Credit cards and charge cards are confusing for many people. Some even ask, “Is a charge card better than a credit card?”

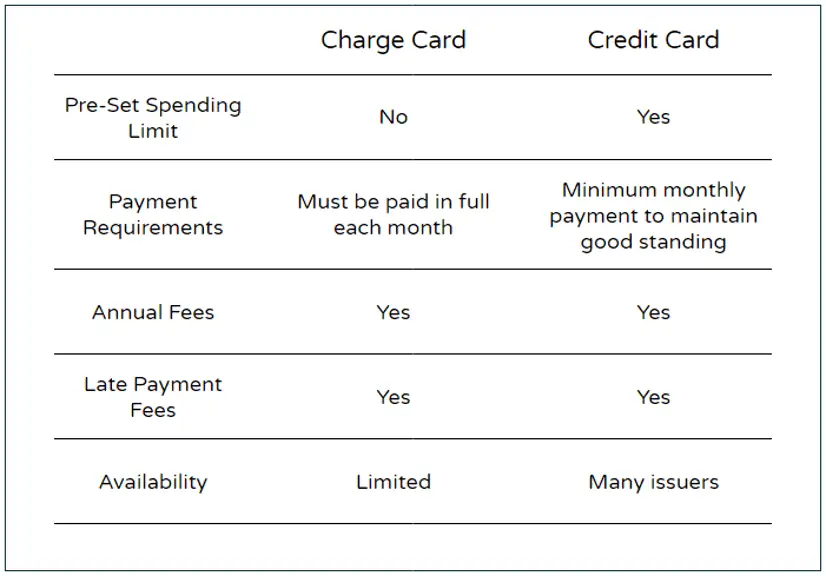

A key difference is that credit cards have a pre-set spending limit, while charge cards have none.

This article will cover their differences, who offer charge cards and if they build credit, their pros and cons, and how they affect your credit score.

What is a Credit Card?

A credit card is a method of payment that allows you to pay for goods and services in physical stores, online and other channels.

It comes with a credit limit, also referred to as the maximum amount you can spend on your credit card.

During application, your credit card issuer will set the limit. If you exceed it, you will be charged an over-the-limit fee by your credit card issuer.

Every time you pay your balance, you get access to more credit, also called revolving credit. If you want your issuer to reduce or increase your credit limit, it is necessary to do it in writing or by speaking with a rep over the phone.

How Do Credit Cards Work?

Credit cards allow you to borrow money up to a specific limit. You make monthly payments on your purchases using your credit card.

Financial institutions issue credit cards to approved consumers who want a line of credit. Each credit card has a credit limit that restricts how much you can spend on your card.

When you receive your monthly statement, it will include a list of transactions you made during the given month and how much you owe your lender.

You can pay the balance in full and avoid paying credit card interest. You can also make a minimum payment, which will incur interest charges and increase the cost of your purchases.

What is a Charge Card?

A charge card is a payment card that has no pre-set limit. It is similar to a regular credit card as it provides you with the capability to make purchases that you pay at a later period.

With a charge card, there is no maximum spending limit. Your card issuer will adjust your limit every month based on your spending patterns and cardholder history.

In succeeding uses, your card issuer will regulate your spending limit, which depends on your income, spending behaviour, and payment history.

How Do Charge Cards Work?

Using a charge card is similar to a credit card, wherein you swipe, tap or insert it.

You can use a charge card for everyday purchases and big-ticket items like home appliances, jewelry or electronics.

When your monthly statement comes, you pay off everything and start with a clean slate in the next month.

If you fail to pay the monthly balance, there will be hefty fees and penalties.

Charge Card vs Credit Card: Key Differences

Charge cards and credit cards have a few primary differences, which we will describe below.

Spending limits

Charge cards have no pre-set spending limits. Charge cardholders can spend what they think they can afford each month. It does not mean, however, that their spending power is unlimited.

The amount that holders of charge cards can spend is typically dependent on their reported annual income and payment history. They also have spending caps, which depend on their financial profile, card usage, and spending habits.

Credit cards have a credit limit. When you apply for a credit card, the issuer will assign you a credit limit, also referred to as the maximum balance you can spend on your card. When you exceed this limit, the store will decline your card, and your purchase will not go through.

You may also face stiff penalties, which will affect your credit score. If you want to increase your credit limit, you must submit a request and pass a credit check, except when the issuer pre-authorized an increase in your credit limit. But you can only spend the maximum limit your card issuer allows you.

Monthly Balance

Charge cards require you to pay the total balance each month. Charge cards do not carry a monthly balance because you are required to pay the balance in full at the end of every month. Although you have more spending power, you cannot stack up debt from month to month.

Credit cards allow you to carry a balance from one month to the next. Credit card holders can carry their balance over several months and pay a minimum amount in due time. You do not need to pay your balance in full every month. But the amount of your debt must not exceed your credit limit.

Types

Charge cards are often premium travel cards. In Canada, charge cards are available as travel cards targeted toward the high-end crowd. They offer rewards through miles or points for travellers and provide premium perks like free flights and accommodations.

Credit cards are available in several types. Various types of credit cards are available today that suit different financial needs. These include low-interest cards, no-fee cards, cashback cards, travel credit cards, and student credit cards.

How Do Credit Cards Affect Your Credit Score?

Your credit score is what lenders use to measure your creditworthiness. The higher your score, the more likely you will get loan approvals and lower interest rates.

The five factors used to calculate your credit scores are payment history, credit history, amount of debt (credit utilization), number of inquiries, and credit diversity (types of credit) or public reports (bankruptcies and insolvencies).

The most critical component of your credit score is your payment history. If you miss payments and carry an unpaid balance, it will decrease your credit score.

Maxing out your available credit also sends an unpleasant signal to lenders because it affects the credit utilization factor of your credit score.

Applying for a credit card likewise has an impact (albeit limited) on your credit score because of the credit check or hard inquiry performed to determine your creditworthiness.

How Do Charge Cards Affect Your Credit Score?

As with credit cards, charge cards involve borrowing money from a lender. Thus, they can impact your credit score.

When you apply for a charge card, your score will temporarily decrease by a few points since your application will appear as a new inquiry on your credit report.

But the most crucial factor of your credit score is your payment history. Pay your balance on time to maintain a positive standing with the credit bureaus.

When you pay your balance on schedule, it will increase your credit score. Conversely, when you have late payments, it will hurt your credit score.

Charge cards have no preset limit and are not factored into your credit utilization ratio, a principal component of your credit score that refers to the percentage of your total credit.

Pros and Cons of Credit Cards

Below are the pros and cons of using a credit card.

Pros

- Convenience in paying for purchases without carrying cash

- Buy now, pay later

- Interest-free grace period on new purchases if you pay your total balance on time

- Different credit card options to choose from

- Requires only a minimum monthly payment on your balance

- Ideal for cardholders who need extra time to pay their debt

- More lenient with credit scores and history

- Pays for purchases anywhere in the world

- Builds a good credit history through complete and on-time monthly payments

Cons

- Potential to spend more, build up debt and pay more interest

- Has a firm borrowing limit

- High cost of borrowing

- Exorbitant interest rates

- Late payments result in steep interest charges that hurt your credit score

- High annual fees

- Late payments can lead to a ballooning debt

Pros and Cons of Charge Cards

The pros and cons of using a charge card are as follows:

Pros

- No pre-set spending limit, which gives you better spending capability

- Bonuses and rewards

- Ideal for travellers as it leverages the cashback and reward system to enjoy benefits like free hotel room upgrades or luxury car rentals

- Prevents overspending and amassing debt

- No APRs; cardholders are not required to pay annual interest rates on borrowed money

- No interest rates due to the required full payment each month

- Potential to earn rewards

- Offers competitive rewards like travel insurance or travel upgrades

Cons

- Requires an excellent credit score to qualify

- Steep annual fees

- Failure to pay your total balance at month’s end can result in huge penalties and a blocked card

- Late payments will decrease your credit score

- Not a lot of choices to pick from

- Offered by a limited number of issuers only

Do Charge Cards Build Credit?

If you are among those who want to know the answer to the all-important question, “Do charge cards build credit,” the short answer is: Yes, they do.

As with credit cards, charge cards are just as effective in building credit and establishing a credit history.

Whether you have a credit card or a charge card, the most critical factor in building your credit is using it wisely and responsibly.

To build credit using your charge card, you must always make payments consistently and on time because payment history is the number one factor in your credit score.

Charge cards do not have a maximum limit, so credit bureaus will not consider the debt utilization ratios of charge cards.

Therefore, if you have a charge card and aim to build credit using it, you must pay your total balance promptly every month.

Who Offers Charge Cards?

Did you know there is only one who offers charge cards in Canada?

Charge cards are not popular in the country since most Canadians are satisfied with the flexibility provided by their credit cards.

So, not everyone knows there is only one issuer of charge cards in Canada. It is American Express.

You probably heard some people ask, “Is American Express a charge card?”

For those wondering, American Express is a financial services corporation specializing in payment cards, which include credit cards and charge cards.

Two of the best charge card options it currently offers in Canada are the American Express Aeroplan Card and the Platinum Card.

American Express initially requires applicants to be Canadian residents with credit files and of the age of majority in the province or territory of residence.

Other requirements such as employment, income and bank account information may be necessary, depending on the applicant’s chosen card.

The American Express Platinum Card

Rewards: Earn 2 pts per $1 spent on dining & food delivery; 2pts per $1 spent on travel; 1pt/$1 everywhere else.

Welcome offer: NA

Interest rates: N/A. Check card details for penalty APRs.

Annual fee: $799

American Express Aeroplan Card

Rewards: Earn 2x Aeroplan pts on Air Canada purchases; 1.5x pts dining & food delivery; 1x pts everywhere else; comprehensive travel insurance coverage.

Welcome offer: NA

Interest rates: Charge card (pay in full each month or 30% interest rate applies).

Annual fee: $120

Is a Charge Card Better Than a Credit Card?

Choosing between a charge card and a credit card boils down to your financial goals and circumstances.

Answering the “Is a charge card better than a credit card” question requires laying down facts that help determine the best option.

A charge card can be an ideal alternative if you prefer having a broader buying power with less risk of negative impacts on your credit score.

Charge cards, however, are not a suitable option for everyone. The strict requirements (an excellent credit score and a high income) are a hindrance to most people.

In comparison, a credit card is a flexible alternative for many who rely on the capability to carry a balance from month to month.

If you think you have the discipline and the funds to pay your charge card back promptly every month, then it could be practical to use a charge card.

FAQs

Charge cards are for people with exceptional credit scores and high incomes, making them difficult to get approval for. Credit cards cater to a more diverse crowd, which includes people with less-than-ideal credit.

These are bank-issued cards, store cards, and travel/entertainment cards. Bank-issued cards include Visa and Mastercard, while store cards include those by retailers like Target or Sears. For travel cards, the most recognized are American Express and Diners Club.

Like with credit cards, a charge card can be used anywhere, such as in shops, restaurants, online, abroad, and anywhere they are accepted. The difference is that charge cards have no pre-set spending limits, so it is easier to make large one-off purchases.

Mastercard is a card payment network that credit card companies utilize to enable customers to make purchases using their credit cards. Mastercard has partnered with financial institutions that issue payment cards that use its network. These cards can either be credit cards or debit cards.