Micro-investing apps make it easier for everyone to participate in the financial markets and invest without requiring extensive investment knowledge or cash.

Traditional investing involves going to your bank to purchase a mutual fund and/or participate in your employer’s pension or Group RRSP plan.

On the other hand, confident investors may choose a DIY approach and invest their money using an online brokerage service.

If all you have to spare is a small amount of change, these traditional models may not work for you.

Micro-investing apps are easy to use on the go. You can install them on your iPhone or Android device and start investing immediately.

The two popular spare change investment apps in Canada are Mylo and Wealthsimple. In the U.S., the likes of Acorns, Stash, and Robinhood lead the pack.

Peer-to-peer platforms such as Lending Loop and Fundrise offer opportunities to invest in alternative assets (e.g. loans and real estate) using small amounts.

What Is Micro Investing?

Micro-investing involves making small and irregular contributions to an investment account to purchase fractional ETF shares.

A popular strategy is to automatically round up your transactions and invest the spare change in the stock market.

For example, if you purchase a cup of coffee for $2.25, a micro-investing app rounds up your purchase to $3.00 and deposits the $0.75 into your investment account.

Micro-investing apps won’t make you rich and may not be adequate to plan your retirement savings; however, they can help you save hundreds of dollars easily every year.

This is money you can put towards debt repayment or use to finance a short-term goal, e.g. a vacation or a down payment on a car.

Best Micro Investing Spare Change Apps

There are two main micro-investing apps available in Canada.

1. Moka (formerly Mylo)

Moka (formerly Mylo) is a Canadian investment app that automatically rounds up your purchases and invests the difference in a portfolio of low-cost ETFs.

After you create an account, you need to connect your bank to the app so that whenever you spend using your debit or credit card, the spare change is invested.

Moka invests your money in a diversified portfolio that reflects your risk tolerance and investment needs. They offer TFSA, RRSP, and non-registered accounts.

Fees: Moka charges a $7 per month fee, and you enjoy additional perks, including cash back offers and fast withdrawals.

Security: They protect your money using 256-bit encryption, similar to what banks use. However, your investment account is not insured by the Canadian Investor Protection Fund (CIPF).

For more details, read this Moka review.

Pros of Moka

- You can start investing with $5

- The app allows you to set multiple financial goals and save toward them

- Socially responsible investing options are available

- Automatic portfolio rebalancing

- Easy access to your money with next-day withdrawals

- You can set up recurring deposits in addition to roundups

- $5 bonus when you refer a friend

- The app is positively rated at 4.4/5 on the App Store by more than 10,000 reviewers

Cons of Moka: The $7 monthly fee can add up to become significant for a small portfolio, and CIPF protection is not available.

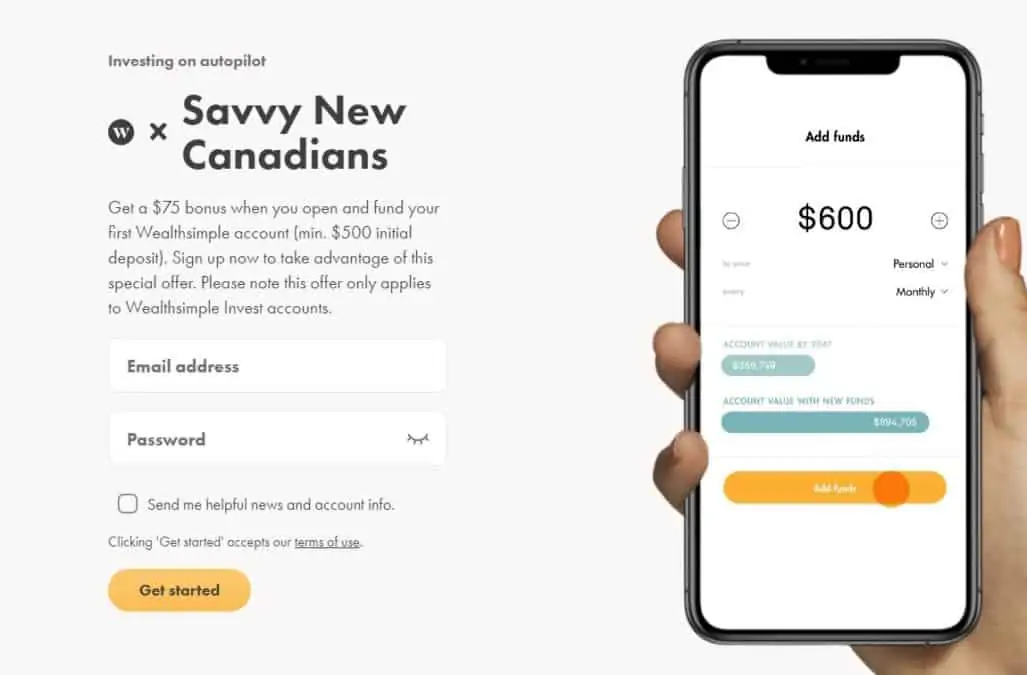

2. Wealthsimple

Wealthsimple is Canada’s popular online wealth management service. Founded in 2014, the company has grown significantly over the years and now has more than $30 billion in assets under management.

The Wealthsimple Invest app offers a Roundup feature that rounds up your purchases to the nearest dollar when you pay for anything with your debit or credit card.

Wealthsimple offers access to various account types, including RRSP, TFSA, RESP, RRIF, LIRA, joint, and business non-registered investment accounts.

It automatically creates a portfolio that matches your risk profile and investment needs…anywhere from a conservative to a growth portfolio.

Fees: There is no additional cost to use Wealthsimple Roundup. Generally, you pay a 0.4% – 0.5% management fee per year, depending on your account size.

In addition to the roundup feature, Wealthsimple also offers the following to interested clients:

Overflow: You can determine how much money you want to keep in your bank account. Excess amounts are automatically invested.

Socially responsible investing: Invest in a portfolio considering environmental and social impacts.

Wealthsimple Trade: A free stock trading app that allows users to purchase fractional shares.

Halal investing: Adherents of the Islamic Faith can invest in a shariah-compliant portfolio that complies with Islamic Law.

When you open a new Wealthsimple account here, you receive a $25 cash bonus.

Pros of Wealthsimple Invest

- Low management fee compared to mutual funds

- Free financial advice

- Automatic rebalancing, deposits, and dividend re-investing

- Access to Wealthsimple Save, a no-fee, high-interest hybrid account

- Access to Wealthsimple Trade, a commission-free stock trading app

- A versatile app with 4.5/5 rating from thousands of reviews

- Bank-level encryption and two-factor authentication to protect your account

- CIPF protects your account for up to $1,000,000

What To Look For in a Spare Change App

Fees: Review the monthly fees and determine what proportion of your investment goes to fees. For example, if you invest $20 monthly and pay $7 in fees (e.g., Moka), your management fee is a whopping 35%. Don’t forget the direct fees that go to ETF providers.

Returns: Look at the historical returns for the funds and how they compare to other players in the industry. Note that historical returns do not guarantee future returns. Also, consider the risk-return relationship.

Minimum Account Deposit: The whole idea behind micro-investing is the ability to invest small amounts. The two apps in this post allow you to start investing with as little as $5.

Who Should Use Micro-investing Apps?

Seasoned investors can opt for a discount brokerage account and take the driver’s seat regarding their investment account. However, they need to understand the financial markets and be ready to do research (e.g. understand dividends) and rebalance their portfolios when needed.

Micro-investing apps work well for people who cannot afford to invest large sums of money. They offer a painless way to invest without depriving yourself or breaking the bank.

They can also be awesome for developing good financial habits and getting out of debt.

Micro-investing apps are the electronic 21st-century version of piggy banks. Beginner investors can use them to get a feel for the financial markets and get in the habit of paying themselves first.

Is Micro Investing Worth It?

It is unlikely you will attain millionaire status using micro-investing.

It is great as a starting point; however, if you are ever going to retire rich… or retire at all, you will need to up your investing game.

As your finances improve, invest even more money using a DIY approach, the services of a robo-advisor, or your bank.

Some of the secrets to successful investing are:

- Invest regularly using the right assets and starting as early as possible to maximize compound interest.

- Cut your investment fees

- Invest with a long-term mentality

- Maximize your tax-sheltered accounts

- Rebalance your portfolio as needed

- Keep things simple

Invest With Moka and get a $5 bonus.

Invest With Wealthsimple and get a $25 Cash Bonus.

Related reading

Hello Enoch,

Thanks for the great article.

Just to add to your comments. Mylo stopped offering their basic $1 plan as it is planned to be grand fathered. All new users are registered with advantage plan by default.

Only upon contacting the customer service team, users will be downgraded to basic plan.

@Ganesh: Thanks for letting me know.

Hey ;). Thanks for your blog, lots of helpful tips. So, I’m really a newbie with this, nobody taught us this stuff in school, so maybe this is an overly simple question, but I’ve a hard time finding an answer googling it. I just want a solid example or two of the difference between putting your money in a savings account (high interest saving account, I am using koho) vs micro-investing (Exploring wealthsimple) when you are just beginning and trying to find what can do with small amounts of extra money that come in. For me, if I put $250 in Koho (with the 1.2% interest) or in Wealthsimple microinvesting. What is better? How much would you earn in each of them over time (a year, 3 years, longer). Just all the numbers online don’t make sense to me without a solid example or two. Just trying to figure out how to maximize small amounts of money. Thanks!

@Cv: There are many differences between a savings and investing account. Using your KOHO vs Wealthsimple example, KOHO is good for keeping funds you may need access to within weeks, months, or even 1-3 years. The money in your savings account earns interest (~1%) and you don’t lose purchasing power. Investing on the other hand (i.e. Wealthsimple) is a long-term game. This is how you can potentially grow the money you don’t need urgently (3 or more years, the longer the better). There will be fluctuations in the stock market over this period and you will see the value of your investment go up and down. Using historical data, the chances are that your money will grow faster when invested over the long term.

Investing is not for short-term savings as the stock market may be down when you need the money urgently and you will be forced to sell at a loss. In the longer term though, you could grow your net worth especially if you are investing in tax-advantaged accounts like the TFSA and RRSP.

Hope this helps.