Have you ever booked tickets or have been on a flight that was delayed, causing you to arrive at your destination hours later than you were supposed to? You may have lost money, missed a connecting flight, or missed an important reservation.

You may think that there’s nothing you can do. But did you know that you are entitled to compensation if your flight was cancelled or delayed for more than 3 hours?

Not many people know this, as airlines don’t tell you about it. With this guide, you’ll learn everything there is to know about flight delay compensation in Canada, including which airlines give you compensation, how much you can receive, how to make a claim, and my personal experience with airline cancellation compensation.

Overview of Flight Delay Compensation in Canada

You are entitled to flight delay or cancellation compensation from Canadian airlines based on a few factors outlined below.

Airlines must provide you with some form of compensation if:

- Your flight is cancelled or delayed for 3 hours or more, and

- If the disruption is within their control and not related to safety issues, and

- If you were notified of the disruption within 14 days or less.

The airline must provide compensation based on your arrival time at the final destination on your flight ticket.

For Large Airlines

According to Air Passenger Protection Regulations, large airlines are defined as those who have carried more than 2 million passengers within each of the past two years. Air Canada and WestJet are two examples of large airlines.

If your flight has been delayed for:

- 3 to 6 hours, you will receive $400 in compensation

- 6 to 9 hours, you will receive $700 in compensation

- 9 hours or more, you will receive $1000 in compensation

For Small Airlines

Small airlines are those that have carried less than 2 million passengers per year for the past 2 years. Some examples of small airlines are Flair and Swoop.

If your flight has been delayed for:

- 3 to 6 hours, you will receive $125 in compensation

- 6 to 9 hours, you will receive $250 in compensation

- 9 hours or more, you will receive $500 in compensation

If you believe you are entitled to flight delay or cancellation compensation, you must make a claim in writing within one year of the disruption. All airlines have 30 days to provide compensation or tell you why they believe compensation is not required.

If they do not respond within 30 days or you do not agree with their response, you can submit a complaint to the Canadian Transportation Agency, and they will act as a mediator between you and the airline.

Compensation must be in Canadian dollars (via cash, cheque, or bank deposit).

Airlines may also offer other forms of compensation, like vouchers or rebates. These must be of a higher value than the compensation required and cannot expire.

When providing compensation, the airline must tell you the amount owed and the value of any other compensation they offer. You can choose between other forms of compensation or the monetary amount. If you choose vouchers, rebates, etc., you must confirm that you know monetary compensation was offered.

If you are travelling internationally and your flight was delayed, you may also be entitled to receive additional compensation for any damages or expenses because of the day. You can make a claim in writing under the Montreal or Warsaw Conventions.

Other Requirements From the Airline

If your flight is cancelled or delayed by more than 3 hours, the airline must be communicative and provide reasonable arrangements for passengers. Some arrangements airlines must provide include:

- Communicate key information, including the reason for the delay or cancellation.

- During delays, they must provide updates every 30 minutes until a new flight arrangement or departure time is confirmed.

- If passengers were informed of the disruption less than 12 hours before the original departure time and have waited at least 2 hours, passengers must be provided food and drink, access to means of communication, and overnight accommodation if necessary (all free of charge).

Airlines must ensure that passengers with flight disruptions get to their final destination, either on the original flight or through alternate arrangements.

When a flight is cancelled or delayed for 3 hours or more, airlines must rebook passengers on the next available flight operated by the same airline or an alternate airline.

The new flight must depart within 48 hours of the original departure time and be a reasonable route from the same airport to the passenger’s destination.

Passengers have the right to accept the new booking or refuse the new arrangements and receive a refund.

View the complete guide on flight delays and cancellations from the CTA to see what you’re entitled to.

Major Airlines Offering Flight Cancellation Compensation

Canadian airlines must provide compensation for flights delayed over 3 hours or cancelled entirely as long as the disruption is within their control. Here are a few major Canadian airlines offering flight delay and cancellation compensation.

Click on the link to visit their website, learn more, and submit a claim through their online form.

How To Make a Claim For Compensation

No matter which airline you are flying with, you have one year from the date of the delay or cancellation to submit a compensation claim. Airlines have 30 days to respond by either providing compensation or telling you why they believe compensation is not required.

You can submit a claim on the airline’s website through their online form.

Here’s how to submit a claim for Air Canada flight cancellation compensation:

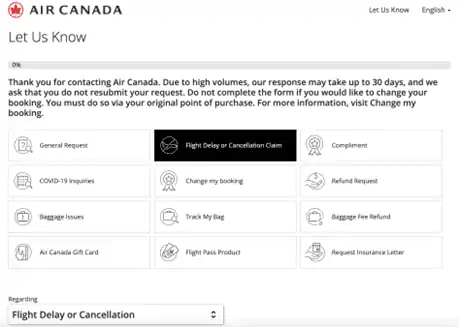

Visit their Contact Us page to complete an Air Canada flight delay compensation form. Select Flight Delay or Cancellation Claim.

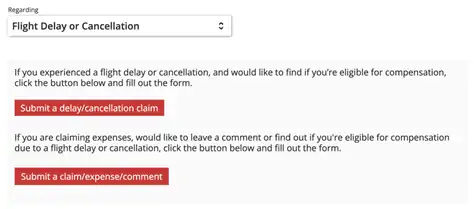

Then, click on the “Submit a delay or cancellation claim” button.

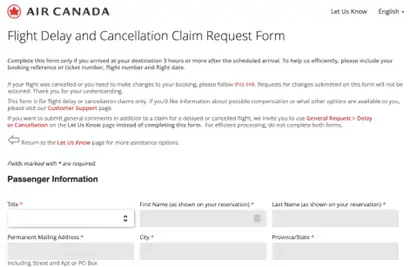

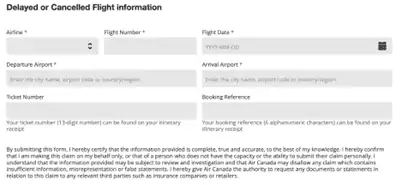

Next, fill out the Flight Delay and Cancellation Request Form with your passenger and delayed or cancelled flight information.

And that’s about it! They should get back to you within 30 days.

Credit Cards With Flight Cancellation Insurance

Here are a few travel credit cards that provide flight delay, interruption, and/or cancellation insurance.

Scotiabank Passport Visa Infinite Card

When you charge at least 75% of the full ticket cost to the Scotiabank Passport Visa Infinite Card, you are covered with flight delay insurance.

You’ll be eligible for reimbursement of necessary expenses, including meals, hotel accommodations, and other emergency items.

If the delayed flight or missed connection lasts 4 hours or more, you may be reimbursed up to $500 per insured person for necessary and reasonable living expenses.

Scotiabank Passport Visa Infinite Card

Best for no FX fees and travel perks

Annual fee: $150

Rewards: Earn 3x Scene+ points on eligible grocery purchases, 2x pts. on dining, entertainment and transit, and 1x pts. on everything else.

Welcome offer: Up to 40,000 bonus Scene+ points and no annual fee for the first year.

Interest rates: 20.99% for purchases, 22.99% for cash advances.

Minimum income requirement: $60,000

Recommended credit score:

Very Good

On Scotiabank’s website

The Platinum Card from American Express

When you charge the full cost of your travel arrangements and flight tickets to the Platinum Card from American Express, you’ll be covered with trip interruption and flight delay insurance.

Trip interruption insurance – get coverage of up to $2,500 per person, up to a maximum of $6,000 for the non-refundable and non-transferable unused portion of your travel arrangements if your trip is delayed or interrupted for a covered reason.

Flight delay insurance – get up to $1,000 in coverage for accommodation, restaurant purchases, and sundry items purchased within 48 hours when your flight is delayed for 4 hours or more and no alternate transportation is available.

American Express Platinum Card

Top credit card for VIP perks

Annual fee: $799 (and $250 annual fee for additional cards)

Rewards: Earn 2x Membership Rewards Points on dining and food delivery, 2x pts. on travel and 1x pts. on everything else.

Interest rates: Variable (charge card)

Minimum income requirement: N/A

Recommended credit score:

Very Good

On Amex’s website

Scotiabank Gold American Express Card

Use the Scotiabank Gold American Express Card to purchase at least 75% of the flight ticket cost, and you’ll be eligible for the reimbursement of hotel accommodations, meals, and other necessary items.

