The new RBC ION+ Visa Card from the Royal Bank of Canada is great for earning Avion points while paying low monthly fees.

This card pays up to 3 Avion points per $1 spent on everyday purchases and offers mobile device insurance, a perk that’s not so common in Canada’s credit card space.

This RBC ION+ Visa review covers its top features, benefits, downsides, and alternative credit cards you can apply for.

RBC ION+ Visa Overview

- $4 monthly fee ($48 annual)

- Additional cards: $0 monthly fee

- 19.99% interest rate on purchases

- 22.99% interest rate on cash advances and balance transfers (21.99% if you reside in Quebec)

- Earn 3x points per $1 spent on grocery, dining, food delivery, gas, rideshare, daily public transit, streaming, digital gaming, and streaming subscriptions

- Earn 1x Avion point per $1 spent everywhere else

- 3,500 bonus Avion points on approval and an extra 3,500 points when you spend $500 in the first 3 months

RBC ION+ Visa Card Benefits

Overall, the RBC ION+ Visa Card can help you rack up easy-to-redeem Avion points while making everyday purchases.

1. Welcome bonus: Get up to 7,000 bonus Avion points (3,500 points following approval and an extra 3,500 points when you spend $500 in the first 3 months). This offer is available for a limited time.

2. Earn Avion Points: You earn 3 Avion points for every $1 spent on the following categories:

- Groceries, dining, and food delivery

- Gas and electric vehicle charging

- Rideshare and daily public transit

- Streaming, digital gaming and digital subscriptions

On all other purchases, cardholders earn 1 Avion point per $1 spent.

3. Mobile device insurance: Get up to $1,000 in coverage for mobile devices purchased using your credit card. This coverage applies for up to 2 years if the mobile device (e.g. smartphone) is lost, stolen, or accidentally damaged.

4. Complimentary DashPass subscription: New cardholders get a 3-month complimentary DashPass subscription that is valued at almost $30. This subscription offer means you enjoy $0 delivery fees on orders of $15 or more when you pay using your RBC ION+ Visa.

5. Save on Gas at Petro-Canada: RBC customers can save 3 cents per litre on gas purchased at Petro-Canada. To enjoy this benefit, you will need to pay using an RBC credit card that is linked to your Petro-Points account.

6. Purchase Security and Extended Warranty Insurance: The RBC ION+ Visa includes extended warranty insurance that doubles the manufacturer’s warranty by up to one extra year. Purchases are also protected against loss, theft, or damage for up to 90 days.

7. Other perks: If you shop at Rexall, you can link your RBC credit card to your Be Well card and earn 50 Be Well points per $1 spent.

Downsides of the RBC ION+ Visa

This card does not qualify as a no-annual-fee credit card. That said, the $4 monthly fee is waived if you have an RBC Signature No Limit Banking Account or RBC Advantage Banking for students account.

There is a $10 minimum threshold when redeeming Avion points.

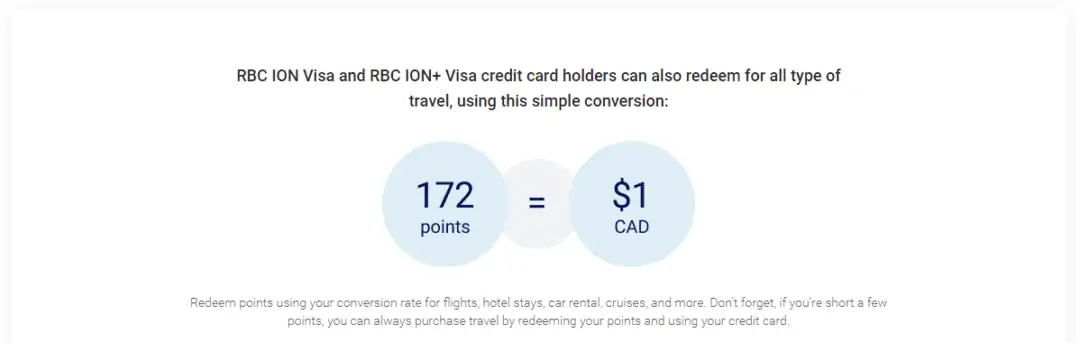

Avion points earned by RBC Ion Visa and RBC Ion+ Visa cardholders are redeemable at a lower rate compared to the conversion rate for Avion credit cards.

How To Redeem Avion Points

It is easy to redeem Avion points to pay your bills or as a statement credit.

You can also redeem points for merchandise via Avion Rewards, including gift cards from over 200 brands. For gift card redemptions, the conversion rate is 1 Avion point = 0.71 cents.

RBC ION Visa and RBC ION+ Visa credit cardholders can also redeem their Avion points for travel at a rate of 172 points = $1 CAD.

Essentially, this makes 1 Avion point equivalent to 0.58 cents.

For Avion credit card holders, the conversion rate for Avion points is 100 points = $1 CAD.

How To Apply For The RBC ION+ Visa Card

You can apply for the RBC ION+ Visa by visiting their website (refer to the RBC page for up-to-date offer terms and conditions).

There is no published minimum income requirement for this card; however, you will need a good credit score to qualify.

RBC ION+ Visa Alternatives

For comparable low-annual-fee credit cards, you can look at the WestJet RBC Mastercard.

For no-annual-fee cards, the Tangerine World Mastercard, Scotiabank Scene Visa Card, and RBC ION Visa Card are options.

WestJet RBC Mastercard: This card has a $39 annual fee. Cardholders earn 1.5% in WestJet dollars when they spend on WestJet flights or vacations.

Tangerine World Mastercard: This Tangerine credit card has no annual fees. Cardholders earn 2% unlimited cash back in 2-3 purchase categories and 0.50% cash back on everything else. This card also includes free Boingo Global Wi-Fi, rental car insurance, and mobile device insurance.

You will need a $60,000 minimum annual personal income to qualify. If you do not meet this income requirement, you can consider the entry-level Tangerine Money-Back Credit Card.

RBC ION Visa Card: This entry-level RBC credit card offers up to 1.5 Avion points per $1 spent. It has no annual fees, and cardholders get access to purchase security and extended warranty insurance. Learn more about this card in our RBC ION Visa review.

Scotiabank SCENE Visa Card: The SCENE Visa Card is an entry-level credit card for students and newcomers. It offers 1 Scene+ point per $1 spent on everyday purchases and 5 Scene+ points/$1 for purchases at Cineplex theatres.

This card has no annual fees. Learn more in our review article.

Is The RBC ION+ Visa For You?

The RBC ION+ Visa card may be suitable if you are looking for a low-annual-fee RBC credit card that earns rewards.

You should note that your Avion points do not carry the same redemption value when compared to the points you earn using an Avion credit card, such as the RBC Avion Visa Platinum or RBC Avion Visa Infinite card.

That said, these two cards have a higher annual fee. With the RBC Ion+ Visa, the annual fee is also divided into $4 monthly payments, so you don’t feel the impact as much.

And, if you want access to mobile device insurance, the RBC Ion+ Visa Card is one of a few Canadian credit cards offering this perk.

Related: