Opening a bank account is a relatively simple process for people of any age in Canada. Even children can open bank accounts in Canada, although certain restrictions may apply.

In this guide, we look into the minimum age to open a bank account online or in person in Canada, what you need to open a bank account and some of the best youth bank accounts available.

Key Takeaways

- There is no minimum age to open a bank account in Canada, but some restrictions may apply.

- Some of the best youth bank accounts include the Tangerine Children’s Savings Account, Scotiabank Getting There Savings Program for Youth, RBC Leo’s Young Savers Account, and CIBC Smart Start Account.

What Do You Need to Open a Canadian Bank Account Online?

Many banks provide the option of opening accounts online, and you can open an account even if you don’t have a job or have been bankrupt.

You do not need very much to open a bank account online in Canada, and the basic requirements include the following:

- An original form of government-issued ID. This must not be a photocopy and should have a photo and signature. For example, a passport, driver’s license, military ID card, or national ID card. You may need to present two forms of ID.

- If you cannot provide a photo ID, you may be able to provide two documents to help show your identification, like a birth certificate or health card.

- You will often need to provide proof of address. This could be a public utility bill or a recent bank account statement.

Keep in mind that banks have slightly different requirements. So check the exact requirements and acceptable forms of ID requested when you open your account.

Applying Online

Applying online is the quickest way to open a bank account. A button on the website will normally say ‘Apply Now’ or something similar.

When you click to apply, you will be asked to provide your personal information, including name, address, etc. In addition, they may ask about your employment and Social Insurance Number.

You may then have to upload an image of your ID and any other documents required. It often takes no more than a few minutes.

Applying In-Person

Applying in person at your local branch is a similar process. However, you may need to book an appointment, and you will need to present the actual documents, including your ID.

What is the Minimum Age to Open a Bank Account in Canada

There is no minimum age to open a bank account in Canada. Generally, any resident who can provide the required documentation can open an account.

However, children under 12 or 13 may need to apply in person with a parent or guardian. Also, specific requirements vary by bank.

For example, Scotiabank requires that children under 12 are accompanied by one of their parents or a legal guardian. But children aged 12 to 15 can open an account independently.

At CIBC, if the child is 11 or under, parents must open the account. At Tangerine, only the parent or legal guardian can open an account, and only if they are already a customer.

How to Open a Youth Bank Account in Canada

There are several youth bank accounts available in Canada. In general, the process for opening one is the same as applying for any other bank account.

However, depending on the applicant’s age, they may need to be accompanied to the branch by their parent or legal guardian, who will need to present a form of valid ID.

While opening some youth accounts online may be possible, it can often only be done in person, depending on the applicant’s age.

The Best Youth Bank Accounts in Canada

There are several youth bank accounts you can choose from in Canada. Here are four of the best:

