that are representative of the benchmark index.

If you have been looking to diversify your portfolio by holding more U.S. stocks, VFV offers an easy solution.

It is worth noting that this ETF is 100% invested in stocks, and you would typically hold it as a portion of your portfolio … and not the only asset.

The risk rating for VFV is “medium,” and it trades on the Toronto Stock Exchange under the ticker symbol “VFV.”

Key facts for VFV as of February 2023 include:

- Inception date: November 2, 2012

- Number of stocks: 506

- Price/Earnings Ratio: 19.1x

- Price/Book Ratio: 3.6x

- Return on Equity: 23.3%

- Earnings Growth Rate: 19.4%

- Management fee: 0.08%

- MER: 0.09%

- Assets under management: $6.988 billion

- 12-month trailing yield: 1.31%

- Distribution frequency: Quarterly

- Eligible accounts: RRSP, TFSA, RRIF, TFSA, DPSP, RDSP

- Currency: CAD

VFV Holdings

VFV is an all-stock portfolio which means it is growth-oriented and exposed to higher volatility compared to portfolios with some allocation to bonds or cash.

A higher volatility means you will potentially enjoy higher returns when the overall market is up and increased losses when there is a downturn.

As of February 2023, the asset allocation of VFV is 100% U.S. stocks.

The top-10 stock holdings are names we are all familiar with, including technology (Apple), media (Alphabet), automobile (Tesla), and pharmaceutical stocks (Johnson & Johnson).

| Stock Name | Ticker Symbol | Weighted Allocation |

| Apple Inc. | NASDAQ: AAPL | 5.99% |

| Microsoft Corp | NASDAQ: MSFT | 5.51% |

| Amazon.com Inc. | NASDAQ: AMZN | 2.29% |

| Berkshire Hathaway Inc. Class B | NYSE: BRK.B | 1.71% |

| Alphabet Inc. Class A | NASDAQ: GOOGL | 1.62% |

| UnitedHealth Group Inc | NYSE: UNH | 1.52% |

| Alphabet Inc. Class C | NASDAQ: GOOG | 1.44% |

| Johnson & Johnson | NYSE: JNJ | 1.42% |

| Exxon Mobil Corp | NYSE: XOM | 1.39% |

| JPMorgan Chase & Co. | NYSE: JPM | 1.21% |

And for the sector categories, VFV has the following exposure:

| Sector | Weighted Allocation in VFV |

| Information Technology | 25.8% |

| Health Care | 15.8% |

| Financials | 11.6% |

| Consumer Discretionary | 9.8% |

| Industrials | 8.6% |

| Communication Services | 7.3% |

| Consumer Staples | 7.2% |

| Energy | 5.2% |

| Utilities | 3.2% |

| Real Estate | 2.7% |

| Materials | 2.7% |

Related: Best Bitcoin ETFs.

VFV Returns and Performance

You can track the performance of VFV since its inception in 2012.

Using the total return based on its year-end net asset value (NAV) and market price:

| Year | NAV | Market Price (CAD) |

| 2013 | 40.65% | 40.97% |

| 2014 | 23.76% | 23.99% |

| 2015 | 20.22% | 20.31% |

| 2016 | 8.46% | 8.22% |

| 2017 | 13.61% | 13.66% |

| 2018 | 3.35% | 2.79% |

| 2019 | 24.49% | 25.12% |

| 2020 | 15.58% | 15.79% |

| 2021 | 27.64% | 27.45% |

| 2022 | -12.69% | -12.62% |

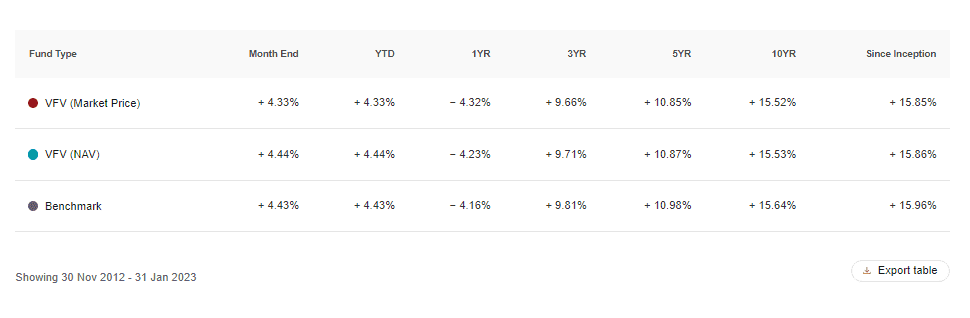

You can also see how the ETF has performed against its benchmark index (S&P 500).

