Looking for free Amazon gift cards? In this post, I show you 21 clever ways to get free Amazon gift cards in Canada and the United States.

It does not take long to start seeing the results from the strategies I use to generate the free gift cards I use to shop online and in-store.

In fact, the sign-up bonuses alone on some of these free apps and websites are enough to start unlocking your free Amazon gift card codes instantly.

Get Free Amazon Gift Cards From Rewards Sites

Join Get-Paid-To (GPT) sites that reward you for completing easy, mindless tasks. These sites offer some of the simplest ways to make money online.

1. Swagbucks

Swagbucks is one of the most popular GPT sites for earning rewards using your phone and in your free time. They pay you to complete surveys, play games, watch videos, surf the internet, and more.

You can redeem your points for various free gift cards, including Amazon gift cards. There are also options to cash out your earnings as PayPal cash.

Click here to join Swagbucks and get a $5 bonus that you can redeem for your free Amazon gift card code.

Related: Swagbucks Review.

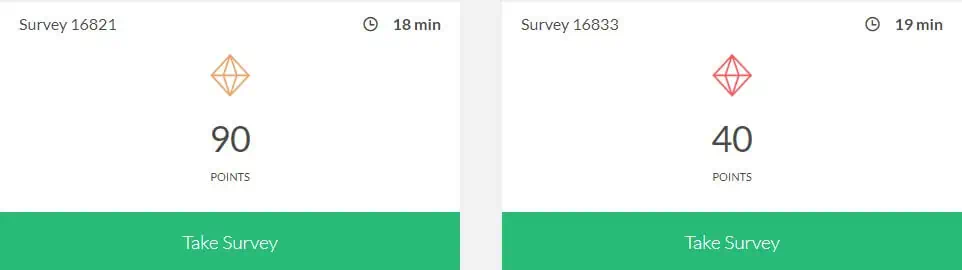

2. Survey Junkie

Survey Junkie tops my list of legit survey sites to make money. They offer an abundance of paid online surveys, so you won’t quickly run out of opportunities to get free gift cards.

The site has over 10 million members who have earned millions of dollars to date.

You can redeem your earnings instantly as cash through PayPal or for e-gift cards and through bank transfer (United States).

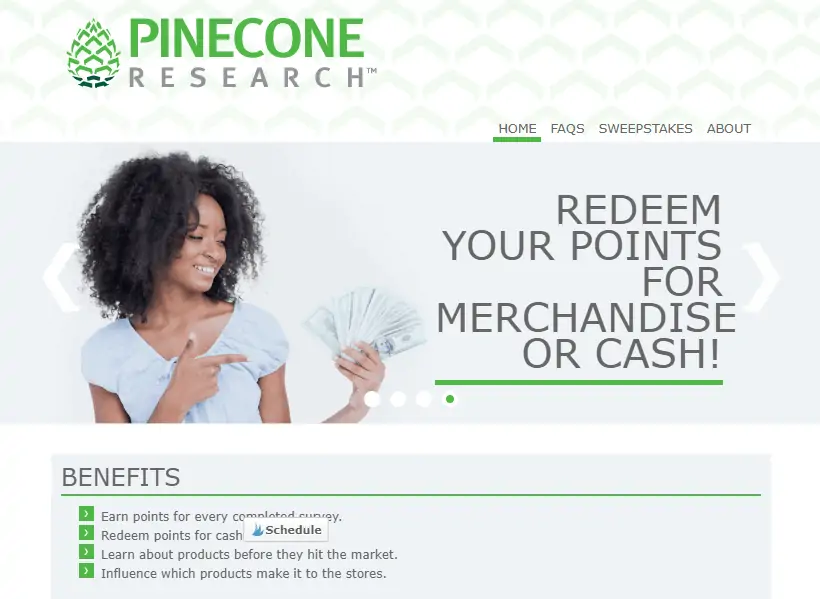

3. Pinecone Research

Pinecone Research is operated by Nielsen, a popular market research firm. When you join their panel and participate in surveys or product testing, you earn points that can be redeemed in several ways:

- Gift cards: Amazon, Walmart, Starbucks, and iTunes

- PayPal cash

- Cheque

- Prepaid Virtual Visa

At $3 per survey, it does not take long to start redeeming your free Amazon gift cards. Check out my Pinecone Research review for more details on how the site works.

Free Amazon Gift Cards Through Cash Back Apps and Websites

Cash back apps generally pay you to shop. You do your routine shopping online or in the store, and these apps reward you with cash or rewards points.

For those apps that award points, you have the option to redeem your points for various gift cards, including Amazon’s.

For the apps that pay you in cash, you can simply use the money earned to purchase free gift cards on Amazon.com.

4. Rakuten (Ebates)

Rakuten, formerly known as Ebates, is one of the oldest sites for earning cash back when you shop online on Amazon and 750+ other retailers.

To get rewards, visit Rakuten, look for your preferred retailer, and click to shop.

Rakuten automatically credits your account with cash back (anywhere from 0.50% to as high as 30%), and they send you a check in the mail, or you can cash out using PayPal.

I sometimes use my Rakuten payout to purchase the Amazon gift cards I use for my online Amazon shopping.

Join Rakuten (up to $30 bonus after making your first purchase worth $30 or more)

5. Install The MobileXpression App

Install the Mobilexpression app and leave it installed for one week to qualify for a free $5 Amazon gift card. It’s that simple!

If you choose to leave the app installed for longer than a week, you receive weekly credits that you can redeem for even more free gift cards.

After 90 days of active membership, they donate a tree on your behalf to Trees for the Future.

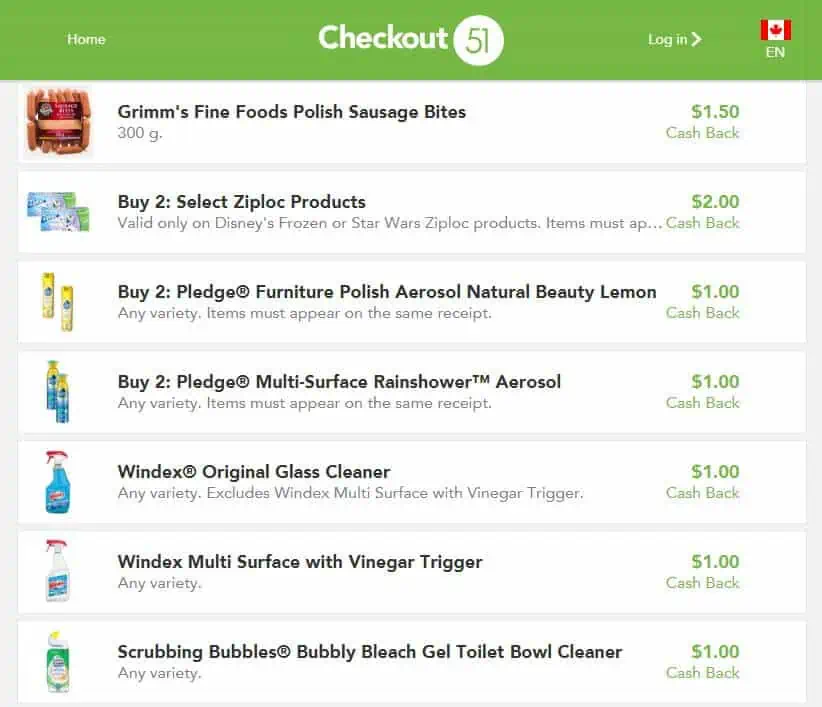

6. Checkout 51

Checkout 51 is my choice cash back app for shopping for groceries. The app comes with tons of new discount offers every week (cash back as high as 30%), and you can generally shop at any store to take advantage of the deals.

Snap a photo of your receipt and upload it using the app to claim your cash back. You can redeem your cash rewards when your balance reaches $20 or more, and they will send you a cheque in the mail.

Learn more about Checkout 51 in this review.

Get Free Amazon Gift Cards From Online Survey Sites

These online survey sites are free to join and will reward you for providing your opinions about the products and services offered by popular brands and retailers.

Surveys won’t make you rich, but they can get you that elusive free Amazon gift card.

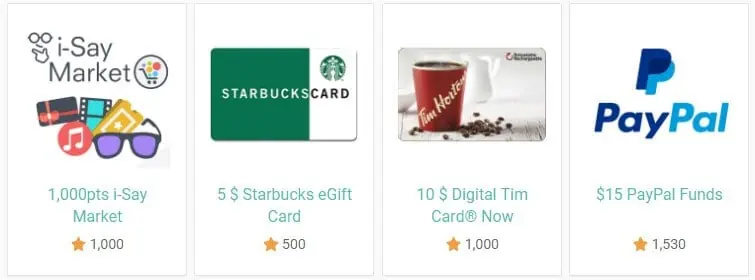

7. Ipsos i-Say

i-Say is a well-known opinion site that is managed by Ipsos, a global market research firm. You earn i-Say points when you take surveys and polls and participate in their loyalty program.

Starting at 500 points ($5), you can redeem your points for:

- Amazon gift cards

- Starbucks gift cards

- iTunes gift cards

- PayPal cash

- Visa prepaid cards

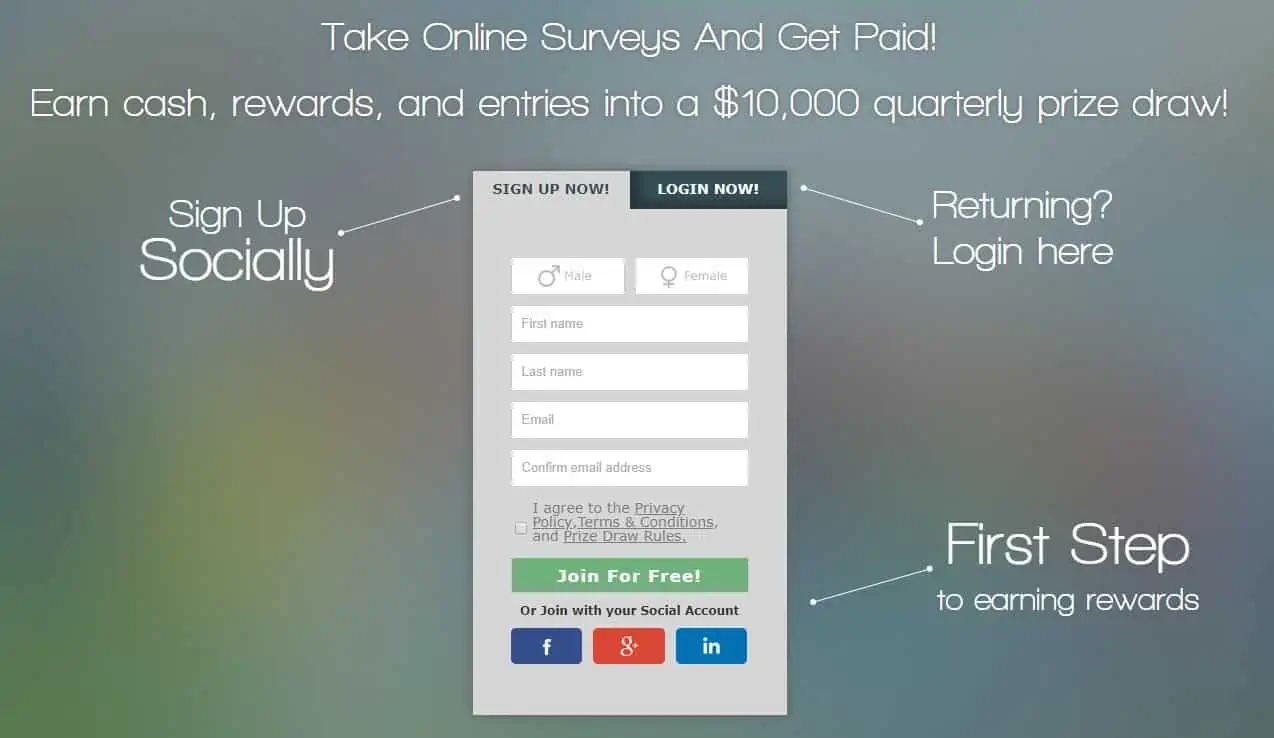

8. Prize Rebel

Prize Rebel has paid its 14 million members more than $29 million as of August 2023 and is available in multiple countries.

Ways to earn points on the site include taking surveys, watching videos, participating in contests, and completing other simple tasks. You can redeem your points for Amazon gift cards starting at $2! And they are often discounted deeply.

For example, a $5 Amazon gift card could go for 370 points instead of the regular 500 points.

Click here to join PrizeRebel and you can also read my review.

9. Maru Voice

Maru Voice was formerly known as the Angus Reid Forum and is based in Canada. Membership requirements for the site are Canadian residency and at least 18 years of age.

You can earn points on the site by taking surveys worth $1 to $3 each and redeeming them for Amazon e-gift cards or cash.

10. Daily Rewards

Similar to Swagbucks, Daily Rewards offers multiple opportunities to get paid in gift cards. It is easy to earn cash rewards when you provide your opinion on a subject matter, shop online, browse the internet, or even watch videos.

The company has paid millions in cash to members and holds an A+ rating with the Better Business Bureau. You can redeem earnings via PayPal when your balance reaches $30 or more and put it towards an Amazon gift card.

11. Harris Poll Online

As the name goes, Harris Poll Online is all about completing surveys and polls online and getting paid for doing so. In addition, you can also win cash prizes in their cash draws and sweepstakes.

Easily redeem your HIPoints for Amazon gift cards starting from $10. You can read our Harris Poll review.

12. Opinion Outpost

Opinion Outpost is all about surveys. They pay you up to $5 per completed survey and $0.50 for every friend you refer.

Easily redeem your points for free Amazon gift cards starting at $5, or opt for PayPal cash with a minimum payout threshold of $10.

13. Toluna

Share your opinions with brands through Toluna and get paid in gift cards. Toluna is available in Canada and the U.S.

Their surveys take between 15-20 minutes, and you can earn up to 50,000 points per survey.

Easily redeem your points for gift cards or PayPal cash.

14. InstaGC

InstaGC works similarly to Swagbucks. Members get paid to complete surveys, watch videos, shop online and browse the internet.

Want to redeem your points for instant gift cards? InstaGC stands for just that. You can choose from over 340 gift card options, including Amazon.

15. Drop App

Drop is available in Canada and the U.S. and automatically credits your account with cash back points when you use your linked credit or debit card to make purchases at your favourite stores.

To get started, download the app to receive a $5 bonus after you link your first card (no promo code required).

1,000 points are equivalent to $1, and you can redeem your points for an Amazon gift card starting at $25 or 25,000 points.

Free Amazon Gift Cards From Amazon (No Surveys)

You can get free gift cards from Amazon directly if you follow these tips.

16. Mechanical Turk

Amazon MTurk is a platform where you can complete simple tasks (microtasks) for money.

Basically, you help Amazon with tasks like data entry, transcription, and surveys, and they pay you using PayPal or an Amazon gift card.

17. Amazon Promotional Offers

During specific times of the year, Amazon offers its customers opportunities to earn free credits.

For example, during the recent Prime Day, you could have earned $10 in free credit for downloading the Amazon app and another $10 after you make your first purchase through the app.

Be on the lookout for these kinds of promo offers if you have a Prime membership.

18. Amazon Trade-In

Trade in your unwanted Kindle, tablet, books, or video games and receive an Amazon.com gift card. Amazon pays for shipping, and there are no fees.

You can also sell your unused stuff on the Amazon online marketplace and get paid.

19. Reload Your Amazon Gift Card

When you reload your Amazon gift card balance with $100 or more, a $5 or $10 bonus may be applied to your account at the same time. Note that this offer is not always available.

Other Ways To Get Free Amazon Gift Cards

20. Microsoft Rewards

This is an additional strategy for getting free Amazon gift card codes in the U.S., Canada, and several other countries.

You earn points for browsing the web using the Bing search engine, taking quizzes, completing daily offers, and when you purchase apps and games.

Easily redeem your points for gift cards.

21. Bonus: Neo Money Prepaid Card

Use the free Neo Money Card when making purchases online and earn up to 5% cash back. When you join, you get a $20 bonus you can put toward an Amazon gift card if you sign up and fund your new account with $50 or more.

Neo Financial is only available in Canada.

Neo Money Account

Unlimited 5% average cash back

No monthly fees + $20 bonus

2.25% non-promo interest rate paid on balance

Unlimited free transactions

Get a Mastercard for payments online and ATMs

Access to a no-annual-fee credit card

Related Posts:

- How To Get Free Starbucks Gift Cards

- 17 Ways To Make Money From Home in Canada

- 23 Free Money Making Apps

- 27 Work From Home Jobs That Pay

- 15 Best Survey Sites for Canadians