Interac e-Transfer limits vary across banks and credit unions in Canada.

Customers of the same bank may also have different e-Transfer limits depending on the type of account they have (personal or business) or whether they have requested an increase.

Not only that, but e-Transfer limits also vary depending on the type of transaction you are conducting, i.e. sending, requesting, or receiving money.

For instance, if your transfer limit is $2,500, but someone sends you $3,500, it will be deposited in your bank account.

Read on to learn about the Interac e-Transfer limits for RBC, TD, Scotiabank, BMO, CIBC, and several others.

What is Interac e-Transfer?

Interac e-Transfer is a secure and fast way to send money to recipients in Canada using your online banking.

Instead of writing a cheque each time you want to pay someone or going to the ATM to withdraw cash, you can seamlessly send them funds using their email or phone number.

As long as your recipient has a Canadian bank account, they can receive e-Transfer funds instantly or within minutes.

You can also use this service to request funds and get paid.

What is the Maximum e-Transfer Limit?

The maximum e-Transfer you can send or receive depends on your bank or financial institution.

Often, it is the same limit as what you have on your client card or debit card.

There are maximum limits for daily (24 hours), 7 days, and every 30 days.

RBC e-Transfer Limit

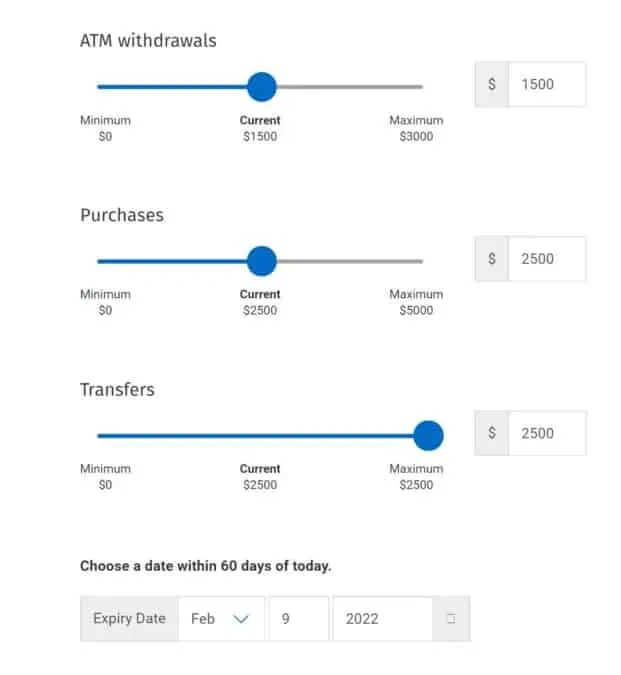

The e-Transfer limit for RBC accounts is based on the daily access limit for your client card.

You can find out what this is when you:

- Sign in to Online Banking

- Select “Daily Transaction Limit” under “Account Management”

You can temporarily edit the limits for ATM withdrawals, purchases, and transfers on this page.

TD Interac e-Transfer Limit

The following limits apply when sending Interac e-Transfers with TD:

- Per transfer: $3,000

- 24 hours: $3,000

- 7 days: $10,000

- 30 days: $20,000

These are the standard limits for both TD personal and business clients.

Scotiabank e-Transfer Limit

If you are a Scotiabank customer, your daily Interac e-Transfer limit is available under “Profile and Settings.”

Simply tap “View transaction limits” to see the limit per transaction and periodic limits.

CIBC e-Transfer Limit

The maximum e-Transfer limits for CIBC are:

- 24-hour period: $3,000

- 7 days: $10,000

- 30 days: $30,000

There is no minimum amount.

When requesting money, there is a $1,000 limit, and you can have up to a maximum of 10 unfulfilled “Interac e-Transfer Request Money” transactions at any one time.

BMO e-Transfer Limit

Transfer limits on BMO are:

- 24 hours: $2,500 or $3,000, depending on your BMO Debit Card’s daily transaction limit

- 7 days: $10,000

- 30 days: $20,000

You can view your debit card limits under “Bank Accounts” in “My Account Summary.”

Simplii e-Transfer Limit

The minimum Interac e-Transfer you can send on Simplii Financial is $0.01.

Hourly and daily limits are:

- 24 hours: $3,000

- 7 days: $10,000

- 30 days: $30,000

National Bank e-Transfer Limit

The daily limit for transfers at National Bank is $3,000.

Businesses can send:

- $5,000 per day

- $25,000 per 7 days

There are no daily, weekly, or monthly limits when receiving Interac e-Transfers to a business account.

The maximum amount per deposit is $25,000.

Tangerine e-Transfer Limit

Interac e-Transfer limits on Tangerine are:

| Interac e-Transfer | Sending | Receiving |

| Daily | $3,000 | $10,000 |

| 7 days | $10,000 | $70,000 |

| 30 days | $20,000 | $300,000 |

Desjardins e-Transfer Limit

Desjardins has one of the highest e-Transfer limits in Canada for personal banking at $5,000 per 24-hour period. You can also receive up to $25,000 per transfer.

For businesses, the 24-hour sending limit is $10,000.

Vancity e-Transfer Limit

Transfer limits at Vancity when sending money are:

- Per transfer: $3,000

- Daily (24 hours): $10,000

- 7 days: $10,000

- 30 days: $20,000

When receiving money, the limit is $25,000 per transfer, and the maximum amount you can request per transaction is $3,000.

For business banking, you can send:

- Per transfer: $6,000

- Daily: $20,000

- 7 days: $20,000

- 30 days: $40,000

The maximum amount when receiving an e-Transfer to a business account is $25,000.

Vancity has one of the highest e-Transfer limits on this list.

Alterna Bank e-Transfer Limit

For Alterna Bank, the sending limits are:

- Per transfer: $3,000

- 7 days: $10,000

- 30 days: $20,000

You can receive:

- Per transfer: $10,000

- 7 days: $70,000

- 30 days: $300,000

For Alterna Savings, these limits apply:

| Interac e-Transfer | Sending | Receiving |

| Per transfer | $3,000 | $25,000 |

| 24 hours | $3,000 | – |

| 7 days | $10,000 | – |

| 30 days | $20,000 | – |

Request Money transactions are limited to $3,000 per request, and you can have up to 50 outstanding requests.

Manulife e-Transfer Limit

The minimum e-Transfer you can send on Manulife is $10. The maximums are:

| Interac e-Transfer | Sending | Receiving |

| Per transfer | $3,000 | $10,000 |

| 24 hours | $3,000 | $10,000 |

| 7 days | $10,000 | $70,000 |

| 30 days | $20,000 | $300,000 |

ATB Financial e-Transfer Limit

Outgoing transfers are limited to:

- Per transfer: $5,000

- 24 hours: $5,000

- 7 days: $35,000

- 30 days: $150,000

The maximum Interac e-Transfer amount you can receive is $25,000.

Can I Increase My Interac e-Transfer Limit?

You may be able to increase how much you can send via Interac e-Transfer by increasing your daily debit limit.

Look for this option in your Online Banking account.

You could also call your bank or visit a branch to see what’s available.

Most banks appear to have a maximum e-Transfer limit of $3,000, while some credit unions and their online banking divisions have daily limits of up to $10,000.

Related:

HSBC Canada is $7k per day, which I think is the highest in Canada. Very useful for paying rent as it can cover rent on a house in a single transfer unlike the other banks (without calling in and having it adjusted).

The bank is being sold though so that may change.