The disparity in returns between VFV and the S&P 500 Index (tracking error) can be attributed to fees and fund expenses.

Note that historical returns are not a guarantee that this ETF will perform well in the feature.

VFV Fees

VFV has a 0.08% management fee, and its management expense ratio is 0.09%.

This is significantly lower than what you pay the average equity mutual fund manager in Canada (1.98%).

How about robo-advisors?

A robo-advisor (online wealth manager) such as Wealthsimple has a 0.40% to 0.50% management fee. After you account for in-built ETF costs, your total fee is in the 0.60% – 0.70% range per year.

Since robo-advisors automate portfolio rebalancing and dividend reinvesting and also provide free investment advice, a 0.70% fee may be worth it.

If you choose to purchase ETFs like VFV directly, make sure to watch out for trading fees.

For example, on TD Direct Investing, you pay $9.99 per trade. Over time, you could rack up enough trading commissions to exceed even the costs of a mutual fund, particularly when you trade small lots.

You can avoid this by using a broker that offers commission-free trades on ETFs, e.g. Questrade (free for purchases) and Wealthsimple Trade (free for both buy and sell orders.

Pros and Cons of Vanguard VFV

VFV offers exposure to the largest capitalization stocks in the U.S. (over 500 of them) at a low cost.

It would be difficult holding each of these stocks by purchasing them individually, and if you were to hold a comparable mutual fund, you can expect to pay a lot more in fees.

If you don’t mind the volatility (ups and downs) of an all-stock portfolio, VFV can give your portfolio extensive exposure to the U.S. market.

That said, you’d want to hold other assets as well, including Canadian and international equities, plus some bonds depending on your risk tolerance.

VFV is easy to purchase using a self-directed brokerage account, and it is eligible for both registered and non-registered accounts.

This ETF is cheap, costing just 0.08% every year. That is, you pay only 80 cents on every $1,000 invested.

That said, a costly brokerage platform can erase any advantage from a lower MER if you are paying trading commissions every time you click on “buy” or “sell.”

VFV vs. VOO

VFV is the Canadian version of the Vanguard S&P 500 ETF offered by Vanguard U.S.

VOO is listed on the New York Stock Exchange and is traded in U.S. dollars. This means you will be paying FX fees if you purchase VOO using Canadian dollars.

Dividends paid out by VFV are subject to a 15% foreign withholding tax. However, if you hold VOO in an RRSP, the dividends earned are not subject to this 15% cut.

VOO has a 0.03% MER, while it is 0.09% for VFV.

VFV vs. VSP

VSP is the Vanguard S&P 500 Index ETF (CAD-hedged).

Basically, the VSP tracks the same U.S. stocks as the VFV; however, it also hedges its currency exposure to the Canadian dollar.

If the U.S. dollar was to weaken or strengthen against the Canadian dollar, VSP is hedged to protect your portfolio and eliminate the effect of the foreign exchange rate.

You pay a small fee for hedging your position. VSP has a 0.09% MER which is the same as VFV.

VFV vs. VUN

VUN is the Vanguard U.S. Total Market Index ETF. It tracks the CRSP US Total Market Index, which comprises large, medium, small, and micro-capitalization stocks in the U.S.

VUN held 3,992 stocks as of February 2023, compared to 506 for VFV.

The U.S. version of VUN is the VTI ETF.

VUN has an MER of 0.16%. The annual fee for VFV is 0.09%.

Related: Best Stock Trading Apps.

How To Buy the Vanguard VFV ETF in Canada

You can easily purchase VFV using Questrade or Wealthsimple Trade.

Questrade:

This online brokerage offers trading in stocks, ETFs, bonds, mutual funds, options, IPOs, GICs, and precious metals.

ETF purchases are free, and you pay a minimum of $4.95 per trade when selling.

Questrade is available on all devices, and experienced traders can access advanced charting, multiple order types, and research.

To start, open an account here and use SAVVY50 to get $50 in free trades after you fund your account with at least $1,000. Learn more about the platform in the Questrade review.

Wealthsimple Trade:

Looking to buy and sell stocks and ETFs for free? Wealthsimple Trade offers commission-free trading whether you are buying or selling.

To avoid FX fees on US trades and to get access to real-time data, you can subscribe to Trade Plus for $10 monthly.

Our readers get a $25 welcome bonus when they open an account and deposit at least $200. Get more details in this review.

Is VFV a Good Buy?

As per Vanguard Canada, VFV is for investors who:

“Are seeking long-term capital growth, want to invest in U.S. large capitalization equity securities within their portfolio, and can handle the ups and downs of the stock market.”

Growth/aggressive portfolios are not suitable for everyone, and you should always invest in line with your risk tolerance and investment needs.

You can gain exposure to a more diversified stock portfolio using an all-in-one ETF like VEQT.

Related: Best ETFs in Canada.

VFV ETF Review FAQs

VFV invests in VOO, which is the U.S. version of the Vanguard S&P 500 ETF.

VFV distributes dividends every quarter in March, June, September, and December. As of February 2023, its distribution yield was 1.21%.

If you are interested in the currency-hedged Vanguard S&P 500 Index ETF, you can purchase VSP, which is CAD-hedged.

VFV Review

Overall

Summary

VFV is Vanguard’s S&P 500 Index ETF. This VFV review covers its fees, holdings, how it compares to VOO and VSP, and how to buy it in Canada.

Pros

- Low management fee and MER

- Diversified across hundreds of stocks

- Eligible for multiple accounts

Cons

- Medium risk asset

- Trading fees can pile up if you pay per trade and make small trades

Great summary, exactly what I needed! How do we know if such ETF rebalance themselves? I assume VFV et VSP will rebalance themselves if needed, independently if they are in WealthSimple Invest or Trade?

@MJC: These ETFs (e.g. VFV) will rebalance themselves to stay in line with their mandate. That said, you will need to rebalance your portfolio if you hold a basket of ETFs that are not “all-in-one” to keep things balanced such as when one fund performs better than the others and exceeds the allocation you intended for it to have. If you are holding these ETFs on Wealthsimple Invest, they do the rebalancing for you. On Trade, you do it yourself. Hope this makes sense?

With regards to the 15% foreign withholding tax, can that be claimed back at tax time? If so, which type of account would be best to hold this ETF ie. TFSA, RRSP or Cash to be able to claim the 15% FWT? Your advice is appreciated.

@Leslie: The US withholding tax does not apply to RRSPs.

Does the US withholding tax apply to TFSA?

@Ash: Yes, it applies to TFSAs.

Hi Enoch, I want to buy a US listed ETF but I am worried about paying US Estate Tax. I would like to buy VOO instead of VFV becaues it performs better and there are lower MER fees. Is it a guarantee I will pay US Estate Tax if my portfolio grows anywhere between $10 million and $50 million? What can I do to guarantee I don’t pay any US Estate Tax? Thanks in advance.

Hello Enoch, does the cost of exchanging cad to USD to buy VOO erode the value of VOO even in an RRSP, making VFV more favourable?

@Muriel: Possibly. That said, for a long-term hold, VOO could come out on top when you consider annual withholding taxes over time. The VOO advantage is enhanced if you have US dollars or use a competitive US-CAD exchange via Norbert’s gambit. Overall, it may not be that much of a difference to bother too much about.

This Globe&Mail article is helpful: https://www.theglobeandmail.com/investing/education/article-watch-out-for-tax-traps-with-us-index-funds/