Quick Answer

- Being rich or wealthy is not the same thing.

- Wealth is not just about having money. It’s about having a financial plan that ensures long-term stability and security.

- The definition of what is considered “rich” varies by location and cultural context. In Canada, for example, the threshold for being considered rich may vary by province or territory.

- The rich vs wealthy mindset is an important factor in differentiating these two concepts. Those with a wealthy mindset focus on building long-term wealth through saving, investing, and earning passive income. Those with a rich mindset may prioritize spending on flashy possessions and experiences.

Have you ever wondered what it means to be rich or wealthy? These two terms are often thrown around as if they’re interchangeable. But there are some key differences that exist between them.

When you think of someone who is rich, you might picture someone with a big house, a fancy car, and designer clothes. But being wealthy is a bit different. It’s more about having financial independence and security.

In this article, we’re going to dive into the differences between being rich and being wealthy. Plus, we’ll give you some tips on how to become wealthy yourself.

What Does It Mean To Be Wealthy?

Wealth is often linked to financial freedom, which means that a person has saved up enough assets to make enough passive income. This supports their lifestyle without having to work a regular job.

Wealthy individuals often have a diversified investment portfolio that generates income, which they can reinvest to grow their wealth even further.

Wealth is having the ability to make choices without worrying about the financial consequences.

For example, a wealthy person can choose to take time off work without worrying about how they will pay their bills, while a rich person may not have that luxury.

What is Considered Rich In the World?

The word “rich” is usually used to describe people who have a lot of money or wealth compared to others in their society. But what makes someone “rich” can mean very different things depending on where they live, their culture, and the situation.

In 2023, to be “rich” would typically involve having a large amount of wealth. Recent information from Credit Suisse’s Global Wealth Report 2021 shows that the world’s total wealth has grown by 7.4% since last year, reaching a staggering $418.3 trillion.

Based on this data, having a net worth in the millions of dollars or more could be considered “rich.” However, it’s important to note that what is considered “rich” can be highly dependent on the country and region you’re in.

For instance, in countries with a lower cost of living, a much smaller amount of wealth could still be considered “rich.” Also, in some cultures, a person’s status and social position may be seen as more important signs of wealth than their income or net worth.

What is Considered Rich in Canada?

The definition of being rich in Canada varies depending on the province or territory. A survey by the investment firm Edward Jones found that Canadians think someone is rich if they make at least $250,000 CAD per year.

But this depends on the province. There are more rich people in Ontario, British Columbia, and Alberta than in other provinces.

Rich vs. Wealthy: Key Differences

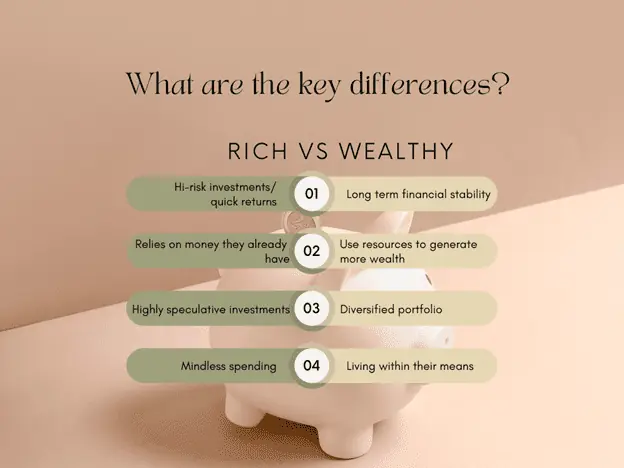

Are you rich or wealthy? These two terms are often used interchangeably, but they have distinct differences. People often associate being rich with material possessions. While being wealthy is more about financial stability and security.

In this section, we’ll dive into the key differences between being rich and being wealthy. Let’s explore further!

Rich vs. Wealthy Mindset

The mindset of a wealthy individual is focused on building long-term financial stability, while the mindset of a rich person is focused on short-term gains.

Wealthy individuals often focus on building a diversified investment portfolio. Rich individuals may focus on making high-risk investments that yield quick returns.

Rich vs. Wealthy Net Worth

The net worth of a wealthy individual is often higher than that of a rich person. This is because wealthy people build up assets and resources that bring in money on their own. Rich people may focus on impressing others and may have more liabilities than their assets.

Rich vs. Wealthy Investments

Wealthy people frequently invest in a diverse portfolio of assets. These include stocks, bonds, real estate, and other alternative investments. Rich people, on the other hand, may invest in high-risk ventures like new businesses or speculative investments in order to make money quickly.

Rich vs Wealthy Spending Habits

Wealthy individuals often live within their means and have a budget that allows them to save and invest their money. Rich people, on the other hand, may tend to spend their money without thinking about how it will affect them in the long run.

How to Become Wealthy

There are several ways to become wealthy, and most of them involve a combination of saving, investing, and earning passive income. Here are some steps you can take to start building wealth:

Save Money

One of the most important steps to building wealth is to save money. You can do this by cutting back on unnecessary expenses, creating a budget, and automating your savings. Aim to save at least 20% of your income each month.

Pay Off Debt

Paying off debt can also help you build wealth because it frees up money that you can put toward savings and investments, start by paying off high-interest debt. For example, credit card debt. Then move on to lower-interest debt, such as student loans and mortgages.

Invest

Investing your money can help you grow your wealth over time. There are many different types of investments, including stocks, bonds, and real estate. Consider working with a financial advisor to help you choose the best investments for your goals and risk tolerance.

Earn Passive Income

Passive income is money you earn without actively working for it. This can include things like rental income, dividends from stocks, and royalties from creative work. Building several streams of passive income can help you build wealth faster.

Start Your Own Business

Starting your own business can be a great way to build wealth because it allows you to earn unlimited income and build equity in your company. But starting a business can also be risky and requires a lot of hard work and dedication.

Conclusion

While being rich and being wealthy may seem like the same thing, there are actually some key differences between the two.

Being rich is often associated with having a high income and flashy possessions while being wealthy is more about having financial independence and the ability to maintain a certain lifestyle without worrying about money.

To become wealthy, it’s important to focus on building wealth over time through a combination of saving, investing, and earning passive income. By following these steps and developing a wealthy mindset, you can start building the life you’ve always wanted.

FAQs

The main difference between the rich and the poor is their financial status. Rich people have high net worth and a steady income stream, while poor people struggle to make ends meet and often live paycheck to paycheck.

Yes, it’s possible to be rich but not wealthy. Rich people often have a high income and may own expensive possessions. But they may also have a lot of debt and not have the financial independence and security that come with being wealthy.

Yes, a millionaire is still considered rich, but it’s important to remember that being rich is relative to the cost of living in a given area.

When Canadians were asked how much net worth they would need to feel wealthy where they live, the average figure was CAD $1.3 million, with residents in Ontario citing the highest figure of $1.5 million and those in the Atlantic and Quebec regions citing the lowest figures of $898,731 and $925,738 respectively.

The “rich vs. wealthy” mindset is all about the different attitudes and beliefs that people have when it comes to money. Those with a “wealthy” mindset tend to focus on building long-term wealth through things like saving, investing, and earning passive income.

Meanwhile, those with a “rich” mindset often prioritize spending money on flashy possessions and experiences.

The 5 habits of millionaires include:

1) Setting specific financial goals

2) Creating and sticking to a budget

3) Investing in their future through savings and investments

4) Being mindful of their spending habits

5) Being open to learning and seeking out new opportunities for growth and income

Related: Ways to Get Rich in Canada.

This article is very wonderful identifying and it’as open the mind set about being rich, investor and poor to me.