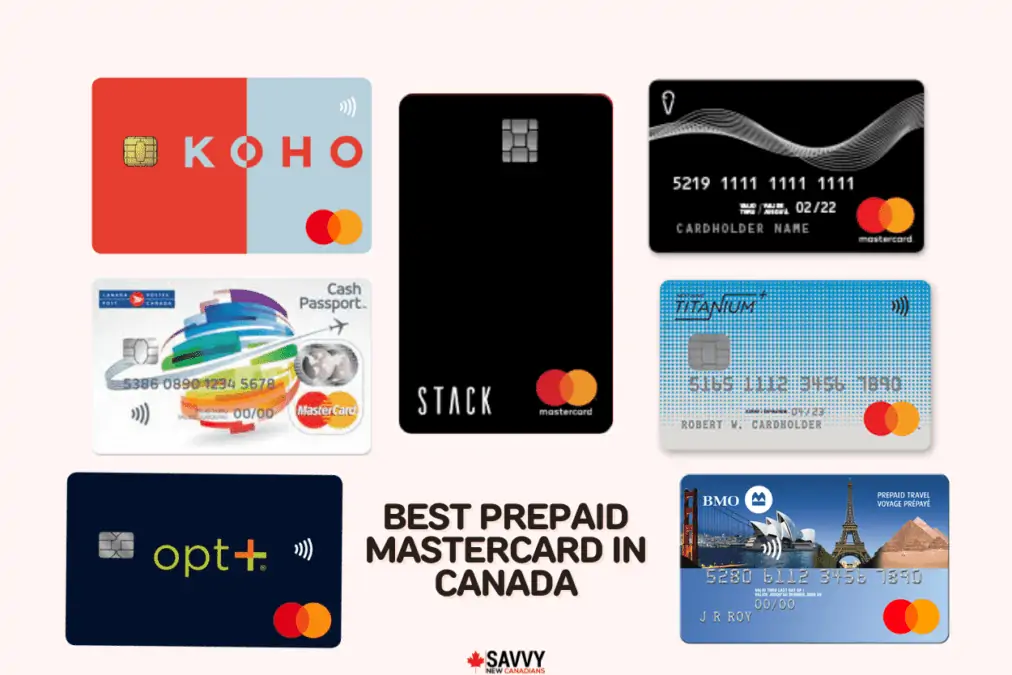

This article covers the best Mastercard prepaid cards in Canada, including reloadable prepaid cards like the Neo Money Card, EQ Bank Card, KOHO Mastercard, and Wealthsimple Cash Card.

Prepaid cards are easy to qualify for as you don’t need a credit history to get approved, and the very best ones offer cash back rewards and other perks.

Since you are spending only the cash available when you use a prepaid card, it can help you manage your finances better and avoid debt. Also, there are no interest fees to worry about compared to a regular credit card.

Read on to learn about the best Mastercard prepaid cards in Canada, their features, benefits, fees, and alternatives.

9 Best Mastercard Prepaid Cards in Canada

| Prepaid Mastercard | Best For | Annual Fee |

| Neo Money Card | Cash back rewards and high savings interest | $0 monthly fee for standard account; $4.99 for Premium |

| EQ Bank Card | Cash back rewards and high savings interest, no FX fees | $0 monthly |

| KOHO Prepaid Mastercard | Cash back rewards, savings interest, and budgeting | $0 to $19 monthly; $1/month inactivity fee if inactive for 6 months (after first year) |

| BMO Prepaid Mastercard | Travel convenience | $6.95; $5/month inactivity fee |

| Cash Passport Prepaid Mastercard | Travel convenience | $15 purchase fee; $3 reload fee; $2.80 monthly inactivity fee |

1. Neo Money Card

The Neo Money Card connects with a free savings account and offers up to 5% cash back at over 10,000 locations in Canada. It is Canada’s best prepaid card.

This prepaid Mastercard offers:

- Cash back rewards at participating retailers (0.5% minimum; unlimited 1% cash back on gas and grocery, and up to 5% at thousands of partner retailers)

- 2.25% interest is paid on your card balance

- Access to a mobile app that tracks your spending

- Free e-transfers using the Neo Money account

- Unlimited transactions and bill payments

The standard Neo Money card is free; however, you can opt for a premium account for $4.99 monthly and access extra perks. These additional benefits include access to credit score monitoring, higher cash back rates, purchase protection, and more.

The maximum balance you can have in your Neo Money account is $200,000. A 2.5% FX fee applies to foreign transactions where applicable.

Get a $20 bonus when you open a free account and fund your card with $50 or more.

Neo Money card

Rewards: Earn an average of 5% cash back at over 12,000 retail partners and a guaranteed minimum of 0.50% (up to $50 monthly); Earn 2.25% interest on your account balance.

Welcome offer: Get a $20 welcome bonus when you complete your first purchase; get up to 15% cash back on your first-time purchases.

Interest rate fee: 0%

Annual fee: $0 (no monthly fees)

2. EQ Bank Prepaid Mastercard

The EQ Bank Mastercard works in tandem with the EQ Bank Savings Plus Account, a high interest savings account. It offers perks you won’t find at other prepaid card providers, such as:

- 0.50% cash back on all purchases (no maximum limits and no categories)

- No ATM fees when you use ATMs in Canada

- FX fees are waived on foreign transactions – saving you up to 3% in fees

- Earn up to 4% interest on your card balance

- No monthly or annual fees

To get the EQ Bank prepaid Mastercard, you can open a free Savings Plus Account online, fund it using Interac e-Transfer, direct deposit, or mobile cheque deposits, and request a card.

You can spend up to $5,000 daily using this card and hold up to $10,000. ATM withdrawals are limited to $500 daily.

EQ Bank Card

Rewards: Earn 0.50% cash back on all purchases and up to 4.00% savings interest on your entire balance.

Perks: Free ATM transactions in Canada, no foreign currency transaction fees abroad, and unlimited transactions.

Interest rate fee: 0%

Annual fee: $0

3. KOHO Mastercard Prepaid Card

The KOHO Prepaid Mastercard is another reloadable prepaid card in Canada.

It offers 1% cash back on grocery, gas and transportation purchases with the free version and interest on your balance.

KOHO also includes a free budgeting app that helps you save money automatically, and you can subscribe to its credit building feature if you want to improve your credit score (costs an extra $5 to $10 monthly).

You can keep a balance of up to $40,000 on your KOHO Card and add funds to it using e-Transfer and direct deposit.

Interac e-Transfers are available, and FX fees are lower at 1.5% (compared to the standard 2.50% fee). If you opt for the Premium account, which includes a higher cash back rate, 0% FX fee, and other perks, a monthly or annual fee applies ($9/month or $84/year). There is also the Everything Plan, which costs $19 monthly.

KOHO Prepaid Mastercard

Rewards: Earn 1% cash back on groceries and transportation, up to 5% unlimited cash back at partner stores in Canada. Get 3% interest on your entire balance. Users also get access to a free budgeting app.

Welcome offer: $20 sign up bonus after first purchase (use CASHBACK promo code during sign-up)

Interest rate fee: N/A

Annual fee: $0 (no monthly fees)

4. BMO Prepaid Mastercard

The BMO Prepaid Travel Mastercard has a $6.95 annual fee. It is reloadable and offers similar conveniences as a credit card.

You can add funds to this card using your BMO Chequing or BMO savings account. If you are not a BMO customer, you can link your bank account to other Canadian financial institutions.

This card offers an extended warranty and purchase protection insurance coverage; however, cash back rewards are lacking.

The maximum balance for the BMO Prepaid Mastercard is $10,000.

In addition to its annual fee, you should note its $5 for statement requests or cash advances, 2.50% foreign currency conversion fees, and an inactivity fee of $5 per month.

Learn more about the card in this review.

5. Canada Post Cash Passport Prepaid Mastercard

The Cash Passport Mastercard holds multiple currencies, including Canadian Dollars, US Dollars, Euros, British Pounds, Australian Dollars, Mexican Pesos, and Japanese Yen.

When making payments in any of these currencies, you avoid paying FX fees if you have an adequate balance on your card.

This prepaid card can be purchased easily at Canada Post offices for $15.

Other fees that apply include:

- 1.50% fee when used in Canada

- $2.80 monthly inactivity fee

- $3 for loading money onto the card

- Variable fees for ATM withdrawals depending on the currency

- 3.25% foreign exchange fee

- $18 shortfall fee

- $20 cash out fee

- Variable fees when you cash out over the counter

The maximum amount you can load in a 12-month period is $30,000. Get more details in this Canada Post Prepaid Mastercard review.

6. Vanilla Prepaid Mastercard

Vanilla Prepaid Cards are available as Vanilla Prepaid Mastercard and Vanilla Prepaid Visa cards.

You can purchase them at multiple locations across Canada, including Walmart, Petro-Canada, London Drugs, Express Mart, Ultramar, and Best Buy.

The Vanilla Prepaid Mastercard is available in $25, $50, $100, and $200 denominations and is non-reloadable.

Activation fees vary based on the amount and range between $3.95 and $7.50. There is also a 2.50% FX fee when you make payments in a foreign currency.

Vanilla prepaid cards are not accepted at gas stations, and they cannot be used for withdrawing cash at ATMs or for pre-authorized billing.

Learn more about how they work in this review.

7. Titanium+ Prepaid Mastercard

Titanium+ Prepaid Mastercard is a reloadable prepaid card sold at Money Mart and Insta Cheques locations in Canada.

It is issued by Peoples Trust Company under license by Mastercard International Incorporated. Peoples Trust also issues several other prepaid cards, including:

- Cash Passport Prepaid Mastercard

- EPIC Prepaid Mastercard

- MyVanilla Prepaid Mastercard

- Preferences Prepaid Mastercard

- Universal Prepaid Mastercard

- West Edmonton Mall Mastercard

You can load the Titanium+ Prepaid Mastercard at any Money Mart store, deposit your paycheque using DirectLoad, or purchase a Vanilla Reload PIN.

This Prepaid card has many fees, including a $9.99 activation fee, $2.99 to $3.95 to load funds, $1.99 for ATM withdrawals in Canada (and $2.99 + 3% abroad), $1.50 for live customer service, $4.99 for a replacement card, $0.25 for automated customer service, and more.

The maximum balance for the Titanium+ Prepaid Mastercard is $15,000.

You can learn more about how it works here.

8. Opt+ Prepaid Mastercard

The Opt+ Prepaid Mastercard is issued by PACE Savings & Credit Union. You can purchase it at any Cash Money store for $14.95 + tax.

To load this prepaid card, you can visit a Cash Money location or set up a direct deposit, so your paycheque is paid directly to your card.

The maximum balance for the Opt+ Prepaid Mastercard is $10,000.

Other card fees include a $7 monthly service fee (after 30 days), $5 for card replacement, a 3% FX fee, $2 for ATM withdrawals in Canada ($3 +3% abroad), $5 for paper statements, $4.95 monthly dormancy fee after 60 days of inactivity, and more.

9. Wealthsimple Cash Card

The Wealthsimple Cash Card is a Prepaid Mastercard that offers 1% cash back rewards on all purchases.

This no-fee Prepaid card is one of the best reloadable Mastercard Prepaid cards in Canada.

You can add funds to your card by linking a bank account.

While there are no transaction limits per day, the maximum spending limit per transaction is $5,000, and ATM withdrawals are limited to $500 per transaction.

Learn more in this review.

Prepaid Mastercard Alternatives in Canada

If you are looking for a no-fee prepaid Visa Card, the CIBC AC Conversion Card works well for foreign currencies.

If your need is for a credit card that is easy to qualify for, you can consider the following options:

Tangerine Money-Back Mastercard

Tangerine Money-Back Credit Card

Rewards: Earn up to 2% unlimited cash back in up to 3 spending categories and 0.50% on all other purchases.

Welcome offer: Get an extra 10% cash back on up to $1,000 in spending in the first 2 months ($100 value); 1.95% balance transfer rate for 6 months.

Interest rates: 19.95% for purchases, balance transfers, and cash advances.

Annual fee: $0

Neo Mastercard

Neo Credit card

Rewards: Average of 5% cash back at 12,000+ partners and a guaranteed minimum of 0.50% cash back across all purchases

Welcome offer: Get up to 15% cash back on your first-time purchases, plus a $25 welcome cash bonus.

Interest rates: 19.99% – 29.99% on purchases; 22.99% – 31.99% for cash advances.

Annual fee: $0

Simplii Financial Cash Back Visa Card

Simplii Financial Cash Back Visa Card

Rewards: Earn 4% cash back at restaurants; 1.5% on gas & groceries, and 0.5% elsewhere (category spending limits apply).

Welcome offer: Earn up to $150 of value in your first 4 months on eligible purchases.

Interest rates: 20.99% on purchases and 22.99% on cash advances.

Annual fee: $0

Visit the link to learn more about the full terms and conditions.

Related: Best Visa Prepaid Cards in Canada.