PolicyMe is an online Canadian insurance solution that provides term life insurance. Their newest offering is critical illness insurance, which covers 44 early-stage and fully-covered conditions.

Critical illness insurance is essential if you don’t have an emergency fund to cover you in the unfortunate event you’re diagnosed with a covered illness or if it runs in your family. If anything were to happen, you and any dependents would be covered.

In this review, we will discuss all there is to know about PolicyMe’s critical illness insurance in Canada, including what it covers, how to get a quote, pros and cons, and if you should get it.

What Does PolicyMe’s Critical Illness Insurance Cover?

PolicyMe’s critical illness insurance covers 44 conditions with coverage amounts from $10,000 to $1 million. Term lengths are 10, 15, 20, 25, or 30 years.

PolicyMe has full coverage for 27 severe conditions and partial coverage for 17 early-stage conditions – the most any insurance provider offers in Canada.

The 27 fully covered conditions include the following:

- Cancer

- Heart conditions

- Neurological conditions

- Autoimmune conditions

- Sensory and mobility conditions

- Transplants and organ-related conditions

The 17 early-stage conditions include:

- Cardiovascular conditions and procedures

- Early-stage blood cancer

- Early-stage breast cancer

- Early-stage intestinal cancer

- Early-stage prostate cancer

- Early-stage thyroid cancer

- Mastectomies

- Prostatectomies

You can view the complete critical illness insurance list on PolicyMe’s website.

