British Columbia has one of the strongest and largest networks of credit unions in Canada.

An alternative to banks, credit unions have been around since the very first caisses populaires (or people’s bank) opened in the early 1900s in Quebec.

In BC, nearly 40 credit unions are serving members and their communities. Vancity Credit Union, First West and Coast Capital are among the biggest and best credit unions in Canada.

In this article, we will cover the best credit unions in BC, what they are, the differences between them and banks, and how their safety compares with that of banks.

Key Takeaways

- British Columbia has some of the best credit unions to use, having nearly 40 of them serving BC communities.

- The best credit unions in Canada include Vancity Credit Union, Coast Capital, and First West Credit Union.

- BC credit unions are guaranteed by the Credit Union Deposit Insurance Corporation of British Columbia (CUDIC).

- CUDIC covers 100% of deposits made by members in BC credit unions (except for Coast Capital which is a federal credit union).

- There is no limit on the deposit amount guarantee, and the BCFSA oversees the CUDIC.

Best Credit Unions in BC

Below are eight of the best credit unions in Canada and the products and services they offer.

1. Vancity Credit Union

Vancity Credit Union is the largest community credit union in Canada and operates within the territories of the Coast Salish and Kwakwaka’wakw people.

Founded in 1946, it is a member-owned community-based financial service institution with over 560,000 members.

Headquartered in Vancouver, it has 54 branches today in Victoria, Metro Vancouver, Alert Bay, the Fraser Valley, and Squamish.

It offers various financial products, including savings accounts, chequing accounts, credit cards, loans and lines of credit, investment options, and business banking services.

To become a member of Vancity Credit Union, you must be a resident of BC, have a Social Insurance Number (SIN), and deposit $5 for your membership shares.

Here’s a Vancity Credit Union review.

2. Coast Capital Credit Union

Coast Capital is a federal credit union headquartered in Surrey, BC. Founded in the 1940s, it is among the biggest and best credit unions in Canada, with over 600,000 members and more than 50 branches.

A certified B Corp company, Coast Capital offers services like day-to-day banking, which includes chequing accounts, savings accounts, credit cards, and student banking.

Other services are mortgages, auto finance, wealth management, business banking, loans, investments, and money tools.

To open an account online, you must be the age of majority in the province where you reside, which is at least 18 years.

As a new member, you must prepare your Social Insurance Number and purchase $5 in membership equity shares.

Related: Coast Capital Credit Union review.

3. First West Credit Union

First West Credit Union is the third largest credit union in the BC area, with over 250,000 members.

Headquartered in the Vancouver suburb of Langley, it has 46 business locations throughout the province.

Its regional centres are in Duncan on Vancouver Island and Penticton in the Southern Interior of BC.

First West Credit Union has four regional divisions:

- Envision Financial – Branch locations in Lower Mainland, Fraser Valley and Kitimat

- Valley First – Branch locations in Okanagan, Similkameen and Thompson Valley regions

- Island Savings – Branch locations on Vancouver Island and the Southern Gulf Islands

- Enderby & District Financial – Branch location in North Okanagan

First West Credit Union’s specialties include personal and business banking, wealth management, and auto financing.

Products include personal and business accounts, credit cards, mortgages, loans, investment solutions, and insurance.

Learn more about First West Credit Union.

4. Interior Savings Credit Union

Founded in 1939, Interior Savings Credit Union has over 77,000 members across 15 BC interior communities. It has 23 branches, 16 insurance offices, and two commercial service centres.

The credit union offers chequing accounts, savings accounts, mortgages and loans, investing and insurance.

Its commercial services centre offers businesses project financing, construction mortgages, commercial mortgages, business lines of credit, payroll services, and other services.

To become a member, visit a branch or apply online. Requirements include British Columbia residency, Social Insurance Number (SIN), ID cards, and a $5 deposit into your shares account.

5. Prospera Credit Union

Prospera Credit Union has been serving British Columbia for over 75 years. Founded in 1943, it has more than 117,000 members across BC.

With headquarters in Surrey, Prospera serves the market through its network of 26 branch locations, a member service centre, and various mobile and digital channels.

The credit union offers a range of savings and checking accounts, credit cards, mortgages, loans and lines of credit, and investing solutions.

Its other services are financial planning, wealth planning, diversity and inclusion, and retail banking.

Banking can be done online, through the credit union app, by making an appointment, or by visiting one of their branches.

6. Coastal Community Credit Union

Coastal Community Credit Union (CCCU) is the largest Vancouver Island-based financial services company.

It has 24 credit union branches throughout Vancouver Island, from Port Hardy to Victoria, and from the West Coast to the Discovery Islands.

CCCU offers a complete array of products and services in personal, business and commercial banking.

Personal banking services include savings and chequing accounts, credit cards, mortgages, loans and credit lines, investing and retirement, and insurance.

Its business banking services include savings and chequing accounts, credit cards, payment solutions, financing, investing and wealth insurance.

7. Community Savings Credit Union

Community Savings Credit Union (CSCU) is a credit union that provides banking products and investment solutions for the working community.

Founded in 1944, CSCU has its headquarters in Surrey, BC. It operates six branches in the Lower Mainland and one in Victoria.

CSCU offers personal banking services like chequing accounts, savings accounts, credit cards, youth and student banking, seniors’ accounts, and account options for those with permanent disabilities.

Its business banking offerings include business chequing and savings accounts, credit cards, loans and lines of credit, commercial lending, and merchant services.

To become a CSCU member, apply online or visit a branch, present valid identification cards, and buy a CSCU equity share for $5 to complete your membership.

8. Gulf & Fraser Credit Union

Gulf & Fraser Credit Union in Burnaby, British Columbia, has been in business for over 80 years and is the sixth-largest credit union in the province.

Through its 27 branches in the Lower Mainland and Fraser Valley of BC, Gulf & Fraser provides a full suite of financial products for personal and business banking and insurance solutions.

The financial products include spending and savings accounts, credit cards, mortgages and loans, insurance, and investment options.

Members can also access financial and investment advice, business banking advice and tools, investment and insurance solutions, estate planning, retirement planning, and more.

Sign up for a Gulf & Fraser membership by completing an online form. A Member Hub representative will contact you within two (2) business days.

Gulf & Fraser members can purchase additional membership equity shares or investment equity shares.

What is a Credit Union?

A credit union is a not-for-profit, full-service financial institution owned by its members. It offers a wide range of financial services and products similar to those offered at banks.

Among the best credit unions to use are those that provide a community-based approach to banking, with an emphasis on satisfying the needs of their members rather than turning a profit.

The range of products and services is similar to banks and typically includes cash deposits, investments, mortgages, etc.

Credit unions are governed by the laws of the provinces where they operate and are either regulated federally or provincially.

Provincially regulated credit unions are not covered by the Canada Deposit Insurance Corporation (CDIC) but instead by their provinces.

The primary legislation governing credit unions is The Bank Act, administered by the Financial Consumer Agency of Canada (FCAC).

Credit Unions vs Banks

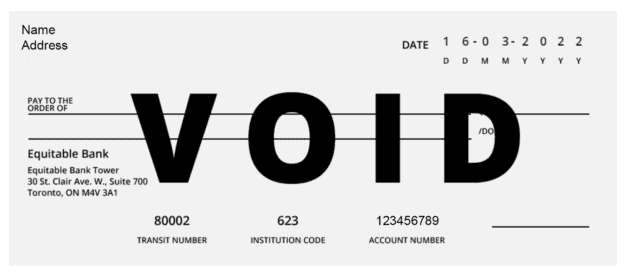

Below is a comparison table showing the significant differences between credit unions and banks.

| Description | Credit Unions | Banks |

| Type of Organization | Not-for-profit financial institution | Private corporations, for-profit companies, or run by a corporate board |

| Responsibility to | Members | Shareholders and investors |

| Goal | To provide affordable financial services Return the profits earned to members | To provide financial returns to shareholders Earn money for shareholders and investors |

| Financial products and services offered | Chequing, savings, mortgages, loans, lines of credit, auto loans, personal loans | Chequing, savings, mortgages, loans, lines of credit, auto loans, personal loans |

| Debit and credit cards | Yes | Yes |

| Requirements to apply | Valid government-issued photo IDs, minor requirements, and buy a share | Valid government-issued photo IDs, required documents |

| Interest rates (savings account) | Higher | Lower |

| Account fees | Lower | Higher |

| Interest rates on loans | Lower | Higher |

| Monthly fees | Lower monthly fees | Higher |

| Who they serve | Local members | No geographical limits |

| Other qualities | Known for strong customer-service track record | More innovative with their online services, technology and overall digital presence |

| Insurance | Covered by provincial deposit insurance providers | Insured by the Canada Deposit Insurance Corporation (CDIC) |

Are BC Credit Unions Safe?

Yes. BC credit unions are safe because of the guarantee provided by the Credit Union Deposit Insurance Corporation of British Columbia (CUDIC).

This deposit insurance guarantee covers all money on deposit with a BC credit union as well as foreign currencies and accrued interest.

Since 2008, the 100% guarantee has been in effect. At present, there is no limit on the deposit amount guarantee. No application is necessary as well.

The deposit guarantee is backed by the Deposit Protection Fund, which is managed by CUDIC.

The BC Financial Services Authority (BCFSA) is in charge of administering CUDIC and providing oversight. The deposit insurance guarantee does not cover credit union equity shares and investments.

CUDIC also does not apply to Coast Capital since it is a federal credit union. Deposits at federal credit unions are guaranteed within specified limits through the Canada Deposit Insurance Corporation (CDIC).

FAQs

Credit unions in Canada are as safe as banks since they adhere to laws such as the Credit Unions Act. They are often backed by their provinces. Federal credit unions get deposit protection from the CDIC.

Most credit unions are reliable, particularly those that provide products and services you need, offer higher interest rates on deposits yet lower interest rates on loans and credit cards, and have fewer or lower fees. Credit unions should also be accredited by agencies like the BBB.

Find a good credit union by researching credit unions in your area. Focus your search on the rates and fees, number of ATM and branch locations, customer service, apps and technology provided, and community focus.

The easiest credit unions to join are those with easy membership requirements. Although some credit unions require an introduction from another member, many require only valid identification cards, being in the age of majority, and an equity share purchase that typically costs about $5.

Related:

I am dealing with Gulf and Fraser Credit Union; their service representatives have been helpful but poorly informed.

They don’t listen, and can’t make a decision. The Vancouver Police Credit Union was a small shop that knew its clientele and made things happen to serve its clientele. I am looking for another credit union that can serve its clientele like VPCU.

I deal with the Prospera Credit Union …Ever since they joined with New Westminster Credit Union

they have become the worst credit union ever …They are always making mistakes which I am tired off …

I will be checking out another place to do my banking …