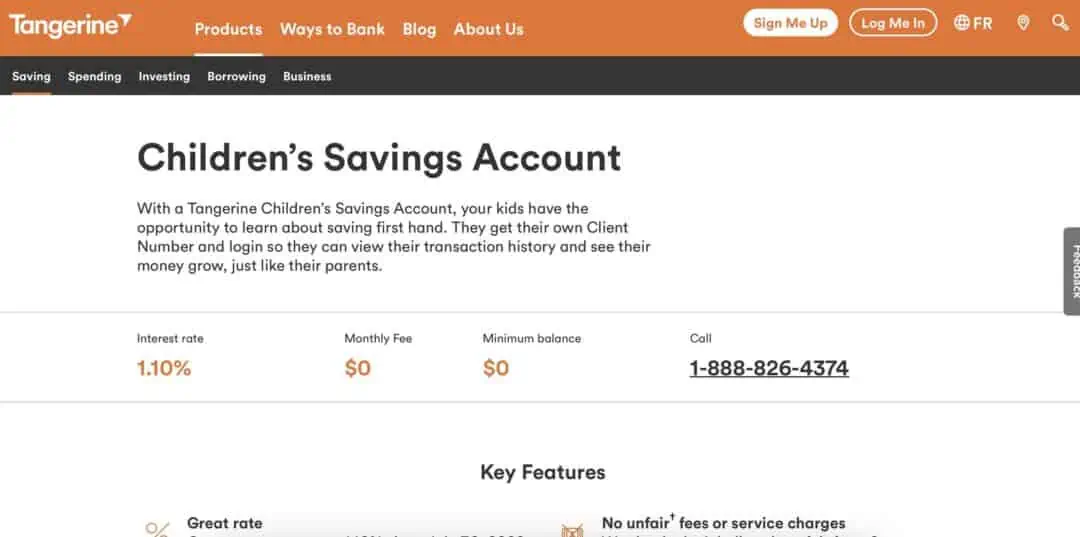

Tangerine Children’s Savings Account

The Tangerine Children’s Savings Account is specifically for children to help them learn about saving.

They get a Client Number, and they can log in, see their transactions, and watch their money grow. The current interest rate is 1.10%, and there is no monthly fee or minimum balance.

It is a simple account without any specific perks, and it’s designed to help children learn about money and saving.

Only the parent or legal guardian can open the account, and they must be an existing Tangerine customer.

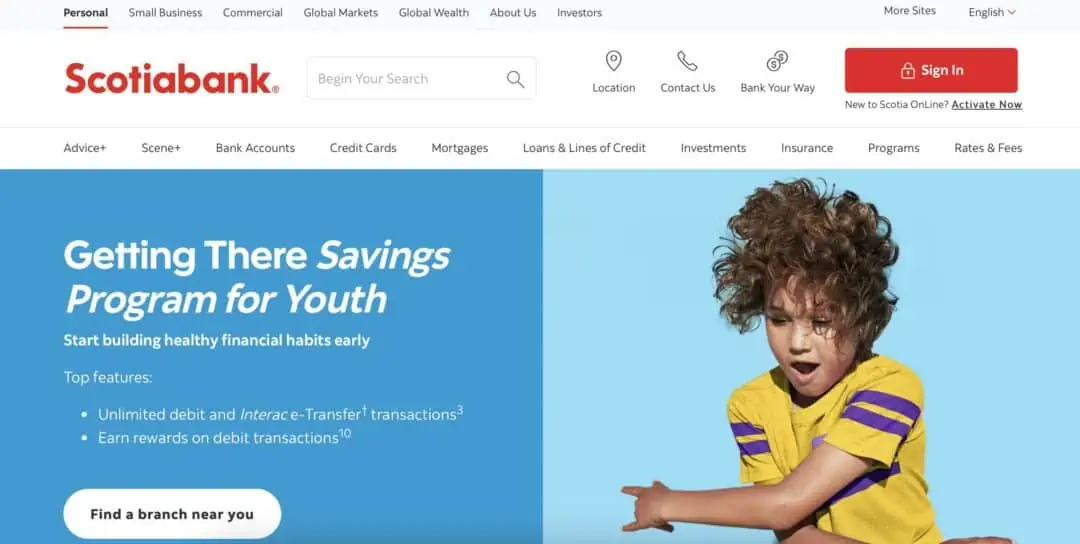

Scotiabank Getting There Savings Program for Youth

The Scotiabank Getting There Savings Program for Youth is an account for children to get them into good financial habits from a young age.

Account holders can earn rewards on their debit transactions and enjoy unlimited debits and Interac e-Transfers.

It’s available for anyone under 19, and users can enjoy the benefits of the Scene+ rewards program.

Account holders can earn 0.05% interest on savings up to $499.99 and 0.10% on savings over $500. There is no monthly fee for account holders aged 18 and under.

Children aged 12 and over can open the account on their own. But for those under 12, their parent or legal guardian must accompany them.

RBC Leo’s Young Savers Account

This account is for children but is more targeted at parents, with the aim being to open an account for your child to start teaching children about money.

It’s a basic account with free and unlimited debit and Interac e-Transfer transactions, and no minimum balance is required.

Children can also use their accounts with the Mydoh app and cash card to monitor their activity.

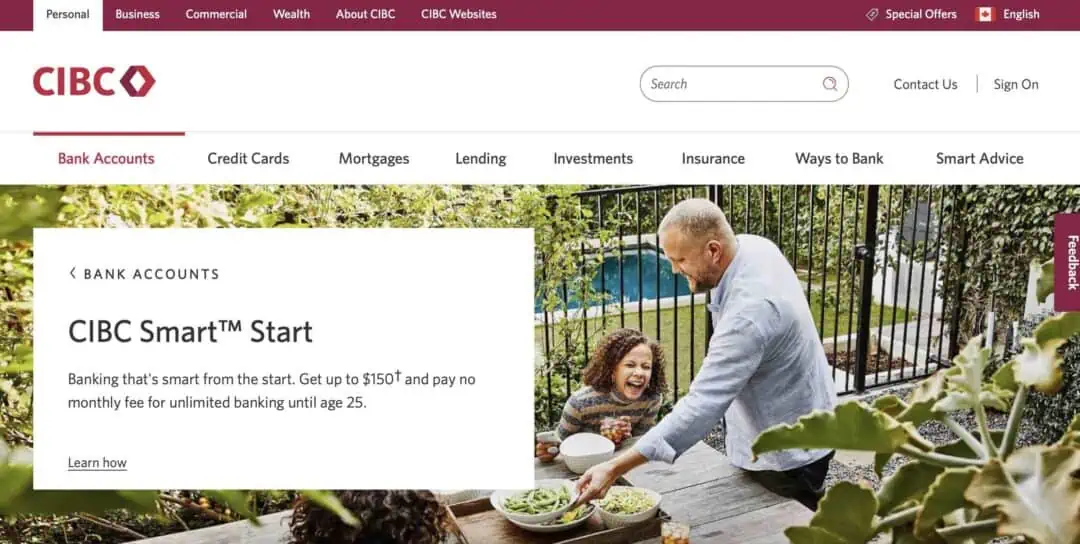

CIBC Smart Start Account

The CIBC Smart™ Start account is free up until age 25. There is no monthly fee and minimum balance requirement, and it comes with unlimited debit and Interac e-Transfer transactions and some student deals.

It includes CIBC Insights to keep track of money, and account holders can make savings on gas.

Anyone aged 13 to 15 can open at a branch without a parent present. If they are 16 and over, they can open an account online. For children under 13, a parent must open an account for them.

How to Open a Bank Account in Canada for Non-Residents

Opening a bank account as a non-resident is not always straightforward in Canada. However, there may be options available if you are planning to get a residency to live, study, or work or if you are a temporary resident.

Start by checking out some of the accounts for newcomers. These are not specifically for non-residents; instead, they are typically aimed at permanent residents and foreign workers.

But you may be able to open an account before you arrive. This may be an option with a larger bank like HSBC, which has a presence in many countries.

If you find a bank that is willing to open a bank account even though you do not have residency, you will probably need to provide ID like a passport as well as details about your employment status and address, immigration papers, temporary residency, work permit, and more.

The best option is to talk to the bank and ask about their requirements.

How to Choose a Bank Account in Canada

Several factors can help you determine which bank account is best for you:

- Type of account – Do you want a chequing or savings account?

- Account fees – How much must you pay for transactions, withdrawals, etc.?

- Interest rate – If you want a savings account, is the interest rate competitive?

- Ease of opening an account – Can you open the account online, or do you have to visit a branch?

- Requirements – Is there a minimum balance requirement you must maintain?

- Other services – Can you get discounts on other services like other accounts and mortgages from the same institution?

FAQs

Yes, a 12-year-old can have a debit card in Canada if they open a bank account.

Several banks provide youth bank accounts for kids in Canada. Check the available options to decide which is best in your circumstances.

Many banks will allow you to open a bank account at 16 without being accompanied by a parent or guardian.

You don’t always need a birth certificate, but you must provide other forms of official ID.

Yes, there is no minimum age requirement for opening a bank account in Canada. However, they may need to be accompanied by a parent.

While a 13-year-old may need to be accompanied by their parent or guardian to open a bank account in Canada, there is no minimum age requirement to open an account.

I have a teen aged grandson who wants to earn interest on his summer earnings

What financial institutions is best?

@Bob: Unfortunately, banks don’t pay much interest on kid’s savings accounts. Here are some options: https://www.savvynewcanadians.com/best-childrens-bank-savings-account-canada/