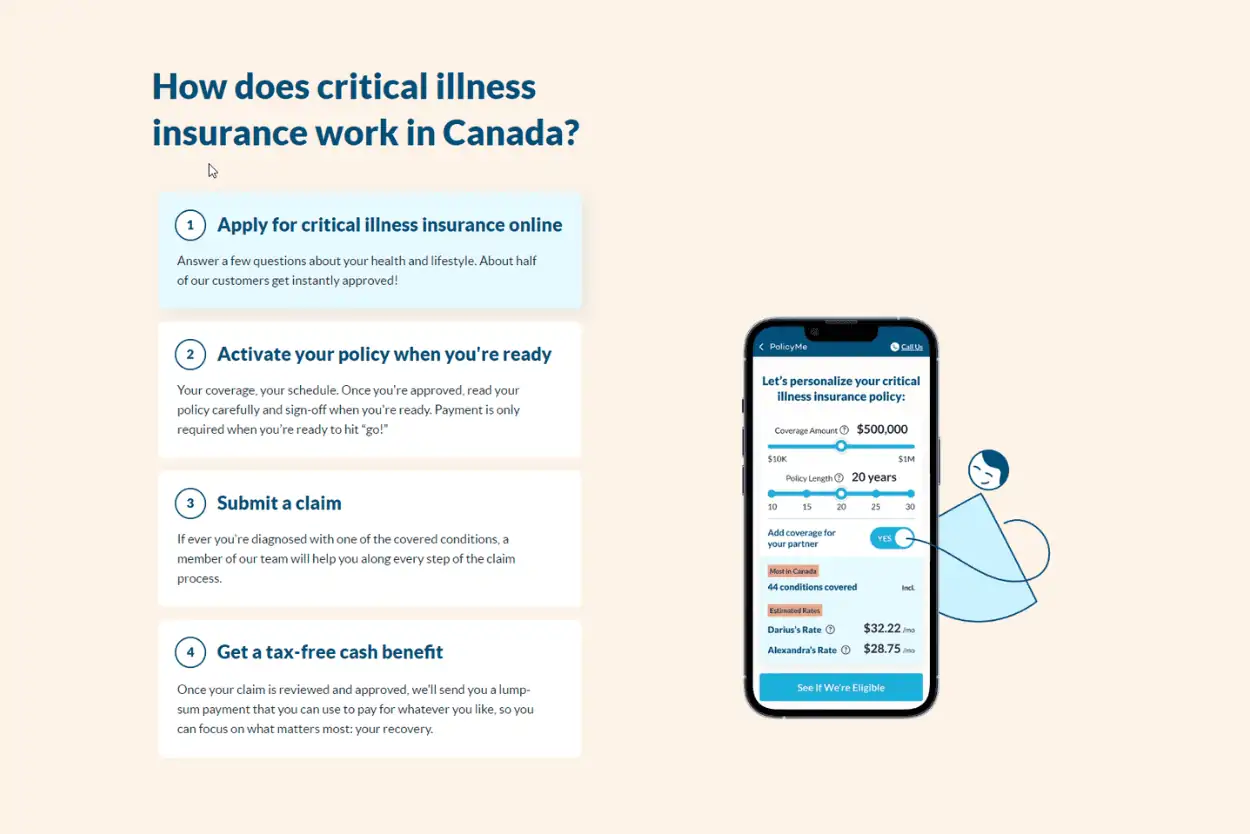

How to Get a Quote from PolicyMe

You can apply for PolicyMe’s critical illness insurance in one of two ways:

If you’re already applying for term life insurance, you can add on critical illness insurance after you’ve completed your application with no additional steps, or you can apply for it on its own.

Alternatively, you can apply for Critical Illness insurance as a standalone product.

Pros and Cons of Critical Illness Insurance

As with all insurance providers, there are pros and cons to consider before proceeding with an application.

Critical Illness Insurance Benefits

PolicyMe covers 44 types of illnesses, both critical and early-stage. No other insurance company in Canada provides that much coverage.

There are various coverage options, from $10,000 to $1 million and 10 to 30 years.

PolicyMe’s application process is quick, easy, and all done online. Many customers don’t have to get a medical exam or phone consultation before getting a quote.

Although everything is done online, you can speak to a licensed advisor for genuine advice seven days a week.

Lastly, critical illness insurance provides peace of mind to you and your family in the event of an illness. You won’t have to scramble for money or pay out-of-pocket for anything that isn’t covered under your regular or provincial health insurance.

Disadvantages of Critical Illness Insurance

Critical illness insurance is beneficial but may not be worth it if you are currently healthy and don’t have an illness that is covered under the insurance policy. It is an extra expense that you need to pay monthly, which can add up over time.

Some critical illnesses are not covered under PolicyMe or other insurance providers, so there’s simply no point in getting it.

If you have an existing disease, some insurance providers may not provide coverage, or they may raise your premium.

What is Critical Illness Insurance?

Critical illness insurance gives you a lump sum of money if you get diagnosed with a covered condition during your term but do not pass away.

This type of insurance covers critical illnesses like cancer, strokes, heart attacks, and more.

Unlike life insurance, this payout goes to you, the policyholder, if you become ill. This money can help replace your income while recovering or pay for out-of-pocket medical expenses not covered by your health insurance.

If your family or others in your life depend on your income, you may want to get critical illness insurance. It is also beneficial for employees or freelancers without critical illness insurance, those without supplemental health insurance, and those who do not have an emergency fund.

Is Critical Illness Insurance Worth It?

Critical illness insurance can be worth it if you have close family members or anyone else who depends on your income. Critical illness insurance is a good idea if you have a disease that runs in the family and you know that you’re likely to be diagnosed with it.

Critical illness insurance covers medical expenses not covered by your regular health insurance and can be a cushion to help support yourself, your family, and other dependents in a time of need.

If you cannot work and have a reduced income, the payout from critical life insurance can be a huge help.

Who is PolicyMe?

PolicyMe is a Canadian online life insurance solution backed by Canadian Premier Life Insurance. Founded in 2018, PolicyMe is available throughout Canada.

They offer an easy application process and affordable rates. You can apply online and receive a quote within just 20 minutes.

Most customers don’t require a medical exam or doctor’s visit and don’t need to schedule a phone call with anyone from the company.

Read our detailed PolicyMe review to learn more.

FAQs

What is and isn’t covered by critical illness insurance differs for each provider. PolicyMe covers 44 types of critical illnesses, the most for any insurance company in Canada. Any illness that is not on this list isn’t covered.

Yes, it covers some types of surgery. PolicyMe’s critical illness insurance covers aortic surgery, heart valve replacement or repair, major organ transplant, the treatment of some cancers, and more.

Once your policy is activated, if you’re ever diagnosed with any of the covered conditions, you can submit a claim, and a team member will help with every step of the process. When the claim is approved, you’ll be sent a lump sum payment that you can use on whatever you need it for.

Critical illnesses include early-stage cancers, heart attack, stroke, dementia, loss of speech, blindness, deafness, kidney failure, coma, and more.

Related: