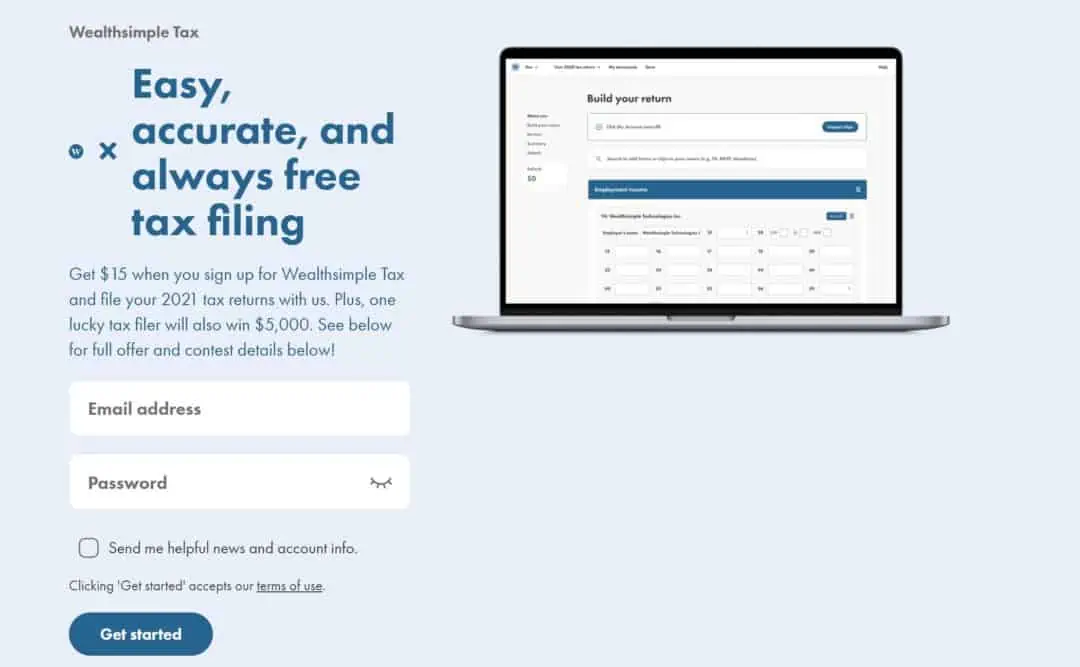

Wealthsimple Tax (formerly SimpleTax) is one of several tax return software that has made filing your taxes easier than ever.

You no longer need to leaf through the pages of a paper tax document, wondering what each section means, and waiting for weeks to get your tax refund.

With electronic tax software like WealthsimpleTax, everything is completed online, there are quick tips and guides along the way, and your refund typically takes days, not weeks.

Not only that, but cheap or free tax software can save you a fair bit of money compared to using an accountant.

There is a misconception that you only need to file a tax return if you have an income to report. This is not true.

The financially savvy thing to do is to file whether or not you have earned income in the previous year. This is because the government uses your return to assess your eligibility for various benefits, including the following:

This Wealthsimple Tax review covers its top features, benefits, downsides, whether it is safe, how it compares to TurboTax, and the help or support you can expect.

Wealthsimple Tax Overview

SimpleTax was founded in 2012 by Jonathan Suter, Allison Suter, and Justin Reynan. It was recently acquired by Wealthsimple, one of Canada’s top robo-advisors, and was rebranded as Wealthsimple Tax in 2021.

Wealthsimple Tax is certified by the Canada Revenue Agency (CRA) to use its NETFILE transmission service so users can submit their tax returns securely over the internet. It is also approved by Revenu Quebec.

This tax software works for simple and not-so-simple tax situations and is available to residents of all provinces and territories in Canada, including Quebec.

Wealthsimple Tax has a simple pricing model, unlike some tax preparation software. It is free to use, and you can donate to support the platform if you wish.

How To File Your Taxes Using Wealthsimple Tax (SimpleTax)

Completing your 2023 personal tax return online using Wealthsimple Tax is straightforward. To get started, open a Wealthsimple Tax account here.

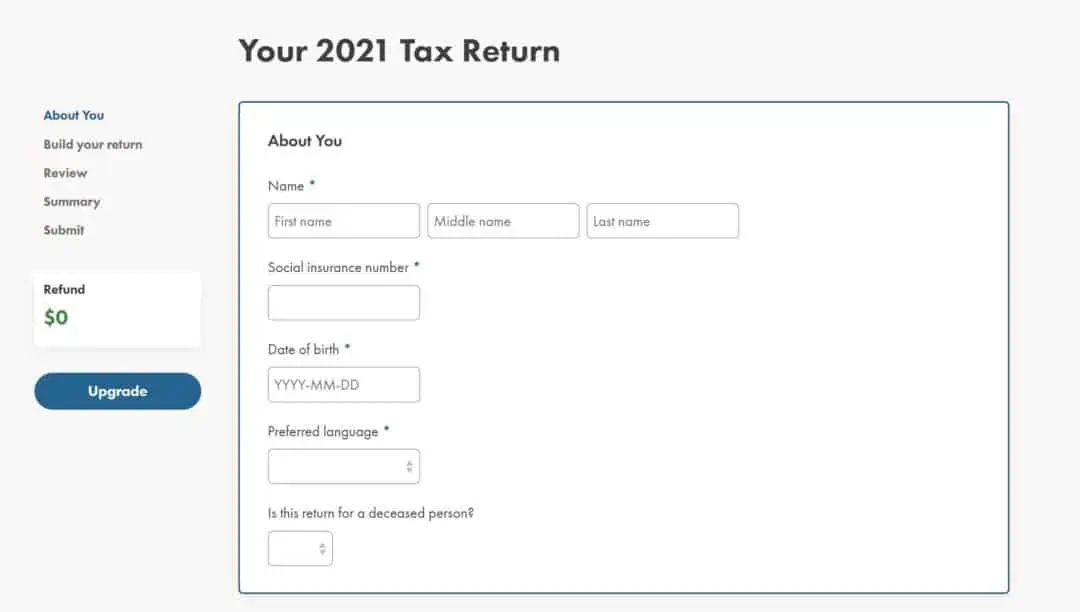

You will need to enter your name, social insurance number, date of birth, and other details that identify you to the CRA.

If you have a CRA MyAccount, you can use the Auto-fill my return option to populate portions of your income tax and benefit return using the information on your tax slips that have already been sent to the CRA.

This is a super-easy way to enter the numbers on your T4, T3, T5, or T4A.

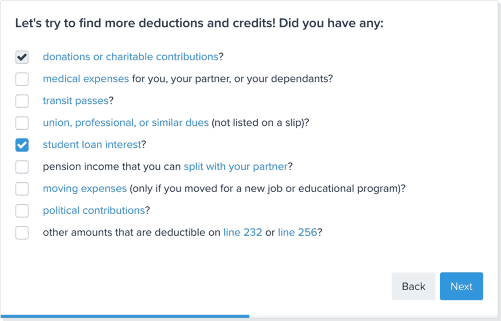

Fill out each section of the form that applies to you, and Wealthsimple Tax will help you find the deductions and credits you qualify for.

If you are looking for specific forms, you can easily find them by using the search box.

When you have entered all the required information, Wealthsimple Tax reviews your return for errors, omissions, and opportunities to optimize your tax refund.

Some of the credits and deductions you can optimize with a partner to increase your refund include donations, medical expenses, child amount, pension splitting, adoption expenses, and the first-time home buyers’ amount.

Once completed, you can securely submit your tax return in a few clicks. The PDF documents show up on your dashboard as well, and you can download, print, or save them for your records.

If you have questions, you can check the Wealthsimple Tax help section for answers or email support at [email protected].

If registered for online mail from the CRA, you should get your Notice of Assessment (NOA) soon after submitting your return.

Also, if you have signed up for a direct deposit, your tax refund could hit your chequing account within 8 business days.

Related: Alberta Tax Brackets and Tax Rates

Benefits of Wealthsimple Tax

Some of the reasons why Wealthsimple Tax (formerly SimpleTax) is considered one of the top tax software in Canada include the following:

1. 100% Accuracy Guarantee: If you pay a penalty or interest to CRA due to an error caused by the software, they will reimburse you.

2. Maximum Refund Guarantee: Wealthsimple Tax guarantees that you will get the maximum refund possible for your circumstances when you file your return using the platform. If another software gets you a larger refund, they will refund any optional payments you made for the year.

3. CRA NETFILE Certified: Wealthsimple Tax is on the list of tax software certified by the CRA to submit returns using its NETFILE program.

4. Fast and Easy Returns: The step-by-step form structure is simple to understand. If you are in doubt, you can answer a few questions, and WealthsimpleTax shows you what’s needed to complete your return.

The Auto-fill my return option accurately fills part of your return with information obtained directly from the CRA. This step is fast and straightforward.

5. Available Nationwide: All residents of Canada can use Wealthsimple Tax, including those living in Quebec.

6. Supports Multiple Platforms: You can use Wealthsimple Tax directly from your web browser and on your smartphone via an iOS app. If you’d rather not download and install anything, it works just fine using a web interface.

7. One-Stop Solution: Individuals filing a personal tax return will find that Wealthsimple Tax caters to both straightforward and complicated tax scenarios. For example, it can handle rental, business, and investment income.

8. Useful Calculators: You can use Wealthsimple’s tax calculators to estimate how much you owe in taxes, or use its RRSP calculator to gauge how your contributions impact your taxes. There are also TFSA and RRSP calculators you can use.

9. Audit Support: You can upgrade your account and get audit support and priority email. If your return is audited by the CRA, Wealthsimple Tax tax experts will guide you through the audit.

10. Crypto Tax Filing: If you traded cryptocurrency during the 2023 tax year, this tax software will auto-fill your tax return with crypto gains or losses for free. (more on how this works below).

11. Capital Gains Reporting: It is not just for crypto. Wealthsimple Tax can also connect with your Wealthsimple Trade account and help you calculate and populate any capital gains incurred due to trading activity in 2023.

12. Robust Support: You can ask questions about your tax return by phone or email seven days a week, including on weekends and holidays.

Downsides of Wealthsimple Tax

Wealthsimple Tax does not support the AgriStability and AgriInvest programs and may not be suitable for farmers using these programs.

If you are looking to file corporate T2 returns, the software only supports personal income tax and benefit returns at this time.

Wealthsimple Tax for Crypto

It is common knowledge that tracking crypto buy and sell trades and figuring out your tax liability can be challenging.

This is especially so if you have used more than one crypto exchange or crypto wallet and placed lots of trades.

For the 2023 tax year, Wealthsimple Tax can help you auto-fill your tax return with crypto gains and losses…for free.

The software supports 300+ exchanges and wallets, including the likes of Wealthsimple Crypto, Bitbuy, NDAX, Shakepay, Coinberry, and more.

Is Wealthsimple Tax Free?

Yes, Wealthsimple Tax is free.

You can file any number of returns that are acceptable via the CRA’s NETFILE system without paying a fee.

While it is recommended that you make a payment after submitting your return using Wealthsimple Tax (SimpleTax), i.e. via a “pay what you want” model, it is totally up to you. You can file your taxes for free.

If you decide to pay, you can use a credit card, PayPal, cheque, or Interac eTransfer.

How Much Does Wealthsimple Tax Cost?

There is an option to upgrade to a Premium account if you think you may need a tax expert to help you with a CRA audit.

This service includes priority email support and audit support.

If the personal tax return you submitted using Wealthsimple Tax is audited by the CRA, they will guide you through the process as needed.

Is Wealthsimple Tax (SimpleTax) Safe?

Wealthsimple Tax is approved by the CRA and Revenu Quebec and uses the secure NETFILE electronic filing system to transmit your data.

When you visit the platform, your traffic is encrypted, and you can also enable 2-factor authentication to provide an extra layer of security.

Free Tax Software in Canada

In addition to Wealthsimple Tax, the following tax software are CRA-approved and offer free versions. Note that features available through the free versions may or may not be limited.

- TurboTax Free

- H&R Block Online

- CloudTax

- GenuTax

- uFile

TurboTax

On TurboTax’s Website

- Fees: $0 to $34.99 (Get 15% discount)

- Promotion: File taxes for free if you have a simple tax return

- Devices: Desktop and mobile apps

WealthsimpleTax vs. TurboTax

| Features | Wealthsimple Tax | TurboTax |

|---|---|---|

| Price | Free (donation) | Free option; paid online software cost $20.99 – $44.99+ |

| NETFILE-approved | Yes | Yes |

| Supports CRA’s Auto-fill | Yes | Yes |

| Support available | Free email and phone support; robust knowledgebase | Paid users can access live support and an online forum |

| Guarantees offered | Maximum refund and 100% accuracy | Maximum refund and 100% accuracy |

| Mobile app | Yes (on iOS devices) | Yes (iOS and Android devices) |

| Availability | Canada-wide | Canada-wide |

| Optional add-ons and services | Premium (priority email support & audit support) | Assist and Review; personal tax filing by an expert; corporate tax filing; desktop app available |

| Learn more | – | Learn more |

Is WealthsimpleTax For You?

Wealthsimple Tax can help you file your tax return on time and for a low cost (assuming you pay a voluntary fee).

Unlike some free tax software services, the Wealthsimple Tax platform can also handle more complicated tax filings involving rental, investment, or self-employment income.

And, if you invested in cryptocurrency, there’s probably no better way to file your capital gains or losses for the 2023 tax year.

Related: Ontario Tax Brackets and Tax Rates

Wealthsimple Tax (SimpleTax) Review

-

Ease of use

-

Pricing

-

Support offered

-

Free tax filing

Overall

Summary

Wealthsimple Tax is a free online tax software in Canada. Learn about its features, benefits, downsides, cost, how it compares to TurboTax, and how to file your 2022 tax return.

Pros

- 100% accuracy guarantee

- Maximum refund guarantee

- CRA approved

- Available throughout Canada

- Supports multiple devices

- Free service (donations recommended)

Cons

- Support only available via email

- Does not offer corporate tax returns

- Does not offer a tax audit service

Does your program allow for joint filing with my spouse

When is 2021 Simpletax available?

@Wolfy: It is already available, but you won’t have access to the full features until Feb 21st.

Hello Enoch, how does Wealthsimple compare to Ufile? Have you reviewed Ufile which is a Canadian company I believe. I see Turbotax and Ufile in retail stores so assume they are the leading tax software companies. Thanks.

@Ron: I haven’t reviewed UFile on this blog, but I have used it personally. Wealthsimple has a nicer user interface and it is better if you are planning to report investment returns. Other than that, the products are very similar.

On accessing the Wealthsimple site to get the free tax software it say that the promotion is over and you are offered the chance to open a Wealthsimple Investment Account.

I guess there is no more free software from them this time at least as of March 2023.

@Will: They host all their products on one App now, i.e. tax, investing, savings, and a prepaid card. When you open an account, you get access to all these products within the same app. You don’t have to use the service you don’t need…just the tax product if that’s what you need.

I have been using Wealthsimple, formerly SimpleTax for years and never had a problem. However, this year I had a problem with the T4A(P) form. It includes boxes 14 through 19 but when I entered the number from box 14 on my T4A(P), my return amount was dramatically decreased. I emailed Wealthsimple support and was told that I may get dramatic results but once I had completed my return everything would be correct.

I then checked the CRA website and learnt that you do not report those boxes because they are already included in box 20. However, if I added the number from box 23 – number of months retirement, Wealthsimple red flagged box 14 – retirement benefit, indicating that it could not be left empty. In the end, I left box 23 empty and could then also leave box 14 empty. But my confidence in Wealthsimple Tax has been eroded. I plan to switch to Turbo Tax.