MogoTrade is the latest stock trading app to offer commission-free trading in Canada.

Investment apps and brokerage platforms already offering free stock trades include Wealthsimple Trade, Desjardins Online Brokerage, and National Bank Direct Brokerage.

This MogoTrade review covers how it works, comparisons to two stock trading sites, green investing, whether MogoTrade is safe, and how to join the waitlist.

What is Mogo?

Mogo is a financial technology company with offices in Toronto, Vancouver, and Winnipeg.

It provides a wide selection of financial services, including:

- Free credit scores and credit monitoring

- Identity fraud protection

- Personal loans

- Prepaid Visa Card

- Digital payments

- Robo-advisor investing (Moka)

Most recently, it launched its zero-commission stock trading platform, MogoTrade, following regulatory approval by the Investment Industry Regulatory Organization of Canada (IIROC).

What is MogoTrade?

MogoTrade is an online brokerage platform you can use to buy and sell stocks without paying trading commissions.

There are only a handful of stock trading apps and websites in Canada that can claim to offer “zero-commission trades.”

Typically, you pay $4.95 to $9.99 per transaction each time you buy or sell a stock or Exchange-Traded Fund (ETF).

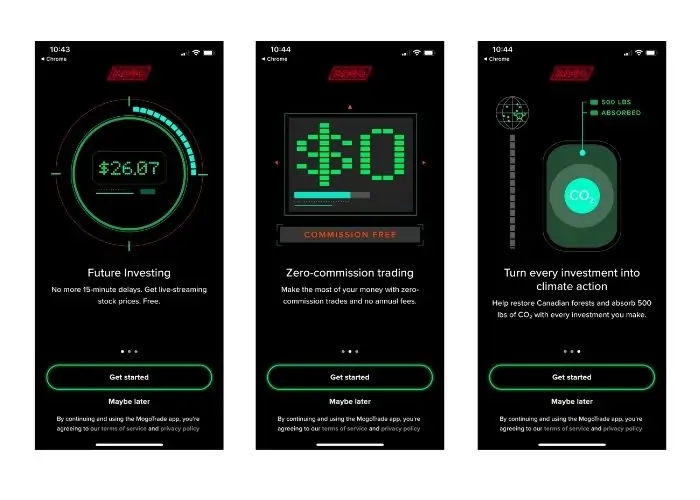

With MogoTrade, you don’t pay commissions and also get the following benefits:

- Free live streaming stock prices: Live streaming quotes are included in the free account package. This means you can make trading decisions based on real-time market data instead of delayed data.

- Green investing: The company says it will plant trees and reforest Canada with every investment you make on its platform. It has partnered with Flash Forest to make this happen.

- Access to other investments: While MogoTrade is only offering stock trading currently, there are plans to support other assets in the future, including cryptocurrency and non-fungible tokens (NFTs).

MogoTrade is made available via MogoTrade Inc. (formerly Fortification Capital Inc.).

How MogoTrade Works

After downloading the MogoTrade app, I was placed on its waitlist.

You can move up to the waitlist faster by inviting your friends either using their unique referral code (such as 0WNCP).

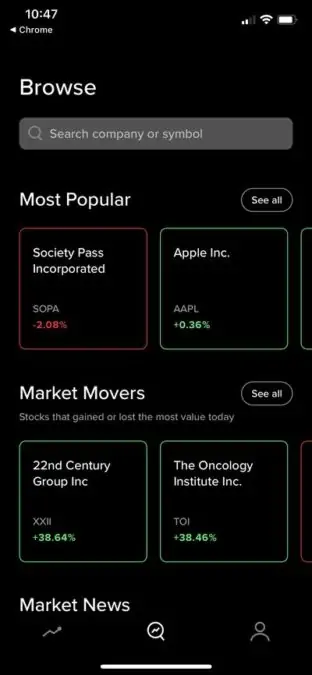

While waiting for the opportunity to place trades, you can use the MogoTrade app to create watchlists for your favourite stocks.

You also get access to live-streaming stock prices and market news.

Full access to MogoTrade’s trading features is expected during the first quarter of 2022.

Join the MogoTrade Waitlist (use referral code 0WNCP).

MogoTrade Fees

Based on the available information, MogoTrade does not charge fees to open an account or place trades.

Whether users will pay FX fees when they trade U.S. stocks is unclear. Typically, this fee can be up to 2% on both buy and sell transactions.

Is MogoTrade Safe?

MogoTrade Inc is a legitimate company and a member of the Investment Industry Regulatory Organization of Canada (IIROC).

It is also a member of the Canadian Investor Protection Fund (CIPF), and your assets are protected against firm insolvency up to $1 million.

MogoTrade vs. Wealthsimple Trade

Wealthsimple Trade is the most popular commission-free stock trading app in Canada.

Here’s how it compares to MogoTrade:

| Features | Wealthsimple Trade | MogoTrade |

| Fees | $0 trading commission; $10/month fee for Trade Plus; 1.5% FX fee for USD trades | $0 trading commission; FX fees unknown |

| Accounts offered | Non-registered personal; TFSA, RRSP | Non-registered personal; TFSA, RRSP |

| Investment products | Stocks, ETFs, crypto via Wealthsimple Crypto | Stocks (and ETFs) |

| Trading platform | iOS, Android, Web app | iOS and Android |

| Account minimum | $0 | Unknown |

| Other features | Instant deposits, fractional shares, multiple order types | Plant trees when you trade; free live-streaming stock prices |

| Referral program | Get a $25 cash bonus | N/A |

Learn more in this Wealthsimple Trade review.

MogoTrade Vs. Questrade

Questrade is the top brokerage platform for experienced traders. It offers commission-free ETF purchases and competitive fees on other trades.

Here’s how it compares with MogoTrade:

| Questrade | MogoTrade | |

| Fees | $0 ETF purchases; $4.95 – $9.95/trade for stocks (and ETF ‘sell’ trades); can fund with USD to avoid FX fees | $0 trading commissions; FX fees unknown |

| Accounts offered | RRSP, TFSA, RESP, RRIF, LIRA, personal non-registered, corporate accounts, margin, etc. | Personal non-registered account; TFSA & RRSP |

| Investment products | Stocks, ETFs, options, mutual funds, bonds, IPOs, GICs, CFDs, FX | Stocks (and ETFs) |

| Trading platform | Mobile apps, desktop app, web app | Mobile apps |

| Account minimum | $1,000 | Unknown |

| Other features | Instant deposit; advanced trading tools; multiple order types | Plant trees for every investment |

| Referral program | $50 free trade credit | N/A |

Learn more about it in this Questrade review.

Pros of MogoTrade

Benefits of MogoTrade when fully operational include:

- Zero-commission trades

- Free live-streaming quotes (costs $3/month on Wealthsimple Trade)

- You get to plant trees and restore Canada’s forests

Cons of MogoTrade

There is limited information on how MogoTrade works, and we don’t yet know if there are fees for US-listed stock trades, withdrawing funds, paper account statements, inactive accounts, etc.

It only offers stocks and ETFs. If you want to also trade options, bonds, mutual funds, and precious metals, you will need to open another brokerage account (e.g. Questrade).

Lastly, it is not currently available in Quebec.

MogoTrade Review FAQs

MogoTrade is separate from MogoCrypto, and it does not currently support crypto trading.

To get started, join the waitlist here and use the referral code (0WNCP). You can download the MogoTrade app and use its watchlists, market news, and live-streaming data.

You can buy and sell stocks in Canada without paying trading commissions using Wealthsimple Trade, MogoTrade, and other platforms.

Related:

- Best Trading Platforms in Canada

- National Bank Direct Brokerage Review

- Best Money Management Apps

- How To Buy ETFs on Questrade