Update: Twitter stock is no longer publicly traded after it was purchased by Elon Musk, Tesla’s CEO, in 2022. If you owned Twitter stock, you will have already received a payout.

Investors who want to know how to buy Twitter shares in Canada must consider a couple of things before investing in the company, which includes evaluating if Twitter is a good buy now.

Twitter is a unique social media platform that offers users a real-time view of what is happening in the world.

Twitter was founded in 2006 by Jack Dorsey, Noah Glass, Biz Stone, and Evan Williams.

The company has since grown to be one of the largest social media platforms in the world, with over 200 million monthly active users.

It has been in the news quite a lot recently after billionaire and Tesla founder Elon Musk announced that he would be taking the company private at $54.20 per share in April 2022.

Since then, this deal has been surrounded by multiple controversies, with Musk at one time backing out of the deal while accusing the company of underreporting the bots on its platform.

Nonetheless, if you have made up your mind to invest in Twitter and want to know how to buy Twitter stock directly, in this article, we will provide a step-by-step explanation of how to buy Twitter shares in Canada.

Moreover, we will also shed light on how you can buy or sell Twitter stock for the best price.

How To Buy Twitter (TWTR) Stock in Canada

Here are the main steps you will have to take if you want to buy Twitter stock now:

- Open an online brokerage account

- Fund your brokerage account

- Research your stock pick, i.e. Twitter’s performance

- Confirm your investment amount

- Search for TWTR

- Place an order for Twitter stock

- Review your Twitter stock investment

We have explained these steps further in detail so you can understand how to buy Twitter stock directly:

Step 1: Open an Online Brokerage Account

When it comes to choosing the right online broker in Canada, you must evaluate them on nine key parameters to make the best decision for your individual needs.

- Regulation: All brokers in Canada must be regulated by either the Investment Industry Regulatory Organization of Canada (IIROC) or the Canadian Securities Administrators (CSA). IIROC-regulated brokers must meet higher capital requirements than CSA-regulated brokers, so this is an important factor to consider.

- Account Minimums: Some brokers require a higher minimum deposit to open an account than others. Make sure to compare account minimums before deciding on a broker.

- Fees: Brokers typically charge fees for services such as account maintenance, trading commissions, and inactivity fees. Be sure to compare the fees charged by different brokers in order to find the most affordable option.

- Investment products: Some brokers offer a more limited selection of investment products than others. If you have a specific investment in mind, like US-listed stocks or particular ETFs, make sure that the broker you choose offers that product.

- Research and Tools: Different brokers offer different levels of research and tools. If you plan to do your own research, you may not need as much from your broker in this area. However, if you want your broker to provide you with research and tools, be sure to compare the offerings of different brokers.

- Customer Service: The level of customer service offered by different brokers can vary significantly. If you need frequent or extensive customer service, be sure to choose a broker that offers the level of service you require.

- Ease of use: Some brokers’ platforms and websites are more user-friendly than others. If you’re not comfortable using complex platforms, look for a broker that offers a more simple interface.

- Reputation: It’s important to choose a broker with a good reputation. Read online reviews like the ones we have written on Questrade and Wealthsimple Trade Plus to compare different brokers before making your final decision.

- Investment accounts offered: Before you purchase Twitter stock with your online brokerage account, you should also check to see if your broker provides Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs).

TFSAs and RRSPs are both government-sponsored programs that offer tax breaks to Canadian investors.

TFSAs allow you to earn tax-free investment income, while RRSPs will enable you to deduct your contributions from your taxable income.

If your broker offers both TFSAs and RRSPs, you’ll need to decide which one is right for you.

If you’re looking for long-term growth, RRSPs may be the better choice. However, if you need access to your money sooner, TFSAs may be the better option.

Once you’ve decided which account is right for you, you can start the process of opening a brokerage account.

To do so, you’ll need to provide some personal information, as well as information about your financial goals. After your account is open, you can proceed to the next step, which involves funding it by making deposits or transfers from your bank account.

Questrade

Trade stocks, ETFs, options, FX, bonds, CFDs, mutual funds, etc.

Get $50 trade credit with $1,000 funding

Low and competitive trading fees

No quarterly inactivity fees

Access to advanced tools and trading data

Top platform for advanced traders

Transfer fees waived

Wealthsimple Trade

Trade stocks, ETFs, and options

Excellent trading platform for beginners

Deposit $150+ to get a $25 cash bonus

Transfer fees waived up to $150

Step 2: Fund Your Brokerage Account

In Canada, you can fund your online brokerage account using multiple methods. Some of the most common ones are:

Interac Online: With Interac Online, you can use your online banking to make a secure, real-time payment from your chequing account to your brokerage account. All you need is the email address or mobile number of the recipient, and you’re set.

Electronic Funds Transfer (EFT): An EFT is an electronic transfer of funds from your bank account to your brokerage account. To set up an EFT, you’ll need to provide your broker with your bank’s transit number, your bank account number and a void cheque or a copy of a recent bank statement.

Wire transfer: A wire transfer is an electronic transfer of funds from one financial institution to another. To set up a wire transfer, you’ll need to provide your broker with your bank’s transit number, your bank account number, the name of the bank and its address, as well as the SWIFT code (if it’s an international wire transfer).

A certified cheque or bank draft: A certified cheque or bank draft is a cheque that’s been “certified” by your bank as being good for payment. To deposit a certified cheque or bank draft into your brokerage account, simply mail it to your broker (make sure you include your account number on the cheque).

Pre-authorized deposit/debits (PAD): With a PAD, you can set up automatic, regular deposits from your bank account to your brokerage account. To set up a PAD, you’ll need to provide your broker with a completed PAD agreement, which you can get from your bank.

Transferring existing investments: If you have investments held at another financial institution, you can transfer them to your brokerage account. To do this, you’ll need to contact the other financial institution to request a transfer form. Once you have the form, you’ll need to complete it and send it to your broker.

Step 3: Research Twitter Stock Performance

You can research Twitter’s stock performance by looking at its stock price history and financial reports. Twitter’s stock price history can give you an idea of how the stock has performed over time. You can also look at Twitter’s financial reports to see how the company is doing financially.

To find Twitter’s stock price history, you can go to Google and type “TWTR Stock,” and a simple real-time price chart will appear at the top of your search results. In addition, you can visit Twitter’s investor relations website to find the company’s financial reports.

After looking at Twitter’s financial reports, you can also read a few research reports on the stock or evaluate it based on a few key metrics, which is called doing ‘fundamental analysis.’ This will help you remove doubts such as “should I buy Twitter stock?”

The goal of fundamental analysis is to determine a security’s intrinsic value, which is the true underlying value of the security and not the market value.

There are many different ratios that can be used in fundamental analysis, but some of the most common are the price-to-earnings (P/E) ratio, the price-to-sales (P/S) ratio, and the price-to-book (P/B) ratio.

The P/E ratio is a measure of how much investors are willing to pay for each dollar of a company’s earnings.

The P/S ratio is a measure of a company’s sales relative to its stock price, and the P/B ratio is a measure of a company’s book value relative to its stock price.

Step 4: Confirm Your Investment Amount

After researching Twitter’s stock, you will get to know is Twitter a good buy now, and then you can proceed to buy the stock.

But before you purchase Twitter shares, there are a few key factors to consider in order to determine how much money you should spend.

The first is the current market value of Twitter shares. As of writing this, 1 Twitter share is worth around $51 USD.

However, this value is constantly changing, so it’s important to keep up to date on the latest price.

Another key factor to consider is your financial situation. How much money do you have to comfortably spend on Twitter shares without putting yourself in a difficult financial position?

Once you have considered these key factors, you can begin to think about how many Twitter shares you would like to purchase.

Fortunately, with fractional shares, you don’t even have to purchase an entire share of Twitter stock.

New-age brokerage platforms like Wealthsimple Trade allow you to buy a fraction – ½, ¼ or any other fraction- of a share.

This means you can spend as little or as much money as you want on Twitter shares without worrying about breaking the bank.

So, if you’re not sure how many Twitter shares to purchase, fractional shares are a great option.

Step 5: Search For Twitter

Looking for Twitter stock on your online brokerage account in Canada? Here’s how to find it in simple steps:

1. Log in to your online brokerage account.

2. Go to the “Quotes” or “Stock Quotes” page.

3. In the search bar, type in either the company name “Twitter” or its ticker “TWTR” and hit enter.

4. To ensure that you don’t find another company with a similar name by mistake, make sure the search results include Twitter’s stock ticker symbol, TWTR.

5. Click on TWTR to view the stock quote page for Twitter.

6. From here, you can choose to buy or sell Twitter stock.

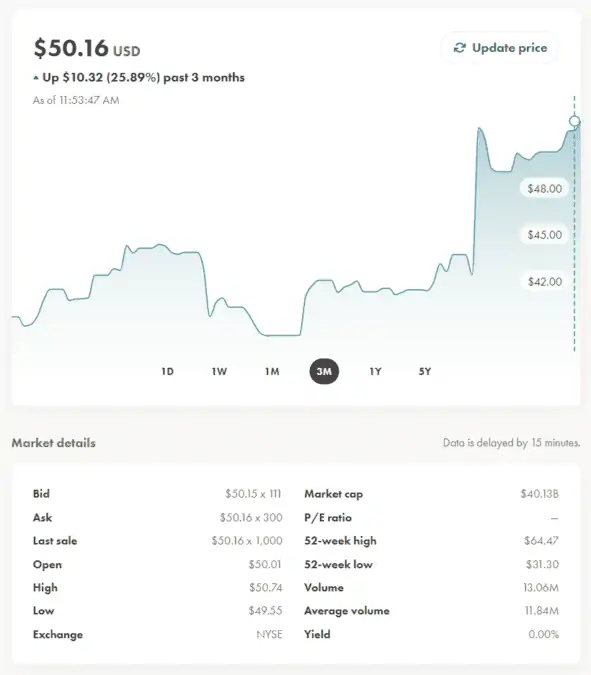

On Wealthsimple Trade, here is what Twitter’s stock page looks like:

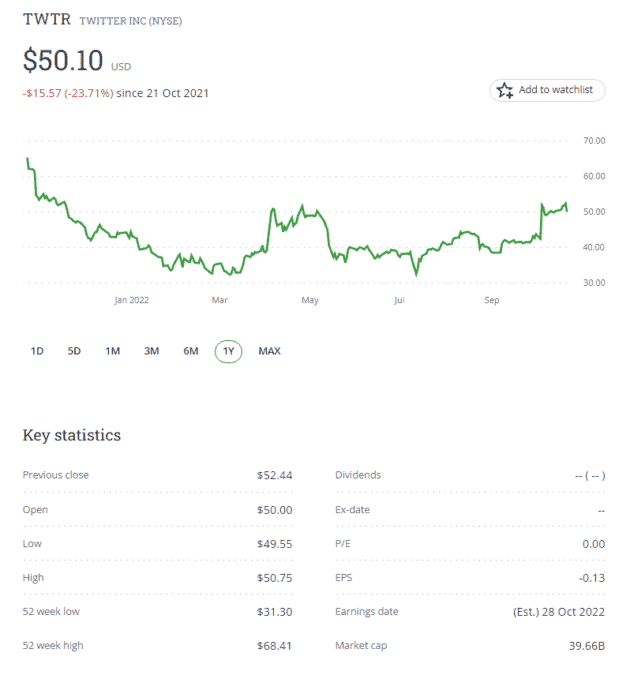

This will be the page that will open on Questrade when you search for TWTR:

Step 6: Place an Order for Twitter Stock

If you’re looking to buy Twitter stock, you have a few options.

You can use a limit order, which means you set a maximum price you’re willing to pay for the shares. Your order will only be executed if the stock price is at or below your limit price.

Alternatively, you can use a market order, which means you’ll buy the shares at the current market price. Keep in mind that market prices can fluctuate rapidly, so there’s a risk you could end up paying more than you wanted to.

Once you’ve found Twitter’s stock on your online brokerage account, you can enter the number of shares you want to buy and select either a limit or market order.

If you’re using a limit order, you’ll also need to enter the maximum price you’re willing to pay.

Once you’ve placed your order, it will be executed when the stock price reaches your limit (if using a limit order) or immediately (if using a market order).

Step 7: Review Your Twitter Investments

When you purchase Twitter stock, you must monitor the stock regularly to ensure that it is performing well. This means looking at the stock price, company financials, and news about the company.

If the stock price is falling, you may want to sell to avoid losing money. If the company releases poor financials, it may be a sign that the stock is not a good investment.

And if there is negative news about the company, it could impact the stock price. By monitoring the stock regularly, you can make sure that you are making a wise investment.

How To Sell Twitter Stock in Canada

Here’s how you can sell Twitter stock in Canada from your online brokerage account:

- Log in to your online brokerage account.

- Go to the “Trade” or “Orders” page.

- Enter “TWTR” in the ticker symbol field.

- Enter the number of shares you want to sell in the “Shares” field.

- Enter your desired “Sell” price in the “Price” field, or you can just go for a market sell order.

- Click on the “Preview” or “Submit” button to place your order.

- Review the details of your order and click on the “Confirm” button to complete the transaction.

Twitter Overview (NYSE:TWTR)

Twitter is a global social media company that operates a microblogging platform with the same name. It was founded back in 2006 by former CEO and current Block CEO Jack Dorsey and is headquartered out of San Francisco, California.

While the platform has about 400 million global users, it pales in comparison to the size of other social media sites like Facebook, YouTube, and Instagram.

While Twitter has attempted to both diversify and monetize the platform over the years, the results have been elusive. Like most social media platforms, Twitter sees most of its revenues from digital advertising on users’ feeds.

There are some premium account subscriptions, but as of now, these have had little fanfare. The company has added features like Twitter Spaces, NFT Profile Pictures, and even tipping with either fiat currency or cryptocurrencies for users with a high amount of followers.

The company has recently been involved in a high-profile acquisition attempt by Tesla CEO Elon Musk. After the number of bot accounts was not accurately disclosed, Musk tried to back out of the takeover bid.

The matter was initially scheduled to be heard at trial later this year; however, Musk now appears to be going ahead with the acquisition. Musk had previously vowed to clean up the bot accounts on the platform while also looking into ways of monetizing the app.

Should I Buy Twitter Stock Now?

If you’re thinking about buying Twitter stock, you’re probably wondering if now is the right time.

Unfortunately, there’s no easy answer to that question. It depends on several factors, including your investment goals and risk tolerance.

That said, Twitter is a strong company with a lot of potential.

It’s one of the most popular social media platforms, with millions of monthly active users. And its annual revenue has also grown yearly for the past five years.

However, with Elon Musk’s proposed acquisition of the company impending, it is hard to gauge how long Twitter will remain a publicly traded company.

If you’re considering buying Twitter stock, do your research and weigh your options carefully. Ultimately, it’s up to you to decide whether or not you think it’s a good investment.

FAQs

Twitter’s stock is not available for purchase on any Canadian stock exchanges. This is because Twitter is not a Canadian company; it is a United States-based company. As such, its stock is only available for purchase on American stock exchanges.

However, some online brokers in Canada do allow their clients to deposit US dollars. This can save you the conversion fee that would otherwise be incurred when converting Canadian dollars to US dollars. When using one of these brokers, you will still need to purchase Twitter’s stock on an American stock exchange.

In our opinion, the cheapest way you can buy Twitter stock in Canada is by purchasing it on commission-free brokerage platforms like Wealthsimple Trade.

Here are a few reasons to buy Twitter stock now:

1. Twitter is a powerful communications platform with a global reach.

2. Twitter is a necessary tool for many news organizations and journalists.

3. Twitter is an important platform for marketing and advertising.

4. Twitter has a strong base of loyal users.

5. Twitter is a unique source of real-time information.

6. Twitter is a large publicly traded company with a market capitalization of over $35 billion.

7. Twitter has a strong balance sheet cash reserves of over $2.6 billion.

8. Twitter has a new CEO who is focused on turning the company around.

Here are a few reasons why you might want to think twice before investing in Twitter:

1. Twitter is losing users: In the past few years, Twitter has been hemorrhaging users. This is a worrying trend for investors as it indicates that people are losing interest in the platform.

2. Twitter is a money-losing company: Despite being one of the most popular social media platforms in the world, Twitter has never been consistently profitable.

3. Other social media platforms are overshadowing Twitter: In recent years, Twitter has been overshadowed by other social media platforms such as Snapchat and Instagram.

4. Twitter is facing regulatory scrutiny: Twitter is currently facing regulatory scrutiny from the US government and other countries due to how it influences public opinions, especially during elections.

5. Elon Musk is taking Twitter private: Elon Musk, the founder of Tesla and SpaceX, has announced that he is taking Twitter private. This is a major concern for investors as it could lead to the platform being delisted from the stock exchange.

Twitter’s stock is not listed on the Toronto Stock Exchange (TSX). The TSX is a stock exchange that is focused on Canadian companies. Twitter is a US-based company, and its stock is listed on the New York Stock Exchange (NYSE).

Related: