Quick Answer

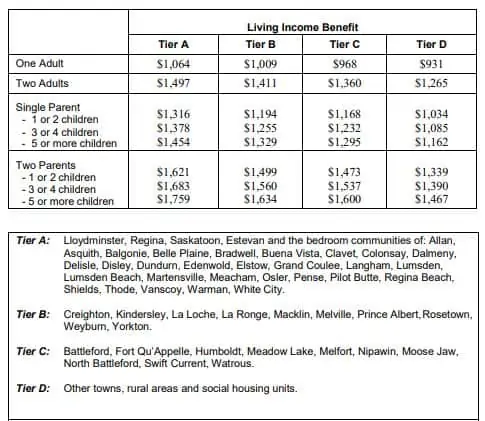

- The SAID living income benefit varies based on your family size and location, ranging from $931 to $1,759.

- SAID recipients who set up direct deposit receive their benefits on the last week of the previous month. Cheques are mailed a few days before the direct deposit payments.

- To qualify for SAID payments, you must reside in Saskatchewan, be at least 18 years old and prove to lack the financial resources to take care of yourself.

The Saskatchewan Assured Income for Disability (SAID) program financially supports eligible individuals with significant and enduring disabilities.

This Social Assistance program can be compared to the PWD benefit in B.C. and ODSP in Ontario.

This article covers everything you must know about the SAID program, including its benefits, application process, current rates, and payment dates in 2024.

SAID Payment Dates for 2024

SAID payment dates vary depending on how your account is set up.

If you have opted for cheque payments, it is mailed out a few days before those with direct deposit setup receive their benefit.

In some cases, payment dates may be customized to meet your needs.

The payment dates for SAID in 2024 are:

| SAID benefit month | SAID cheque is mailed | SAID direct deposit date |

| January | December 22, 2023 | December 28, 2023 |

| February | January 25, 2024 | January 30, 2024 |

| March | February 26, 2024 | February 28, 2024 |

| April | March 25 | March 27 |

| May | April 25 | April 29 |

| June | May 28 | May 30 |

| July | June 25 | June 27 |

| August | July 25 | July 30 |

| September | August 27 | August 29 |

| October | September 25 | September 27 |

| November | October 28 | October 30 |

| December | November 26 | November 28 |

Related: Saskatchewan Income Tax Brackets and Rates.

SAID Program Benefits

The Saskatchewan Assured Income for Disability (SAID) program provides income to individuals with significant disabilities so they can pay for basic needs and other costs.

The program is made up of three main components including:

Living Income: This covers basic needs such as food, shelter, and transportation.

Disability Income: Pays for costs related to a disability.

Exceptional Need Income: Helps to cover bills like those for service animal grooming costs, special food items, and home care.

SAID beneficiaries may also qualify for:

- Supplementary Health Benefits: Covers medical supplies and appliances, drugs, dental care, optical, podiatry, medical transportation, and hearing services.

- Northern Living Supplement.

- Personal Living Benefit

- Household Disability Support Benefit

SAID Eligibility Requirements

To qualify for SAID payments, you must meet specific age, residency, financial, and health/disability criteria.

Age and Residency: You must reside in Saskatchewan and be 18 years of age or older.

Financial: Your financial status is considered when you apply for SAID, and you must show that you lack the financial resources to take care of yourself.

The threshold for money in the bank or in cash is $1,500 for the applicant and a second adult (per person) in the family, plus $500 for each additional family member.

Income sources and assets that are exempt or partially exempt when assessing your SAID application include:

- Income tax refund

- Canada Child Benefit

- Disability Housing Supplement payments

- Inheritances up to $100,000

- GST Credit

- Scholarships

- Gifts up to $200 per year

Disability: Your disability must be ‘significant and enduring’. This means they are permanent, and you require support from a person, service animal, assistive device, modified environment, or accommodation.

A medical professional is required to complete a medical form on your behalf as part of the SAID application process.

Related: Best Work From Home Jobs.

SAID Benefit Program Rates

The living income benefit varies depending on your family size and location and ranges from $931 to $1,759 per month.

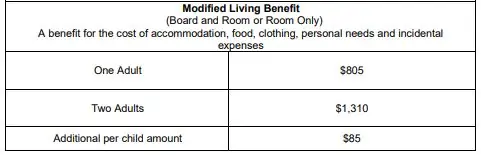

Modified living benefits if you live in a board and room or room-only arrangement are:

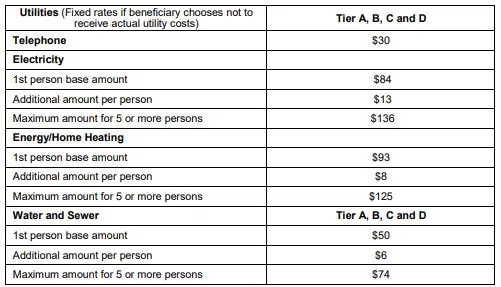

Fixed benefit rates for utility when you do not opt to receive actual utility costs are:

Depending on the size of a family, the laundry allowance ranges from $10 to $25.

If eligible, you can also receive:

- Disability Income Benefit: $70/month

- Northern Living Supplement: $50 per member of a family unit

- Exceptional Needs Activity Benefit: $25/month

- Household Disability Support Benefit: $25/month

While on SAID, you can earn income through employment up to a certain amount before SAID payments are clawed back.

The annual exemption is:

- Single person: $6,000

- Couple: $7,200

- Family: $8,500

You can take a look at the rate card (PDF) and track your annual earned income exemption using the SAID exemption tracking sheet.

While waiting for your SAID application and Disability Impact Assessment to be completed, you may be able to access temporary SAID benefits.

How To Apply For SAID

You can apply for SAID by calling 1-888-567-7243 or visiting your local Social Services Offices. If you have a hearing impairment, call 1-866-995-0099 (TTY).

After completing your application, you will be scheduled for a Disability Impact Assessment, which involves an interview with an assessor.

If your SAID application is denied, you can submit an appeal within 15 days of being notified.

SAID Program Increase in 2024

Funding for the Ministry of Social Services increased in the 2021 – 2022 budget by an additional $54.4 million.

Specifically, this increased funding for SAID by $19 million.

That said, there is currently no information about whether monthly SAID payments will increase this year.

Other Saskatchewan Income Assistance Programs

Depending on your circumstances, you may be eligible for other income assistance programs:

Saskatchewan Income Support (SIS): Eligible recipients may qualify for income support if they earn a low income or are unemployed and need assistance with paying for basic needs. The basic SIS benefit is up to $350 for adults and $65 per child. You may also qualify for shelter benefits up to $1,150 for a family with three children or more.

Provincial Training Allowance (PTA): Low-income adult students who are enrolled in full-time Adult Basic Education or vocational skills training programs may qualify for the PTA. This includes a living allowance of up to $1,476 plus daycare and northern allowance. Recipients may also qualify for an employment and training benefit.

Saskatchewan Employment Supplement (SES): Lower-income families with children may qualify for the monthly SES benefit. They receive up to a maximum of $562.50. You can earn up to $4,070 per month in employment income while on SES and depending on how many eligible children you have.

Personal Care Home Benefit (PCHB): This program provides financial assistance to seniors who need help with the cost of living in a licensed personal care home. Eligible recipients receive the difference between $2,000 and their monthly income.

Other benefits available include:

- Saskatchewan Rental Housing Supplement (SRHS)

- Registered Disability Savings Plan (RDSP)

- Child Care Subsidy

The Saskatchewan Assistance Program (SAP) and Transitional Employment Allowance (TEA) programs have closed, and recipients can now apply for financial help through SIS.

Saskatchewan Income Support (SIS) Payment Dates

Note that the Saskatchewan Income Support (SIS) benefit is paid on the same schedule as SAID as follows:

| SIS benefit month | SIS cheque is mailed | SIS direct deposit date |

| January | December 22, 2023 | December 28, 2023 |

| February | January 25, 2024 | January 30, 2024 |

| March | February 26, 2024 | February 28, 2024 |

| April | March 25 | March 27 |

| May | April 25 | April 29 |

| June | May 28 | May 30 |

| July | June 25 | June 27 |

| August | July 25 | July 30 |

| September | August 27 | August 29 |

| October | September 25 | September 27 |

| November | October 28 | October 30 |

| December | November 26 | November 28 |

The Saskatchewan Employment Supplement (SES) benefit is paid on the last working day of each month.

The Saskatchewan Rental Housing Supplement (SRHS) program stopped accepting new applications in 2018.

Related:

hi, what if a person on SAID gets married and moves in with a working ft employed person? do they lose their benefits?

Yes it will be docked from your income in “proportion to your partner’s earnings” so you will not gain any financial benefits. That is the most straightforward answer.

Unfortunately it is a very vicious cycle that make things very tough on couples in those situations. It’s like the old tradition of asking the father of the bride for her hand before the proposal, in this case though he would need to ask your case worker for permission for your hand. How messed up is that. Especially with the medication aspect or if you have any additional services/ help needed financially for the disability.

This makes the decision between marriage and medication tough. I have I wish you all the best. The system is intimidating but it shouldn’t be discriminating. It’s tough enough for people on SAID (add Covid to the equation) to get out there and meet people, it’s not like we have co workers. Let alone working together with your partner through the red tape (can’t cohabitate or share finances, be common law) the living expenses are unbelievable to be single and disabled. It’s tough to get a pet let alone a husband (speaking from a she/her perspective)

Above are facts and my opinion about the facts presented.

Below as I write this there is a pop up ad for stop “Asian hate” Yet disabled people are the largest minority and statistically some of the most discriminated against or forgotten within the system.

Dealing with something complicated enough to put someone on disability in the first place is tough, having someone by your side can be the difference between life and death sometimes. Why doesn’t the system make it possible for disabled people to be happily married and not poor. Covid has proven that people can work from home, even in my condition yet this has only created an overflow of people clammering to do the jobs I have been told for 7 years I cannot do, or have had people that are “more mobile/accessible” get at home jobs before me.

I used to travel the country, working 7 days a week supporting myself AND a significant other. Now I still don’t even have a chance to be employed outside or inside my home as the rest of the world can now work from home but the disabled trying to just be independent and live their own life are completely lost in translation. These people could be leading the way and managing working from home. It’s been their life for years, figuring out the alternate way.

I really just wish people with disabilities were not written off unless they are there to meet the quota.

What can a parent apply for if thier adult child is on the said program. If child need 24 hour care therefore cannot work. Been looking at alot of options but very few can work without paying adequate care. When first applied for said, one option was to go on assistance to care for our child. But now one of us has passed one leaving me to be the sole caregiver. Would like to know my options.

I need a list of jobs that can be done at home that isn’t hard on my back or my brain

can a person be receiving SAID and SIS at the same time?