You can also be insured for up to $500 per insured person for necessary living expenses incurred if a flight is delayed more than 4 hours or if you miss your connecting flight.

Scotiabank Gold American Express Card

Best travel credit card in Canada

Annual fee: $120

Rewards: Earn up to 6x Scene+ points on groceries, 5x pts. on dining, food delivery, & entertainment, 3x pts. on gas, and 1x pts. on everything else.

Welcome offer: Get up to 40,000 bonus Scene+ points in the first 12 months.

Interest rates: 20.99% for purchases, 22.99% for cash advances.

Minimum income requirement: $12,000

Recommended credit score:

Good

On Scotiabank’s website

RBC Avion Visa Infinite Card

With the RBC Avion Visa Infinite Card, you are covered with emergency purchases & flight delay insurance.

Coverage begins 4 hours after your flight has been delayed, connection missed, or if you have been denied boarding.

Flight delay insurance – get up to $250 per occurence per covered person, up to a maximum of $500 for reasonable and necessary expenses.

Emergency purchases insurance – get up to $500 per occurence per covered person, up to a maximum of $2,500 for reasonable and necessary expenses.

BMO CashBack World Elite Mastercard

When you use the BMO CashBack World Elite Mastercard to purchase your flight tickets, you are covered with flight delay insurance. Get up to $500 in coverage per account, per trip, when your flight is delayed by more than 6 hours.

My Personal Experience With Flight Cancellation Compensation

Earlier this year, I booked a roundtrip flight from Brussels, Belgium, to Toronto, Canada. The flight arriving in Toronto went smoothly, but it was a different story on the way back to Brussels.

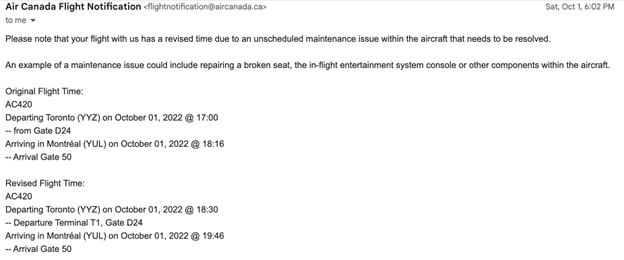

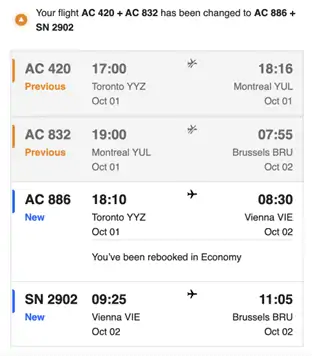

On October 1, 2022, I was scheduled to take a flight from Toronto to Montreal, then a connecting flight from Montreal to Brussels. There was a 45-minute layover between flights, which would have been okay if there had been no delays.

Here’s what happened:

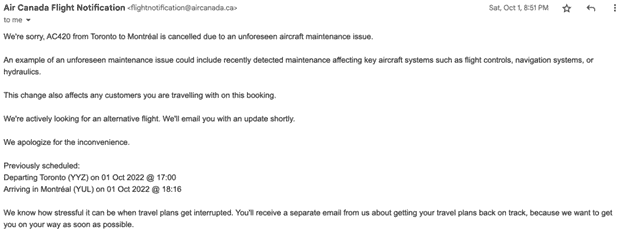

A few hours before arriving at the Toronto Pearson International Airport, I got a text and email that my flight from Toronto to Montreal was delayed by 1 hour 30 minutes (from 17:00 to 18:30) due to an unscheduled maintenance issue with the aircraft. This means I would have missed my connecting flight.

Not too long after, I got another message that it was further delayed and would be leaving Toronto at 19:00 and arriving in Montreal at 20:16.

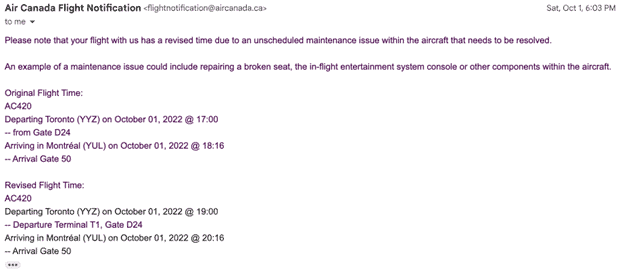

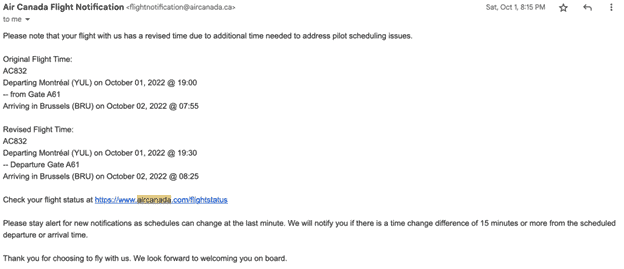

Then, I got another message saying that my connecting flight in Montreal was delayed by 30 minutes, from 19:00 to 19:30. At this point, I knew I would miss that connecting flight.

Finally, I was notified that the first flight from Toronto to Montreal was cancelled due to an unforeseen aircraft maintenance issue.

Air Canada automatically put me onto new flights, which should have given me enough time in between to catch the connecting flight.

My new flights were from Toronto to Vienna, then Vienna to Brussels. I would have arrived in Vienna at 8:30, then caught the connecting flight at 9:25. However, the first flight was delayed for over 2 hours due to unforeseen circumstances and an uncooperative passenger.

So, I missed my connecting flight but managed to get on another one a few hours later.

Because my first flight was delayed, then cancelled, and it caused me to arrive at my final destination (Brussels) more than 3 hours late, I submitted a claim for compensation.

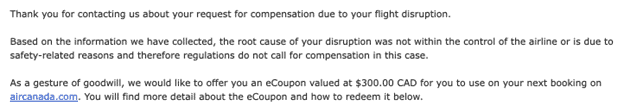

I submitted the compensation form on October 12, 2022, and heard back on November 10th. They promised they would review the issue and get back to me within 30 days – it took them 29.

Air Canada and the CTA claim that you are entitled to compensation of $400 CAD for delays between 3 and 6 hours, but I only got $300 in the form of an eCoupon.

According to Air Canada, this is why I did not receive $400:

“Based on the information we have collected, the root cause of your disruption was not within the control of the airline or is due to safety-related reasons, and therefore regulations do not call for compensation in this case.”

They must provide compensation if the delay or cancellation is within the airline’s control or due to a safety-related reason. The flight I was supposed to take was delayed, then cancelled, but the reason for that was not within their control.

After reviewing my request, Air Canada stated that regulations do not call for compensation. However, they offered me an eCoupon valued at $300.00 CAD, which can be used on my next booking.

It is valid for 3 years and can be used towards the purchase of air travel and ancillary services offered by Air Canada, Air Canada Express, and Air Canada Rouge-operated flights.

Final thoughts? Submitting a claim is worth it, as you’ll probably get some form of compensation. However, don’t rely on Air Canada or another airline to follow through on their promise of giving you $400, $700, or $1,000, as they may say the same thing and claim that the cause of the disruption was not within their control.

Don’t expect them to get back to you promptly – it took 29 days to hear back from them when they promised to get back to me within 30 days.

FAQs

A flight must be delayed for 3 hours or more for you to receive compensation. The delay must be within the airline’s control and not related to safety issues.

Airlines owe you monetary compensation or an alternate form of compensation, such as vouchers or rebates, if your flight was delayed for over 3 hours. Small airlines owe you $125 to $500, and large airlines owe you $400 to $1,000, depending on how long the delay was.

Submit a claim for flight delay compensation on the airline’s website. They will ask you to enter your personal and flight details, including your reference or booking number and the ticket number. The airline will look into the disruption and can see if the flight has been delayed or cancelled.

There are no rules for how long an airline can delay a flight, but if it is delayed for more than 3 hours, they must provide adequate communication, access to food and drink, accommodation, and more.

No, you may only make a claim if your flight is cancelled or delayed for more than 3 hours. However, if your flight is delayed, the airline must provide updates every 30 minutes with details about the reason for the delay until a new departure time has been confirmed.

Related: