Paymi is a Canadian cash back app that pays you to shop at your favourite stores. The app is unique because you are rewarded with “real” cash you can transfer directly into your bank account.

When you sign up for a Paymi account using a referral code or link, you receive a $5 welcome bonus.

Other popular cash back apps in Canada include Rakuten, Neo Money, KOHO, Checkout 51, and the Drop app.

Paymi Overview

Paymi is a rewards app and program that pays consumers when they shop at participating brands and retailers. The company is based out of Toronto and has a partnership with CIBC.

The Paymi web and mobile app are free to use, and you can access your account on a computer, tablet, or smartphone.

For more details about Paymi and how it works, read my detailed Paymi review.

How Paymi Works

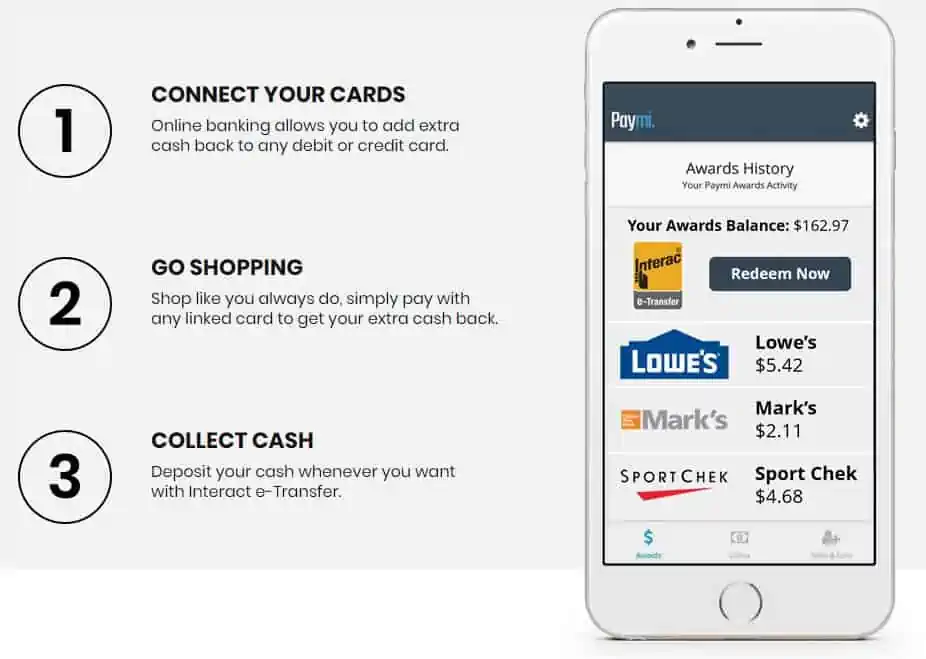

Here’s how to start earning cash back with Paymi:

- Register for an account.

- Connect your credit and debit cards so Paymi can track your eligible purchases and automatically credit your account with cash back. You can connect cards from multiple financial institutions.

- Shop at any of their partner stores and retailers.

- Cash back is usually credited to your account within a week or less.

When your Paymi cash back balance reaches $25, you can transfer the funds to your bank account for free using Interac e-Transfer. Transfers below $25 attract a $1.50 Interac fee.

List of Paymi Partners

Users of Paymi can earn cash back at the following places:

BurgerKing, SportChek, Indigo, Leon’s, Mark’s, Frank and Oak, Staples, J. Crew, Spotify, H&M, Indochino, Zara, Aldo, Altitude Sports, Mary Browns, Bed Bath and Beyond, Urban Barn, Mobile Klinik, Sporting Life, and several others.

Is Paymi Safe?

Paymi does not have access to your online banking details, and the company notes that they are “committed to protecting the information we collect.”

As with any other app and online business, you run the risk of your information getting into the hands of hackers; however, you can help secure your account by ensuring you set strong passwords and by taking quick action if you notice anything weird going on.

Users can deactivate their accounts at any time. You can read more about Paymi’s privacy policy on its website.

Paymi Referral Code

When you join Paymi using a referral link, you automatically qualify for a $5 cash bonus after linking your first debit or credit card (no code required).

As a member, you can share your referral code with friends and family, and when they open an account, you both earn a $5 bonus.

You can access your custom referral code through your account’s “Refer and Earn” section.

Paymi Alternatives

Some of the other cash back apps and websites I use to maximize my savings are:

1) Neo Money: This prepaid card and cash back app pays you up to 5% cash back on purchases. You also get a $20 welcome bonus when you fund your account with your first $50 or more.

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

2) Rakuten: Formerly known as Ebates, this site offers cash back at more than 750 stores in Canada. You can get a $30 welcome bonus here after you make your first purchase of $30 or more.

Rakuten

$30 sign-up bonus when you spend at least $30

Earn up to 40% cashback

Features 3,000 stores and retailers

Redeem earnings by PayPal & check

3) Caddle: Great app for earning cash back on grocery purchases. Enter the promo code S9EL0HJGVY to get a $1 bonus.

Caddle

$1 sign-up bonus

Earn cash back on groceries

Cashback app powered by RBC

Redeem earnings via cheque

Conclusion

I love using Paymi to earn cash back when I shop in-store.

The great thing with cash back apps is that you can combine rewards while still earning loyalty points and cash back from your credit card.

Paymi Referral Code: Get a $5 Sign-Up Bonus & Cash Back

Overall

Summary

Paymi is a popular cash back app for Canadians. This Paymi referral code or special sign-up link gives you a $5 cash bonus.