It’s that season of the year when you are required to file your tax return – aka tax season!

Whether you are looking forward to tax time or not may depend on if you expect to get a refund or if you will owe the government money. (Hint: Those expecting a significant tax refund are often ecstatic when tax season comes around). 🙂

Tax filing via electronic channels has become more simplified in the last few years, especially with recent integration opportunities available through the Canada Revenue Agency (CRA) and the increasing sophistication of online tax software.

Of the nearly 30 million tax returns filed last year, 91% were transmitted electronically; paper returns accounted for the rest.

Depending on your circumstances this year, you may be able to file your returns yourself using paid tax software, free of charge at a tax preparation clinic, or you may choose to hire an accountant.

For those intending to use the DIY option, this is where TurboTax comes into play!

TurboTax is Canada’s #1 best-selling and most popular income tax software and has been used by millions of Canadians for over 20 years. The TurboTax software is owned and marketed by Intuit Canada.

Why Use TurboTax?

If you are wondering about your choice of tax software for processing your tax return this year, here are some reasons to consider choosing TurboTax:

1. Guaranteed Maximum Refund and Accuracy

Individuals who prepare their own tax returns often fear that they may be missing out on eligible deductions and tax credits, ultimately cheating themselves out of refunds.

Not surprising, as nobody wants to give the government more of their hard-earned money if they don’t have to!

TurboTax guarantees that when you use their tax software, you’ll get the maximum refund possible. They also guarantee 100% accuracy and that there will be no errors.

If there are any errors due to using their software and they lead to CRA penalties, TurboTax will reimburse the penalty plus interest.

2. Support

The availability of multiple forms of support is one area that makes TurboTax stand out. Support available to tax filers includes:

- An online community where you can ask and receive answers from experts and other customers.

- Phone support

- Video tutorials

- TurboTax SmartlookTM: an online, on-demand service that connects Canadian tax filers to live, personalized tax advice from qualified tax experts.

While the level of support you can access is somewhat dependent on the edition of TurboTax you are using (or purchasing), there is always some level of support available, even for the free version!

3. Simplicity

About 50% of Canadians do not feel comfortable filing their taxes. A few years ago, I was not either. Have you looked at those paper tax forms recently? If you are not an accountant or are not used to figuring out numbers, manually filing a complicated tax return is simply not your idea of an entertaining evening or weekend.

The TurboTax software makes this tax filing a breeze – it takes you through the process step-by-step, showing you only what’s required for your own specific income, benefits, and tax situation.

4. NetFile Certified

NETFILE is an electronic tax filing service that allows you to send your tax return directly to the CRA through the internet. TurboTax is one of the tax software products certified by the CRA to use the NETFILE system.

By submitting your return directly, you can get your refund much faster – in my case, I received it in 10 days. You also get immediate confirmation that your tax return was transmitted successfully.

Filing via a paper return means waiting up to 8 weeks for your refund.

5. CRA Auto-Fill My Return

Individuals with a CRA My Account can connect their TurboTax account to CRA to automatically populate their tax information already on file. TurboTax makes the auto-fill my return very easy to accomplish, potentially saving you lots of time.

Related: How To open a CRA MyAccount

6. Support for Multiple Platforms and Devices

TurboTax is available via the internet (web-based) and can also be downloaded and installed on your personal computer. Both online and download options offer varying benefits and features depending on your chosen version.

So, you can download and install it on your Windows or Mac PC, or if you prefer, choose one of the many online versions and access it on the web anywhere using your PC, tablet, or phone.

7. TurboTax Free

There are online and download versions of TurboTax that you can access free of charge.

With TurboTax Free, you can still use the Auto-Fill my return through CRA, ask questions on AnswerXChange, and expect 100% accuracy.

However, you will not have access to some premium features, including the ability to transfer your previous tax information and store your return online. It may also not be suitable for more complicated tax situations.

8. Other Resources

There is an abundance of other resources on the TurboTax website, including a blog, income tax and refund calculators for all provinces and territories, an expense claim calculator for self-employed individuals, tax tips, and more. These are all freely accessible.

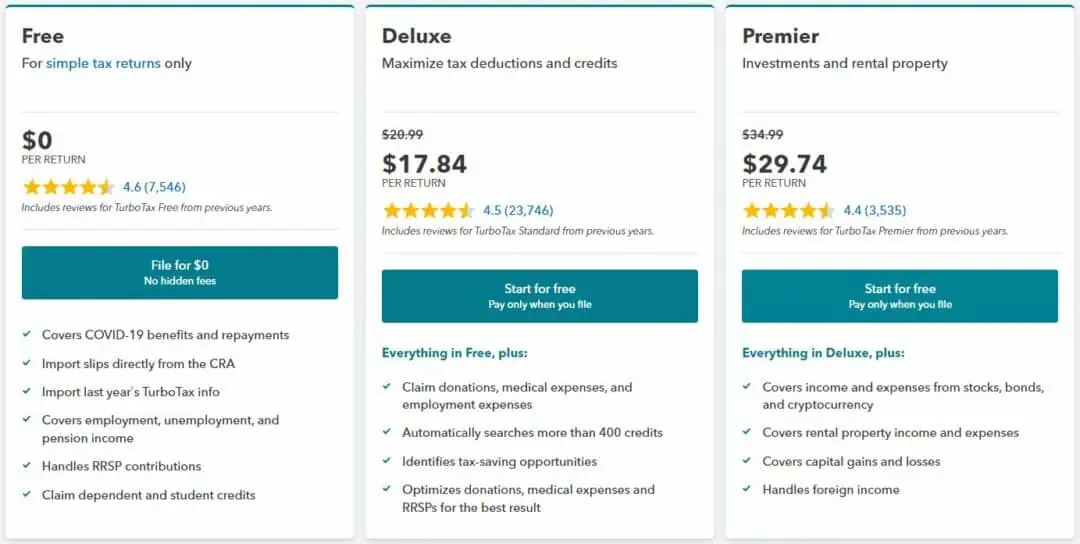

Choosing Your TurboTax

Generally speaking, you can choose between the online (web-based) and the PC-installed versions. There are multiple tiers of features available depending on what you choose/pay for. As the features/benefits increase, so does the cost.

If you are filing a single return and your tax situation is relatively simple, the Free or Standard online version (15% discount link) is probably all you need.

The Premier version (15% discount link) targets those looking for additional guidance on investment income and expenses or who have a rental property they have to account for.

If you are filing more complicated returns, including those with freelance income/home-based business, you can look at their Self-Employed package (15% discount link).

For those who would rather have someone else take care of their tax filing, the TurboTax Assist & Review or Full Service may be worth looking at.

If you would rather download the software to your desktop instead of using the online version, desktop download versions are also available.

Is TurboTax Safe?

TurboTax is NETFILE-approved, which means they can securely transmit your tax information to the Canada Revenue Agency.

The security they employ for your account is also top-notch. TurboTax uses multi-factor authentication and data encryption to ensure that your private data is kept safe.

2024 Tax Filing Updates in Canada

For your 2023 tax return, the tax deadline is on April 30, 2024. If you are self-employed, your tax filing deadline is on June 15, 2024.

2023 Tax Filing Updates in Canada

For your 2022 tax return, the tax deadline is on May 1, 2023. If you are self-employed, your tax filing deadline is on June 15, 2023.

2022 Tax Filing Updates in Canada

2022 Tax Filing Updates in Canada

For your 2021 tax return, the tax deadline is on May 2, 2022. If you are self-employed, your tax filing deadline is on June 15, 2022.

Below is a summary of tax changes to watch out for in Canada in 2022.

Those who received the Canada Recovery Benefit (CRB), Canada Recovery Caregiving Benefit (CRCB), and Canada Recovery Sickness Benefit (CRSB) can expect to receive a T4 from the CRA.

The CPP contribution rate has increased to 5.70% in 2022, or 11.40% if you are self-employed.

The RRSP contribution limit for 2022 is 18% of your earned income in 2021 or a maximum of $29,210.

The TFSA contribution limit for 2022 is $6,000 (same as in 2021).

2020 Tax Filing Updates in Canada

Tax updates to watch for when you file your 2020 tax return and for the 2021 tax year include:

If you worked from home due to COVID-19, you may be eligible to claim up to $400 for work-space-in-the-home expenses, office supplies, and more. You can claim $2 for each day you worked from home in 2020, up to a maximum of $400 (or 200 workdays).

The CPP contribution rate for workers increases to 5.45% in 2021, or 10.90% when combined with the employer rate.

The CRA will send you a T4A if you have received the CERB or CESB benefits so you can record the payments when you file your tax return.

The maximum annual RRSP contribution limit is 18% of your income up to a maximum of $27,830.

2019 Tax Filing Updates in Canada

Some of the new tax changes that come into effect in 2019 and which affect your tax filing in future years include:

The tax filing deadline has been pushed to June 1, 2020 (from April 30, 2020). Canadians can also defer their income tax payments for the 2019 tax year until after August 31, 2020.

The small business tax rate has been reduced from 10% to 9%. Also, note that there is now a lower limit to the passive income small business owners can keep before higher corporate tax rates kick in.

Low-income workers will receive an increase in Canada Workers Benefits (a refundable tax benefit formerly known as the Working Income Tax Benefit).

New carbon taxes have been introduced, and fuel costs are expected to go up by April 2019. Direct tax rebates will be available to residents of provinces that do not yet have an agreement with the federal government (Manitoba, Ontario, New Brunswick, and Saskatchewan).

The Enhanced CPP goes into effect with rates increasing to 5.1%. The maximum pensionable earnings for 2019 is $57,400. While CPP payments have increased, EI premiums will drop by 4 cents for every $100 of insurable earnings (i.e. from $1.66 to $1.62 per $100).

Related: TurboTax Coupon Code

TurboTax Review

-

Ease of Use

-

Customer Support

-

Free Version

-

Price

-

Available Features

Overall

Summary

TurboTax is the #1 best-selling income tax software in Canada, and has been used by millions of Canadians for over 20 years. Depending on your tax situation, you have the choice of a free version, as well as several paid versions (online and PC).

My sister in law does my taxes for me but Turbo Tax sounds reasonable- looks like there are different price points which is good.

@GYM: Lucky you! I don’t mind doing my taxes, but if I had the option to download it to someone else (for free, of course), I would do it in an heartbeat. 🙂

Cheers.

I have been using Turbo Tax for ever and it is so easy to use. I do a minimum of 5 returns a year.

Great review:)

@Caroline: Thanks! Yeah, I also think the software makes it easy for anyone to use, particularly, the helpful prompts that show up now and again and remind you not to forget something. 5 reviews – you are a busy lady!

I have not yet received my 2018 turbo tax by e-mail. How do I get a hold of them to let them know.

Howard

[email protected]

A: All Intuit products come with a 60-day Satisfaction Guarantee, with the exception of ProFile which is 14 days. If you aren’t satisfied with your Intuit products, ***simply*** call customer service at 1-800-434-6820 within 60 days of purchase in order to begin processing your return or exchange request.

It is NOT simple. Calling this number for a refund is simple. For the second time, calling Intuit support leads one on a goose chase. I was told that for Turbotax Canada, I needed another number, which the support person could NOT find (support outsourced to Philippines or India), and then called Level 2 support. Then told to use https://support.turbotax.intuit.ca/contact. The 800 number is BS.

In years past, I made one call to support during taxtime. Could hardly understand the person, and the person seemed unfamiliar with Canada or Canadian tax.

Simply put, Turbotax is good when it works. But if you have any problem, it is not good.

“Unfortunately at this time, this is as far as you can go” should be their motto. People can’t file using this program because they say they are”updating forms” and said they will be done in February. Well, here we are in March and not only have the not fixed it, but they dont update their customers who are left in the dark. They have NO idea when it will be ready so we can file.

Hi . We had Turbo Tax Premium and tried to netfile . the software program to report a foreign rental address is not allowing because according to CRA the software is not adequate, you cannot autofill another country and city.

Despite excellent attention by several Turbo tax staff they could not find the answer.

I tried to get a partial refund because of this inadequate software that was ok to autofill most of the tax report but still not for netfile.

The last person worked very hard to get a partial refund of $20, laughable as he had to check with several others to evaluate. 60 days satisfaction assured. Hmm right. well, the supervisor said I used the software so I cannot get a partial refund . I asked, well how would I be dissatisfied if I never used it?

of course, being spineless these jokers put their hourly personnel on the phone and hide so you cannot speak with them!

So, completely dissatisfied. I would use UFile and Simple Tax next time or better go to a real tax person.

I would not never use this stock boy style company again… really conmen!!

Do it online DO NOT USE THE DOWNLOAD OR CD VERSION! The reason I am saying this and rather angrily is this: It does not autosave the system regularly crashes when the cra import fails and over all it is not as easy to use. I have used the online version for years. It was easy,simple and i never had one single issue with it. This year I used the download version. I want to throw my computer out the window right now. it is so frustrating to use. It is crashtastic. Just use the online version and save yourself the aggravation.

I have been using the CD version of Turbo Tax for years with few issues. This year I was able to NetFile my Federal income tax, but the program would not allow me to NetFile my Quebec Income tax.

EasyStep indicated a FIX was required on investment income taxable dividends. Without a “FIX”, I would not be able to NetFile. Since I had copied all information correctly from my two (2) RL-3( which are not exactly the same as the Federal T5), I called Customer Service for assistance FIVE times trying to get to the bottom of this.

Yesterday Customer Service finally admit they had an issue and it had not been fixed, so I would need to mail in my Quebec Income tax return. [No compensation would be forthcoming]

I cannot tell you how many hours I spent on the phone with people who had no clue what they were talking about or how many times they had me delete information and put it back, elevated to level one, then two. I repeated the problem each time I called as they supposedly do not retain much info and do not know if a call was elevated or to whom or if a promised email was ever sent regarding the problem or if a resolution had been found. Terrible service!

What a nasty joke for the #1 best selling income tax software in Canada. Surely they can do better.

I will not waste my money on this tax program again.

Sorry to hear about your difficult experience.

I have been using TurboTax (previously QuickTax) for years and I find that the last couple of years support has not been what it used to be. For the last part of last tax season software started giving me a message that: TuboTax was unable to verify if an update is available. After many attempts with tech support the issue was never resolved. This year I just downloaded the premium version and I have the same problem and after several attempts to have this fixed with tech support I am ready to throw in the towel and go to something else. Have tried UFile in the past ans was quite impressed. I believe this will be my last year using TurboTax.

@Salvatore: I have only used the online version and not the downloadable one. So far, I have never had issues with the online TurboTax software and have found it to be fast and user-friendly.

for those who use the downloaded multiple filings [for families] you need windows as there is no package for apple. I hope this is changed as I will only have apple next year.

tried using the free online version. it appeared to make an error regarding CPP. I had yo explain to the tax expert what CPP was. the issue was an overpayment. expert had to talk to her supervisor. I was sharing my screen but suddenly cobrowse did not work anymore and everything they claimed to try would not work. Expert did not seem to have any knowledge of taxes and Guest program would not load on tablet, tor laptop or desktop. simple questions about numbers not reconciling. worst customer service experience! Cannot recommend this to anyone.

Those of you on the standard or deluxe version but have simple T3s. Don’t get fooled by the fact that there isn’t a little lock symbol beside it when you are entering what income information you have. It will force you to upgrade to premier and not let you move on until you do just to enter T3 information even though it originally told you that you wouldn’t need any upgrades to do it. Double the price just do enter information that requires no extra brain or tax thinking beyond it has increased your income.

My tax situation has not changed from last year- no new deductions or other changes. But now I have been told that I can’t use the free version for simple situations and must pay for it! As a senior- I object to this- I almost feel that I am being scammed by this company. When I messaged them about it- the reply was that they had optimized the program so my case no longer qualified for the simple return. Such a convenient and nebulous answer. Needless to say- I am going back to doing a paper return!

The auto fill function does not work if you have a lot of documents. I have between 100 and 200 documents, mostly T5008. I goes to CRA ok and starts to download. The hang up is while it is updating the return. It blows up and you need to to start over. I have done this about a dozen times at different times of day and on different days. Turbo Tax help desk guy told me to keep trying. Not much help. I am seeing others having same issue last year too. By the way it was OK for my wife who has obly about 20 documents. I will try Turbo Tax one more time. If not resolved I will move on to something that works. I am using the web version. Second year doing so. For about 15 years i was using the Windows installed version. Anyone else haviing this issue?

Yes, I have the exact same problem. After manually entering 100 slips, I found out that one cannot enter more than 100 T5008 transactions, hence the AutoFill not working. I read on Canada.ca that if you have more than a 100 transactions and using the web form, you need to file two returns for that year. I’m wondering how would that work out, what do I do about the rest of the tax info. When you used the Windows installed version, did you have more than a 100 T5008 slips ?

Turbo tax Canada is no longer free if you have any type of investments. Switching to a different company.

I have used TurboTax for the past 3 years claiming a dividend from a $5600.00 paid up life insurance policy that has a dividend of $156.00 that earned $6.74 last year. I have had the same claims for the last 3 years but this year Turbo Tax decided that I have a investment account and charged me $19.99 to do my tax return and my total income last year was $21,150.00. I am a senior citizen and I think this is despicable. Looks like I will be looking for another source to do my tax return next year. I also see that Turbo Tax is being sued in the US for this very reason.

My only complaint about Turbo Tax is there is no way to enter exchange rates for multiple foreign securities transactions except to do the calculations outside of the software. For example, the T5008 forms for US$ securities come stated in US$ and this is what is downloaded from CRA. You have to convert the purchase amount as of the purchase date and sale amount as of the sale date to Canadian dollars to enter in TurboTax; in other words, you need to over-type the downloaded amounts. If you have only one or two sales, it is not a big deal; however, if you have hundreds of transactions, it becomes a computational and cut and paste headache to complete your return.

Also, you can download a maximum of 500 of these T5008 forms. If you have more than that, you’re entering everything by hand.

@Leslie: Thanks for your feedback.

I ditched Turbotax last year since it could not handle more than 100 T5008 forms downloaded from CRA. I worked with them to fix the issue but to no avail. I would have had to manually enter a lot of T5008 forms manually. That was a non starter.

So after doing some research I ended up with H&R Block’s online service. It worked.