Looking to invest in ETFs? This guide covers how to buy ETFs in Canada by following a few steps.

Exchange-Trade Funds (ETFs) make it easy to invest in the stock markets if you are a beginner.

Instead of worrying about picking individual stocks, bonds, commodities, and other financial products, ETFs provide exposure to thousands of these assets in a single fund.

How To Buy ETFs in Canada

The principal way to buy an ETF in Canada is to use a self-directed brokerage account.

With this option, you can retain full control of your investment portfolio and choose which ETFs you are buying or selling at any time.

You can also invest in ETFs using a robo-advisor. These online wealth management companies buy and sell ETFs on your behalf based on your risk tolerance and investment objectives.

Lastly, you can invest in ETFs by using a financial advisor.

How To Buy ETFs in Canada Using a Brokerage Account

Follow these steps to buy and sell Canadian ETFs.

Step 1: Open a Brokerage Account

You need a discount brokerage account to buy ETFs for your portfolio.

While there are many of them to choose from, I have compiled a list of the best trading platforms in Canada to save on fees and get the best value.

For this guide, I will focus on the top two – Questrade and Wealthsimple Trade.

When opening your brokerage account, you will need to choose an account type.

Broadly speaking, there are registered and non-registered accounts. A registered investment account offers tax advantages, and gains are either tax-free or tax-deferred.

Popular registered accounts include:

- Tax-free savings account (TFSA)

- Registered retirement savings plan (RRSP)

- Registered education savings plan (RESP)

- Registered retirement income fund (RRIF)

Non-registered investment accounts are also referred to as ‘taxable’ accounts.

You can learn about the investment account options available in Canada and how registered vs non-registered accounts compare.

The brokerage will ask you to provide basic personal and employment information, some financial numbers (assets and liabilities), and a summary of your financial/investment knowledge.

Best Brokerages in Canada

Wealthsimple

Questrade

Qtrade

$25 sign up cash bonus with $150+ deposit

$50 trading fee rebate

Up to $150 signup bonus

$0 trading commission for stock and ETF trades

$0 ETF purchases; $4.95-$9.95 for stock trades

100+ free ETFs; $6.95-$8.75 for ETF/stock trades

Available on all devices and great for beginners

Offers other securities incl. FX and bonds

Excellent customer support

After the account is open, you will need to fund it with Canadian dollars.

If you plan on making USD-denominated trades, you could also deposit USD dollars if the brokerage supports it. This can help you save on FX conversion tees.

Step 2: Create an Investment Plan

When you buy a mutual fund or invest in ETFs using a robo-advisor or financial advisor, they invest your money in a portfolio that matches your risk profile.

If you are buying ETFs via a self-directed brokerage account, it is up to you to choose which ETFs you buy and in what proportion.

For example, if you have an average risk tolerance and have a plan to hold your investments for the long term, say 10, 15, 20 years or longer, you may decide on a balanced portfolio.

A balanced portfolio is typically made up of 60% stocks and 40% bonds.

If you have a higher-than-average risk tolerance and a similar investment timeframe, you could choose a growth portfolio that is up to 100% stocks.

Your preferred asset allocation will determine which ETFs you buy and how much.

All-in-one ETFs have made it easier to design investment portfolios without needing to buy a bunch of them.

To summarize, when creating your investment plan, consider the following:

Risk tolerance: How much portfolio volatility and losses can you tolerate before ditching your investment plan?

Time horizon: How long can you hold your investments before needing the funds? The longer your investment time horizon, the more aggressive you can be with holding risky assets.

Age is also a factor here. If you are close to retirement age, your time horizon is ‘short-term’ by default.

Investment objectives: Are you trying to preserve your capital or aiming to grow your portfolio (howbeit with some downside risks)?

Step 3: Research ETFs To Buy

There are thousands of ETFs available worldwide. Since you won’t be buying them all (and shouldn’t), you need to research which ones to buy.

You could choose an ETF based on the type:

- Equity (stock) ETF

- Bond (Fixed Income) ETF

- Commodity ETF

- Currency ETF

- Factor ETF

- Real Estate ETF

- Sector ETF

- Sustainable (SRI) ETF

You can choose ETFs based on country, strategy, theme, provider, and more.

