Scotiabank offers several credit card bonuses that are worth looking at.

If you are in the market for a new credit card, a solid credit card promotional offer could easily give you hundreds of dollars worth of benefits.

Whether the welcome bonus offered is real cash or points you can convert to rewards, a credit card sign-up bonus sometimes makes signing up for a new card worthwhile, even when paying an annual fee. Sometimes, credit card offers also waive the annual fee for one year.

I cover some of Canada’s best Scotiabank credit card promotions below.

Scotiabank Credit Card Promotions

Juicy bonuses are available when you apply for the most popular Scotiabank credit cards.

1. Scotiabank Gold American Express Card

- Annual fee: $120

- Promo offer: Up to 40,000 points ($400 value)

- Minimum income requirement: $12,000

The Scotiabank Gold American Express card is a great travel and grocery credit card.

You earn 5 points per $1 on groceries and entertainment purchases, 3 points per $1 on gas and daily transit, 6 Scene+ points on every $1 you spend at Sobeys, Safeway, Freshco, Foodland & other participating stores, and 1 point per $1 on everything else.

Cardholders get a documented Priority Pass membership with access to 1,200 VIP Lounges worldwide and comprehensive insurance coverage.

This card also waives the 2.50% foreign transaction fee when you make purchases in foreign currency.

This card is one of Scotiabank’s best credit card promotions. When you apply for a new Scotiabank Gold AMEX card, you earn up to 40,000 bonus points as follows:

- 20,000 points ($200 value) when you spend at least $1,000 in the first 3 months, plus

- 20,000 points ($200 value) when you spend at least $7,500 in the first year

If you have a qualifying Scotiabank chequing account (Preferred or Ultimate), you can waive up to $139 in annual credit card fees.

2. Scotiabank Passport Visa Infinite Card

- Annual fee: $150

- Promo offer: Up to 40,000 points ($400 value)

- Minimum income requirement: $60,000 personal or $100,000 household income

The Scotiabank Passport Visa Infinite card is a premium credit card considered one of Canada’s best travel credit cards.

It offers 2 Scene+ points on every dollar you spend on groceries, daily transit, dining and entertainment, 3 Scene+ points on every $1 you spend at Sobeys, Safeway, IGA, Foodland & other participating stores, and 1 point per dollar on all other purchases.

This card comes with a comprehensive suite of travel insurance, including travel emergency medical (up to $1 million), trip cancellation, rental car, flight delay, travel accident insurance, and more.

Extra VIP perks include six complimentary airport lounge access annually plus the waiver of foreign currency conversion fees.

New cardholders can earn up to 40,000 bonus points as follows:

- 30,000 points ($300 value) when you spend $1,000 in the first 3 months, plus

- $10,000 points ($100 value) when you spend at least $40,000 in the first year

Learn more about the Scotiabank Passport Visa Infinite in this review.

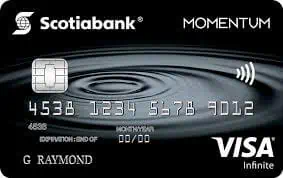

3. Scotiabank Momentum Visa Infinite Card

- Annual fee: $120

- Promo offer: 10% cash back for first three months and 1st-year fee waived

- Minimum income required: $60,000 personal or $100,000 household income

If you are looking for the best-rated cash back card, the Scotia Momentum Visa Infinite card is worth checking out.

In the first three months of signing up for the card, you earn 10% cash back on purchases (on up to a total of $2,000 – a $200 value).

After the promotional period ends, you earn 4% cash back on groceries and recurring bill payments, 2% on gas and daily transit, and 1% cash back on everything else.

This card offers comprehensive travel insurance coverage and new mobile device insurance that protects your smartphones and tablets.

Lastly, the $120 annual fee is waived in the first year. This Scotia Momentum Visa Infinite review goes into more detail.

4. Scotia Momentum Visa Card

- Annual fee: $39

- Promo offer: 0% rate on balance transfers for the first 6 months

- Minimum income required: $12,000

Scotia Momentum Visa Card is a low-fee credit card that’s great for earning cash back and saving on interest fees if you carry a balance.

After the Scotiabank promotion ends, you earn 2% cash back on grocery, gas, recurring payments, and drugstore purchases.

Also, new cardholders can take advantage of a low 0.00% balance transfer rate for the first six months. Learn more about this card in our detailed review.

5. Scotiabank Value Visa

- Annual fee: $29

- Promo offer: 0.00% balance transfer interest rate

- Minimum income required: $12,000

The Scotiabank Value Visa card is one of the best low-interest credit cards in Canada.

For the first 6 months, you enjoy a low-rate 0.00% balance transfer rate and pay 12.99% after the promo ends.

This interest rate is significantly lower than the average rate for balance transfers and purchases and can save you a tonne of money over time.

Cardholders also save up to 25% on car rentals at participating Budget and AVIS locations.

6. Scotiabank Scene+ Visa Card

- Annual fee: $0

- Promo offer: Up to 5,000 bonus Scene+ points

- Minimum income required: N/A

This no-fee card is great for students and is easy to qualify for if you are a new immigrant.

You earn 2 Scene+ points on every $1 you spend at Sobeys, Safeway, and several other participating stores; 2 Scene+ points per $1 you spend at Cineplex theatres; and 1 Scene+ point for every $1 you spend on general purchases.

The Scene+ points earned can easily be redeemed for free movies at Cineplex, food purchases at participating restaurants, and when you shop at over 1,100 eligible grocery stores across Canada.

New cardholders get 5,000 bonus points after spending $750 in the first 3 months. This is equivalent to three free movies.

Find out more in my Scotiabank Scene+ Visa review.

Scotiabank Overview

Scotiabank, or the Bank of Nova Scotia, is one of the Big Six banks in Canada, with 900 branches across the country.

As you would expect from a major bank, it provides a wide range of financial services, including an extensive selection of credit cards.

Many of the credit cards earn rewards, including cashback and Scene+ points. There are also credit cards for students, low-interest, and premium credit cards to choose from.

Pros and Cons of Scotiabank Credit Cards

Pros:

- One of the biggest banks in Canada.

- Offers a wide range of credit cards.

- Earn cashback and Scene+ reward points with several cards.

- Visa, Mastercard, and American Express credit cards are available.

- A low-interest option is available.

- Additional benefits and insurance coverage are provided with several cards.

- Many of the credit cards have low annual fees and income requirements.

Cons:

- Most of the rewards cards require an annual fee.

- Only one Mastercard option is currently available.

- Only one low-interest card is available.

How to Apply for a Scotiabank Credit Card

You can apply for a Scotiabank credit card directly on the Scotiabank website. Just choose the card you want and click the “Apply Now” button.

You must confirm that you are at least the age of majority in your province or territory, that you are a Canadian resident, and that you have not been declared bankrupt in the last seven years.

You must also provide other personal information, like your employment status. If there is a minimum income requirement, you must confirm you meet this. You will also need to verify your identity if you are not a customer.

Once you’ve provided all the required information, you can complete the application and await approval.

Scotiabank Credit Card Eligibility Requirements

Scotiabank has eligibility requirements for its credit cards. The most basic requirements for all its cards are that you are a Canadian resident, at least the age of majority where you live, and have not declared bankruptcy in the previous seven years.

There will also be a minimum personal income requirement, and you must confirm that you meet this. Alternatively, you can meet the minimum household income or total assets under management requirements, which differ for each card.

Scotiabank will also carry out a credit check, and you must confirm that you allow it to do this. It does not state that you need a specific credit score, but a score of 660 is usually considered the minimum requirement.

Scotiabank Credit Card Rewards

One of the best things about Scotiabank credit cards is the rewards they provide. There are two main types of rewards available: cashback and Scene+ points.

Cashback

You can earn cashback with several Scotiabank credit cards, like the Scotia Momentum® Visa Infinite Card.

This allows you to earn cashback on eligible purchases, but the amount you can earn differs for each card. Some cards give you higher earnings than others, and some specifically reward purchases in categories like groceries or dining.

Scene+

With Scene+, Scotiabank’s rewards program, you can earn points when you spend using certain credit cards. Some cards allow you to earn more points than others.

You can earn points for grocery purchases, dining, entertainment, daily transit, and other types of spending.

Some credit cards will allow you to earn more for spending at certain stores. For example, with the Scotiabank Passport® Visa Infinite Card, you can earn 3x points for grocery purchases at Sobeys, IGA, and Safeway stores.

You can then redeem points when shopping at selected grocery stores, dining at selected restaurants, booking travel via the Scene+ portal, at Cineplex theatres, and on gift cards and merchandise at the Scene+ website. You can also redeem your points for statement credit.

How to Choose a Scotiabank Credit Card

With so many Scotiabank credit cards to choose from, how should you decide? Here are the main factors to keep in mind:

- Rewards potential – Check how many reward points or how much cashback you can get with different credit cards.

- Card type – Choose the type of card that best fits your needs. For example, some are specifically targeted at students.

- Eligibility requirements – There is no point in applying if you don’t meet the requirements. Most have a minimum income requirement, and while this can be as low as $12,000, it can be much higher.

- Annual fee – Some credit cards are free, while some cost hundreds of dollars.

- Interest rates – Some are low-interest cards, like the Scotiabank Value® Visa Card.

- Perks and benefits – Some cards include additional benefits like car rental savings, mobile device insurance, and travel insurance coverage.

- Sign-up bonuses – These change constantly, so we won’t list them here, but check them out when you apply for your credit card.

- Credit card network – If there is a particular reason why you would prefer a Mastercard or American Express, take this into account when choosing your card.

List of Scotiabank Credit Cards

Here are the credit cards that Scotiabank currently lists on its website:

- Scotiabank Passport® Visa Infinite Card

- Scotia Momentum® Visa Infinite Card

- Scotiabank Gold American Express® Card

- Scotiabank® Scene+™ Visa Card

- Scotia Momentum® Visa Card

- Scotia Momentum® No-Fee Visa Card

- Scotiabank American Express® Card

- Scotiabank Platinum American Express® Card

- Scotia Momentum® Mastercard® Credit Card

- Scotiabank® U.S. Dollar Visa Card

- Scotiabank Value® Visa Card

- Scotiabank® Scene+™ Visa Card (for students)

- Scotiabank Value® Visa Card (for students)

- Scotia Momentum® Visa Card (for students)

- Scotia Momentum® No-Fee Visa Card (for students)

- Scotiabank American Express® Card (for students)

- L’earn® Visa Card

Scotiabank often runs welcome bonuses, but these change frequently, so you should check the current bonus when you are considering applying for a new account.

Scotiabank does not state the exact credit score required, but a score of 660 is the general requirement for most credit cards in Canada.

Scotiabank offers several premium credit cards that allow you to earn more Scene+ points or cashback.

This depends on your requirements. There are credit cards that allow you to earn cashback and Scene+ points, as well as low-interest options and student credit cards. They have different annual fees, so explore the options available.

Some Scotiabank credit cards have a high annual fee, while some do not have any fee. If you sign up for other products like the Ultimate Package, fee waivers may be available on selected credit cards.

Related reading: