Managing your finances has never been so important, and many personal finance and budgeting apps are available to help you.

These make it convenient and simple to make saving goals, keep track of your spending, and set better budgets that you can stick to.

Apps like Mint, YNAB, and EveryDollar have already proved immensely popular in Canada. And now there is a new money management app available for Canadians: Billi.

In this guide, we look at Billi, its key features, pros and cons, and more. We also compare it with several other popular apps to help you choose the right solution for your financial needs.

Update: Billi is no longer available. You can use Chexy instead and let your rent payments increase your credit score.

Chexy is a rent payments platform that lets renters earn rewards when they pay their rent using a credit card and, in the process, build credit on rent. Compared with Billi, which was a money management app, Chexy focuses more on renters and how they can take advantage of rent — their biggest expense — by earning rewards and using it to build or improve their credit.

What is Billi?

Billi is a new Canadian personal finance, budgeting and credit-building app. It was created by a team of finance experts and was released in Canada in 2022.

It provides a single platform where you can access all your financial information and improve how you handle your finances.

The Billi app allows you to see exactly where your cash is going, so you can make informed decisions about your finances. It’s available to download at both the Play Store and the App Store.

Billi’s Top Features

Billi has several useful features to help you manage your finances. Here we look at these in more detail.

Connect All Your Accounts

You can start using Billi by connecting all your bank accounts and credit cards, which is a simple process.

Once connected, you can see them all in the app in one place, making it convenient to track all of your accounts.

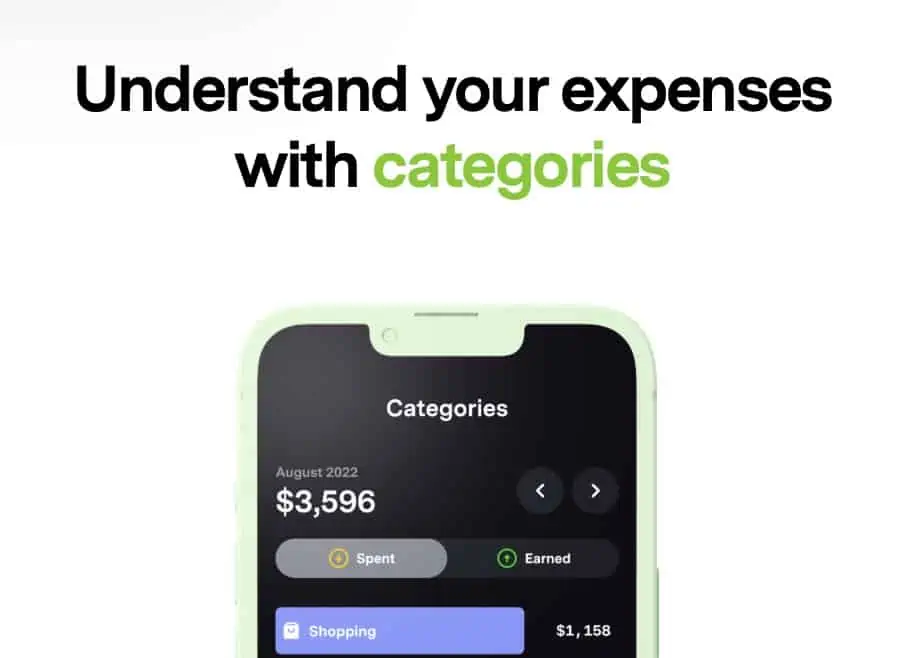

Spending Tracker

One of the main features of Billi is the ability to categorize your spending. You can use this spending tracker app to see details of your spending categories, including Shopping and Groceries.

This gives you a clear idea of how much you’ve spent on each category in a specific period and help you create budgets.

You can also visualize your spending. Billi provides simple charts that show you, for example, your average spending per day or week so you can spot financial trends and know exactly where your money is going.

You can also keep a close eye on all your subscriptions and bills and then set up alerts when bill payments are due to avoid missing payments.