Here’s an ETF guide on the various types and a list of some of the best Canadian ETFs.

When choosing an ETF, you should also look at its:

Fees: The Management Expense Ratio (MER) you pay on an ETF will cut into your returns. While ETFs are often cheaper than mutual funds, you may be able to find identical ETFs with lower fees.

Performance: Although past performance does not guarantee future results, it makes sense to check how the ETF has performed in the past and compare its returns with similar ETFs. Also, see how it compares with its benchmark index.

Step 4: Buy the ETFs

You can now place a trade for the ETFs you want to buy. There are different order types with these common ones:

Market order: Buy or sell an ETF immediately at the current best market price.

Limit order: Buy or sell an ETF at a specific price or better (i.e. lower for “buy” or higher for “sell”).

Stop order: Buy or sell an ETF when a stop price has been breached.

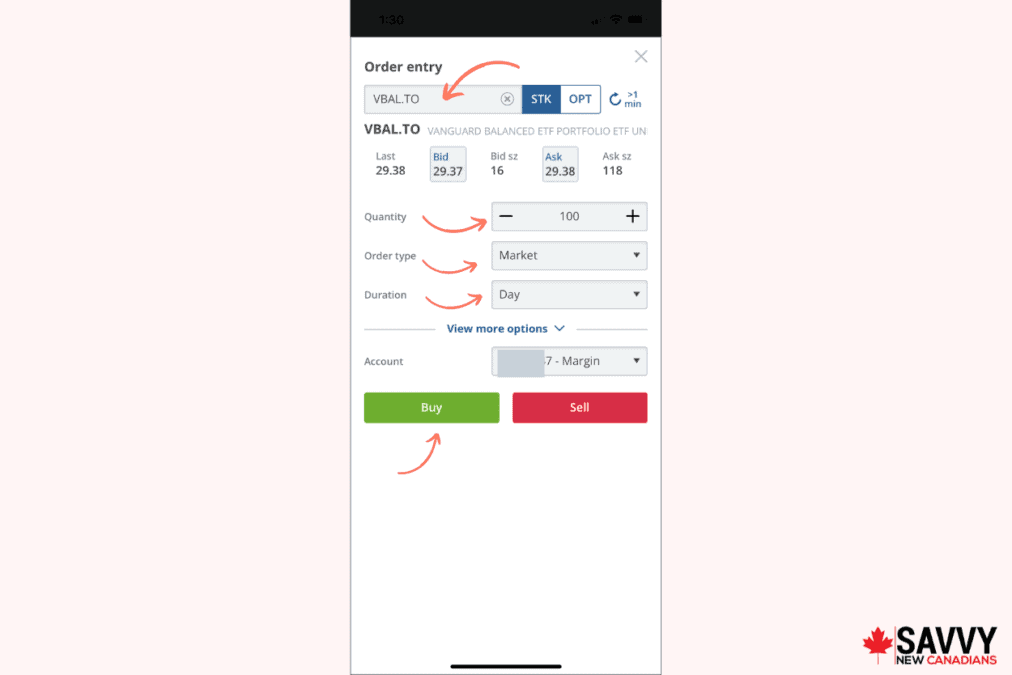

How To Buy ETFs on Questrade

Follow these steps to buy ETFs on Questrade.

- Click on Buy/Sell to open the order entry screen

- Search for the ETF by typing the name or ticker symbol

- Enter the trading details, including quantity, order type (Market), and duration

- Click on the “Buy” button to review and place your ETF order

Here’s a more detailed guide on how to use Questrade.

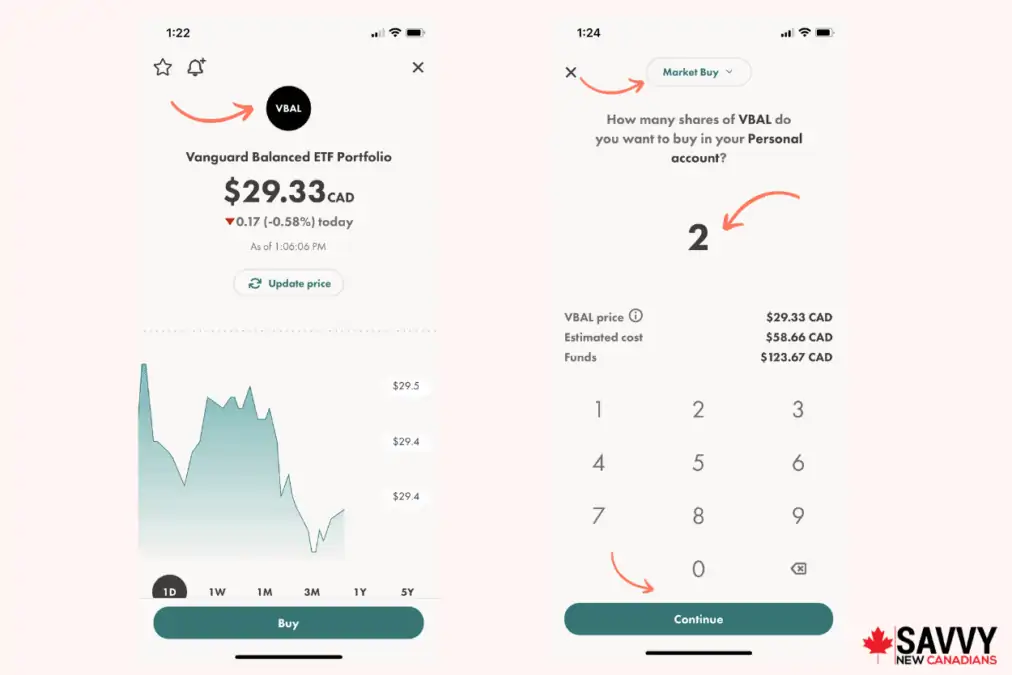

How To Buy ETFs on Wealthsimple Trade

Follow these steps to buy ETFs on Wealthsimple Trade:

- Search for the ETF you want to buy using its ticker symbol in the search bar (e.g. VBAL).

- Click on the “Buy” button

- Select the order type (default is “Market Buy”) and enter how many units of ETF you want to buy.

- Click on “Continue” to confirm the number of shares and amount and place your order.

Step 5: Stick To Your Plan

The best investment plan involves “buying” and “holding”. Invest with a long-term timeframe and avoid trying to time the market.

You will want to revisit your portfolio 1 to 2 times a year to rebalance asset allocations if they are off-track. If using an all-in-one ETF, there may be no need to rebalance.

Consider investing on a regular schedule regardless of how the stock market is performing and even if you are only investing small amounts. This is referred to as “dollar-cost averaging”.

What To Look For When Choosing a Brokerage

There are several online brokers in Canada. You can narrow down your options using these factors:

Trading commissions: Questrade and Wealthsimple Trade offer no-commission ETF trades (only buy-side for Questrade). On some other trading platforms, you pay up to $9.95 to buy or sell ETFs. These fees add up over time and dampen your investment returns.

Account fees: In addition to trading commissions, i.e. whether they have other fees for account maintenance (inactivity fees), transfer fees, etc.

Account minimum: How much money do you need to start trading? Most brokers have no minimum, or you may need to fund with $1,000.

Investment types: Confirm that the broker offers the investment product you want to invest in, such as stocks and ETFs.

Trading tools: You need access to market data, price alerts, watchlists, charting tools, multiple order types, technical indicators, and more. If you are a beginner, basic trading tools are adequate. When you start placing advanced trades, your trading needs may change.

Trading platforms: Ideally, you want access to both desktop and mobile platforms so you can trade while on the go.

Security: The brokerage should be a member of CIPF and IIROC, and it should have industry-standard security measures in place to protect your account.

Promotions: If you are opening a new account, you may as well take advantage of available promotional offers. For example, for Questrade, you get $50 in free credit when you deposit $1,000 in your new account.

How To Buy ETFs in Canada Using a Robo-Advisor

A robo-advisor is an online wealth management platform that automatically invests your money using algorithms and ETFs.

When you first sign up for a robo-advisor account, you are required to complete an investor questionnaire. This is used to determine your risk tolerance and investment objectives.

The robo-advisor then recommends a portfolio that matches your risk profile.

When you fund your account, they buy ETFs on your behalf, and you can set up automatic contributions.

Like a brokerage account, you choose whether you want to open a registered (such as TFSA, RRSP, or RESP) or non-registered account.

Unlike a brokerage trading account, you don’t choose the individual ETFs in your portfolio.

Robo-advisor charge a fee for managing your portfolio (0.25% to 0.70%), and their benefits include:

Automatic rebalancing: Your portfolio’s asset allocation is kept on track automatically

Financial advice: If you have a question about your investments, you can give them a call.

Automatic investing: You can set up pre-authorized contributions and make your investing 100% hands-free. For a self-directed brokerage account, you need to log in to your account and manually place a trade. Also, they do research on what ETFs to buy.

Tax-loss harvesting: A robo-advisor can help you save on taxes using tax-loss harvesting.

Top robo-advisor choices in Canada:

Questwealth Portfolios

This is the robo-advisor service offered by Questrade.

Questwealth’s management fee ranges between 0.20% and 0.25%, depending on your account size. It offers a conservative, income, balanced, growth, aggressive, and SRI investment portfolio.

Open an account here and get up to $10,000 managed free for 1 year.

Wealthsimple Invest

This is Canada’s most popular robo-advisor. Its management fee ranges from 0.40% to 0.50%, depending on your account size.

Wealthsimple offers conservative, balanced, growth, Halal, and socially responsible investment (SRI) portfolios.

Open an account here and get a $25 cash bonus when you fund with $500 or more.

Exchange Traded Funds Explained

An ETF is a ‘basket’ or ‘pool’ of investment products such as stocks, bonds, or commodities.

They can be purchased using a brokerage account as you would with stock, and their prices fluctuate throughout a trading day.

The value of an ETF is determined by the price performance of its underlying assets (i.e stocks or bonds), and they are usually passively managed.

Most ETFs aim to replicate the returns of a benchmark index.

When you buy an ETF, you get the benefit of diversification, liquidity, and lower management fees compared to mutual funds (more on this later).

ETFs vs. Mutual Funds

Both ETFs and mutual funds hold a ‘basket’ of investments such as stocks or bonds. They are managed by professionals and offer portfolio diversification.

Here’s how ETFs differ from mutual funds:

- ETFs trade all day like stocks

- ETFs are usually passively managed, and their returns are expected to mirror that of a benchmark index such as the S&P 500

- ETFs have lower expense ratios

- They are more tax-efficient than mutual funds

ETFs vs. Stocks

An equity ETF usually holds thousands of stocks.

Instead of buying individual stocks and concentrating your portfolio on a few assets (risky!), one ETF can provide exposure to 10,000+ stocks across various sectors of the economy and geographical locations.

It can also be cheaper to buy an ETF since you only pay trading commissions (if applicable) for one ETF (or a few) as opposed to buying hundreds of individual stocks.

Both stocks and ETFs are listed on stock exchanges, such as the Toronto Stock Exchange (TSX), and you can buy them using a trading account.

Pros and Cons of ETFs

The advantages of ETFs are:

- Lower fees compared to mutual funds

- Offer in-built portfolio diversification

- Lower transaction fees compared to buying individual stocks

- All-in-one ETFs make for hassle-free investing

- Trade throughout the day like stocks

- Easier for beginners to build a solid portfolio

- You can invest in specific niches or themes

The disadvantages of ETFs are:

- Some ETFs have high expense ratios

- An ETF may not have the same returns as its underlying index. This is referred to as “tracking error.”

- If your broker changes trading commissions, these fees can add up over time

- You may need to manually rebalance your portfolio

How To Buy ETFs FAQs

You can buy ETFs directly by using a brokerage account like Wealthsimple Trade or Questrade.

Yes, ETFs are great for beginners because they provide portfolio diversification and are easy to buy using a trading account or robo-advisor.

To sell an ETF, log in to your account and place a “sell” order for the amount of ETF you own and want to sell. You can place a market or limit order.

Yes, you can buy US and other foreign-listed stocks in Canada using a discount brokerage account.

Yes, some ETFs pay dividends. Here are some dividend-paying ETFs.

Related: