The BMO Premium Plan chequing account is a great option for those who want an all-inclusive banking experience.

For $30 a month, this BMO chequing plan offers unlimited transactions, no-fee global money transfers, and up to a $150 rebate on the annual fee of eligible credit cards.

This review will provide you with a comprehensive overview of the BMO Premium Plan chequing account, including its features, fees, and minimum balance requirement.

Key Takeaways

- The BMO Premium Plan chequing account is BMO’s chequing account with the most included features.

- For a $30 monthly fee, this bank account offers its users unlimited transactions, free global transfers, waived overdraft protection, and up to a $150 rebate on eligible credit cards’ annual fees.

- You can waive the BMO Premium Plan monthly fee by maintaining a minimum balance of $6,000.

BMO Premium Plan Features

Unlimited Transactions

With this chequing account, you can carry out unlimited banking transactions, including debit purchases, transfers, and bill payments, without paying extra penalties or fees. The same applies to Interac e-Transfer transactions.

Non-BMO ATM Withdrawals Worldwide

BMO won’t charge you its usual $2 or $5 per transaction fee when withdrawing from non-BMO ATMs worldwide.

Free Global Money Transfer

Send money to other parts of the world quickly for free. This chequing account allows you to wire funds to up to 50 countries in different currencies without paying the usual $5 BMO transaction fee per global transfer.

Waived Overdraft Protection

Enjoy the benefits of overdraft protection without paying an additional $5 monthly. Note, though, that you must still pay the overdraft interest rates.

Up To $150 Credit Card Rebate

Receive rebates for your eligible credit cards’ annual fees. You can get a $150 rebate for the BMO Ascend World Elite Mastercard.

However, for the credit cards BMO AIR MILES World Elite Mastercard, BMO CashBack World Elite Mastercard and BMO eclipse Visa Infinite Card, only a $120 annual rebate applies.

Included OnGuard Identity Theft Protection

Protect your identity and financial information without paying more money. BMO offers its OnGuard Identity Theft Protection program, which usually costs over $150 annually, to its Premium Plan chequing account primary users for free.

Waivable Monthly Fee

You won’t have to pay for this account’s $30 monthly fee if you maintain a minimum balance of $6,000 in your bank account.

Other Features

Other features of the BMO premium plan chequing include:

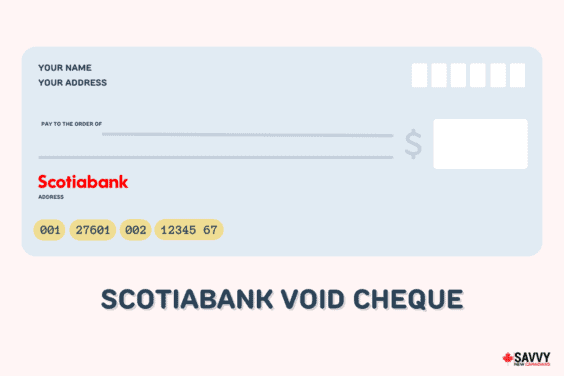

- Getting free cheques, money orders, and drafts.

- Being eligible for a $12 annual discount on the BMO safety deposit boxes.

- Opening bank accounts for your family members for free (BMO Family Bundle).

BMO New Account Offer

Up to $350 cash bonus offer

Waive monthly fees by keeping minimum balance

A premium account with unlimited transactions

Includes credit card fee rebate & free identity theft protection

BMO Premium Chequing Account Fees

As an all-inclusive account, the BMO Premium Plan chequing doesn’t have many extra or optional fees.

The banking features you usually need to pay for when using other BMO chequing account types, such as overdraft protection, are already included in this banking account.

So, the only fee worth noting in the BMO Premium Plan is its monthly fee of $30, which can be fully waived if you maintain the required minimum balance.

Note: Students, seniors, and anyone 18 years old or younger can enjoy a $0 monthly plan fee.

BMO Premium Plan Minimum Balance

The minimum balance to waive this BMO Plan’s monthly fee is $6,000.

The amount must be maintained entirely in your BMO primary chequing account. It doesn’t include any money held in your family members’ bank accounts, even if you’re part of a BMO Family Bundle.

How To Open A BMO Premium Chequing Account

BMO only requires 2 documents from BMO Premium chequing account applicants: their Social Insurance Number (SIN) and Canadian address.

As long as you have these, you may open a BMO account online in less than 10 minutes. You can also visit your local BMO branch or call the bank’s customer support to do so.

All Canadian residents may apply for a BMO Premium Plan Chequing account regardless of age. However, minors must sign up for this banking account with the assistance of a legal guardian.

BMO Premium Plan Student Offer

Full-time post-secondary students are eligible to apply for a BMO Premium Plan account for only $13.05 a month. This offer allows students to save $203 annually until one year after graduation.

On top of the regular features the BMO Premium Plan brings, students also get their first accidental fee fully rebated with the Easy First Fee Reversal service. Plus, they can also access other BMO student-exclusive offers, such as more affordable lines of credit.

Applying for the BMO Premium Plan student offer is easy. The eligibility requirements are the same as when opening a regular BMO chequing account. However, on top of the regular documents, you must also show proof of your full-time student status.

Note: If you’re applying online for this student offer, show proof of your student registration to a local BMO bank within 6 months of opening your chequing account.

Pros And Cons Of The BMO Premium Chequing Account

Here’s a quick overview of the pros and cons of this BMO chequing account.

Pros:

Packed With The Most Features

This plan has the most banking features in BMO’s chequing accounts, so you don’t have to worry about paying extra fees when making numerous transactions within or outside Canada.

Waivable Fee

Although the $30 monthly fee is on the pricier side of banking fees, you can skip it if you maintain the required minimum balance of $6,000.

Complimentary OnGuard Identity Theft Protection

With this chequing account, you’ll have the assurance that your information is protected from online identity thefts and scams. Along with safeguarding your assets, this service also offers you peace of mind.

Cons:

Costly $30 Monthly Fee

If you don’t maintain the required minimum balance, you must pay $30 a month, which is significantly more expensive than the banking fees of other chequing accounts.

High Minimum Balance Requirement

This limits the amount of money you can grow through investments or set aside in a high-interest savings account.

Other BMO Bank Plans And Fees

If you don’t think the BMO Premium Plan is the best for your budget or needs, consider the other BMO chequing accounts below. Their features are more limited, but they’re cheaper than the BMO Premium chequing account.

BMO Plus Chequing Account

If saving money is your priority, this chequing account is the best BMO has to offer.

It costs $11.95 per month, but this fee can be fully waived as long as you maintain the minimum balance of $3,000. With this chequing account, you’ll enjoy up to 25 transactions monthly.

However, every transaction after that will cost you $1.25. Hence, this will only be cost-effective if you know how to limit your banking transactions.

BMO Performance Plan Chequing

The BMO Performance Plan Chequing is BMO’s most popular chequing account. Like the Premium Plan, it offers unlimited transactions, includes the OnGuard Identity Protection program and allows you to make banking accounts for your family members for free.

This chequing account costs $16.95 per month, but the fee can be fully waived if you maintain the minimum balance of $4,000.

Take note, though, that this chequing account doesn’t include the standard overdraft protection.

BMO Premium Chequing Account Alternatives

Listed below are the 3 top alternative chequing accounts to the BMO Premium chequing plan. They all offer unlimited transactions.

| Simplii No Fee Chequing | RBC Signature No Limit Banking | EQ Bank Savings Plus Account | |

| Monthly Fee | $0 | $16.95 | $0 |

| Minimum Balance Requirement to Waive Fee | N/A | Non-waivable | N/A |

| Overdraft Protection | $4.97 per month | Included | Not Available |

| Non-bank ATM withdrawal fee (in Canada) | $1.50 | $2 or $3 | Free |

| More Information | Read Review | Read Review | Visit Website |

FAQs

BMO’s chequing accounts are not free. However, the monthly fees for its Plus, Premium and Performance chequing accounts can be fully waived if you maintain their corresponding minimum balance requirements.

You don’t have to put a specific amount of money in your chequing account. However, if you maintain a certain balance, you might be able to waive your monthly fee, depending on your chequing account.

Yes, the BMO debit has foreign transaction fees. BMO charges you an additional 2.5% for your international purchases and deducts 2.5% for your international refunds.

The maximum daily withdrawal for BMO depends on your bank account. Some users have a $1,000 withdrawal limit, and others have a $2,000. You can always call BMO to adjust your daily withdrawal limit as needed.