You may need to cancel an RBC e-Transfer after you have sent it.

This could be due to sending an e-Transfer to the wrong email or recipient, or you may have simply changed your mind.

If the receiver has set up auto-deposit for e-Transfers, you could be out of luck as they will usually receive the funds automatically in their bank account.

If they are not set up for auto-deposits or have not accepted your e-Transfer, you can edit or cancel it through RBC Online Banking.

Read on to learn how to cancel e-Transfers in RBC, associated fees, how to edit and resend transfers, and update your contacts list.

How To Cancel an e-Transfer With RBC

Follow these 5 steps to cancel an e-Transfer on RBC:

- Sign in to RBC Online Banking

- Select “Payment History”

- Click on the Interac e-Transfer you want to cancel

- Select “Cancel Payment”

- Choose a deposit account and complete the cancellation

If you are on the RBC Mobile App, the steps are a bit similar; however, it takes 6 steps:

- Click on the yellow Move Money button at the bottom of the screen

- Click on “Send or Cancel an Interac e-Transfer”

- Select the “History” tab

- Click the Interac e-Transfer you want to cancel

- Select “Cancel Transfer” at the bottom of the screen

- Choose an account to deposit the funds and complete the cancellation

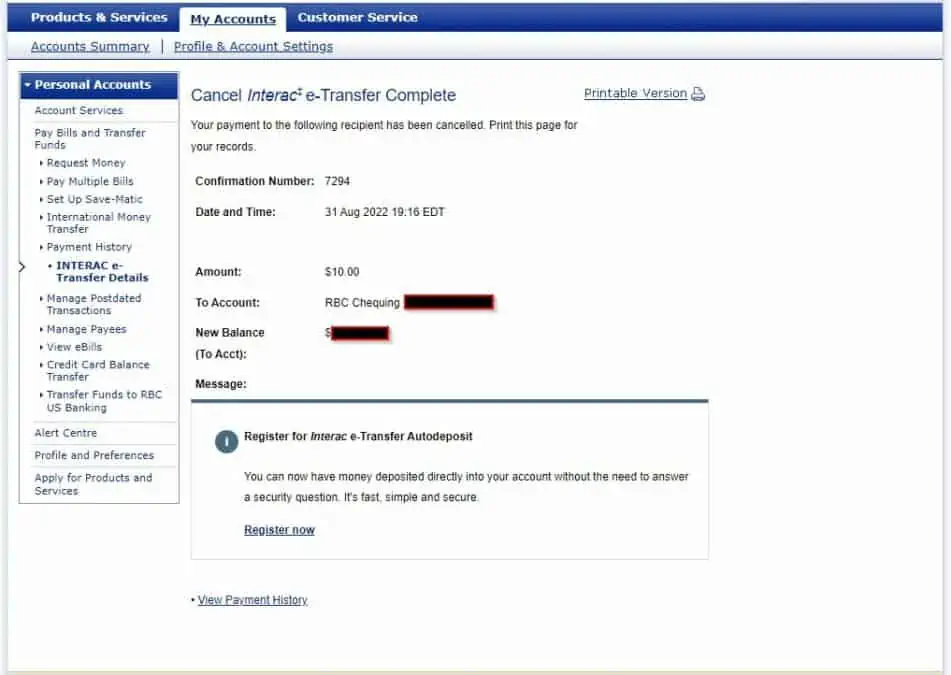

Cancel RBC Interac e-Transfer: Step-by-Step Guide

Here is a visual guide on how to cancel an RBC e-transfer when using Online Banking:

Step 1: Sign in to RBC Online Banking

Log in to your RBC Online account on a laptop or tablet. You can also use your phone’s web browser or the app since the steps are similar.

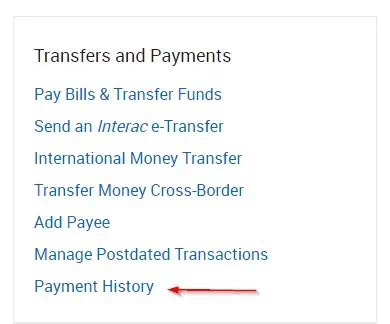

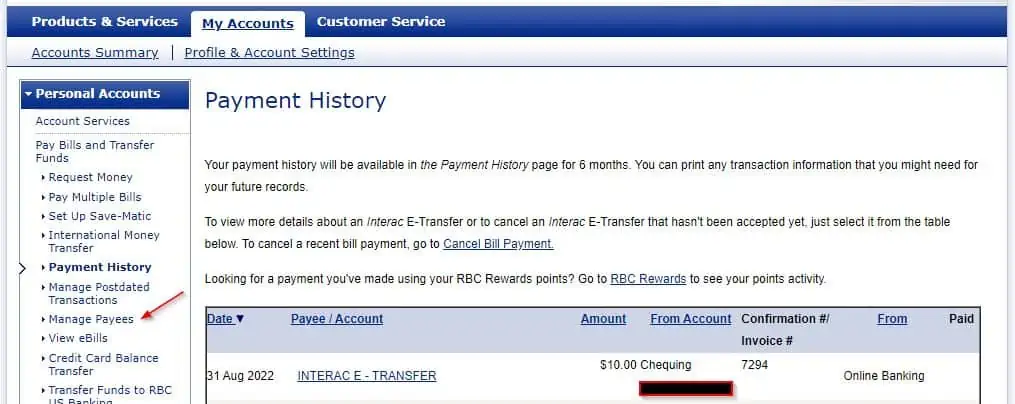

Step 2: Select “Payment History”

On the right side of your RBC Online Banking dashboard, look for “Payment History” and click on it.

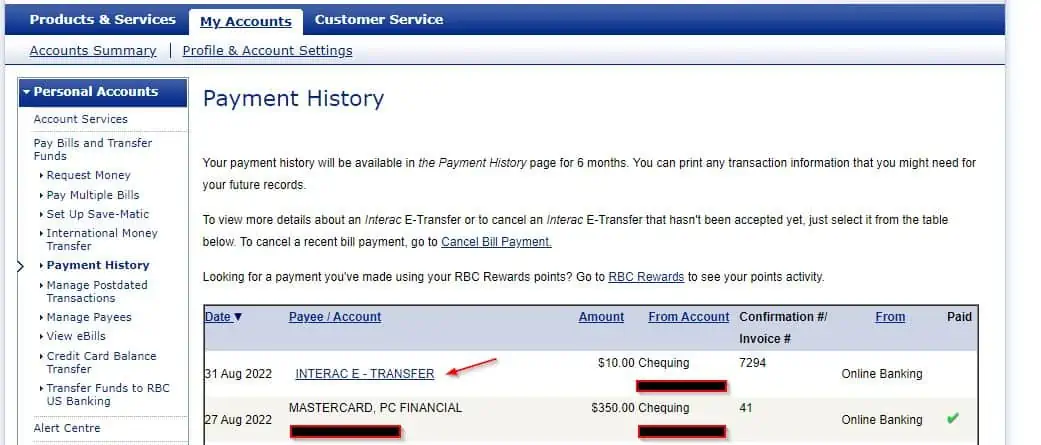

Step 3: Click the Interac e-Transfer You Want To Cancel

Under Payment history, you will find a list of payments you have made over the last 6 months (include Interac e-Transfers, credit card payments, etc.).

Select the e-Transfer you want to cancel.

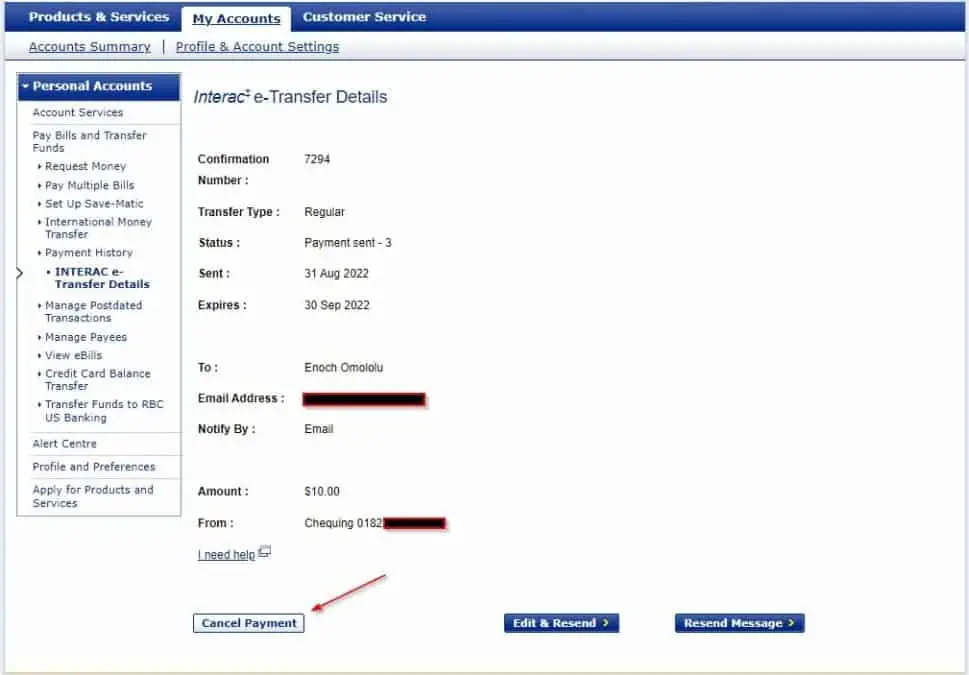

Step 4: Click on “Cancel Payment”

On the next screen, you will find the details of your Interac e-Transfer transaction.

Select “Cancel Payment” to proceed. You can also choose to edit the recipient’s details on this page (more on this later).

If the recipient has already received the transfer, you won’t see the “Cancel Payment” option.

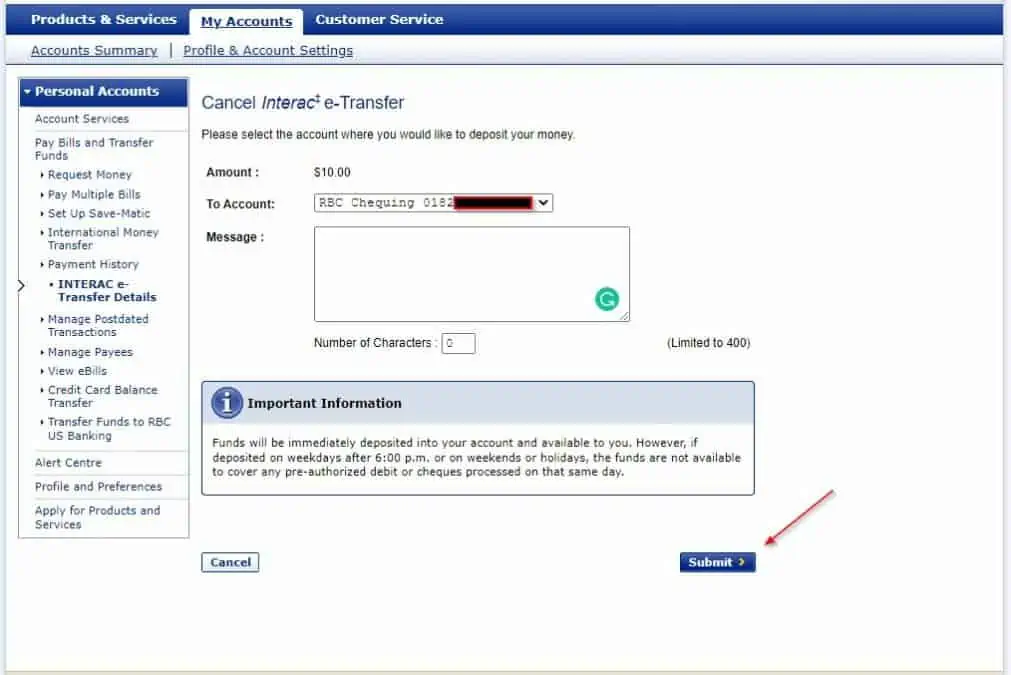

Step 5: Choose a Deposit Account

On the next screen, choose the RBC bank account you want to deposit your money in. This can be any of the RBC chequing or savings accounts on your profile.

While there is a box to add a massage, this is not important.

Proceed by clicking on the “Submit” button, and your transfer will be cancelled.

The funds will be deposited in your account right away. If your e-Transfer is cancelled after 6pm on a weekday or on a weekend or holiday, you may not be able to withdraw the money until the next business day.

These steps also work for RBC business bank accounts.

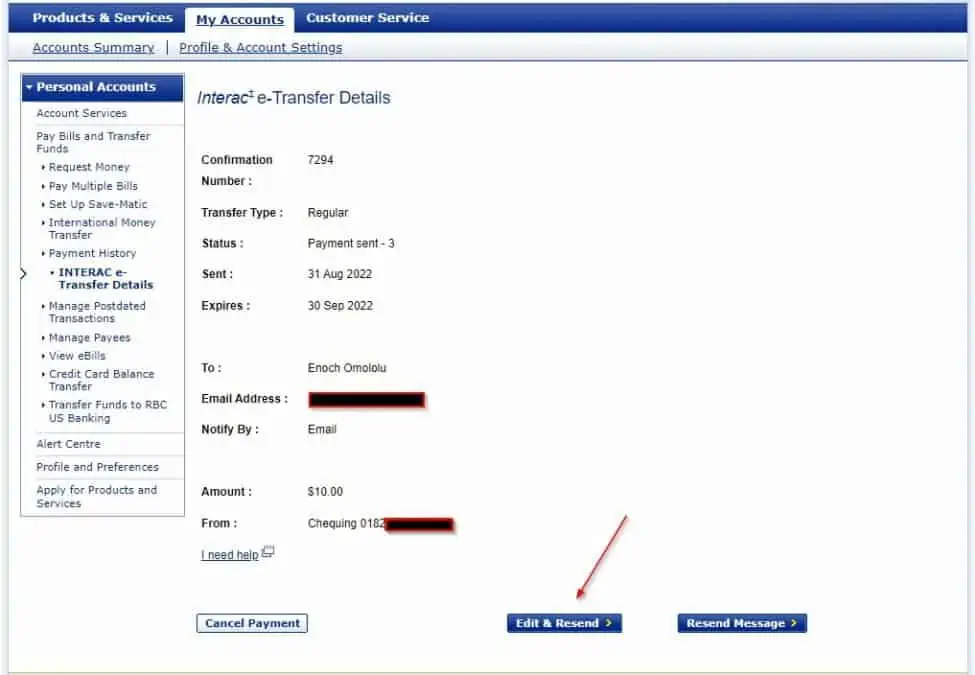

How To Resend or Edit An RBC Interac e-Transfer

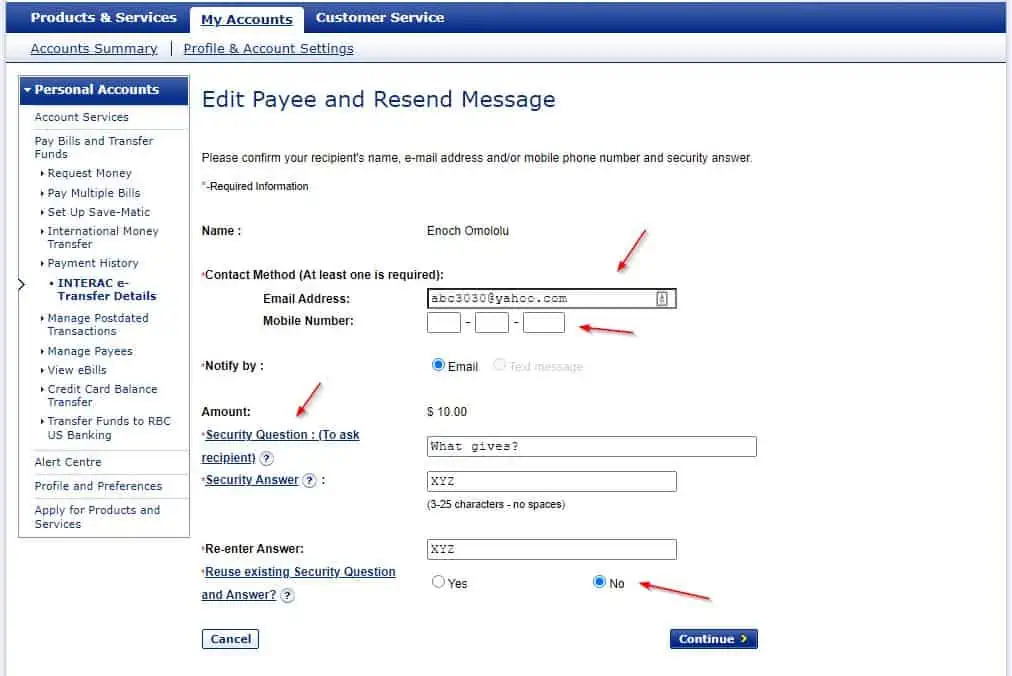

You may want to edit and resend an Interac e-Transfer on RBC if you have entered the wrong recipient information, such as email address, phone number, or security question.

Going back to step 4 above, click on “Edit & Resend” instead of “Cancel Payment.”

On the next screen, you can modify and update the email address and phone number of the receiver. The security question and answer you set can also be edited.

You will need to select the radio button for “No” under “Reuse existing Security Question and Answer?” to update this section.

Click on “Continue” to save and resend your e-Transfer.

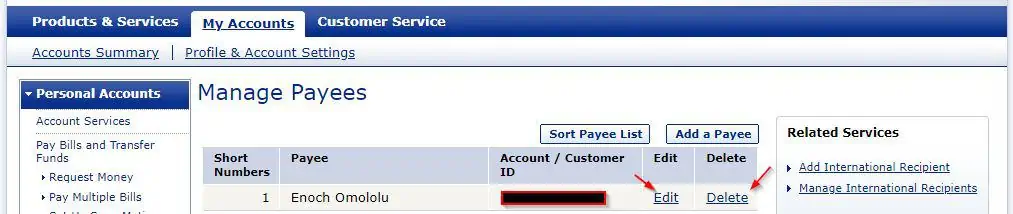

How To Edit or Delete e-Transfer Contacts in RBC

If you are sending a one-time Interac e-Transfer to a recipient, you may want to delete their contact details from your list of payees. This way, you won’t mistakenly send them money in the future.

You can also choose to edit a contact and update their name, email address or phone number.

To edit or delete e-Transfer contacts on RBC, sign in to Online Banking and click on Payment History”.

On the left-hand side of the screen, select “Manage Payees” from the menu items.

Click on “Edit” to update a contact’s information or “Delete” to delete them entirely.

If you are on the RBC Mobile App, you can edit or delete an e-transfer contact by following these steps:

- Click on “More” in the menu section at the button on the screen.

- Select “Settings”

- Click on “Manage Payees”

- Select the “Recipients” tab

- Click on the e-Transfer contact and edit or delete as required

RBC Cancel e-Transfer Fee

RBC does not charge an e-Transfer cancellation fee.

Interac e-Transfers expire after 30 calendar days. If you are reclaiming an Interac e-Transfer after it expires, you have up to 15 days to reclaim and deposit the funds back into your account.

If you do not reclaim an expired e-Transfer within 15 days, a $5 fee is charged.

To reclaim an e-Transfer, simply visit your payment history, select the appropriate Interac e-Transfer, and click on “Cancel Payment” as discussed previously.

Related reading:

- Best RBC Credit Cards

- RBC Direct Investing

- RBC Secured Credit Cards

- RBC Advantage Banking For Students Review

FAQs

No, an Interac e-Transfer sent to a recipient who has enabled auto-deposit cannot be cancelled.

When you can cancel an RBC Interac e-Transfer, it should occur immediately, and funds are deposited back into your bank account.