If you have a CIBC paper cheque, it is easy to void it by simply using a pen to write “VOID” in large letters across its front.

If you’d rather not pay to get a chequebook, you can still get access to CIBC void cheques through your online banking account.

This guide details how CIBC void cheque samples work, how to read a CIBC cheque, and how to print a CIBC void cheque online.

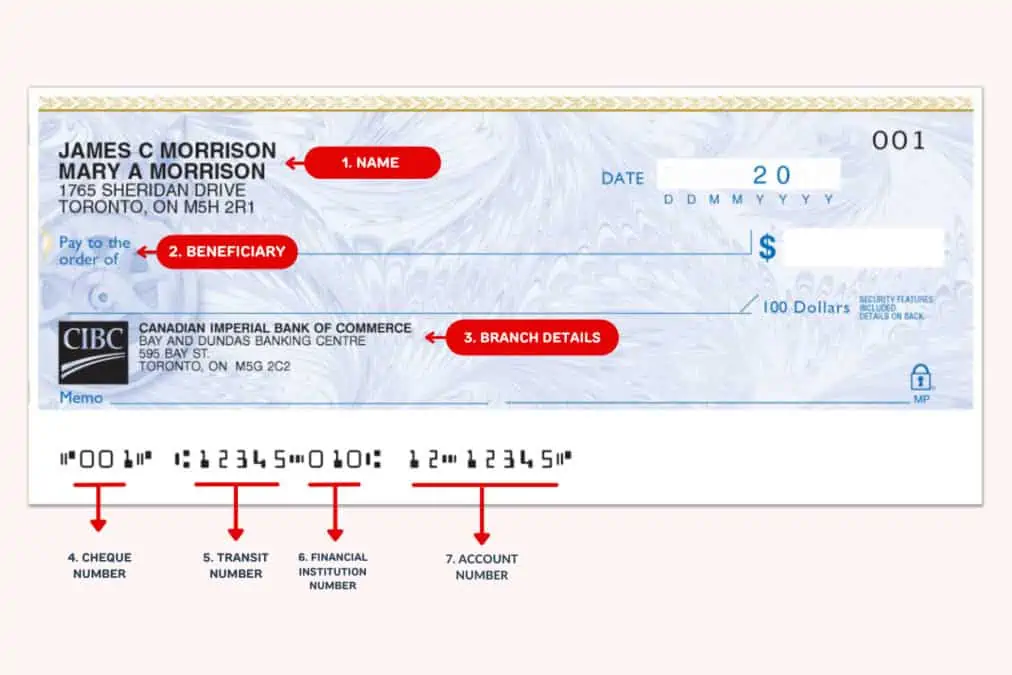

How To Read a CIBC Sample Cheque

A sample cheque is often required when you need to set up direct deposits to your bank account or pre-authorized debits (such as loan repayments, rent, mortgage, or childcare).

A cheque contains all your bank account information (i.e. financial institution number, transit number, and bank account number), and a recipient can easily use the numbers on it to link to your bank account – for both deposits and withdrawals.

A Canadian Imperial Bank of Commerce Bank (CIBC) sample cheque is also referred to as a CIBC “specimen” or “void” cheque.

So, what information does a CIBC sample cheque contain?

1. Name: Your name is printed at the top of the cheque. This indicates you (the “drawer”) who owns the bank account from which funds are being withdrawn. Your home address is also printed under your name.

2. Beneficiary (payee): The line on the “Pay to the order of” section is where you write the name of the individual or organization to whom you are making a payment. For a void or sample TD cheque, this section is left blank.

3. Bank account and branch details: This section includes the bank name and the address of the bank branch where your account is held.

4. Cheque number: This 3-digit number is what the bank uses to identify the cheque transaction on your bank statement. On your CIBC cheque, it is shown at the far left bottom in the MICR (Magnetic Image Character Recognition) encoding line as well as on the top right corner of the cheque.

5. Transit (branch) number: This 5-digit number refers to the specific bank branch where you initially opened your bank account. Transit numbers for Canadian banks are maintained by Payments Canada.

6. Financial institution number: This 3-digit number is also referred to as the bank code. CIBC’s institution code is 010. This institution number stays the same regardless of which CIBC bank branch you use.

7. Account number: This 7-12 digit number identifies your bank account. The bank account numbers for CIBC are 7-digit long, and they include a dash. For example, in the CIBC sample cheque above, the bank account number is 12-12345.

When you combine CIBC’s institution number and transit number and add a leading zero “0”, you get your routing number.

For example, using the CIBC sample cheque above, the routing number is 00101212345.

Related: CIBC Chequing Accounts Review.

How To Get a CIBC Void Cheque Online

You can create a CIBC void cheque by writing “VOID” across the front of the cheque using a dark pen (black or blue ink) or permanent marker.

Avoid covering the numbers at the bottom of the cheques, as they are needed to set up your direct deposit or periodic automatic payments.

CIBC paper cheques are not free, so you may want to save money by downloading a CIBC void cheque through your online banking instead.

A CIBC void cheque sample is also referred to as “direct deposit form” or “pre-authorized debit form.”

Follow these steps to access a “Direct deposit form” on CIBC:

- Sign in to CIBC Online Banking

- Select the bank account you need a void cheque for

- Select the “Void cheque/direct deposit info” link under the “Manage My Account” dropdown

- Check the information to ensure it is correct and includes all the details you need

- Print the form and sign it

CIBC’s void cheque or direct deposit form contains all the information that would normally be on a cheque (i.e. transit number, institution number, and account number).

You can give a copy of this to anyone looking to set up direct deposit or pre-authorized debit to and from your bank account.

Related: Best Online Banks for Newcomers.

How To Write a CIBC Cheque

You can easily write a CIBC cheque by following these steps:

- Fill in the date in the upper right corner of the cheque.

- Write the name of the beneficiary on the line where it says “pay to the order of.”

- Write the amount of money you are looking to pay. If the sum includes cents, you can add them in the blank “ /100” area. For example, $100.90 can be written as “One hundred dollars and 90/100”. You should also fill out the box where you have the “$” sign with the amount in figures.

- Fill out the “Memo” section with the reason for the payment. For example, “February rent.”

- Sign the cheque at the bottom left corner to make it official before handing it to the beneficiary (payee).

CIBC Void Cheque FAQ

You can print off a CIBC void cheque or direct deposit form from your CIBC online banking account.

You can order CIBC cheques online for a fee. While you can print your own cheques, they must meet certain requirements, including ensuring that your bank account information is written in magnetic ink.

The numbers below a CIBC cheque include the cheque number, transit (bank branch) number, financial institution number, and your bank account number.

The cost of CIBC’s personalized cheques varies depending on the quantity you are buying and the personalization and styling you require.

Related: