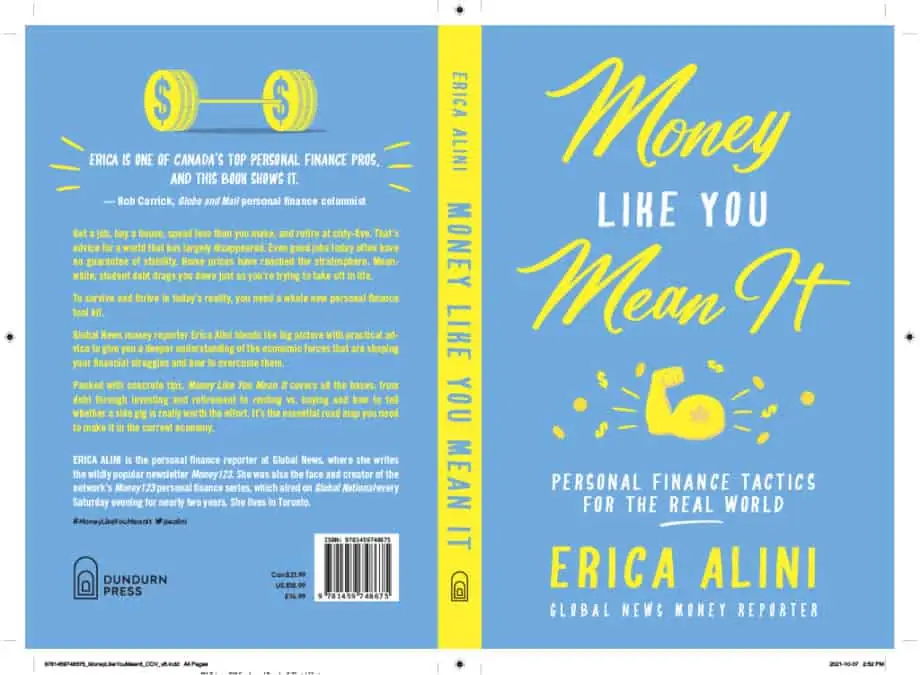

Money Like You Mean It: Personal Finance Tactics for the Real World, the personal finance book written by Erica Alini, is one of my top reads for 2022.

It was also one of the top picks in the personal finance book giveaway we hosted at the end of 2021.

Drawing from her experience as a personal finance reporter and her discussions with several Canadian personal finance experts, Erica provides practical tips in Money Like You Mean It that everyday Canadians can use to improve their financial lives.

The book covers a wide range of financial topics including:

- Debt management, budgeting, and credit

- Homeownership, rent vs buy, and navigating today’s real estate market

- How to value your time, negotiate a salary, and make money

- How to invest smartly

- Retirement planning and financial independence

- How to prepare for life’s curveballs

- Family finance, and more

You can get the book on Indigo, Amazon, or eBooks.com.

Money Like You Mean It: Personal Finance Tactics for the Real World

Wondering whether “Money Like You Mean It” should be on your reading list for 2022?

I did a Q&A with Erica to give readers a brief introduction to the many nuggets in this book. Read her answers below.

Question 1: I think that easy access to credit has wrecked many a newcomer’s finances by making it easy for them to over-extend on loans of all kinds. Your book talks a lot about mental hacks for fighting debt as well as practical strategies for saving and paying down debt. Where should readers start their journey towards becoming debt-free?

Cheap and easy-to-access debt is a financial trap for Canadians, especially if you’re a newcomer from a country where credit doesn’t flow quite so freely.

Being a consumer in North America means being constantly surrounded by financial temptation. So much marketing nudges you toward spending and borrowing more. In my book, I draw from behavioural economics to offer some psychological hacks you can use to deflect those nudges.

The first step: Choose a powerful vision for why you’re saving or paying off your debt. For example, instead of thinking “I need to pay off my credit card debt,” think about what that would enable you to do. For example, let’s say that if you didn’t have those credit card payments eating up a chunk of your monthly budget, you’d be able to bump up your rent and upgrade from, say, a dingy basement rental. Bingo! That’s your vision: moving to a sun-flooded apartment. Focus on that and you’ll be much more motivated to tackle your debt.

Another hack: If you have big, long-term financial goals, chop them up into smaller goals. It’s easy to become demotivated if the finish line feels really far away. So set yourself intermediate targets along the way. For example, if you’re saving up for a big down payment on a house, think of your progress in $5,000 increments. Set yourself a timeline and buy yourself a little feel-good treat every time you’ve socked away another $5,000.

Third step: You need a system to keep your finances on track day today, but that doesn’t mean you have to budget with spreadsheets and record every cent you spend. Instead, in the book, I show you how to manage your financial inflows and outflows with the Money-Bucket System. This is about automating as much of your bill-paying, savings and debt repayments as you can by channeling your cash into several bank accounts (the money buckets) that fund different aspects of your life.

Below is a chart showing how a couple with kids might organize their Money Bucket System. The “allowance” account is money you can spend on whatever you want without worry, knowing you’ve already taken care of your financial commitments:

Question 2: You covered a lot on housing and the significant challenges faced by millennials looking to buy a home in todays’ expensive real estate market. If you were given a magic wand (that works), what would be the top two actions you would take to resolve some of the pressing challenges facing homebuyers right now?

Aren’t magic wands (that work) just the best?

If I had one I would wave it to bring home prices back in line with incomes across Canada. I would also fix the rental market so that having a landlord would become just as attractive a housing option as having a mortgage. And they all lived happily ever after …

Question 3: Continuing with housing, what advice would you give to a millennial who is pondering the age-old “rent vs. buy” question?

OK, back to the real world. If you’re new to Canada, looking for housing is likely one of those moments when reality sets in: there are many things to love about Canada, but not everything is wonderful. And let’s face it, the cost of housing – whether it’s rent or home prices – is downright ugly across so much of the country.

As I write in the book, balancing the cost of housing with the cost of the rest of your life is the single biggest financial challenge facing millennials and Gen. Z – a group that includes a large number of new immigrants.

Here’s my approach to the rent vs. buy question.

Step one: figure out whether you’re living in a renters’ or buyers’ market. In the book, I provide a simple formula you can use to gauge that by comparing the yearly rent and the purchase of comparable homes.

Step two: if you’re in a buyers’ market, I explain how to calculate whether you can afford to buy a house. If you’re in a renters’ market, you also need to make sure you can actually afford local rents. Renting is often significantly cheaper than buying in Canada, and renters can accumulate wealth by saving and investing. But let’s be honest: in many large cities rents are so high many tenants struggle to squirrel away anything at all. You don’t want to be a renter who can’t save.

Even if you can afford the rent in a renters’ market, there’s also the question of whether you can find a rental that suits your life. It’s easy to live well as a renter if you have a well-paid job in a big city and are child-free. It can get trickier (though it’s not impossible) if you live in a smaller community or have a family.

Long story short: the rent vs. buy decision is about math but it’s also about lifestyle. And if you can’t afford the kind of home you need wherever you’re living, you may need to consider moving, which can be incredibly hard if you have a job you love in a big city (and it’s still unclear to what degree the switch to work-from-home has decoupled big jobs from big cities).

Unfortunately, there is no magic wand when it comes to housing. But I give you a step-by-step roadmap to help you make a decision that won’t leave you house-poor.

Question 4: In your “making money like you mean it” section, you talk about work from home, the gig economy, salary negotiations, job-hopping, and more. Many readers of Savvy New Canadians have a side hustle. What advice do you have for people who want to value their time better with regard to side hustling?

Side hustles can be great. But they can also be a trap. In the long run, working more than one full-time job can lead to exhaustion and actually harm your ability to improve your income because you’re so tired all the time you can’t think creatively or see opportunity.

Side-hustles are a short-term means to an end. It’s fine to rev your engine to the max for a limited period of time if you want to turbo-charge your income to achieve a particular financial goal, like saving up for a down payment on a house. Or perhaps you want to switch careers and a side-hustle can be your way into a new industry.

However, if you’re using your side-hustle simply to pay the bills, your No. 1 priority should be to land a better full-time job.

Also, beware of the start-up costs of side-hustles. Many gigs involve considerable initial investments of time and money. Do you already have all the gear and equipment required? Is there a learning curve, and how long will it be before you’re pulling in some real money?

A side-hustle with steep up-front costs may still be worth it if the eventual payoff is also large, for example, if the gig might eventually turn into a better-paying or more fulfilling career. But if you’re just hoping to make a quick buck for a short-term financial goal, make sure to choose a side-hustle you can pick up quickly and at little or no cost (for example, a gig where you use tools/software/equipment you already own and use for your day job).

Question 5: I agree when you say that learning about investing is not optional. I often come across newcomers who, having immigrated to Canada in their late 40’s and 50’s, are feeling pressured to grow their retirement savings quickly by investing in a handful of stocks they are hoping will do extremely well. Or they get carried away with shady investments that promise to give them unrealistic returns. What’s your take on investment strategies/options that work long-term, involve little effort, and that may be better suited for people who are just beginning to learn about investing?

My approach to investing is to keep it low effort and low cost. Trying to beat the market is almost always a hopeless enterprise if you’re investing for retirement. Plenty of research shows you’re much better off with a diversified portfolio that simply mirrors the market.

In the book I discuss three ways to do so while keeping your investment fees down: index mutual funds, all-in-one exchange traded funds (ETFs), and robo advisors. All three are perfectly good options, although each has pros and cons, which I discuss.

Question 6: Life insurance, wills, and estate planning. My sense as a personal finance blogger who interacts with readers from various backgrounds is that people don’t like to talk about the unexpected or anything that remotely reflects their mortality. Your book covers these topics in detail. How would you summarize “prepping for life’s curveballs”?

Answer: People don’t like to talk about money or death, let alone the two together. That’s understandable, but here’s the thing: life insurance, wills, and estate planning aren’t really about you. They’re mostly about taking care of your loved ones.

If you’re relatively young and in good health, there are life insurance options so cheap and easy to get that there’s really no excuse for not having a policy. If you don’t have coverage you should get on it right now. You can compare policies online and might not even need a medical to sign up for one.

Wills are also getting increasingly affordable. If you have a simple situation, there are sites that will guide you through drawing up a legal will the way tax software helps you complete your tax return. If you’ll excuse a bad pun, it’s dead simple.

You can get Money Like You Mean It: Personal Finance Tactics for the Real World on Indigo, Amazon, or eBooks.com.