NEW FEATURE: Billi Boost

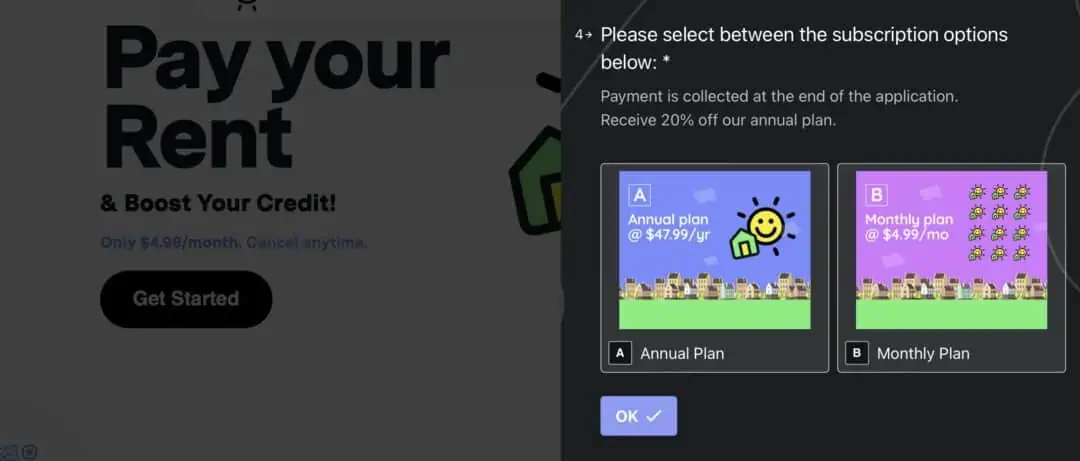

Billi Boost is a paid feature in Billi that allows renters to improve their credit score using the rent payments they’re already making. It costs $4.99 per month or $47.99 annually, and you can cancel anytime.

Billi will verify your rent payment each month and report it to the major credit bureaus in Canada.

You connect your bank account and pay your rent as normal every month, so you are not borrowing additional money. Instead, it simply reports the payments, which can help to increase your credit score. You can pay your rent by e-transfer, pre-authorized debit, cheque and even cash!

Increasing your credit score could help you qualify for better loan rates and credit cards.

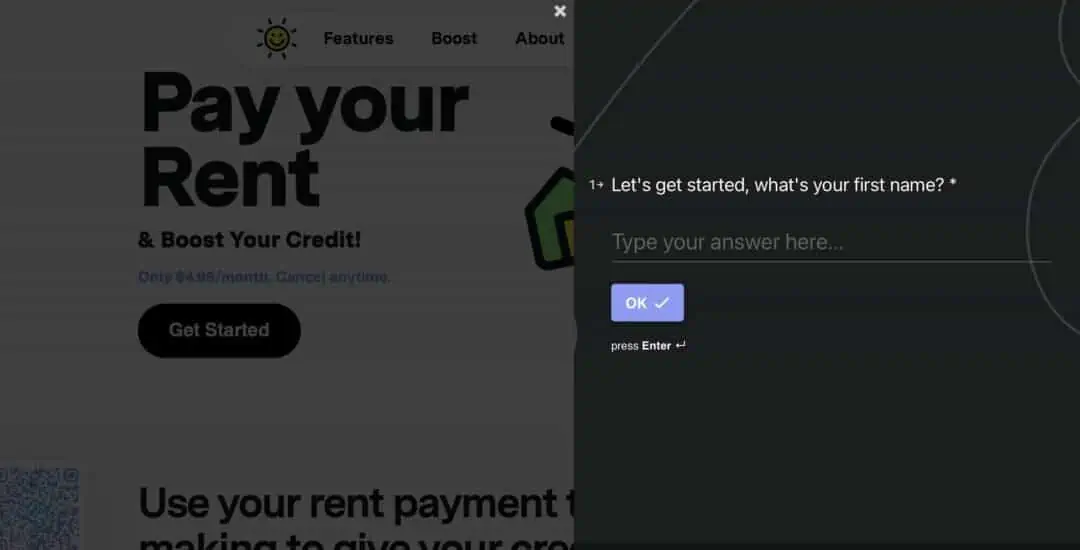

How to Sign up for Billi Boost

Getting started is very simple, and you can sign up for Billi Boost directly from their website.

Start by entering your first name, last name and email address.

Choose from two subscription options, Monthly or Annual. The Annual plan is $47.99 and comes with a 20% discount.

Enter your date of birth, address, and other personal information. It won’t take long, and you will pay at the end of the process. Then you’re ready to start building your credit using your rent payments.

To use other Bili features, connect your bank accounts and credit cards. After doing this, the app will categorize your spending. You can also set up bill reminders and start taking control of your finances.

How Much Does Billi Cost?

Billi is free to use for the main features, like tracking your spending and seeing your balances. There is no charge to add your financial accounts and credit cards.

However, if you want to use Billi Boost, it will cost $4.99 per month or $47.99 annually.

Is Billi Safe and Legit?

Billi is a trustworthy and legitimate app that is legit. It is safe to use, and it takes security seriously.

It uses 256-bit encryption and claims it keeps all your data completely anonymous. All data travelling from your phone to Billi’s servers is encrypted, and when you log out of the app, the data stored on your phone is wiped.

Data is also stored in an encrypted database behind several firewalls. Billi also has view-only access to your bank accounts, so it cannot make any modifications.

Pros and Cons of Billi

There are several pros and cons to consider before using Billi:

Pros:

- Simple to use and with a good user interface.

- The main services are free to use.

- It takes security very seriously, and all data is encrypted between your phone and Billi’s servers.

- Setting up and connecting your accounts is a quick and easy process.

- Billi Boost is a simple way to build your credit history with a payment you’re already making.

- Get reminders when your bill payments are due so you don’t miss them.

- A great way for newcomers to Canada to start to build credit within months.

- Rental payments can be automated.

Cons:

- No longer available.

- If you want to use Billi Boost, you will have to pay $4.99 monthly.

- Billi is still fairly new, so it does not yet have an established reputation.

- It only reports your rent payments to Equifax and not TransUnion.

Billi Alternatives

There are several alternatives to Billi you might want to try out:

Billi vs Borrowell

Borrowell differs slightly from Billi because it has no spending tracking or budgeting info. Its main feature is that you can use it to see your credit score for free. You can also get personalized tips to meet your financial goals.

It has two million customers and is a reputable company. It is free to use and has over 50 financial product partners that it recommends based on your profile.

It also offers a service to build credit with your rent like that offered by Billi, which costs $5 per month.

You can also use the credit builder tool for $10 per month. This essentially provides you with a loan, but you don’t receive the money on approval. You then make monthly payments, and it reports your payments to Equifax.

Billi vs Mint

The Mint app is mainly a budgeting app. You can add all your accounts to the app, including your investments, to get a full picture of your finances.

You can then track cash flow, get clear insights into spending, and even use the Bill Negotiation tool to save money on bills.

Set budgeting goals, get into better financial habits, and get alerts to improve your spending habits. You can even invest in cryptocurrency. You can also pay for an ad-free version for $1 per month.

However, while it has more features than Billi, it lacks a credit-building feature.

Billi vs YNAB

YNAB (You Need a Budget) is a finance management app with a 34-day free trial. After the trial, it costs $14.99 per month or $99 if you pay annually.

It provides insight into your spending, and it is all about simplifying money. You can add all your accounts and expenses and use the app to build your budget and stick to it.

The app aims to make you feel more organized with your money, pay off debt, and get more control over your finances.

YNAB does not directly help you build credit.

Related: Check out this detailed review of YNAB.

Billi vs EveryDollar

EveryDollar is a free app that also offers premium features for a cost. If you want to use these extra features, it costs $12.99 per month or $79.99 if you pay annually.

Use the app to track your spending, plan your budgets, customize categories, set savings goals, and set up bill reminders. You can also personalize your budget and split receipts into multiple categories.

Premium features include connecting your bank account, getting recommendations based on how you track expenses and generating custom income and spending reports.

EveryDollar does not directly help you build credit.

Should You Get Billi?

If you’re looking to improve your credit score fast in Canada using rent payments you are already making, Billi Boost can help. Even if you have no credit history, you can use Billi Boost to build credit from scratch.

It is also helpful for easily tracking your spending. The main features are free to use, so download the app and try it yourself.